This version of the form is not currently in use and is provided for reference only. Download this version of

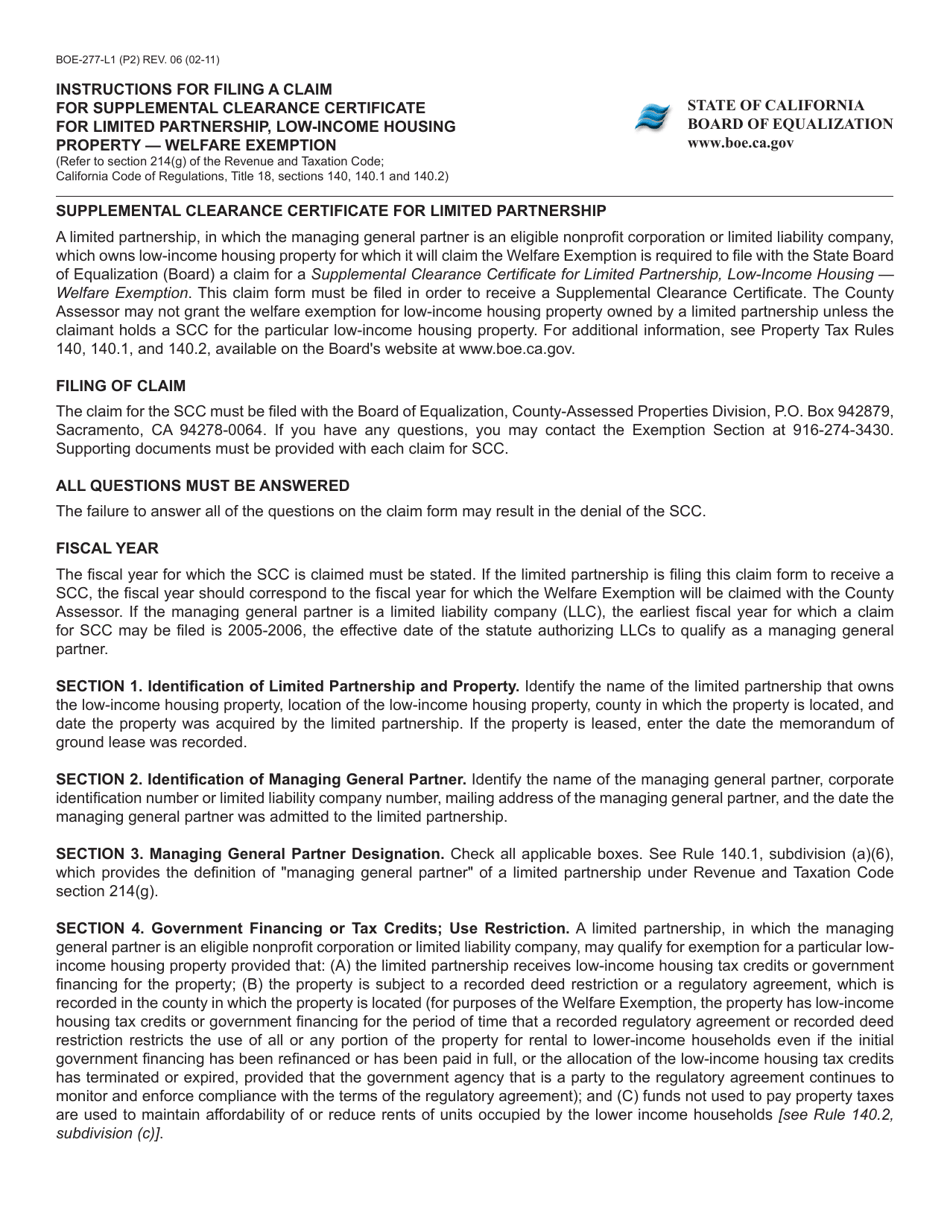

