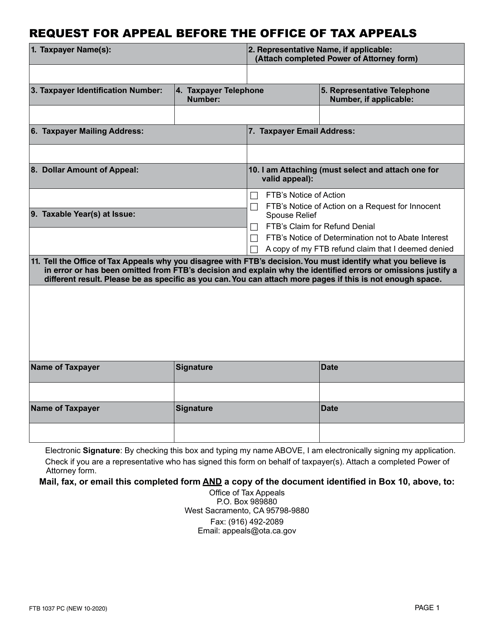

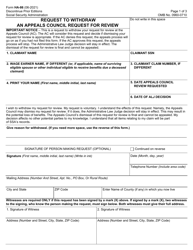

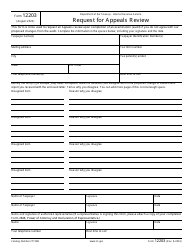

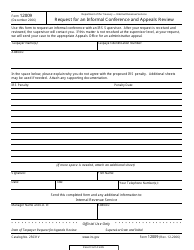

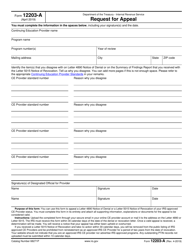

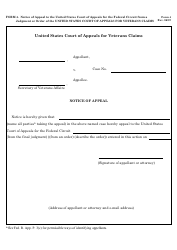

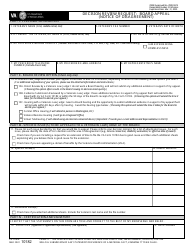

Form FTB1037 Request for Appeal Before the Office of Tax Appeals - California

What Is Form FTB1037?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB1037?

A: Form FTB1037 is a Request for Appeal Before the Office of Tax Appeals in California.

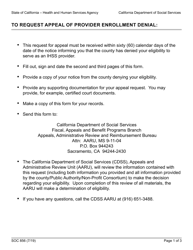

Q: Who can use Form FTB1037?

A: Any taxpayer who wants to appeal a tax decision made by the California Franchise Tax Board can use Form FTB1037.

Q: What is the purpose of Form FTB1037?

A: The purpose of Form FTB1037 is to request an appeal before the Office of Tax Appeals in California.

