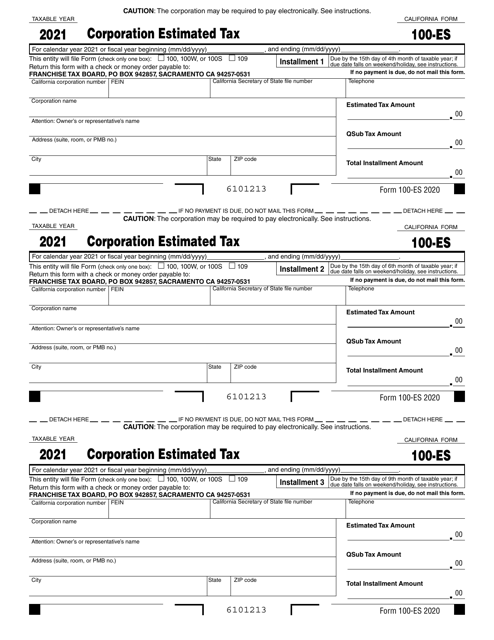

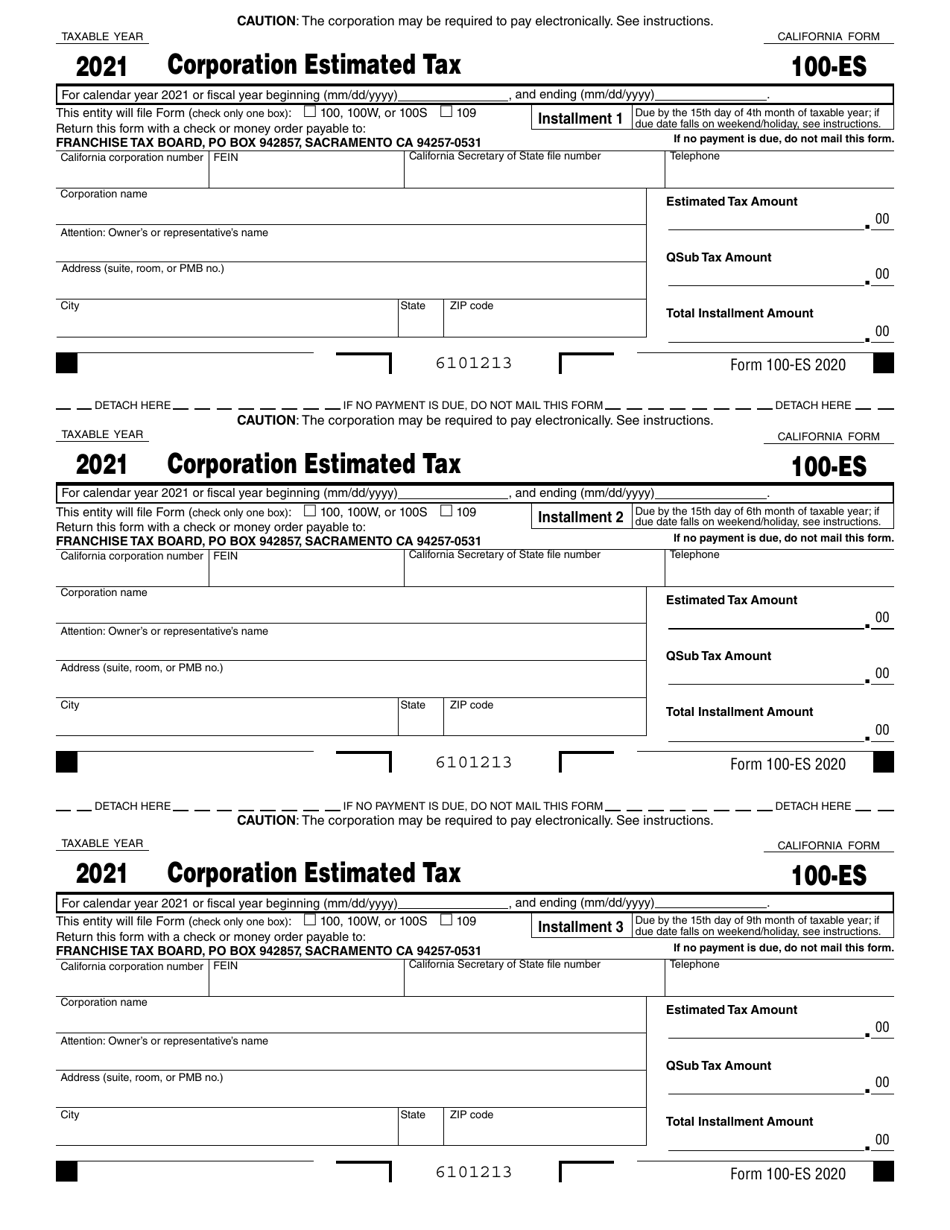

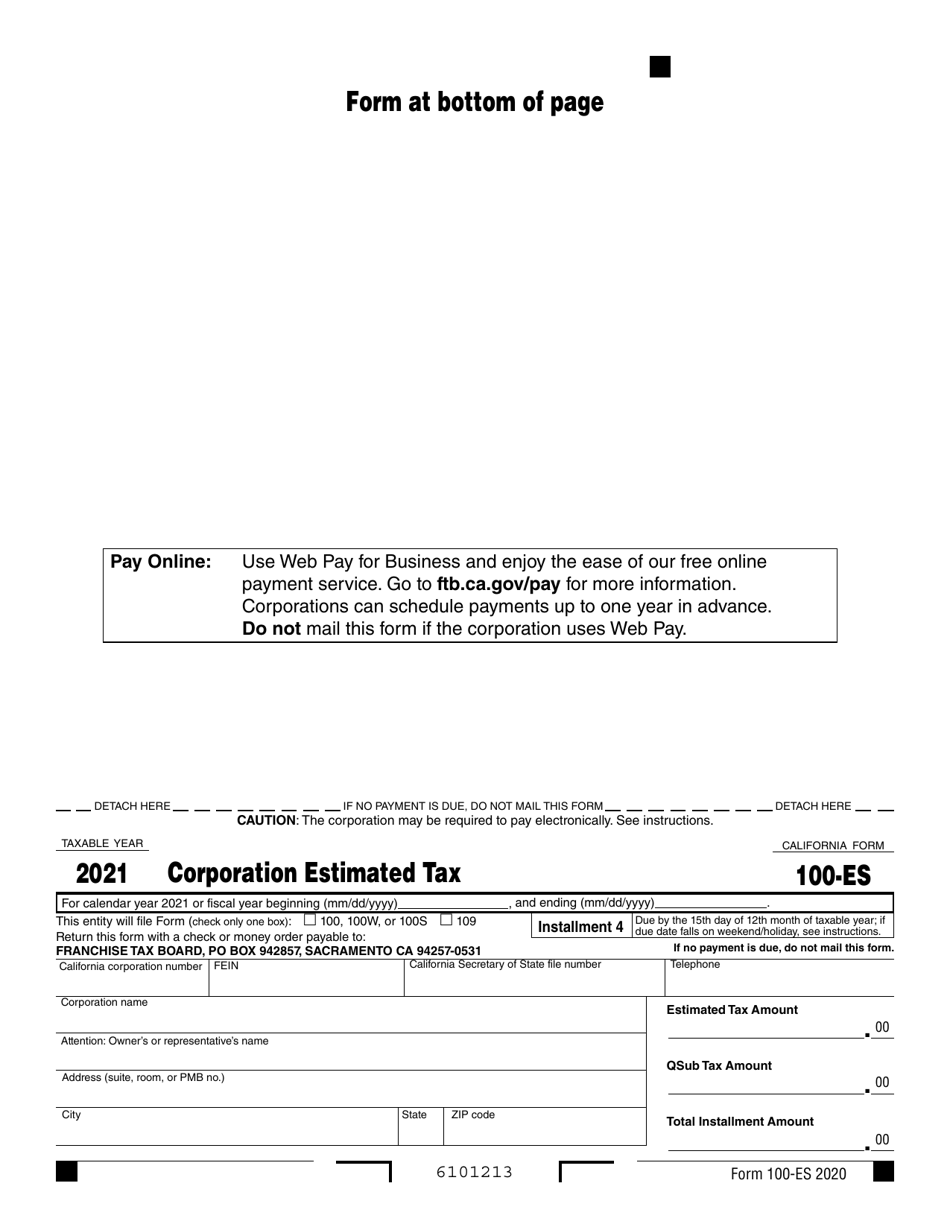

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 100-ES

for the current year.

Form 100-ES Corporation Estimated Tax - California

What Is Form 100-ES?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100-ES?

A: Form 100-ES is a tax form used by corporations in California to make estimated tax payments.

Q: Who needs to file Form 100-ES?

A: Corporations in California that expect to owe $500 or more in tax for the year must file Form 100-ES.

Q: What is the purpose of Form 100-ES?

A: Form 100-ES is used to make estimated tax payments throughout the year, so corporations can meet their tax obligations.

Q: When should Form 100-ES be filed?

A: Form 100-ES should be filed by corporations on a quarterly basis. The due dates are April 15, June 15, September 15, and December 15.

Q: What happens if a corporation doesn't file Form 100-ES?

A: If a corporation fails to make estimated tax payments using Form 100-ES, they may be subject to penalties and interest on any underpayment of tax.

Q: Is Form 100-ES specific to California?

A: Yes, Form 100-ES is specific to corporations in California. Other states may have their own estimated tax forms.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100-ES by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.