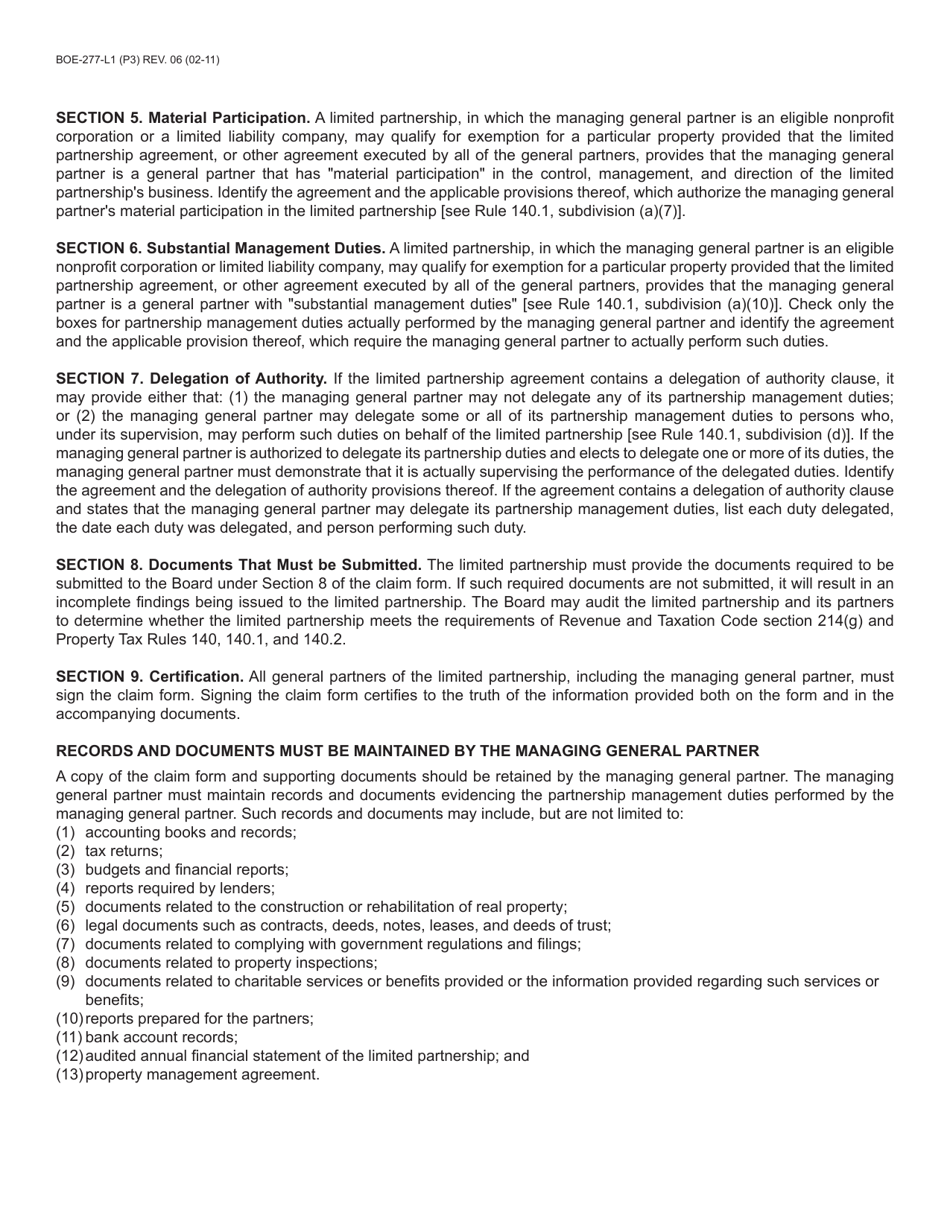

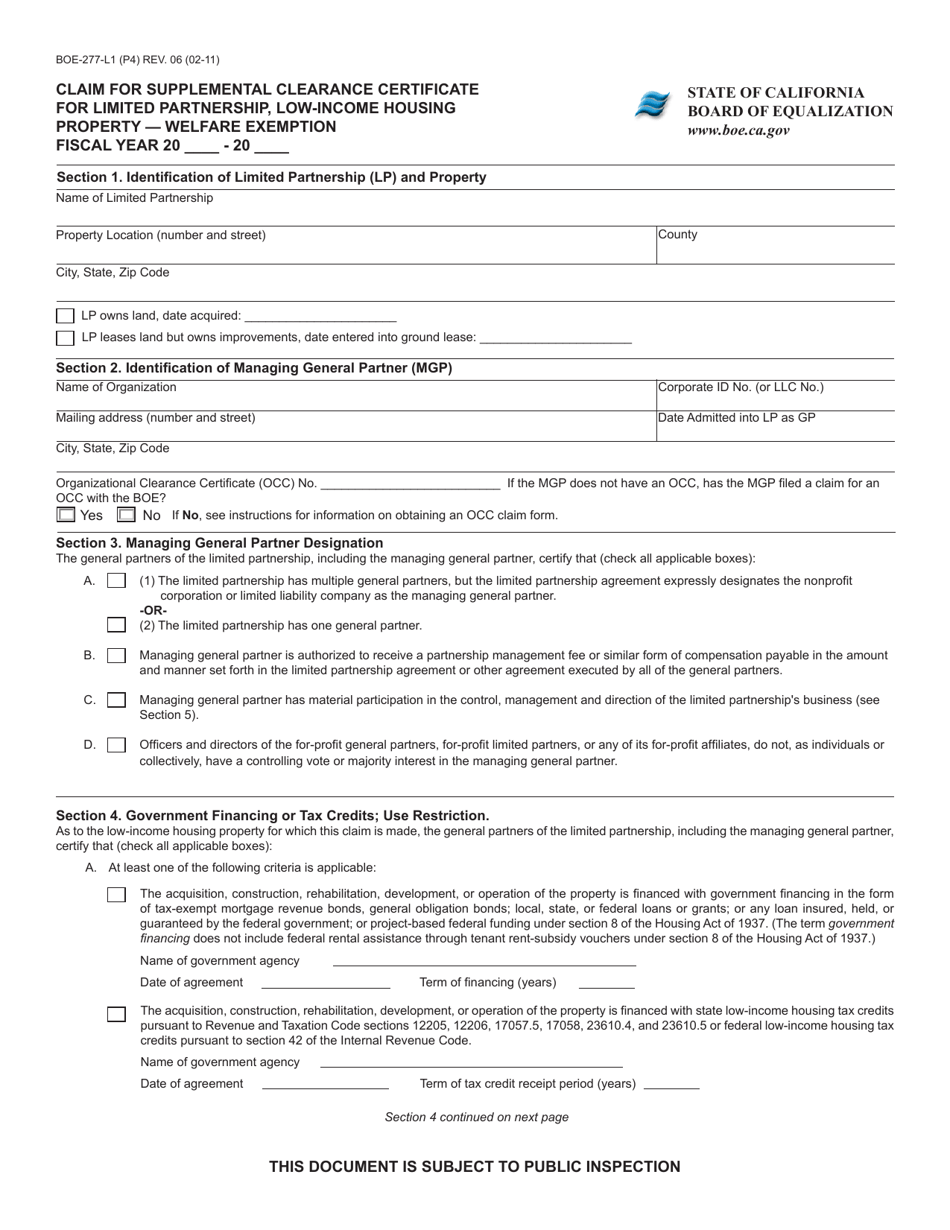

