This version of the form is not currently in use and is provided for reference only. Download this version of

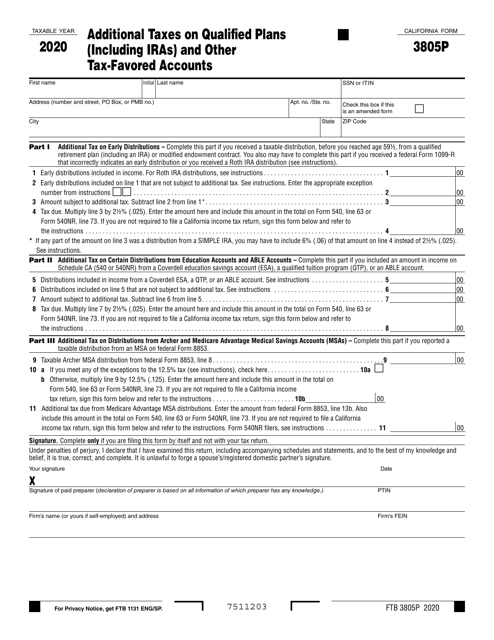

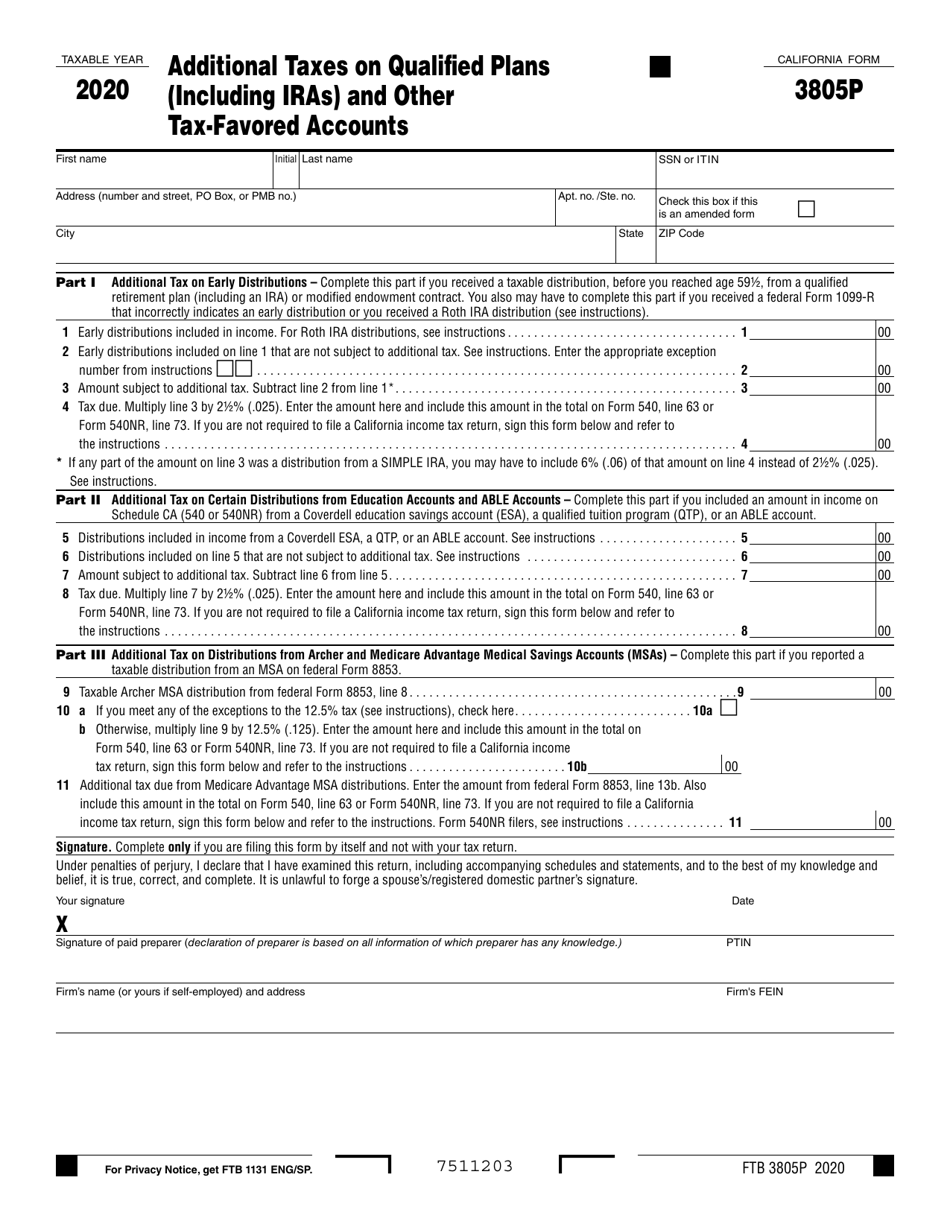

Form FTB3805P

for the current year.

Form FTB3805P Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts - California

What Is Form FTB3805P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3805P?

A: Form FTB3805P is a tax form used in California to report additional taxes on qualified plans (including IRAs) and other tax-favored accounts.

Q: Who needs to file Form FTB3805P?

A: Taxpayers in California who owe additional taxes on qualified plans and tax-favored accounts are required to file Form FTB3805P.

Q: What is the purpose of Form FTB3805P?

A: The purpose of Form FTB3805P is to calculate and report additional taxes imposed on distributions from qualified plans and tax-favored accounts.

Q: What types of accounts are included in Form FTB3805P?

A: Form FTB3805P includes qualified retirement plans, individual retirement arrangements (IRAs), health savings accounts (HSAs), and Archer medical savings accounts (MSAs).

Q: How do I fill out Form FTB3805P?

A: To fill out Form FTB3805P, you will need to provide information about your qualified plan or tax-favored account distributions, calculate the additional tax owed, and enter the necessary details into the form.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3805P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.