This version of the form is not currently in use and is provided for reference only. Download this version of

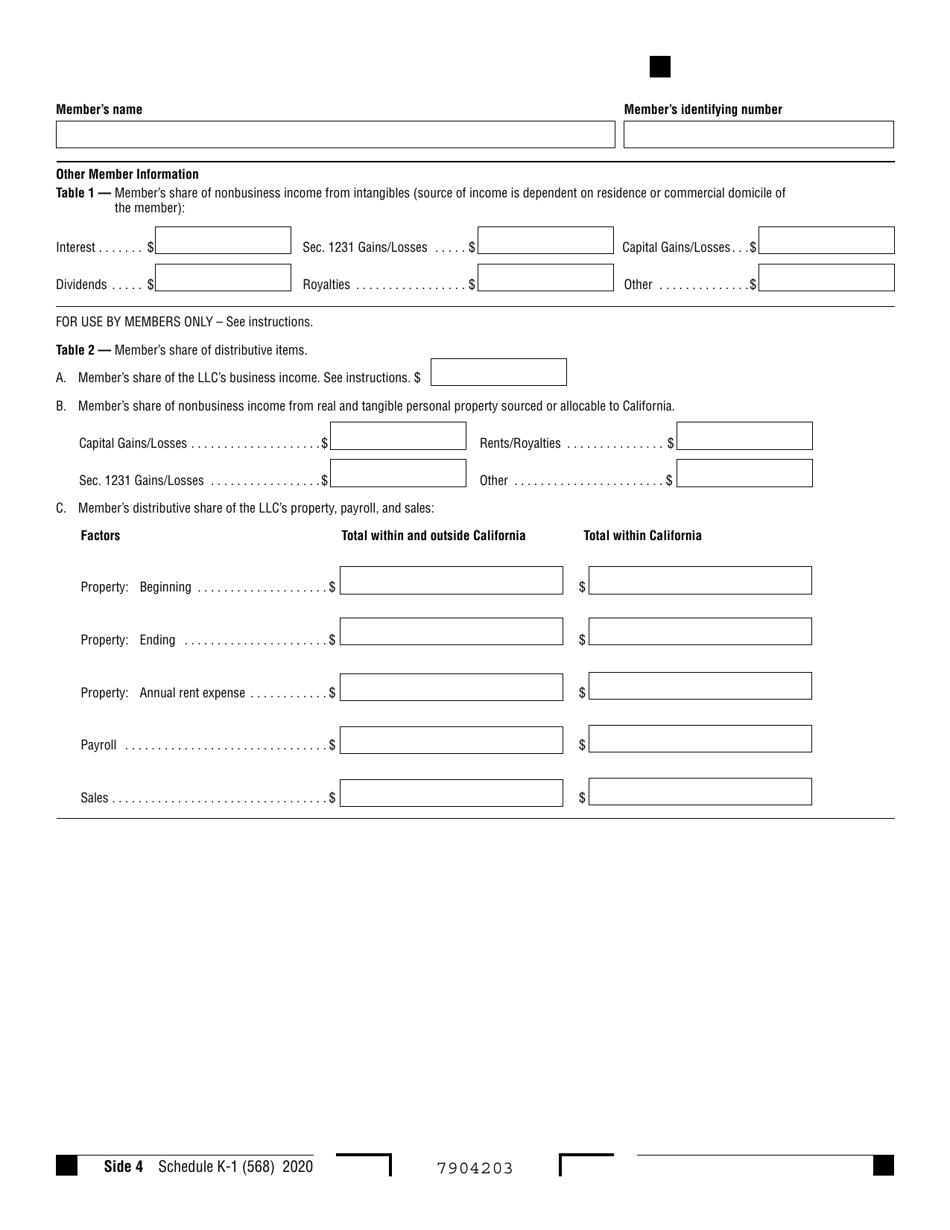

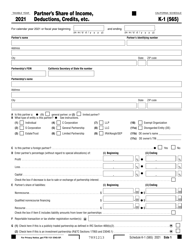

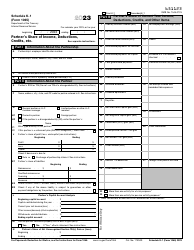

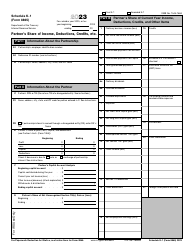

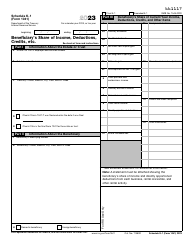

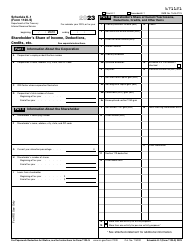

Form 568 Schedule K-1

for the current year.