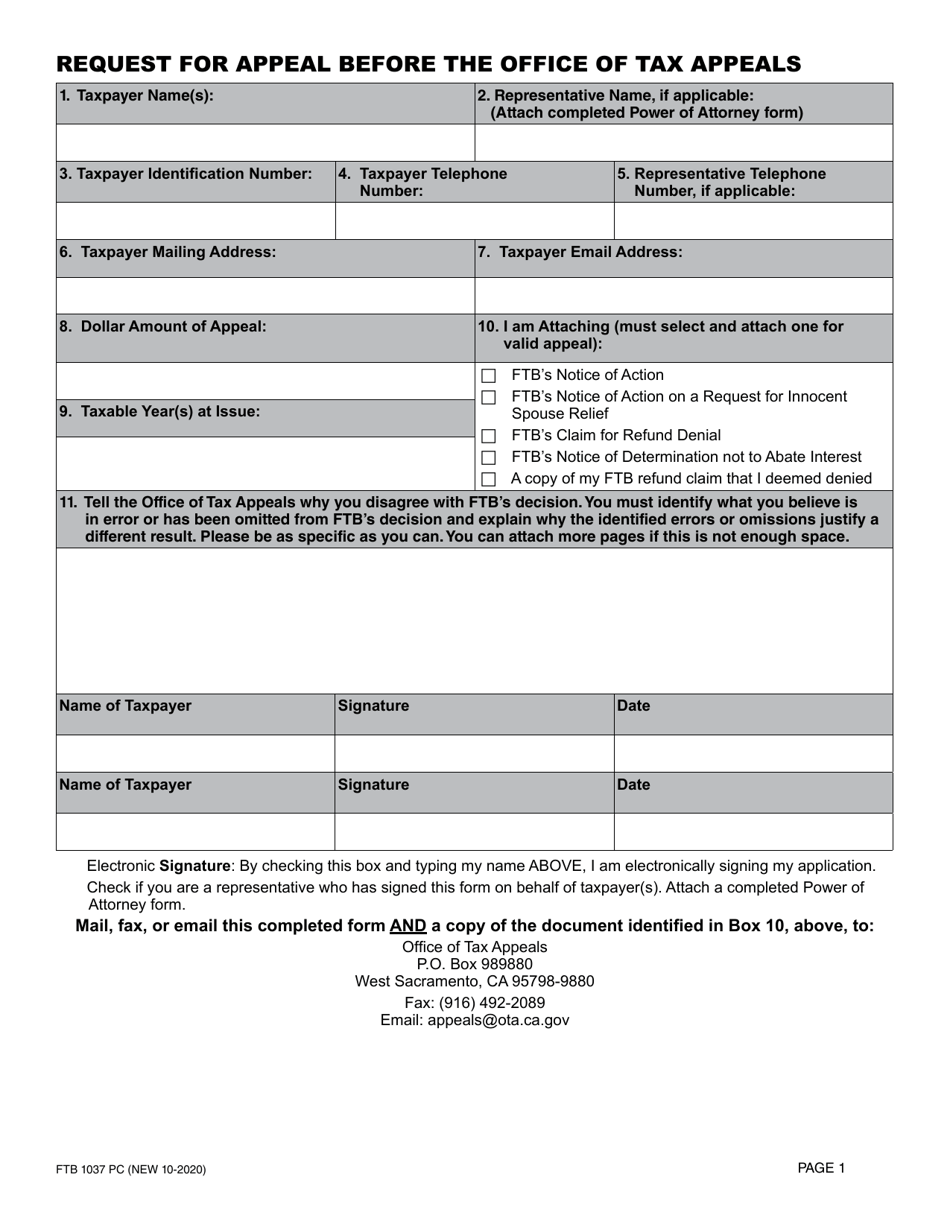

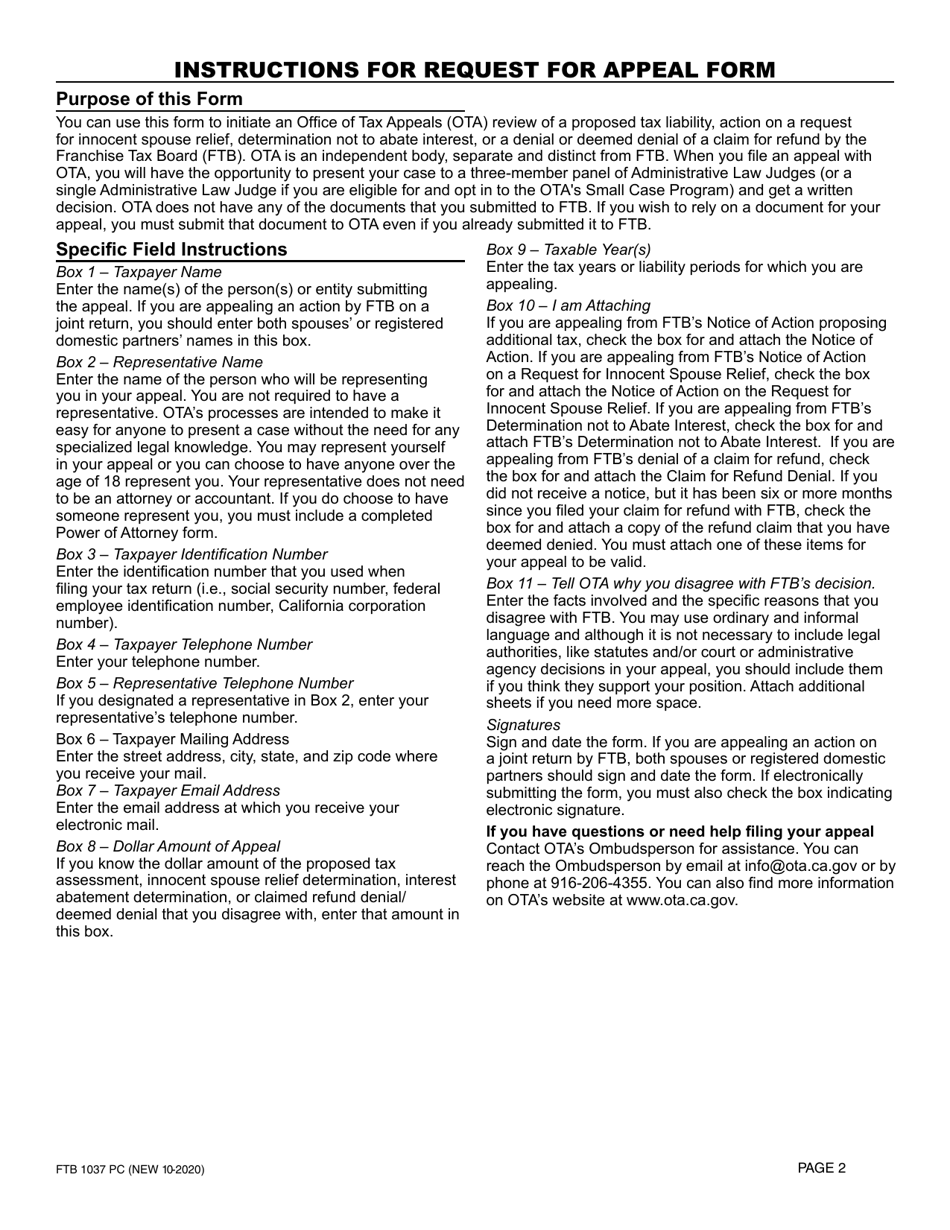

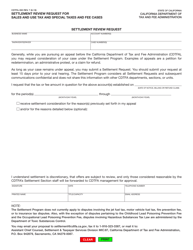

Q: How do I fill out Form FTB1037?

A: You need to provide your personal information, details of the tax decision you are appealing, and the reasons for your appeal.

Q: Is there a deadline to file Form FTB1037?

A: Yes, you must file Form FTB1037 within the specified time period mentioned in the tax decision you are appealing.

Q: What happens after I file Form FTB1037?

A: After you file Form FTB1037, your case will be reviewed by the Office of Tax Appeals, and a hearing will be scheduled.

Q: Can I represent myself in the appeal process?

A: Yes, you can represent yourself in the appeal process or you can hire a tax professional to represent you.

Q: Is there a fee to file Form FTB1037?

A: No, there is no fee to file Form FTB1037.

Q: Can I appeal the decision of the Office of Tax Appeals?

A: Yes, if you disagree with the decision of the Office of Tax Appeals, you can appeal further to the California courts.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB1037 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.