This version of the form is not currently in use and is provided for reference only. Download this version of

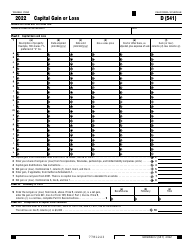

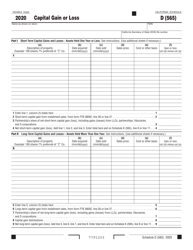

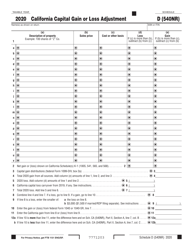

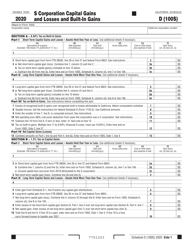

Form 540 Schedule D

for the current year.

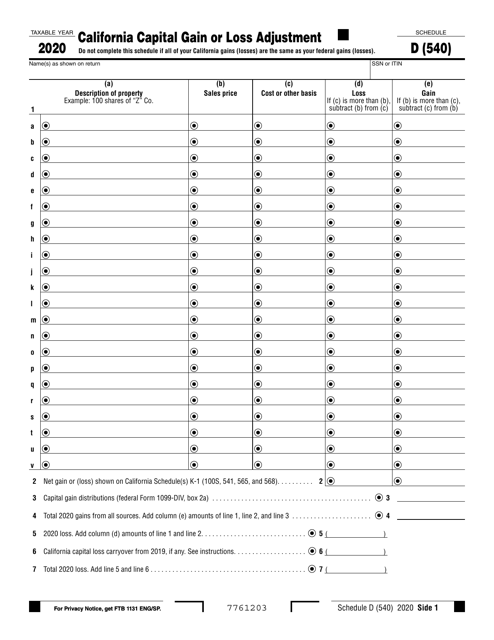

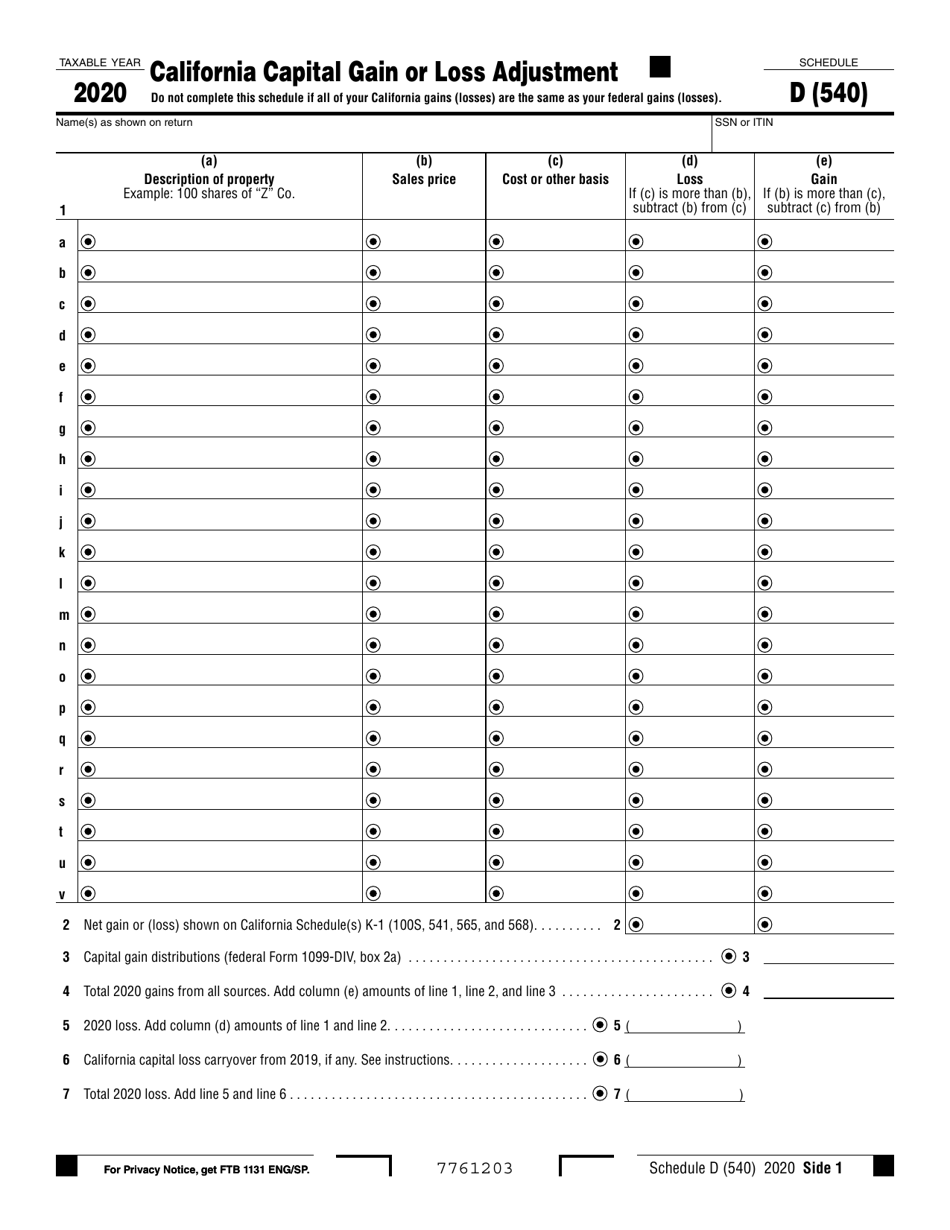

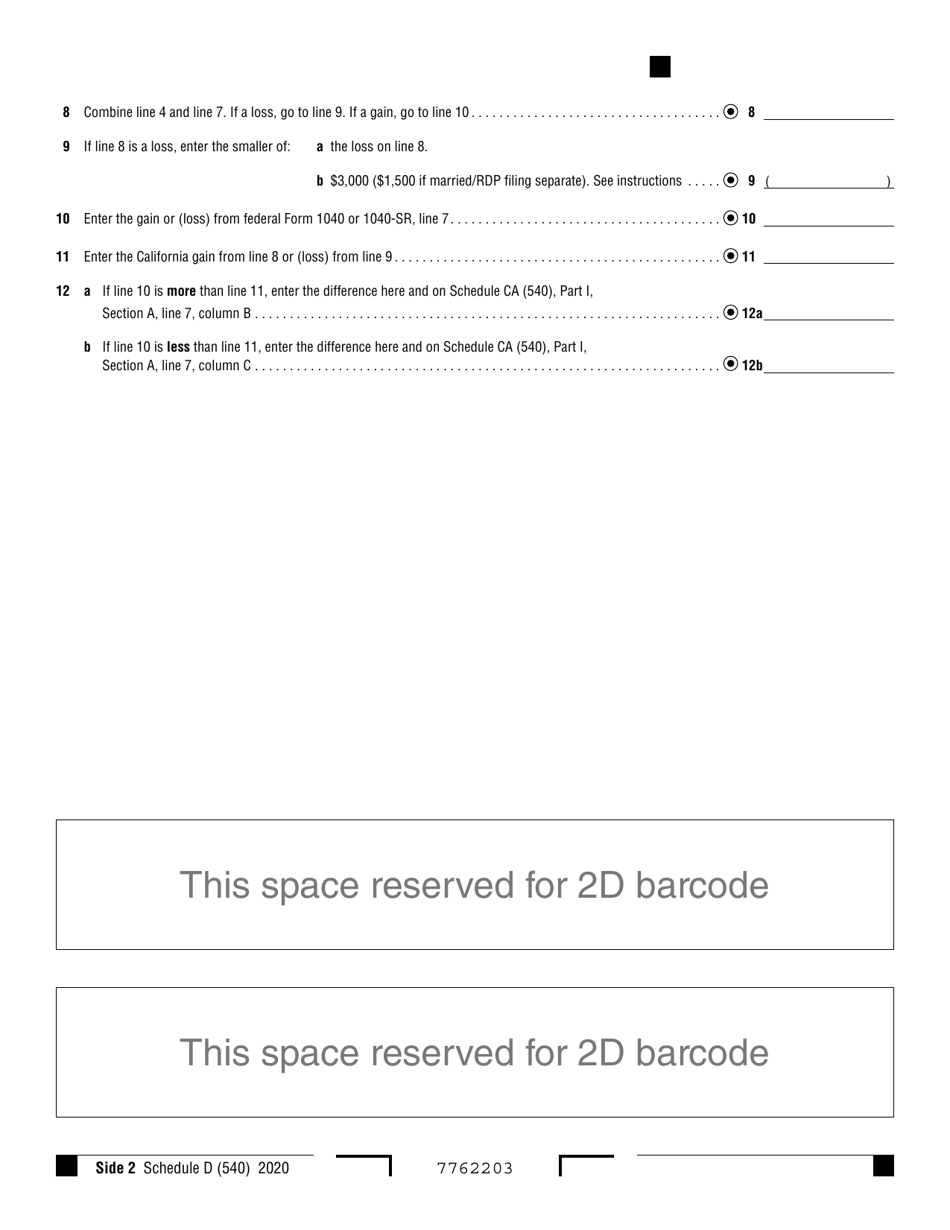

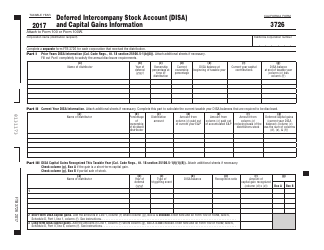

Form 540 Schedule D California Capital Gain or Loss Adjustment - California

What Is Form 540 Schedule D?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 540, California Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540 Schedule D?

A: Form 540 Schedule D is a California tax form used to report capital gains or losses on your state tax return.

Q: Who needs to file Form 540 Schedule D?

A: You need to file Form 540 Schedule D if you have any capital gains or losses to report on your California state tax return.

Q: What is a capital gain?

A: A capital gain is a profit you make from selling an asset, such as stocks, real estate, or a business.

Q: What is a capital loss?

A: A capital loss is a loss you incur from selling an asset for less than its original cost.

Q: How do I calculate capital gain or loss?

A: To calculate capital gain or loss, subtract the original cost (or basis) of the asset from the selling price.

Q: What is the purpose of Form 540 Schedule D?

A: The purpose of Form 540 Schedule D is to report and adjust capital gains or losses for California tax purposes.

Q: When is Form 540 Schedule D due?

A: Form 540 Schedule D is due by the same deadline as your California state tax return, typically April 15th.

Q: Do I need to attach any supporting documents with Form 540 Schedule D?

A: You may need to attach certain documents, such as brokerage statements or property sale documents, to support your capital gain or loss calculations.

Q: What happens if I don't file Form 540 Schedule D?

A: If you have capital gains or losses to report and you don't file Form 540 Schedule D, you may be subject to penalties and interest on your tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540 Schedule D by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.