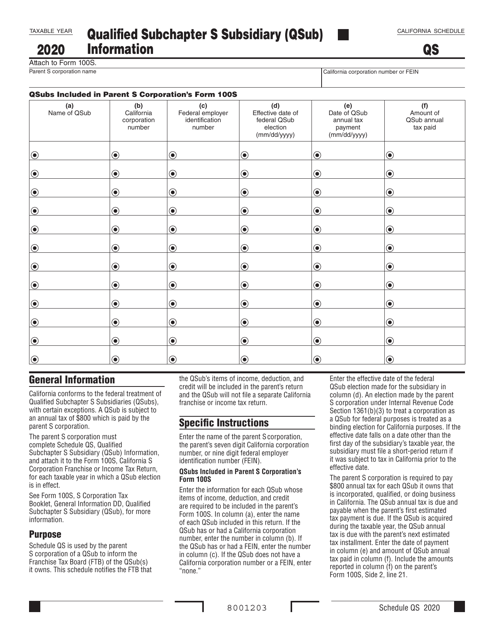

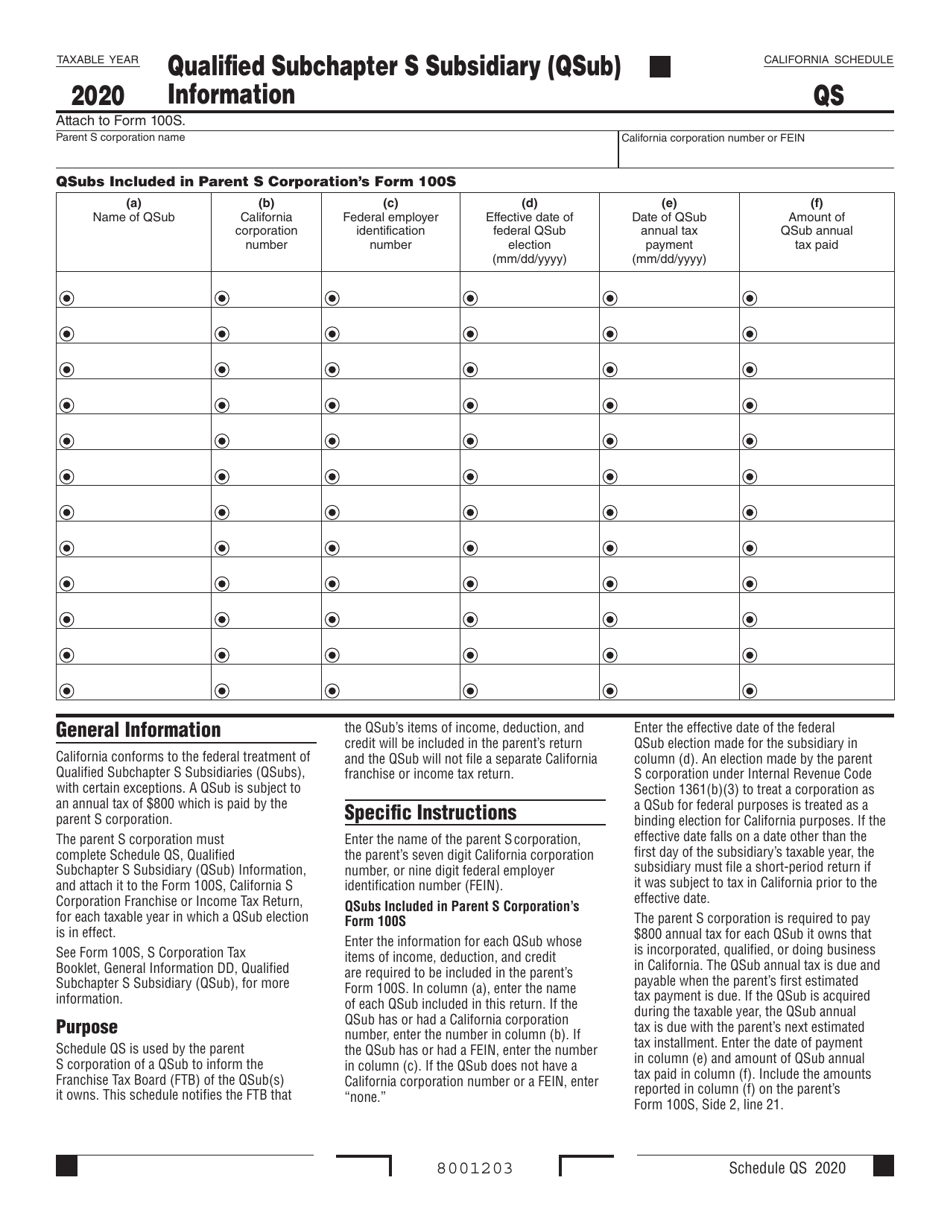

Form 100S Schedule QS Qualified Subchapter S Subsidiary (Qsub) Information - California

What Is Form 100S Schedule QS?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 100S, California S Corporation Franchise or Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100S Schedule QS?

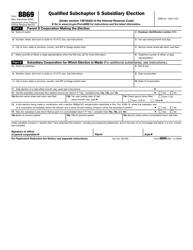

A: Form 100S Schedule QS is a form used in California to provide information about a Qualified Subchapter S Subsidiary (Qsub).

Q: What is a Qualified Subchapter S Subsidiary (Qsub)?

A: A Qualified Subchapter S Subsidiary (Qsub) is a subsidiary corporation that is wholly owned by another S corporation.

Q: Why is Form 100S Schedule QS required?

A: Form 100S Schedule QS is required to report information about the Qsub and its relationship with the parent S corporation.

Q: Who needs to file Form 100S Schedule QS?

A: S corporations in California that have a Qualified Subchapter S Subsidiary (Qsub) need to file Form 100S Schedule QS.

Q: What information is required on Form 100S Schedule QS?

A: Form 100S Schedule QS requires information about the Qsub's name, federal Employer Identification Number (EIN), and the percentage of stock owned by the parent S corporation.

Q: When is Form 100S Schedule QS due?

A: Form 100S Schedule QS is due on or before the due date of the S corporation's California tax return, which is generally the 15th day of the 4th month following the close of the taxable year.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100S Schedule QS by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.