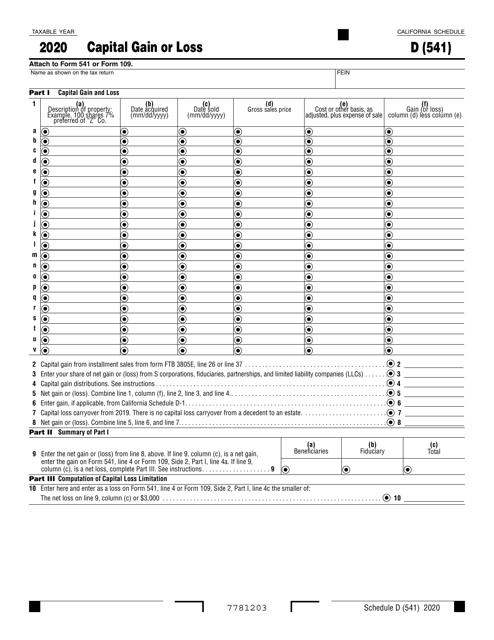

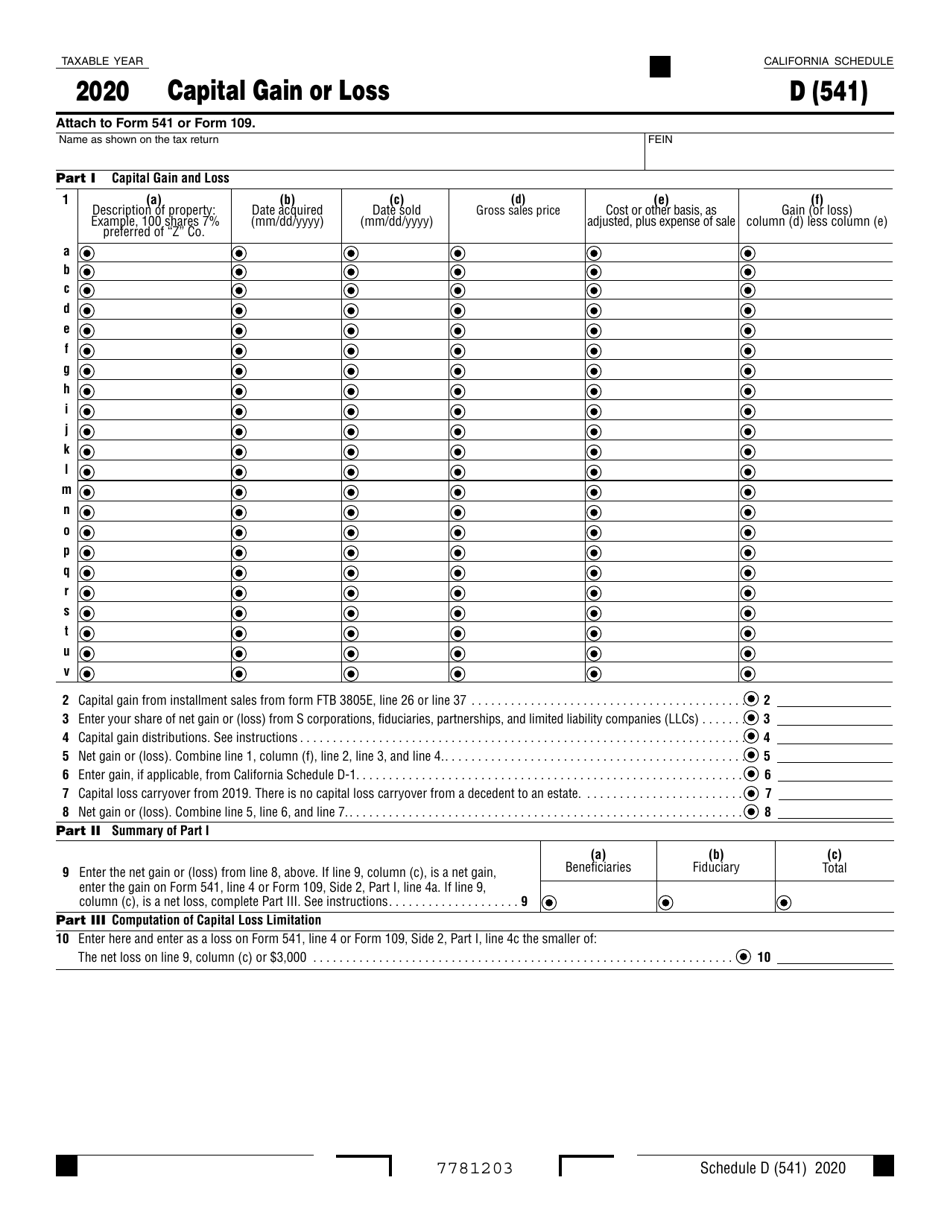

This version of the form is not currently in use and is provided for reference only. Download this version of

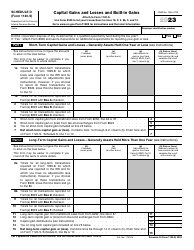

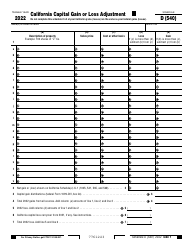

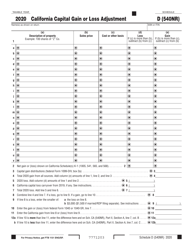

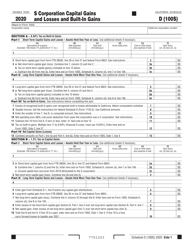

Form 541 Schedule D

for the current year.

Form 541 Schedule D Capital Gain or Loss - California

What Is Form 541 Schedule D?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 541, Payment for Automatic Extension for Fiduciaries. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541?

A: Form 541 is a tax form used by estates and trusts to report income, deductions, and credits.

Q: What is Schedule D?

A: Schedule D is a specific section of Form 541 used to report capital gains or losses.

Q: What is capital gain or loss?

A: A capital gain is the profit made from selling an investment, while a capital loss is the loss incurred.

Q: Is Schedule D required for estates and trusts in California?

A: Yes, estates and trusts in California are required to file Schedule D if they have capital gains or losses to report.

Q: What information is needed for Schedule D?

A: To complete Schedule D, you will need to provide details about the capital assets bought or sold during the tax year.

Q: When is the deadline to file Form 541?

A: The filing deadline for Form 541 in California is April 15th or the 15th day of the 4th month following the close of the taxable year.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 Schedule D by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.