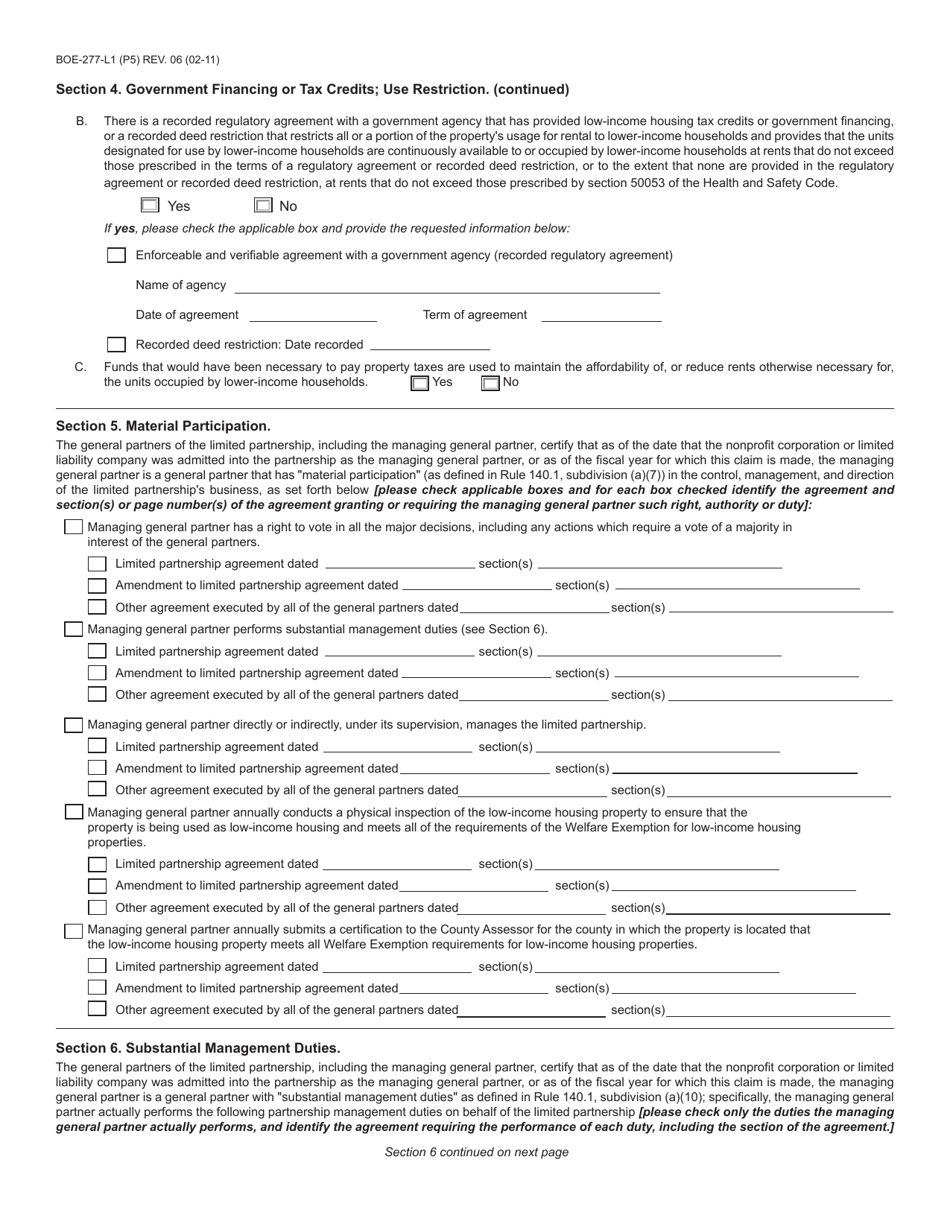