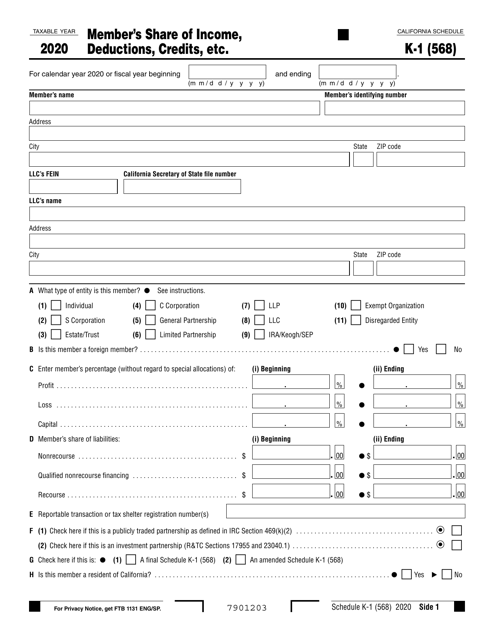

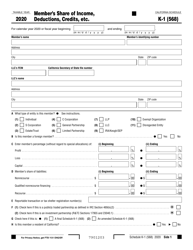

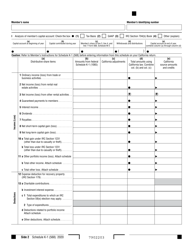

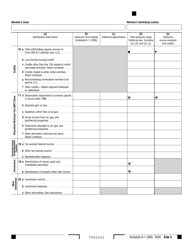

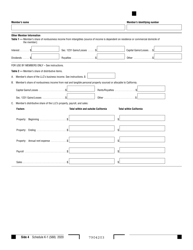

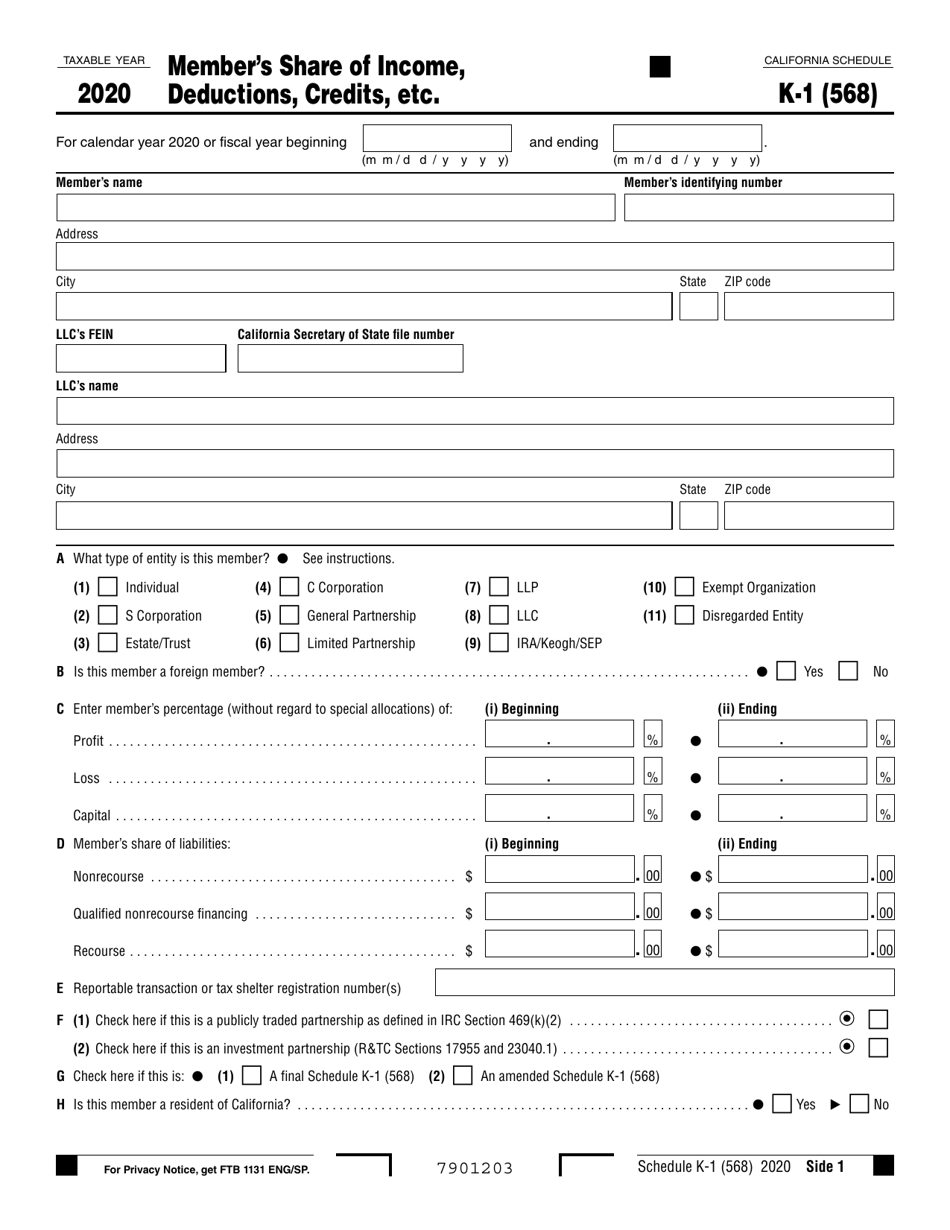

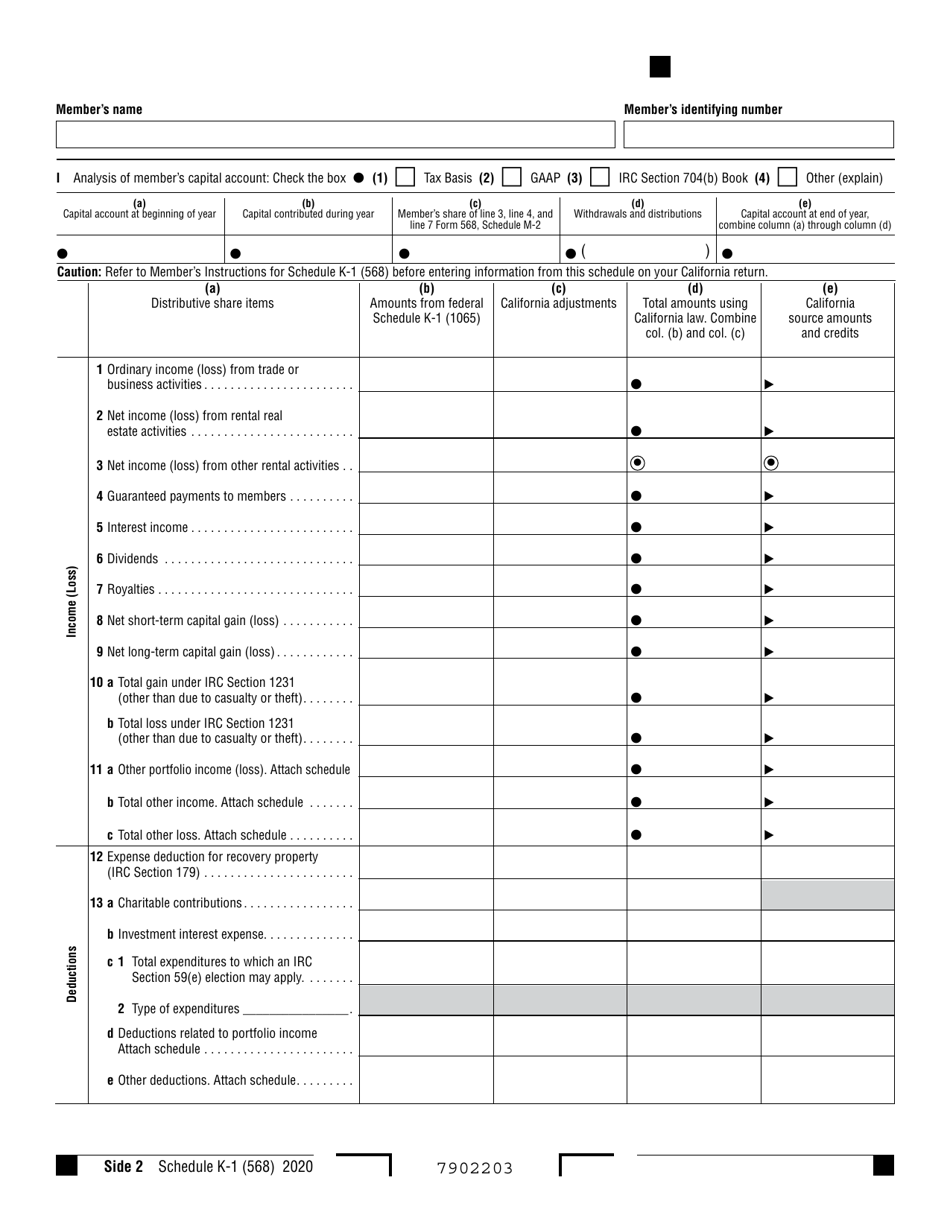

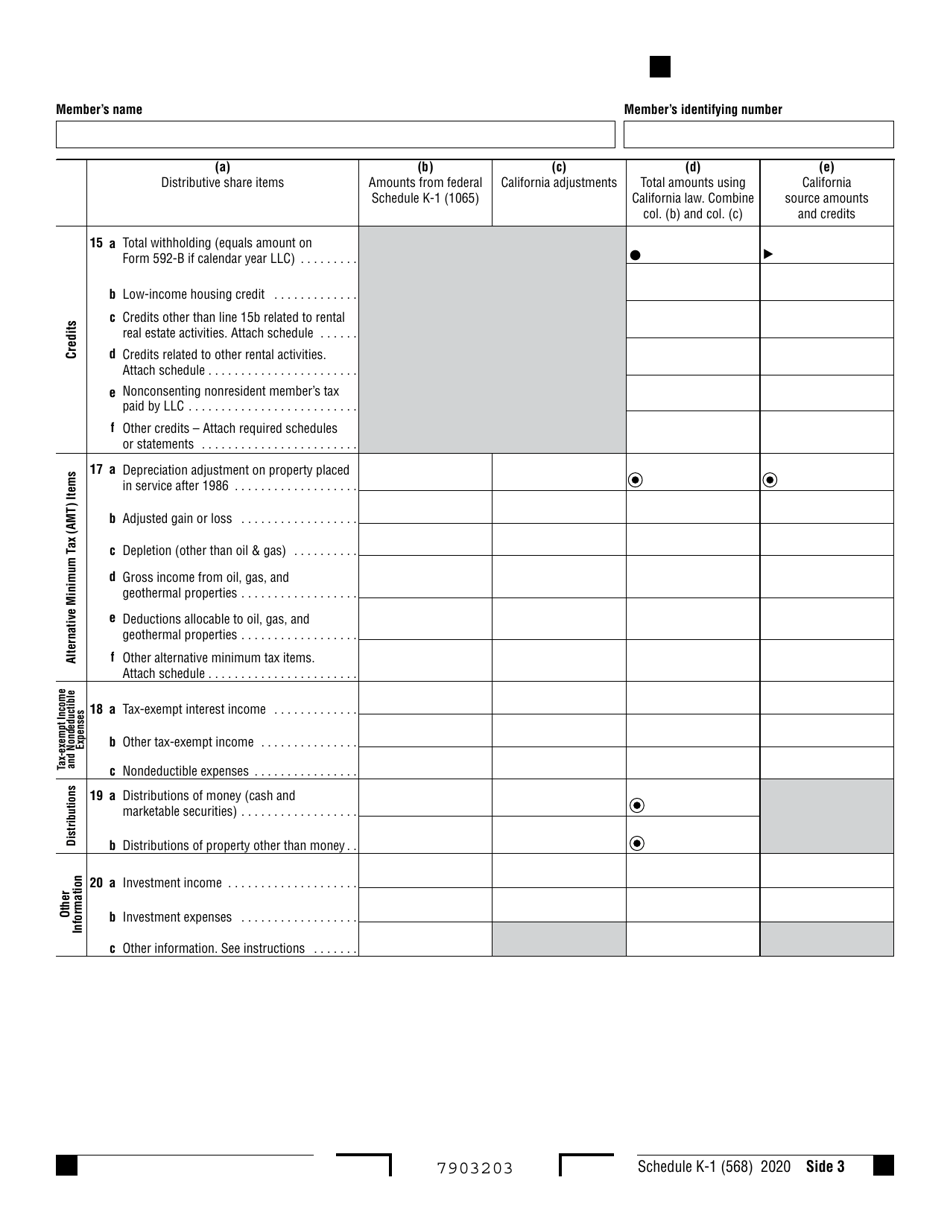

Form 568 Schedule K-1 Member's Share of Income, Deductions, Credits, Etc. - California

What Is Form 568 Schedule K-1?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 568, Limited Liability Company Return of Income. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 568 Schedule K-1?

