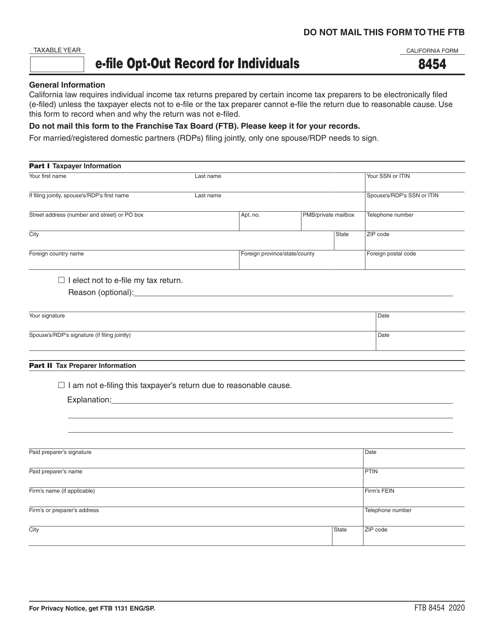

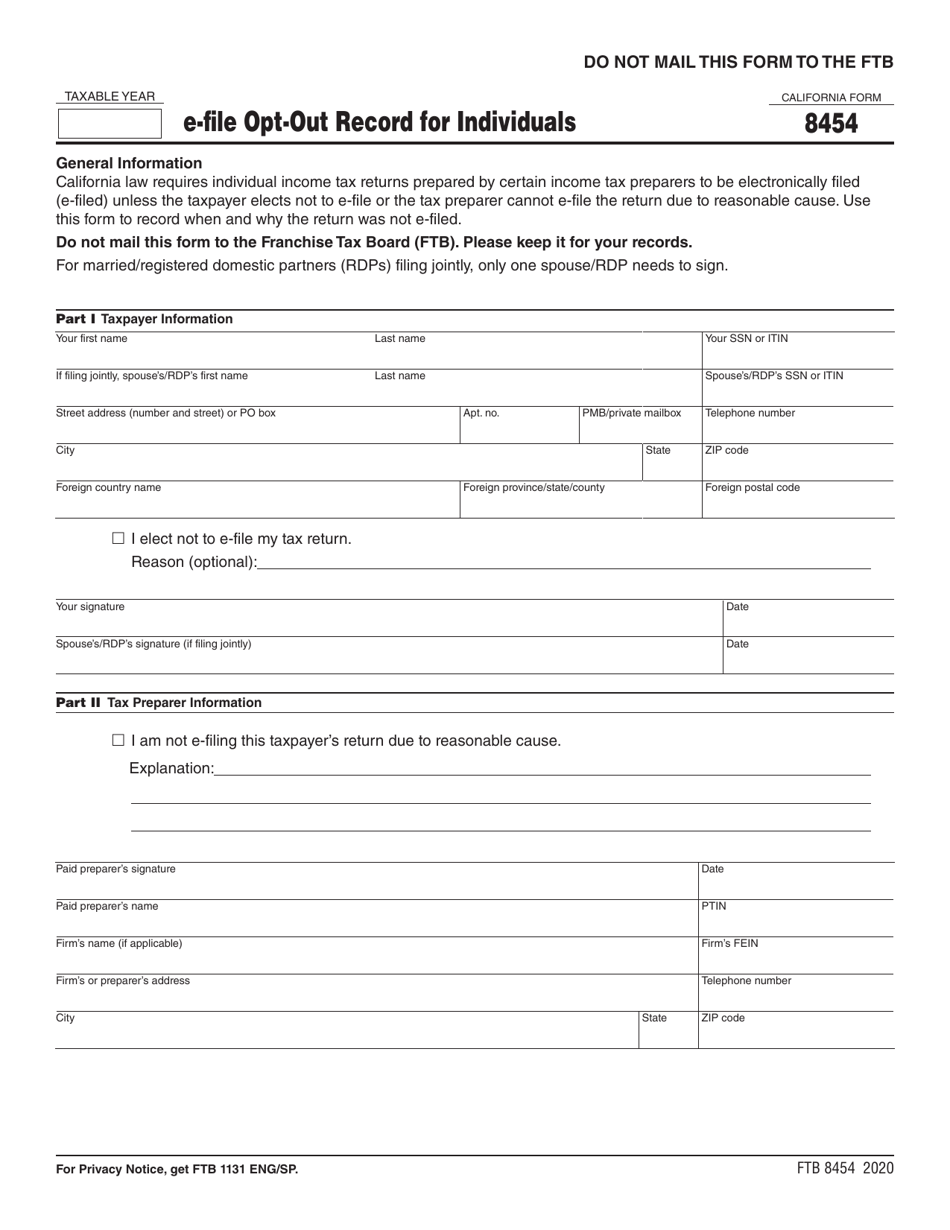

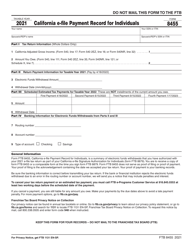

This version of the form is not currently in use and is provided for reference only. Download this version of

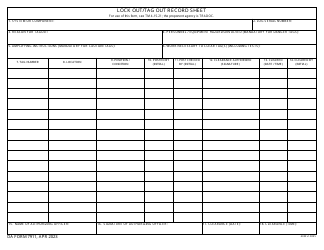

Form FTB8454

for the current year.

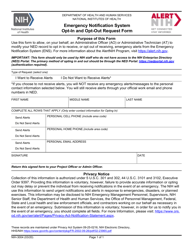

Form FTB8454 E-File Opt-Out Record for Individuals - California

What Is Form FTB8454?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB8454?

A: Form FTB8454 is a document used by individuals in California to opt-out of electronically filing their tax returns.

Q: Who needs to file Form FTB8454?

A: Individuals in California who choose not to e-file their tax returns need to file Form FTB8454.

Q: What is the purpose of Form FTB8454?

A: The purpose of Form FTB8454 is to inform the California Franchise Tax Board that an individual wishes to opt-out of electronically filing their tax returns.

Q: Can I e-file my tax return if I file Form FTB8454?

A: No, if you file Form FTB8454 to opt-out of e-filing, you will need to paper-file your tax return.

Q: Is there a deadline to file Form FTB8454?

A: Form FTB8454 should be filed before the due date of your tax return.

Q: Do I need to attach any other documents with Form FTB8454?

A: No, you do not need to attach any other documents with Form FTB8454.

Q: Can I file Form FTB8454 electronically?

A: No, Form FTB8454 cannot be filed electronically. It must be mailed to the California Franchise Tax Board.

Q: What should I do if I have already e-filed my tax return but want to opt-out?

A: If you have already e-filed your tax return but want to opt-out, you should contact the California Franchise Tax Board for further guidance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB8454 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.