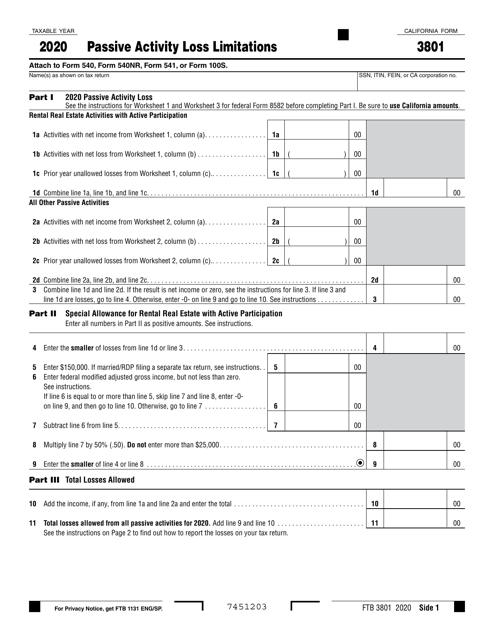

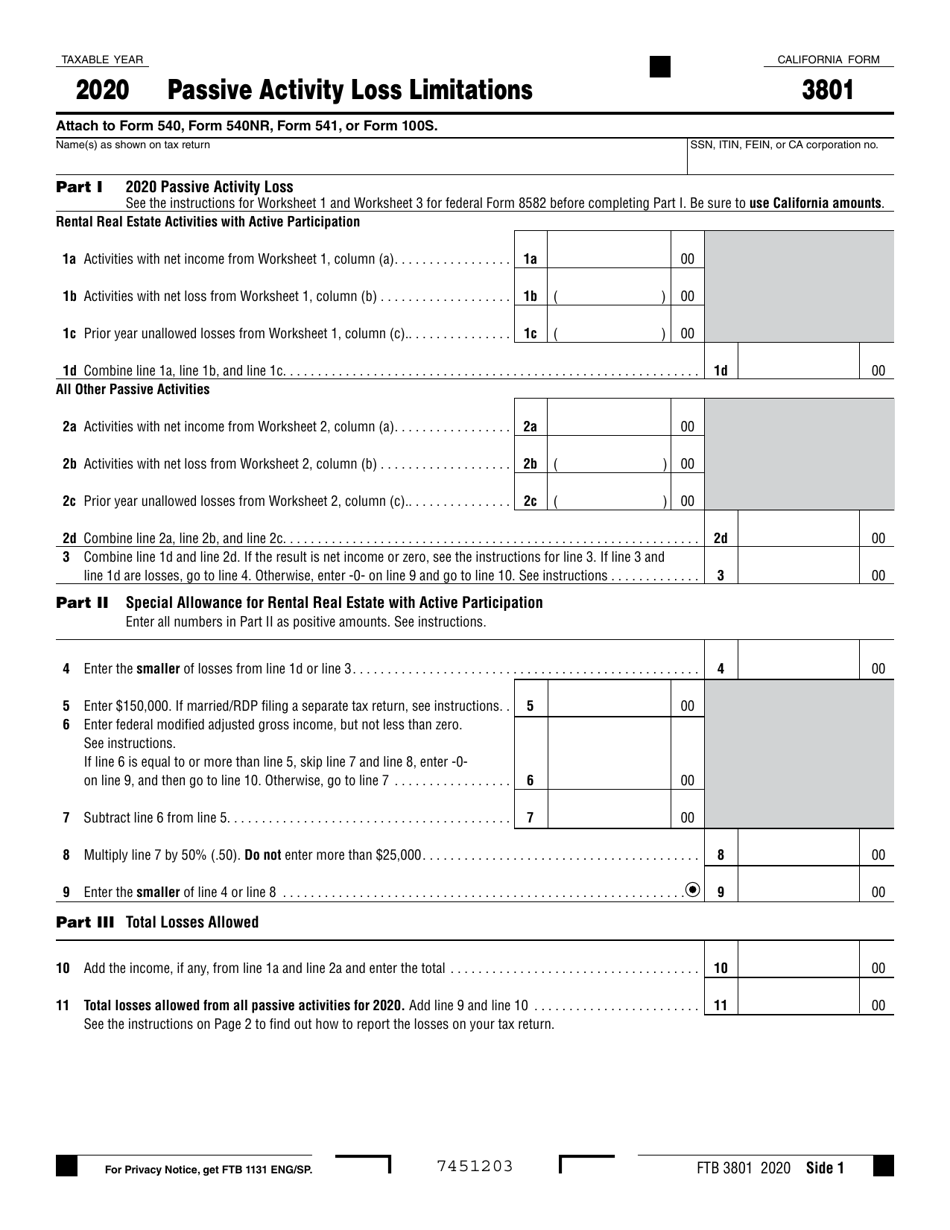

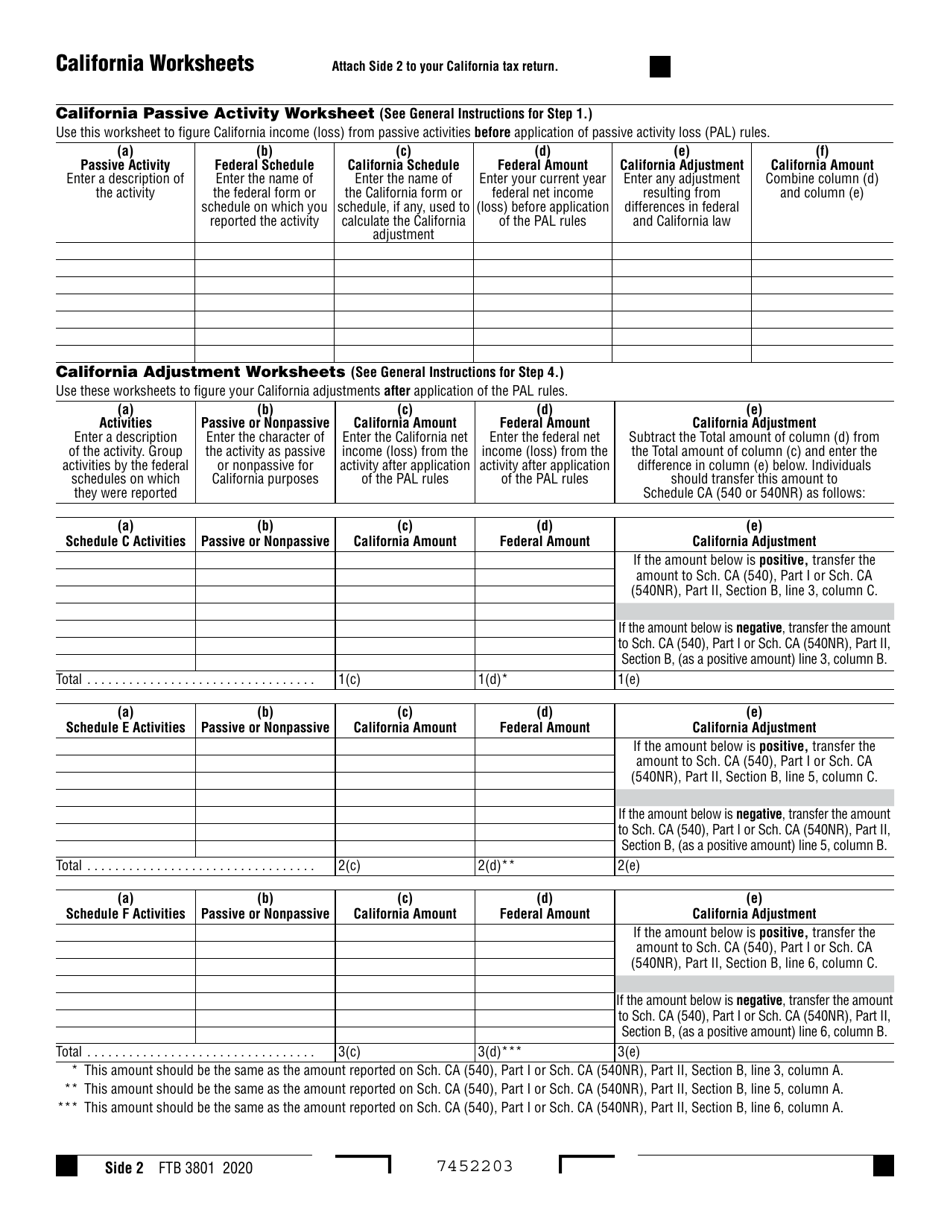

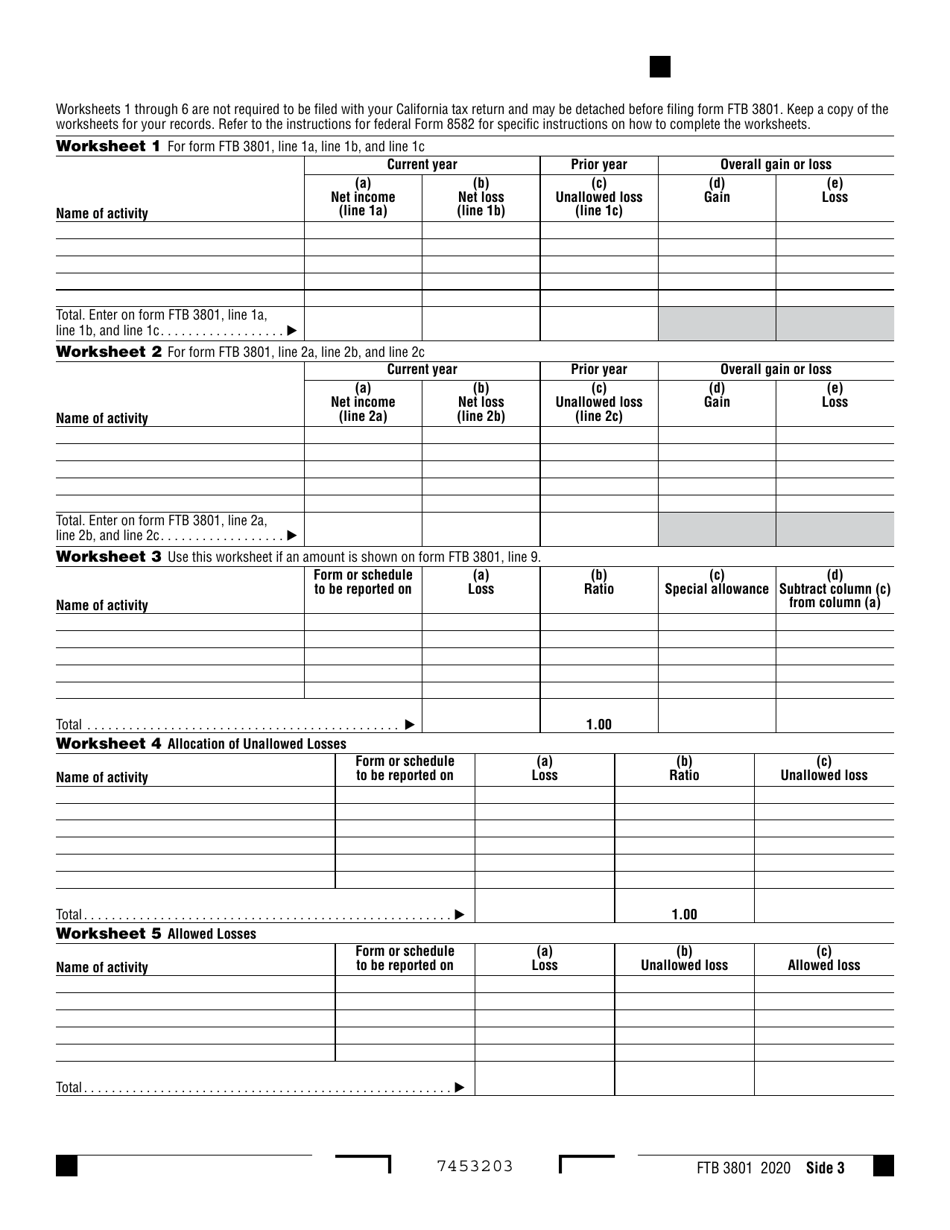

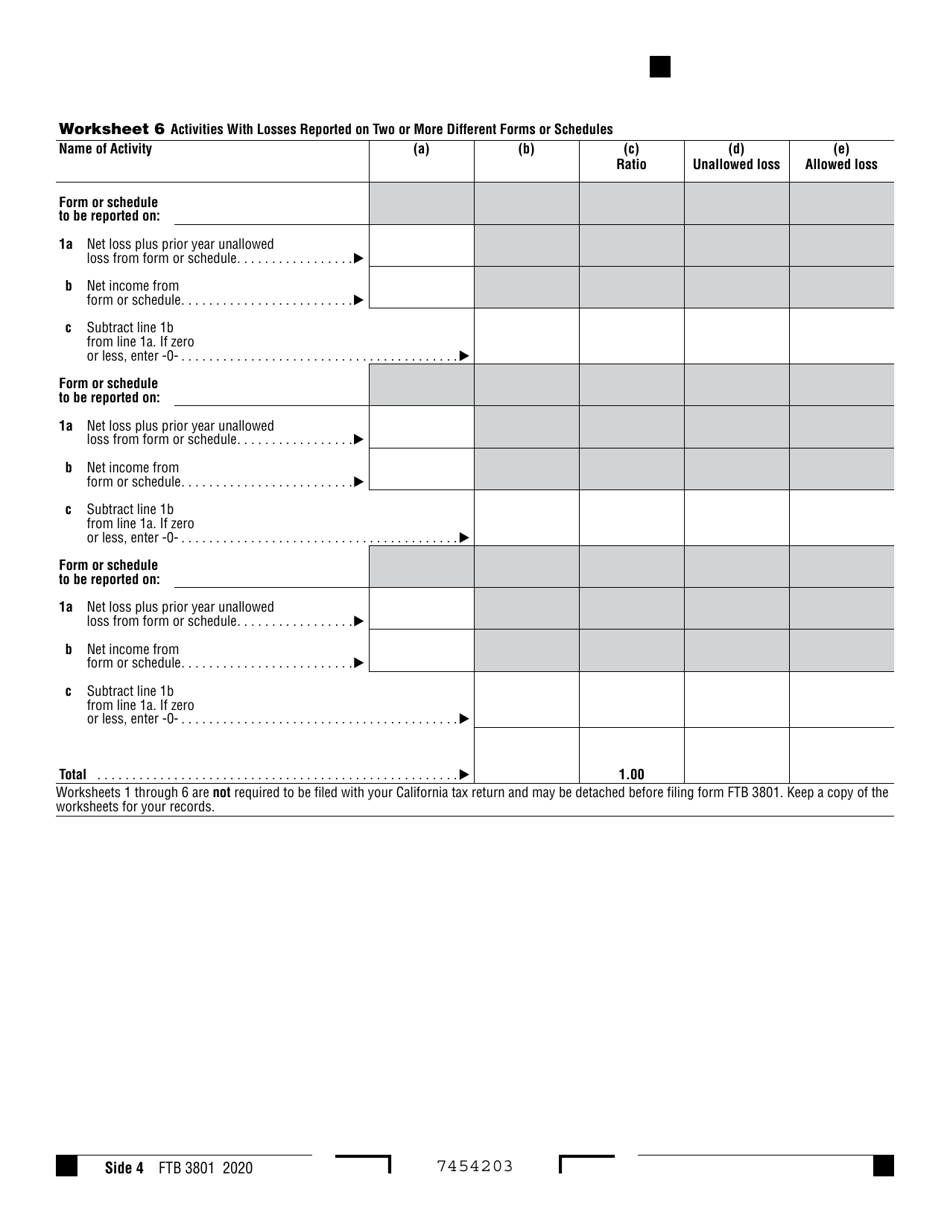

Form FTB3801 Passive Activity Loss Limitations - California

What Is Form FTB3801?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3801?

A: Form FTB3801 is California's Passive Activity Loss Limitations form.

Q: What does the form calculate?

A: The form calculates the amount of passive activity loss that can be deducted on your California tax return.

Q: Who needs to file Form FTB3801?

A: You need to file Form FTB3801 if you have passive activity losses and you are a California resident, part-year resident, or nonresident with California-source income.

Q: What is a passive activity?

A: A passive activity is a trade or business in which you do not materially participate, such as rental activities or limited partnerships.

Q: How does Form FTB3801 work?

A: Form FTB3801 determines the amount of passive activity loss that is allowable based on your filing status, adjusted gross income, and the type of passive activity.

Q: Is Form FTB3801 the same as the federal Form 8582?

A: No, Form FTB3801 is specific to California and may have different rules and calculations than the federal Form 8582.

Q: When is the deadline to file Form FTB3801?

A: The deadline to file Form FTB3801 is the same as the deadline to file your California tax return, which is usually April 15th, unless it falls on a weekend or holiday.

Q: What happens if I don't file Form FTB3801?

A: If you have passive activity losses and fail to file Form FTB3801, you may not be able to deduct those losses on your California tax return.

Q: Can I e-file Form FTB3801?

A: Yes, you can e-file Form FTB3801 if you are using approved tax software or a licensed tax professional.

Q: Can I file Form FTB3801 separately from my California tax return?

A: No, Form FTB3801 must be filed in conjunction with your California tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3801 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.