This version of the form is not currently in use and is provided for reference only. Download this version of

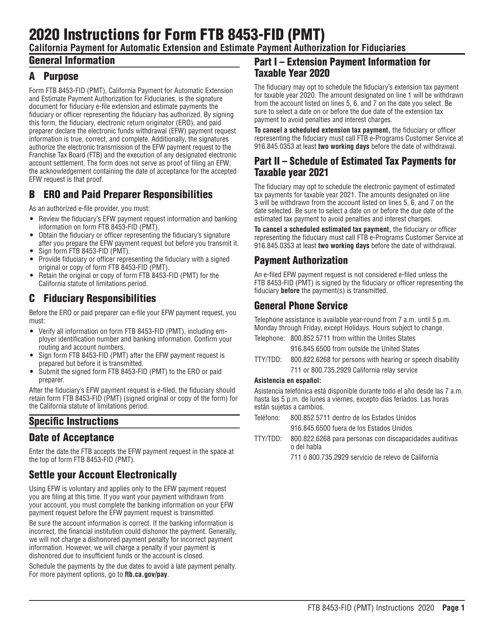

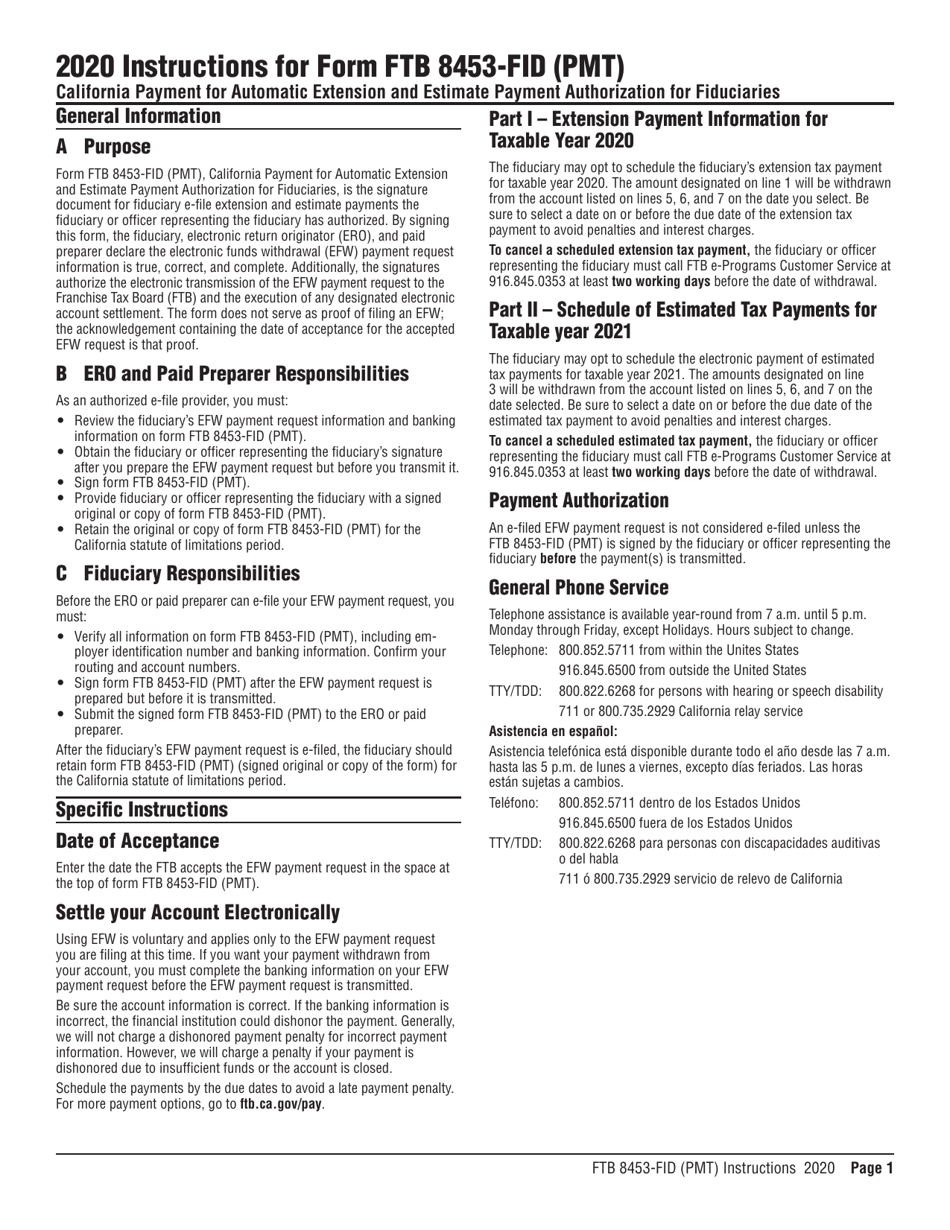

Instructions for Form FTB8453-FID (PMT)

for the current year.

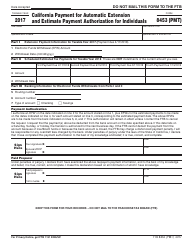

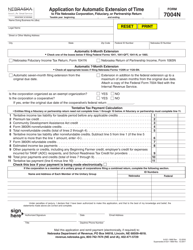

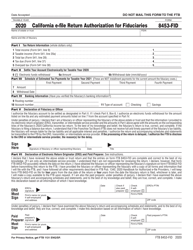

Instructions for Form FTB8453-FID (PMT) California Payment for Automatic Extension and Estimate Payment Authorization for Fiduciaries - California

This document contains official instructions for Form FTB8453-FID (PMT) , California Payment for Automatic Extension and Estimate Payment Authorization for Fiduciaries - a form released and collected by the California Franchise Tax Board.

FAQ

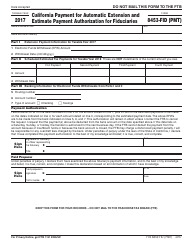

Q: What is Form FTB8453-FID?

A: Form FTB8453-FID is a form used by fiduciaries in California to authorize automatic extensions and estimate payments.

Q: Who needs to file Form FTB8453-FID?

A: Fiduciaries in California who want to request an automatic extension or make estimate payments need to file Form FTB8453-FID.

Q: What is the purpose of Form FTB8453-FID?

A: The purpose of Form FTB8453-FID is to authorize automatic extensions and estimate payments for fiduciaries in California.

Q: When is Form FTB8453-FID due?

A: Form FTB8453-FID is due on or before the original return due date of the fiduciary return.

Q: Is Form FTB8453-FID required for all fiduciaries in California?

A: No, only fiduciaries who want to request an automatic extension or make estimate payments need to file Form FTB8453-FID.

Q: Can Form FTB8453-FID be filed electronically?

A: Yes, Form FTB8453-FID can be filed electronically using the FTB's secure Web Pay system.

Q: What information is required on Form FTB8453-FID?

A: Form FTB8453-FID requires the fiduciary's name, address, Social Security Number (SSN) or California Fiduciary Identification (CFID) number, tax year, amount of payment, and signature.

Q: Do I need to attach any documents with Form FTB8453-FID?

A: No, you do not need to attach any documents with Form FTB8453-FID, unless specifically instructed by the Franchise Tax Board.

Q: Can I pay the estimated tax electronically with Form FTB8453-FID?

A: Yes, you can make your estimate payment electronically using the FTB's Web Pay system or by including a check or money order with your form.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.