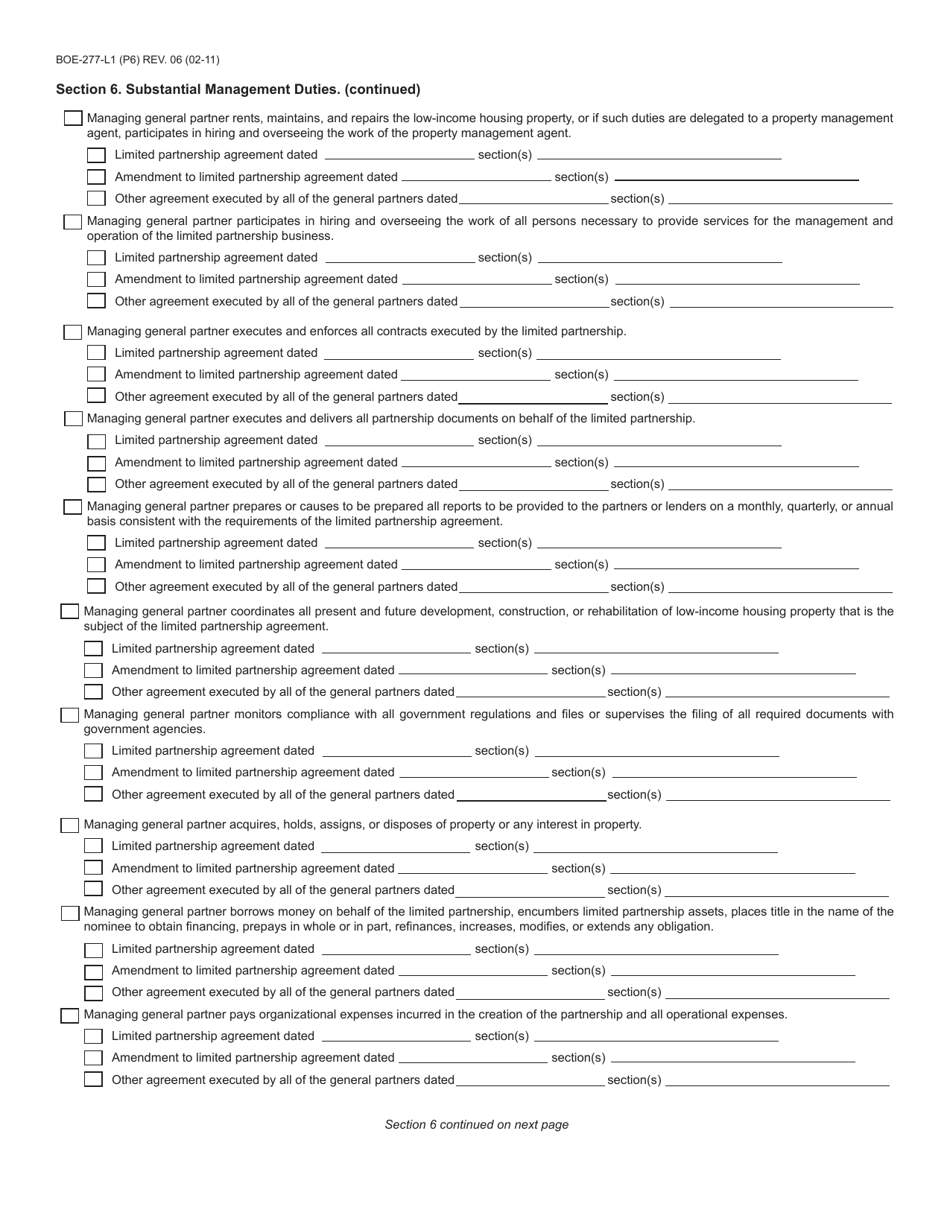

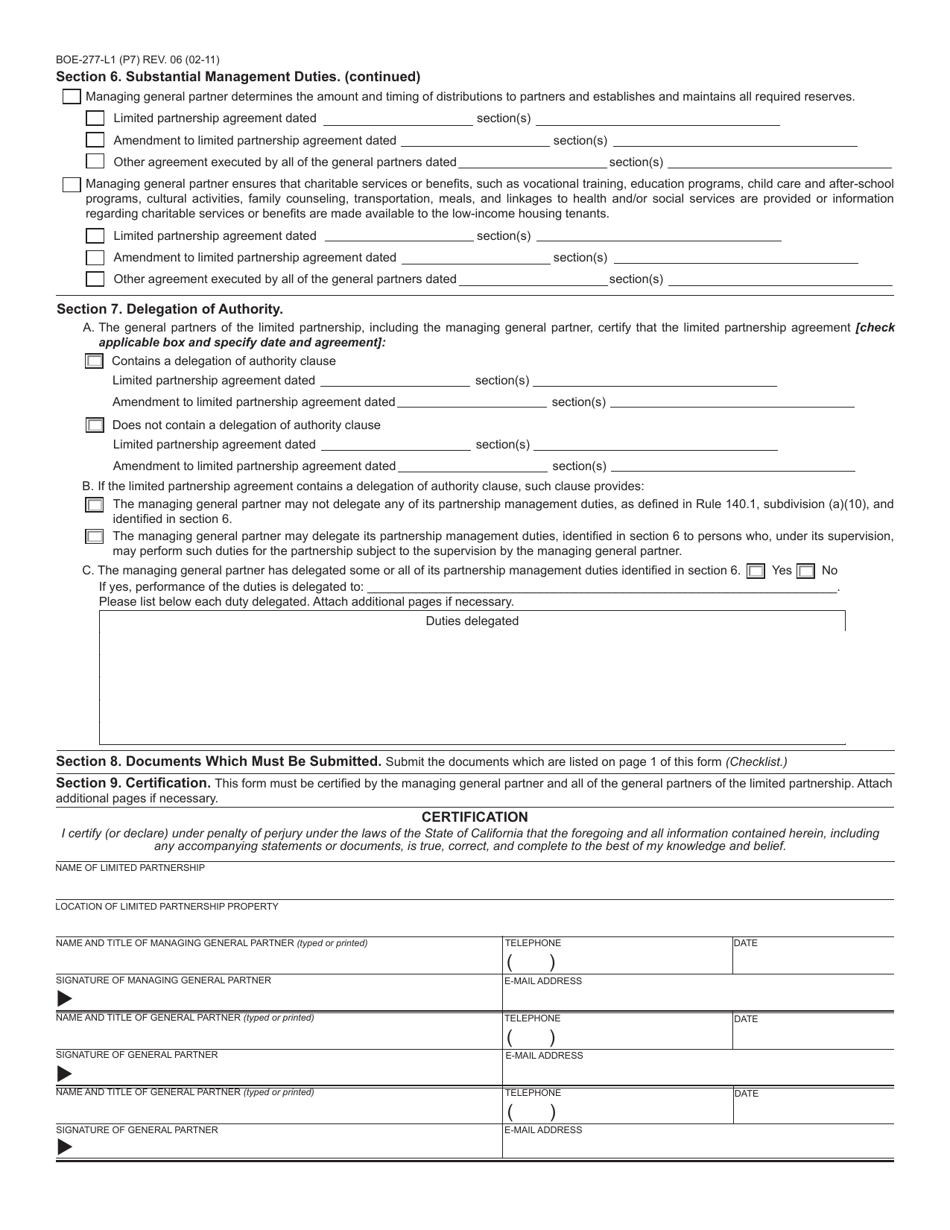

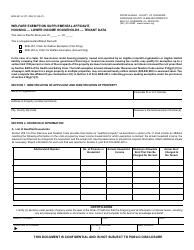

Form BOE-277-L1

for the current year.

