This version of the form is not currently in use and is provided for reference only. Download this version of

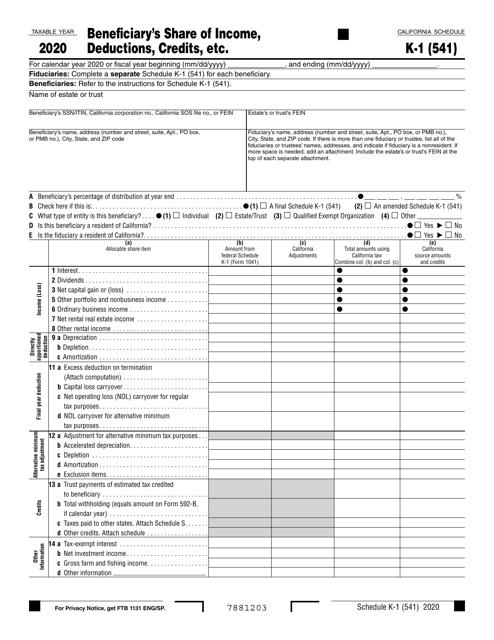

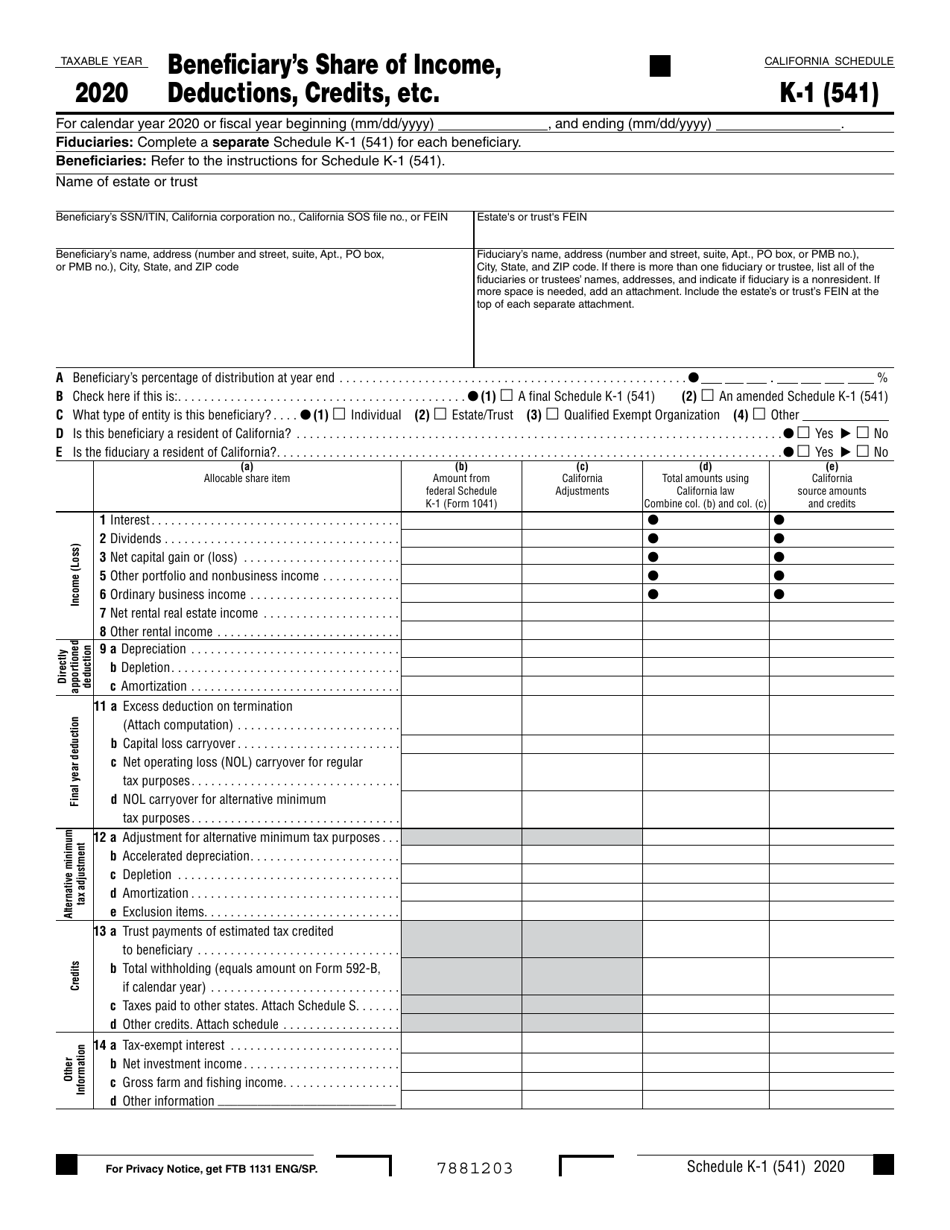

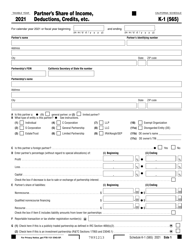

Form 541 Schedule K-1

for the current year.

Form 541 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc. - California

What Is Form 541 Schedule K-1?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 541, Payment for Automatic Extension for Fiduciaries. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541 Schedule K-1?

A: Form 541 Schedule K-1 is a tax form used by beneficiaries of a California trust to report their share of income, deductions, credits, and other information.

Q: Who needs to file Form 541 Schedule K-1?

A: Beneficiaries of a California trust need to file Form 541 Schedule K-1 if they have received income, deductions, credits, or other items from the trust.

Q: What information is reported on Form 541 Schedule K-1?

A: Form 541 Schedule K-1 reports a beneficiary's share of the trust's income, deductions, credits, and other relevant information.

Q: When is the deadline to file Form 541 Schedule K-1?

A: The deadline to file Form 541 Schedule K-1 is usually April 15th, unless an extension has been granted.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 Schedule K-1 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.