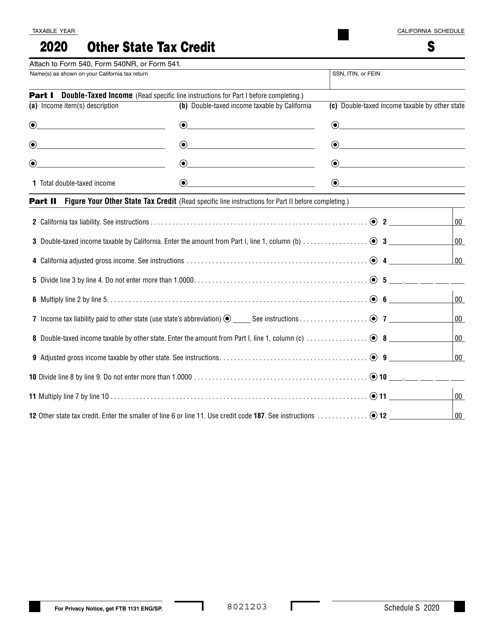

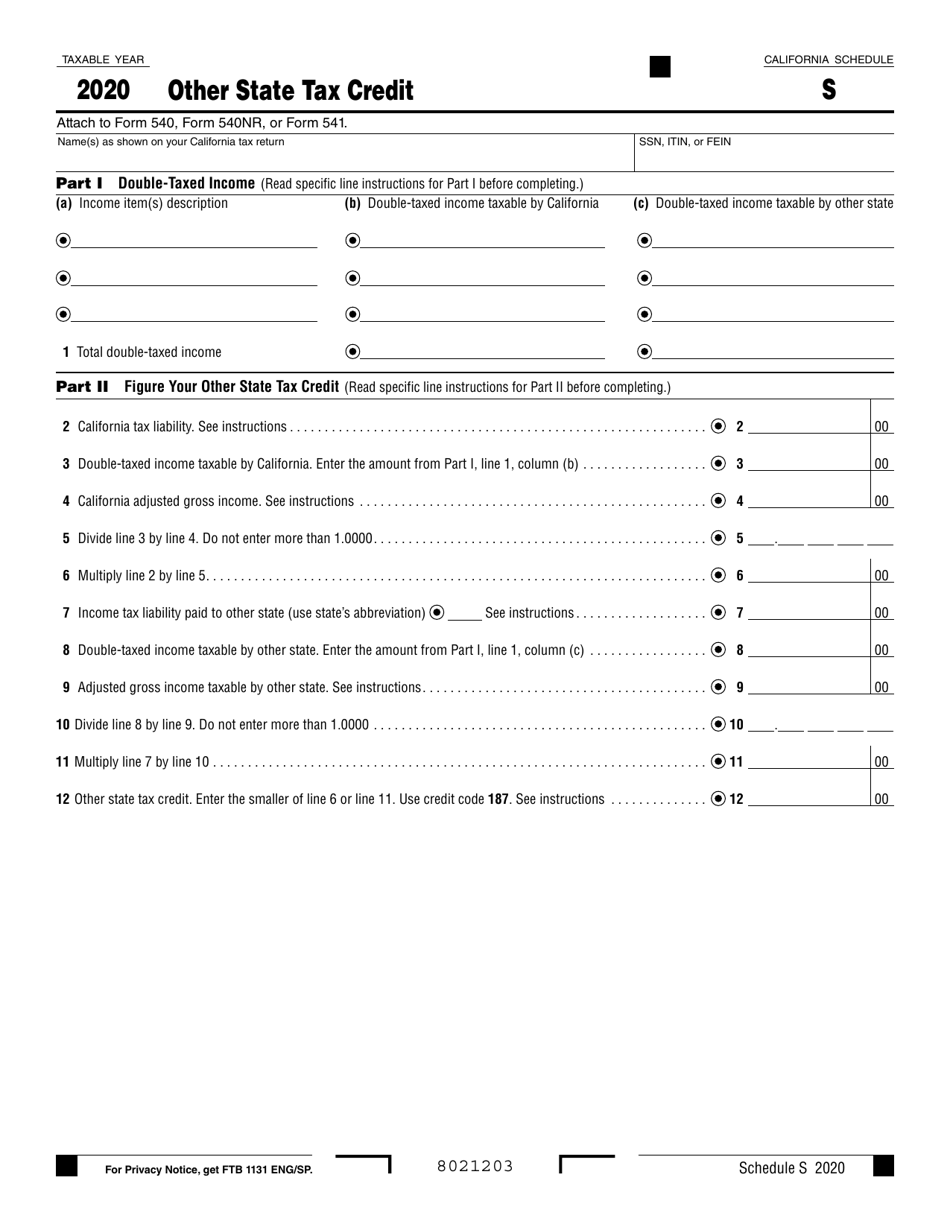

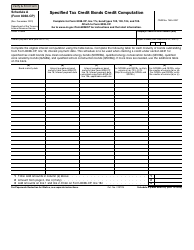

Schedule S Other State Tax Credit - California

What Is Schedule S?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule S Other State Tax Credit?

A: Schedule S Other State Tax Credit is a form used by taxpayers to claim a credit for taxes paid to another state.

Q: Why would I need to use Schedule S Other State Tax Credit?

A: You would need to use Schedule S Other State Tax Credit if you paid taxes to another state and want to claim a credit for those taxes on your California state tax return.

Q: How do I fill out Schedule S Other State Tax Credit?

A: You will need to provide information about the other state, including the amount of taxes paid and any credits or deductions you already claimed in that state. The instructions on the form will guide you through the process.

Q: When is Schedule S Other State Tax Credit due?

A: Schedule S Other State Tax Credit is typically due at the same time as your California state tax return, which is generally April 15th.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule S by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.