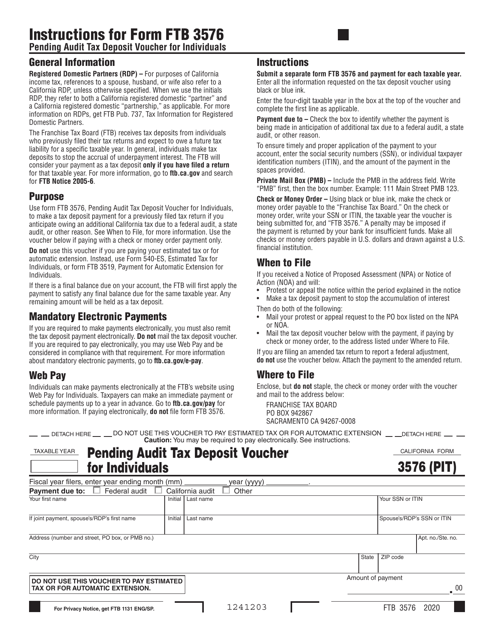

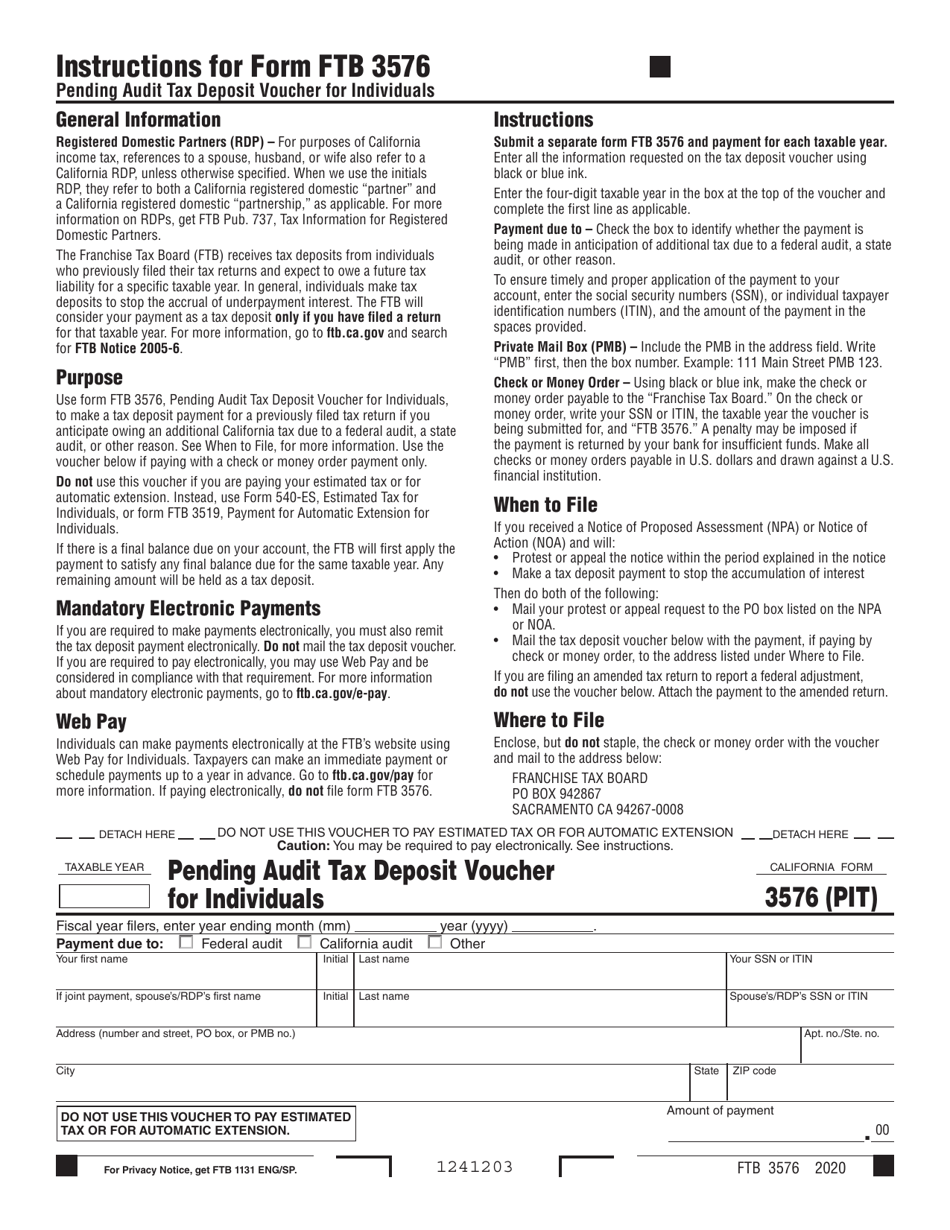

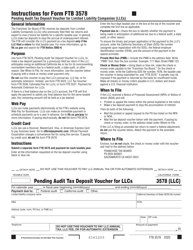

Form FTB3576 Pending Audit Tax Deposit Voucher for Individuals - California

What Is Form FTB3576?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3576?

A: Form FTB3576 is the Pending Audit Tax Deposit Voucher for Individuals in California.

Q: Who needs to use Form FTB3576?

A: Individuals who are under audit by the California Franchise Tax Board may need to use Form FTB3576.

Q: What is the purpose of Form FTB3576?

A: The purpose of Form FTB3576 is to make tax deposits while an individual's tax audit is pending.

Q: When should I use Form FTB3576?

A: You should use Form FTB3576 when instructed by the California Franchise Tax Board during the audit process.

Q: What should I do if I have any questions about Form FTB3576?

A: If you have any questions about Form FTB3576, you should contact the California Franchise Tax Board for assistance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3576 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.