This version of the form is not currently in use and is provided for reference only. Download this version of

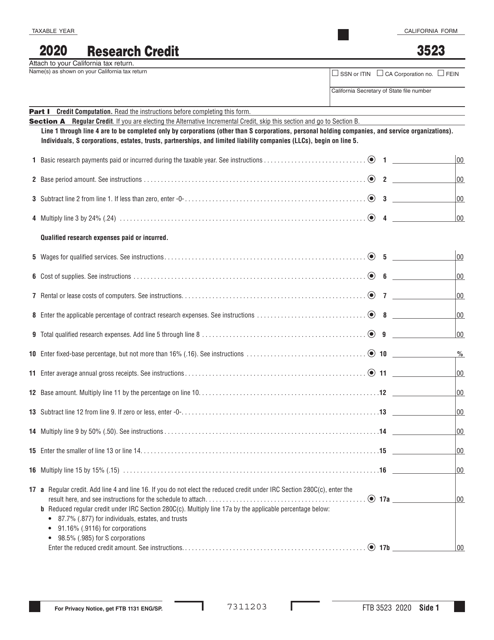

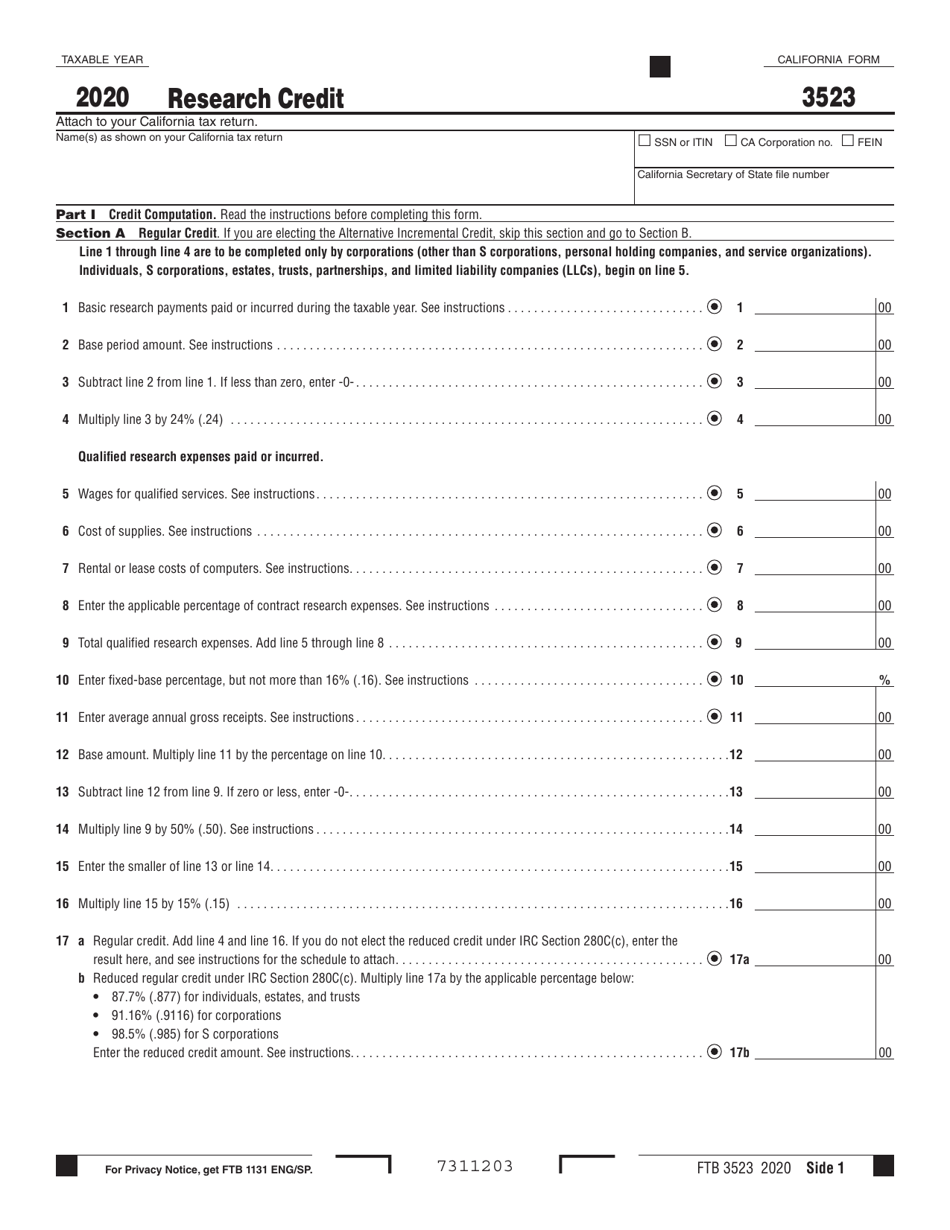

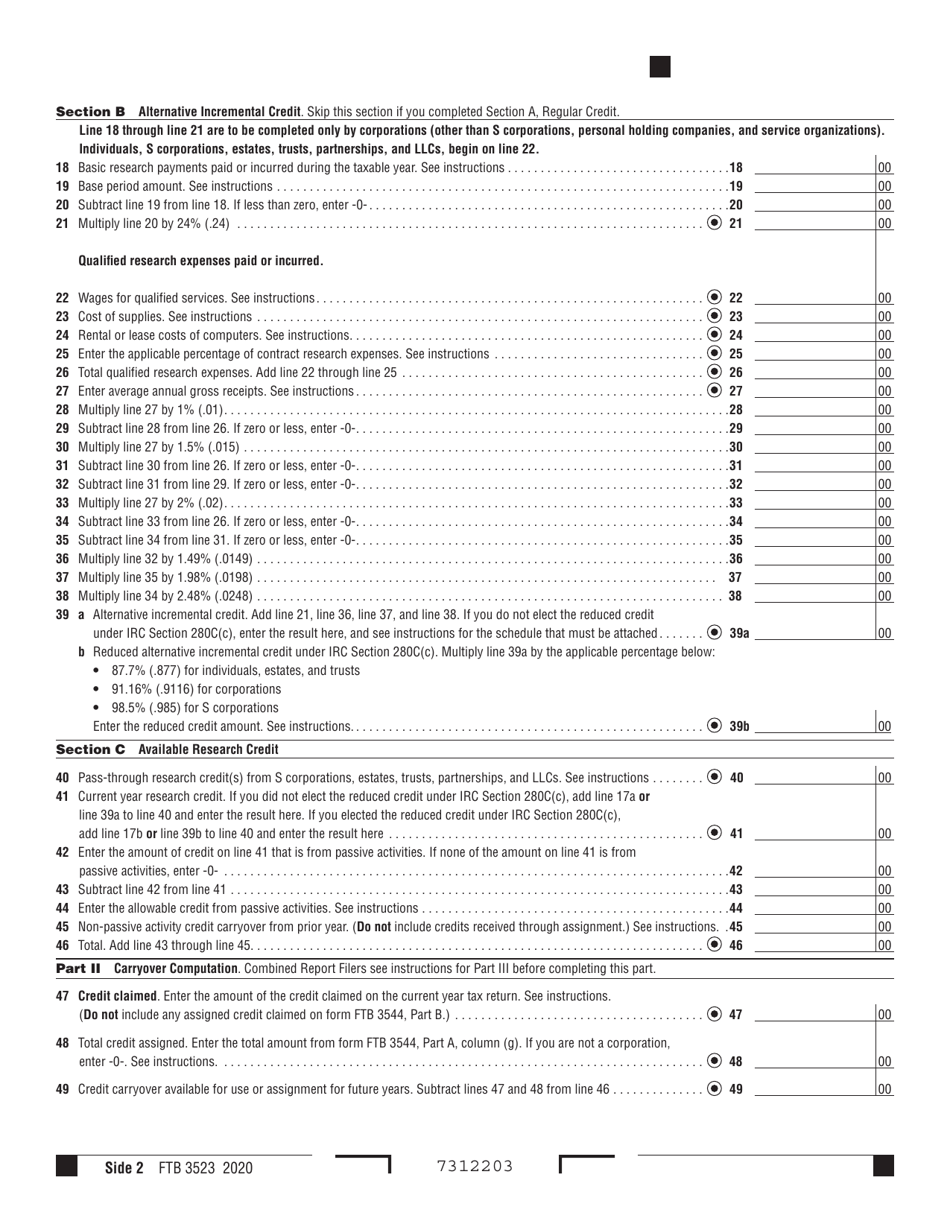

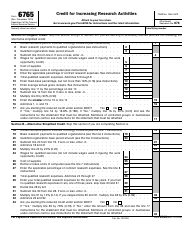

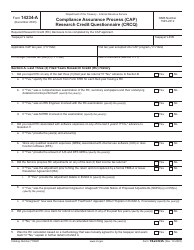

Form FTB3523

for the current year.

Form FTB3523 Research Credit - California

What Is Form FTB3523?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB 3523?

A: Form FTB 3523 is a tax form used to claim the California Research Credit.

Q: What is the California Research Credit?

A: The California Research Credit is a tax credit available to businesses that engage in qualified research activities in California.

Q: Who can claim the California Research Credit?

A: Any business that conducts qualified research activities in California is eligible to claim the credit.

Q: What are qualified research activities?

A: Qualified research activities are activities undertaken for the purpose of discovering information that is technological in nature and aimed at developing a new or improved business component.

Q: What information is required to complete Form FTB 3523?

A: To complete Form FTB 3523, you will need to provide information about your business, the amount of qualified research expenses incurred in California, and other supporting documentation.

Q: When is Form FTB 3523 due?

A: Form FTB 3523 is generally due on the 15th day of the 4th month following the close of the taxable year.

Q: Can I claim the California Research Credit on my federal tax return?

A: No, the California Research Credit is only available for California state tax purposes and cannot be claimed on the federal tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3523 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.