This version of the form is not currently in use and is provided for reference only. Download this version of

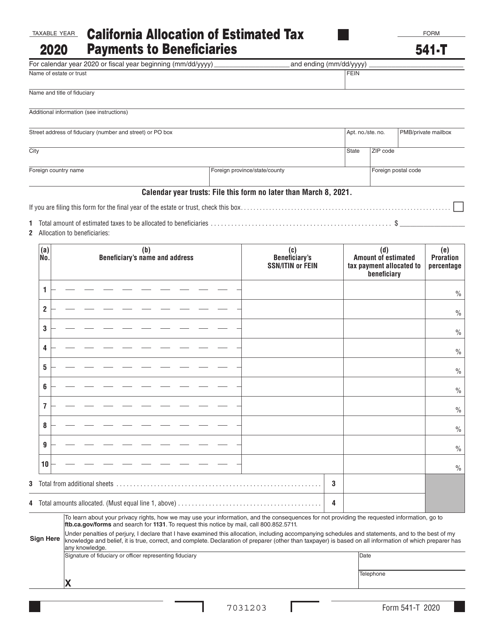

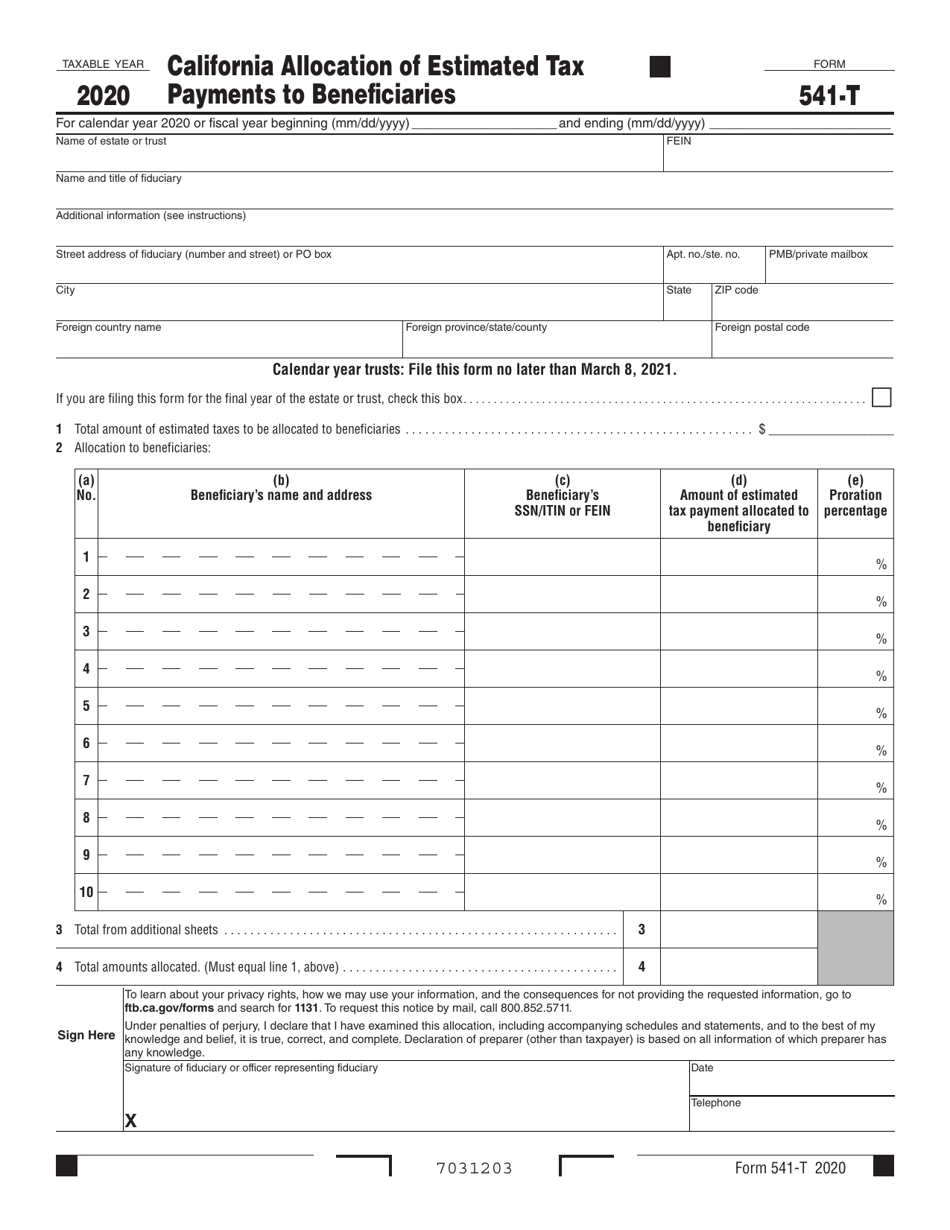

Form 541-T

for the current year.

Form 541-T California Allocation of Estimated Tax Payments to Beneficiaries - California

What Is Form 541-T?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541-T?

A: Form 541-T is the California Allocation of Estimated Tax Payments to Beneficiaries form.

Q: What is the purpose of Form 541-T?

A: The purpose of Form 541-T is to allocate estimated tax payments to beneficiaries in California.

Q: Who needs to file Form 541-T?

A: Fiduciaries of estates or trusts who want to allocate estimated tax payments to beneficiaries in California need to file Form 541-T.

Q: Is Form 541-T specific to California?

A: Yes, Form 541-T is specific to California and is used for allocating estimated tax payments within the state.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541-T by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.