This version of the form is not currently in use and is provided for reference only. Download this version of

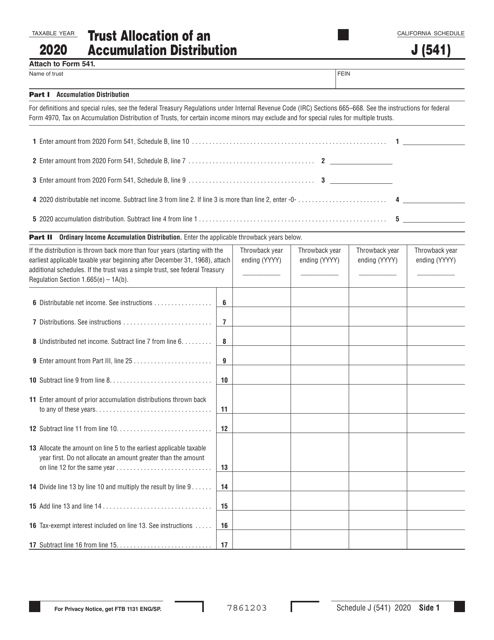

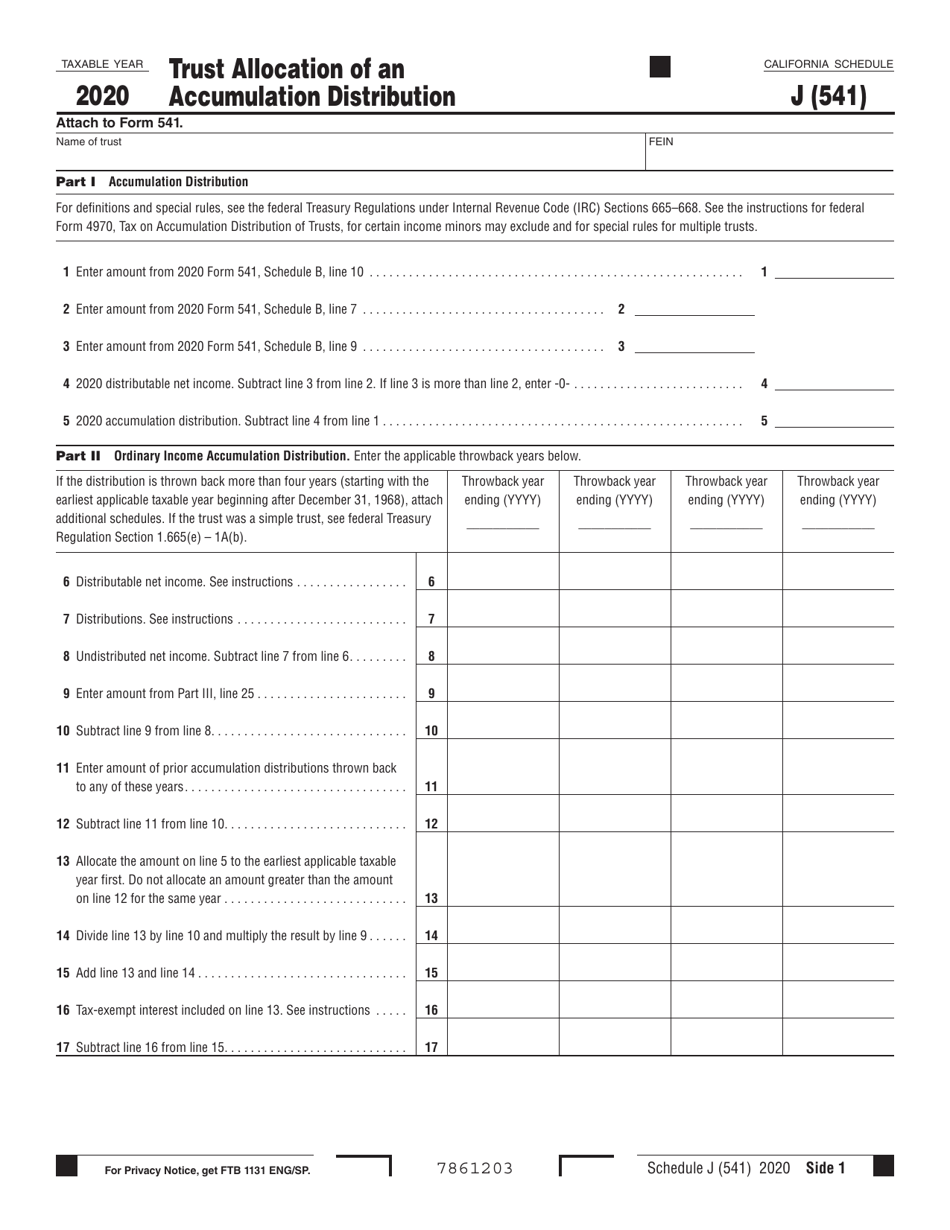

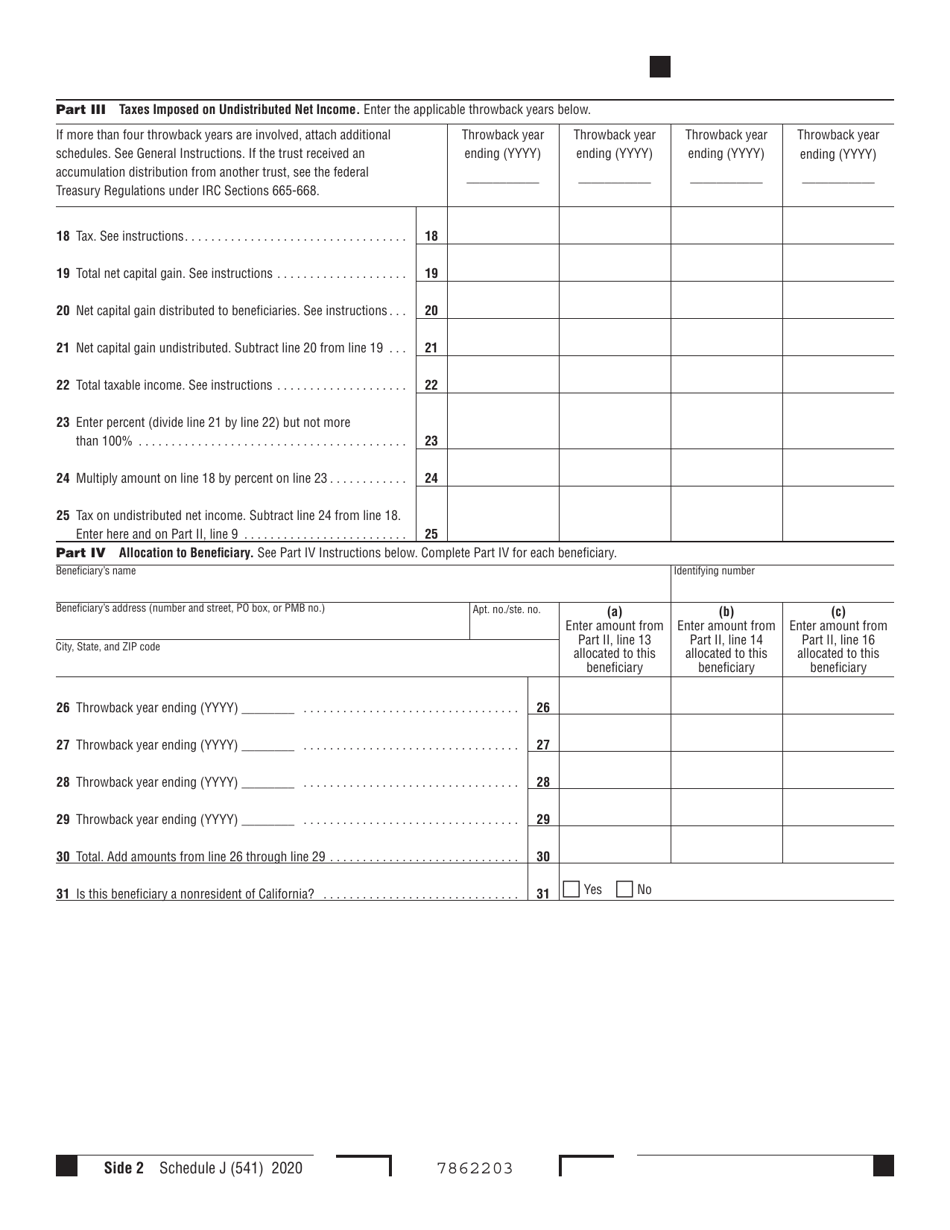

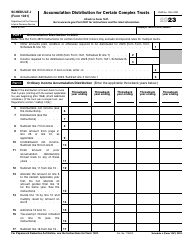

Form 541 Schedule J

for the current year.

Form 541 Schedule J Trust Allocation of an Accumulation Distribution - California

What Is Form 541 Schedule J?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 541, Payment for Automatic Extension for Fiduciaries. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541 Schedule J?

A: Form 541 Schedule J is a tax form used in California to report the allocation of an accumulation distribution by a trust.

Q: What is an accumulation distribution?

A: An accumulation distribution is a payment made by a trust to its beneficiaries from the accumulated income of the trust.

Q: Who needs to file Form 541 Schedule J?

A: Anyone who is required to file Form 541, California Fiduciary Income Tax Return, and has made an accumulation distribution from a trust must also file Form 541 Schedule J.

Q: How do I fill out Form 541 Schedule J?

A: To fill out Form 541 Schedule J, you must provide information about the trust, the beneficiaries receiving the accumulation distribution, and the amount and allocation of the distribution.

Q: When is Form 541 Schedule J due?

A: Form 541 Schedule J is due on the same date as the California Fiduciary Income Tax Return, which is typically April 15th.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 Schedule J by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.