A: Form 568 Schedule K-1 is a form used by members of a California Limited Liability Company (LLC) to report their share of income, deductions, credits, and other information.

Q: Who needs to file Form 568 Schedule K-1?

A: Members of a California LLC who are required to report their share of income, deductions, credits, etc. need to file Form 568 Schedule K-1.

Q: What information does Form 568 Schedule K-1 require?

A: Form 568 Schedule K-1 requires the member's personal information, the LLC's information, and details about the member's share of income, deductions, credits, etc.

Q: When is the deadline to file Form 568 Schedule K-1?

A: The deadline to file Form 568 Schedule K-1 is the same as the deadline for filing the LLC's tax return, which is generally due on the 15th day of the 4th month after the close of the tax year.

Q: Are there any penalties for late filing of Form 568 Schedule K-1?

A: Yes, there are penalties for late filing of Form 568 Schedule K-1. The specific penalties depend on the amount of tax owed and the length of the delay in filing.

Q: Do I need to include Form 568 Schedule K-1 with my personal tax return?

A: No, Form 568 Schedule K-1 should not be attached to your personal tax return. It should be kept for your records and provided to your tax preparer, if applicable.

Q: Can I e-file Form 568 Schedule K-1?

A: Yes, you can e-file Form 568 Schedule K-1 if your tax preparer or software supports electronic filing for California tax forms.

Q: Can I make changes to Form 568 Schedule K-1 after it has been filed?

A: Generally, you cannot make changes to Form 568 Schedule K-1 after it has been filed. However, if you discover an error or omission, you may need to file an amended Form 568 Schedule K-1.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 568 Schedule K-1 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.