This version of the form is not currently in use and is provided for reference only. Download this version of

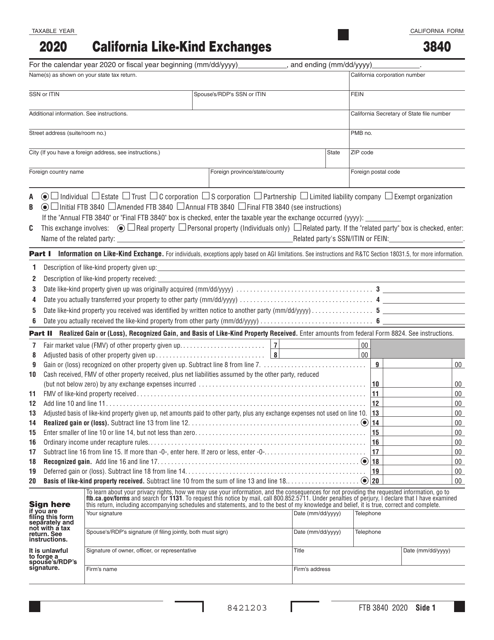

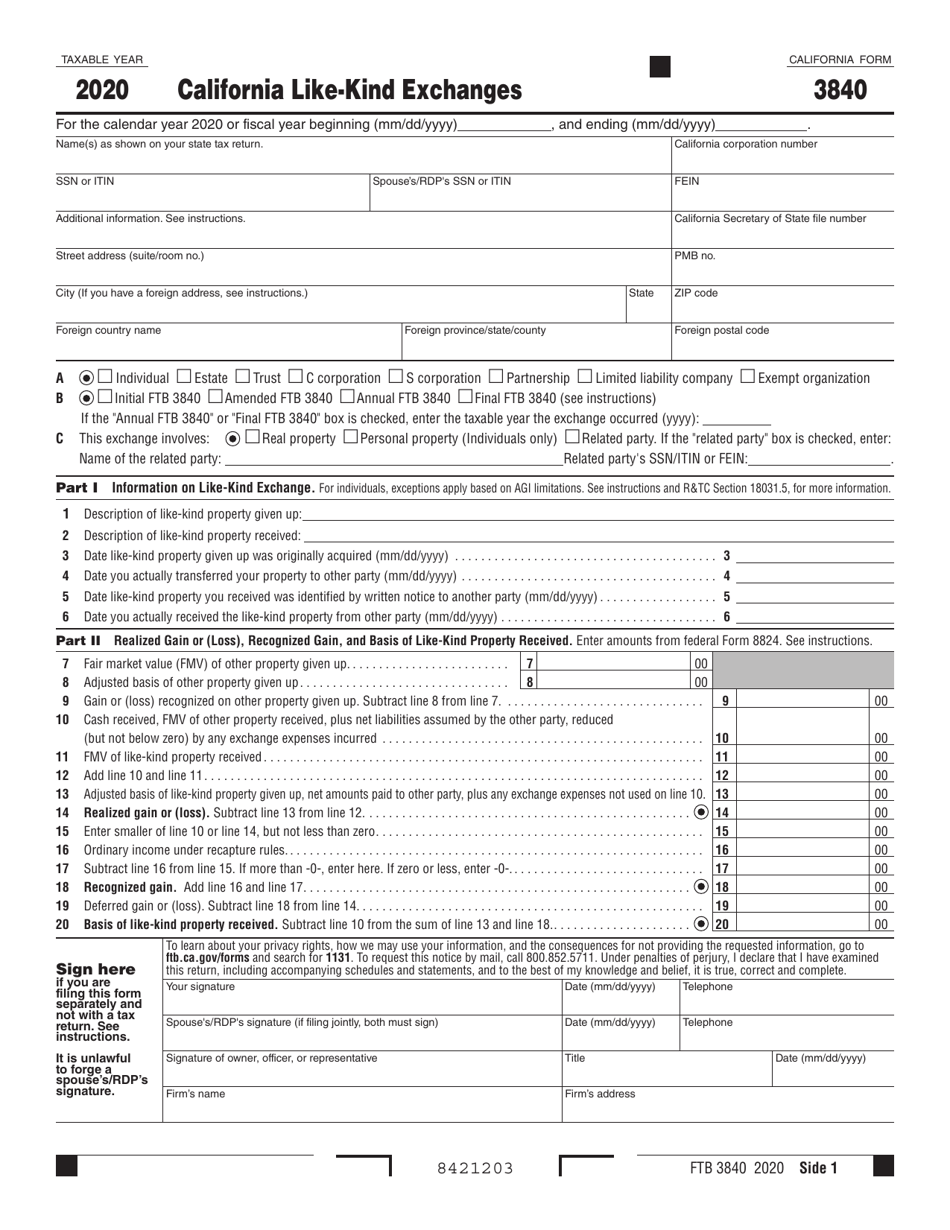

Form FTB3840

for the current year.