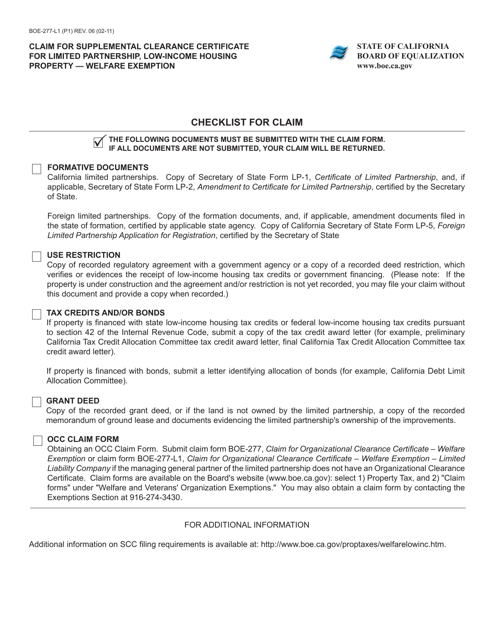

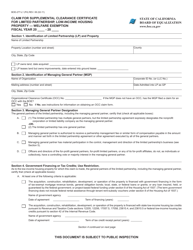

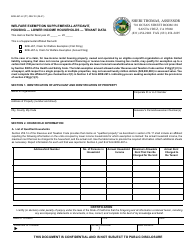

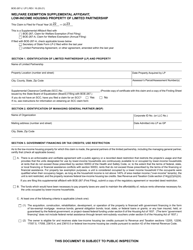

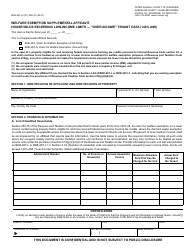

Form BOE-277-L1 Claim for Supplemental Clearance Certificate for Limited Partnership, Low-Income Housing Property - Welfare Exemption - California

What Is Form BOE-277-L1?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-277-L1?

A: Form BOE-277-L1 is a claim for a supplemental clearance certificate for limited partnership, low-income housing property - welfare exemption in California.

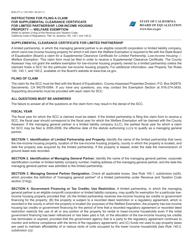

Q: Who can file Form BOE-277-L1?

A: Limited partnerships that own low-income housing properties in California and qualify for the welfare exemption can file Form BOE-277-L1.

Q: What is the purpose of Form BOE-277-L1?

A: The purpose of Form BOE-277-L1 is to claim a supplemental clearance certificate for the welfare exemption for low-income housing properties owned by limited partnerships.

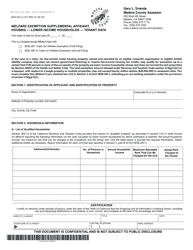

Q: What is the welfare exemption for low-income housing property?

A: The welfare exemption for low-income housing property is a tax exemption in California that provides relief for limited partnerships that own low-income housing properties.

