This version of the form is not currently in use and is provided for reference only. Download this version of

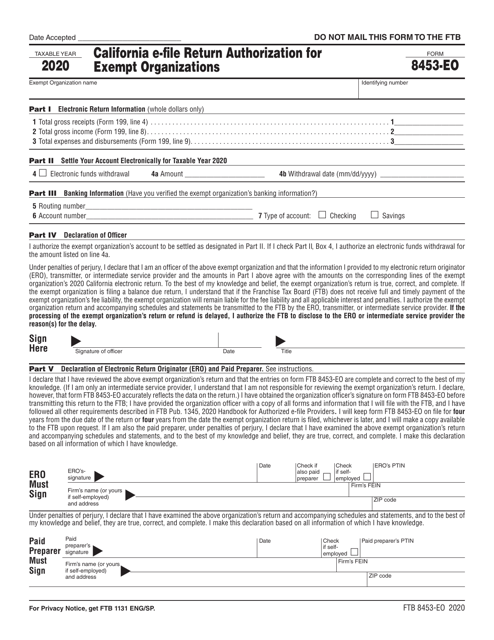

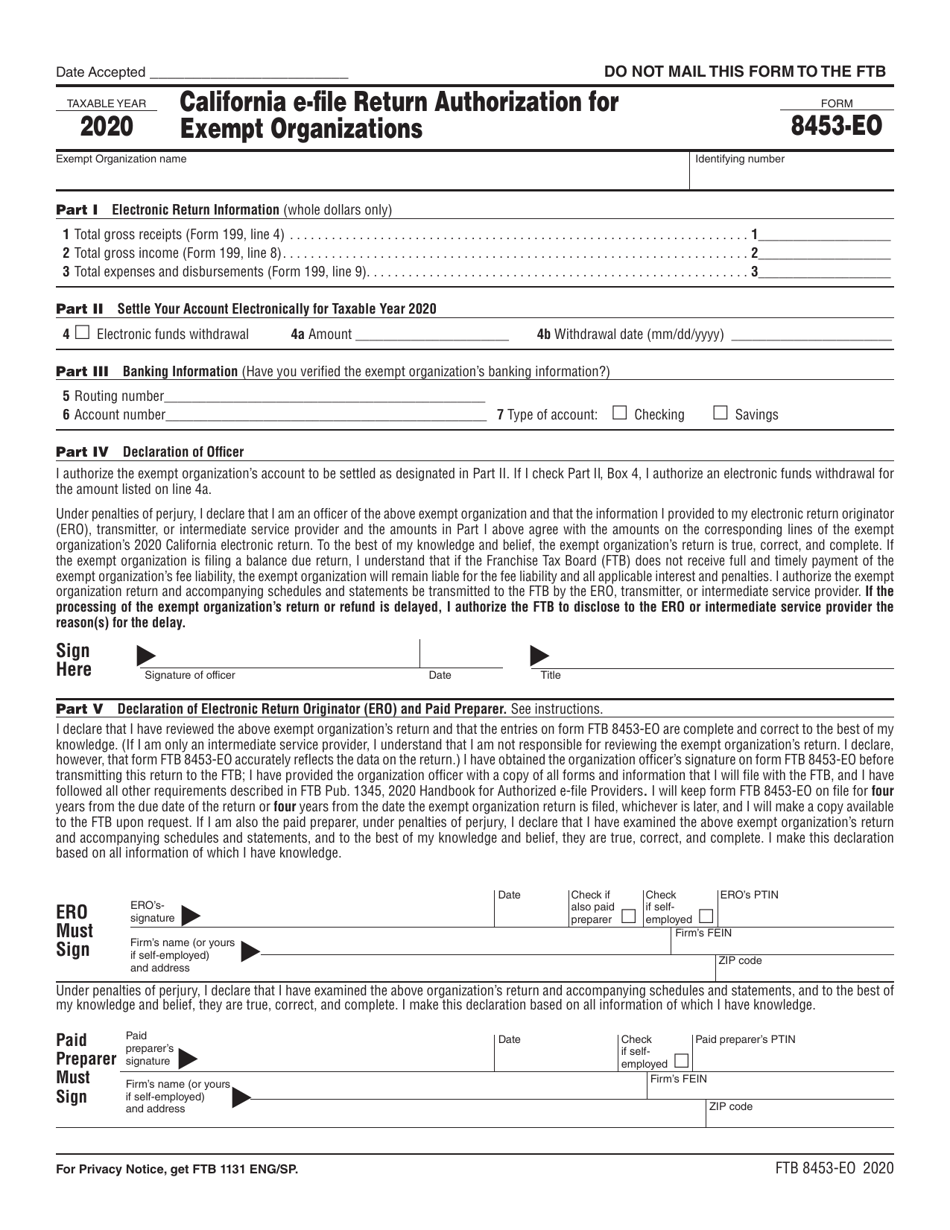

Form FTB8453-EO

for the current year.

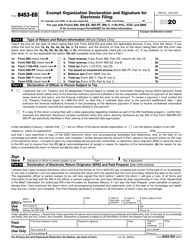

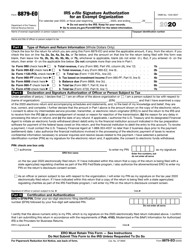

Form FTB8453-EO California E-File Return Authorization for Exempt Organizations - California

What Is Form FTB8453-EO?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB8453-EO?

A: Form FTB8453-EO is the California E-File Return Authorization for Exempt Organizations.

Q: Who needs to file Form FTB8453-EO?

A: Exempt organizations in California need to file Form FTB8453-EO.

Q: What is the purpose of Form FTB8453-EO?

A: The purpose of Form FTB8453-EO is to authorize the e-filing of tax returns for exempt organizations in California.

Q: Can I file Form FTB8453-EO electronically?

A: Yes, Form FTB8453-EO can be filed electronically.

Q: Are there any fees for filing Form FTB8453-EO?

A: No, there are no fees for filing Form FTB8453-EO.

Q: What supporting documents are required for Form FTB8453-EO?

A: Form FTB8453-EO does not require any supporting documents.

Q: When is the deadline for filing Form FTB8453-EO?

A: The deadline for filing Form FTB8453-EO is the same as the deadline for filing the tax return, typically April 15th.

Q: Is Form FTB8453-EO only for California residents?

A: No, Form FTB8453-EO is for all exempt organizations, both residents and non-residents of California.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB8453-EO by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.