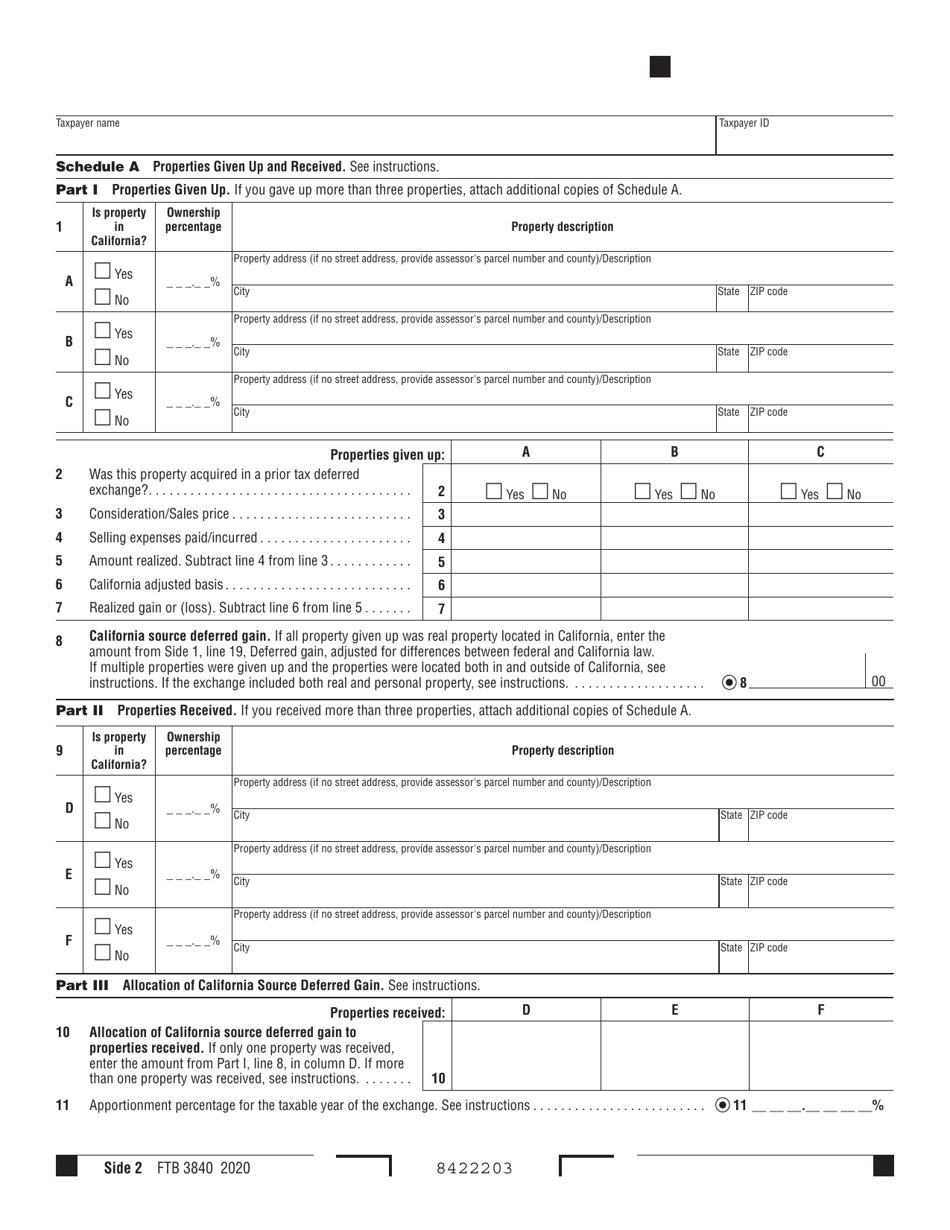

Form FTB3840 California Like-Kind Exchanges - California

What Is Form FTB3840?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form FTB 3840?

A: Form FTB 3840 is the California Like-Kind Exchanges form.

Q: What is a Like-Kind Exchange?

A: A Like-Kind Exchange is a transaction allowed by the IRS where an individual can defer capital gains taxes on the sale of certain business or investment property by reinvesting the proceeds into a similar property.

Q: When should I file Form FTB 3840?

A: Form FTB 3840 should be filed with the California Franchise Tax Board (FTB) when you are deferring capital gains taxes on a Like-Kind Exchange.

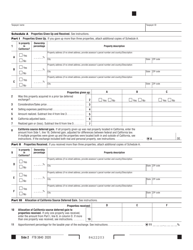

Q: What information is required on Form FTB 3840?

A: Form FTB 3840 requires information about the property being sold, the property being acquired, and details about the exchange transaction.

Q: Are there any deadlines for filing Form FTB 3840?

A: Yes, Form FTB 3840 should be filed within 12 months from the end of the tax year in which the original property was sold.

Q: Are there any special rules or requirements for California Like-Kind Exchanges?

A: Yes, California has its own rules and requirements for Like-Kind Exchanges, so it is important to carefully review the instructions and consult with a tax professional.

Q: Can I e-file Form FTB 3840?

A: Yes, you can e-file Form FTB 3840 if you are using approved tax software or a tax professional who offers e-filing services.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3840 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.