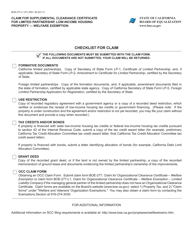

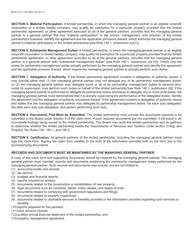

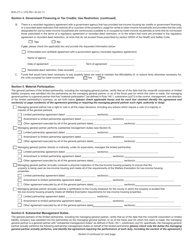

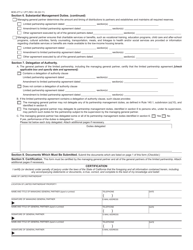

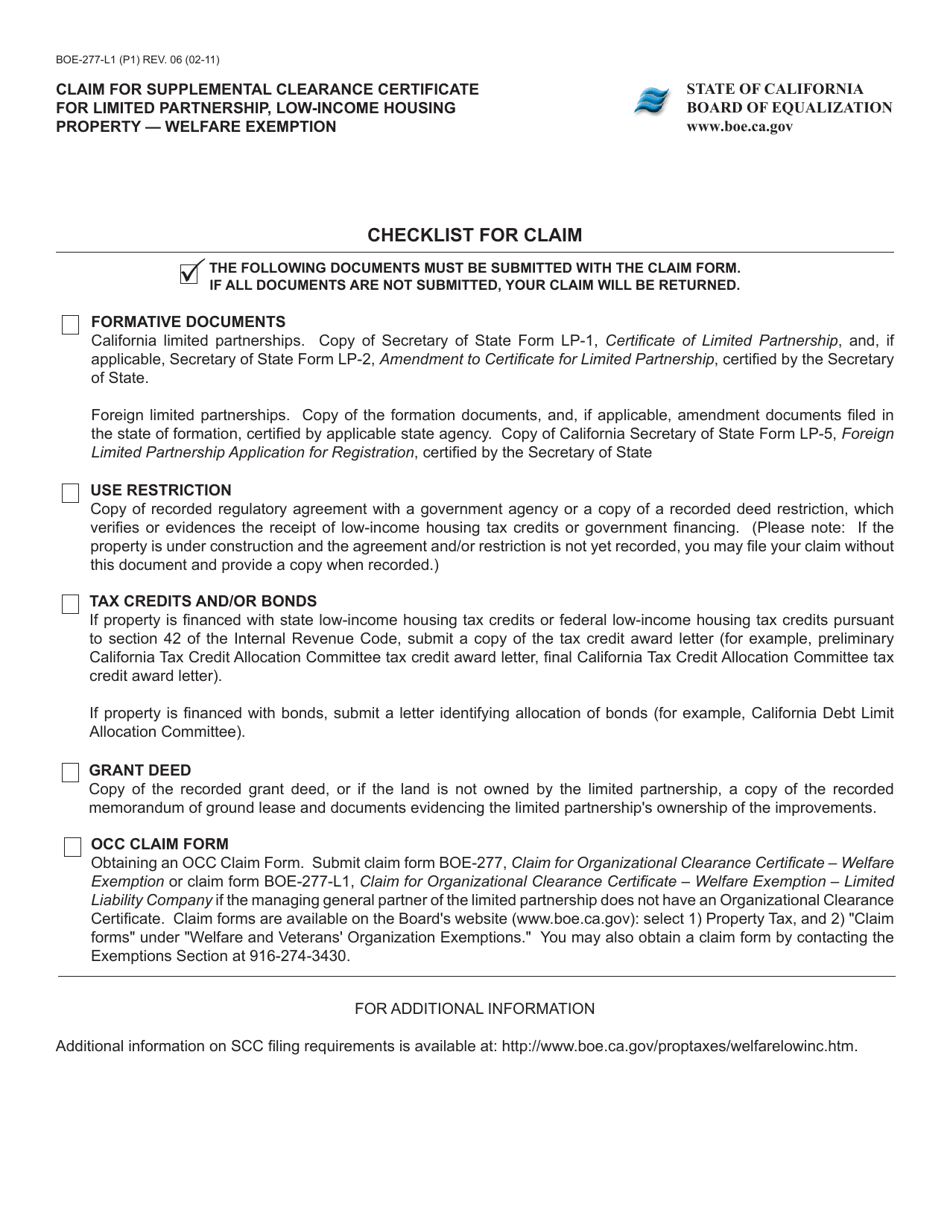

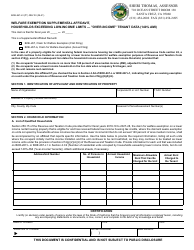

Q: What documentation is required to file Form BOE-277-L1?

A: To file Form BOE-277-L1, limited partnerships must provide supporting documentation such as financial statements, partnership agreements, and other relevant records.

Q: Is there a fee to file Form BOE-277-L1?

A: No, there is no fee to file Form BOE-277-L1.

Q: What is a supplemental clearance certificate?

A: A supplemental clearance certificate is a document that provides evidence of eligibility for the welfare exemption for low-income housing properties.

Q: What is the deadline to file Form BOE-277-L1?

A: Form BOE-277-L1 must be filed annually with the California State Board of Equalization by February 15th.

Form Details:

- Released on February 1, 2011;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-277-L1 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.