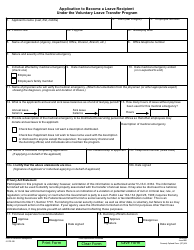

This version of the form is not currently in use and is provided for reference only. Download this version of

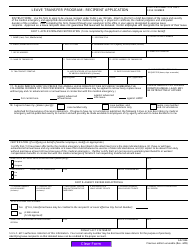

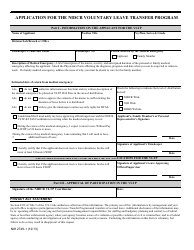

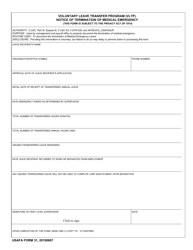

Form CALHR271

for the current year.

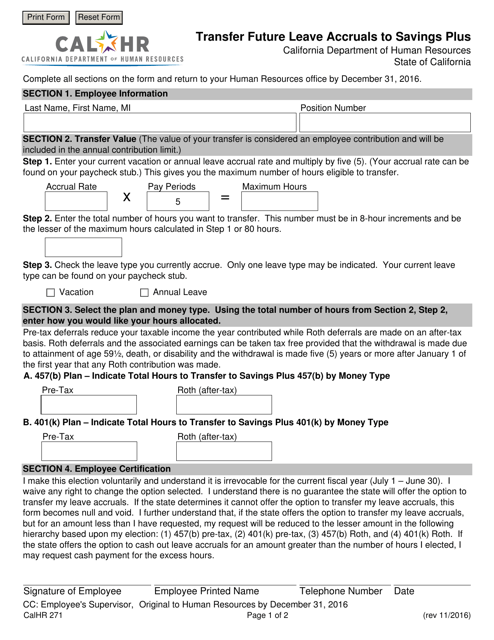

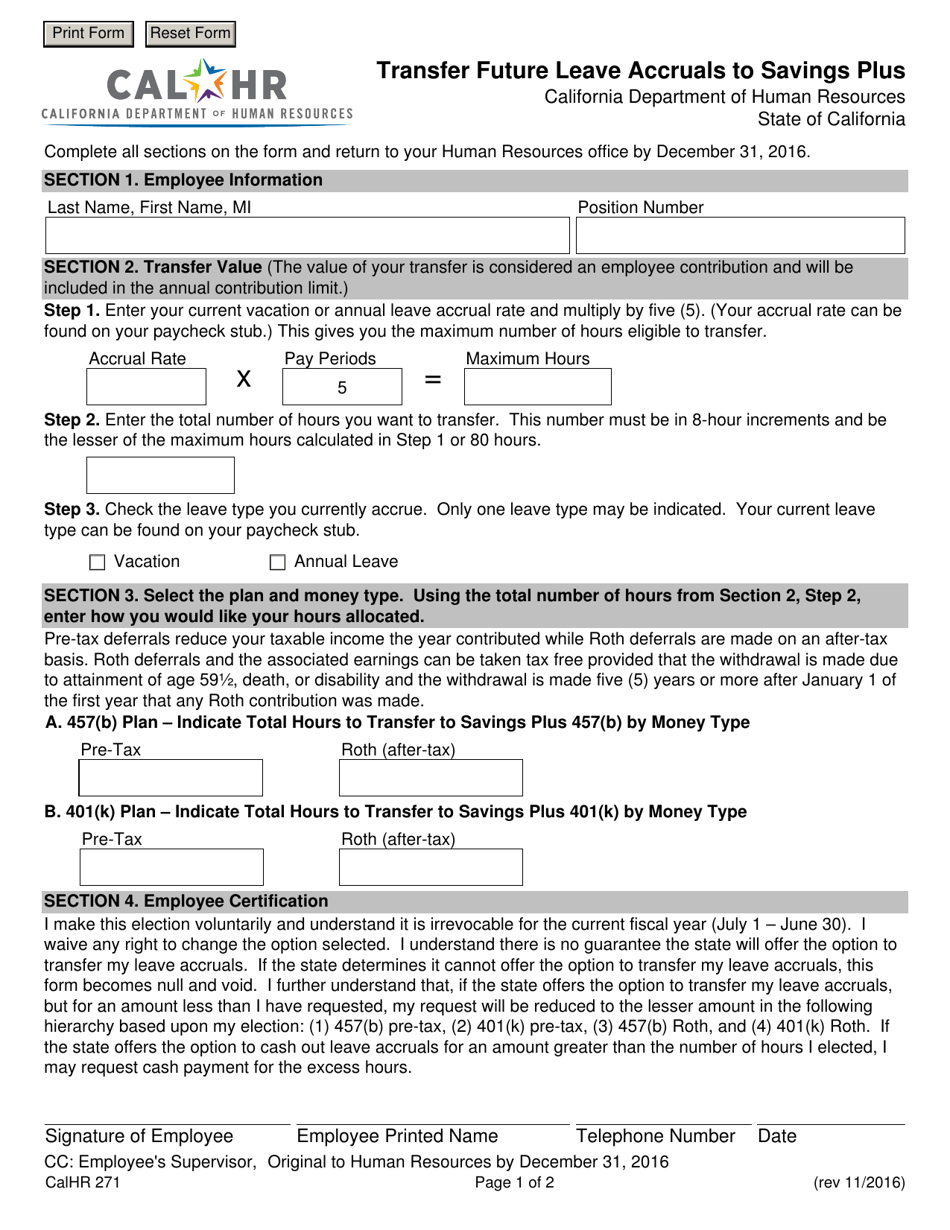

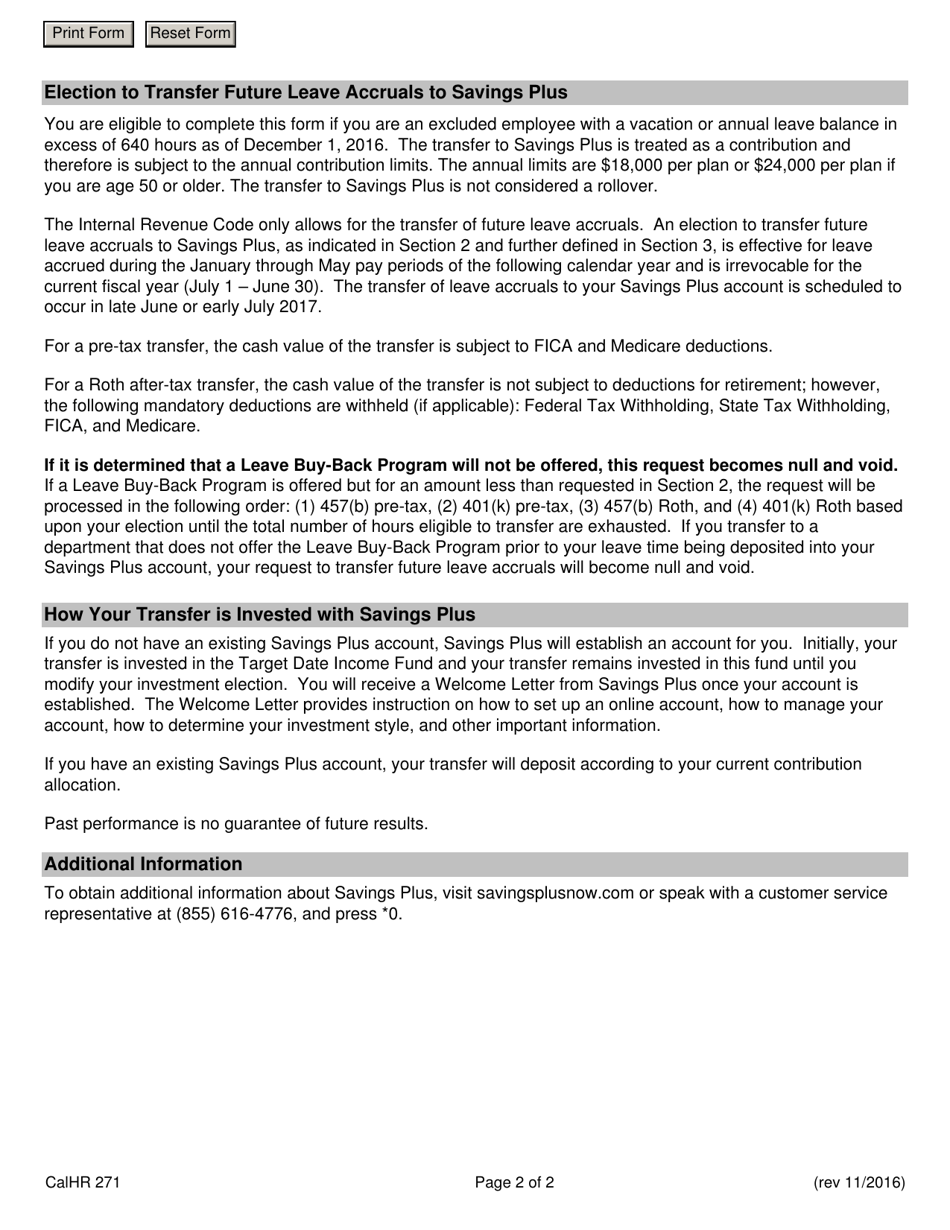

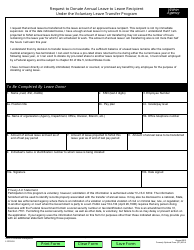

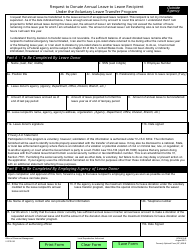

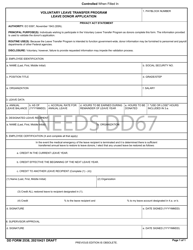

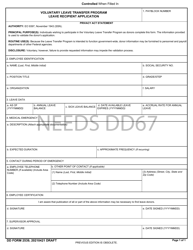

Form CALHR271 Transfer Future Leave Accruals to Savings Plus - California

What Is Form CALHR271?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CALHR271?

A: CALHR271 is a form used to transfer future leave accruals to Savings Plus in California.

Q: Why would I want to transfer my future leave accruals to Savings Plus?

A: Transferring future leave accruals to Savings Plus allows you to save for retirement and potentially earn competitive investment returns.

Q: How do I transfer my future leave accruals to Savings Plus?

A: You can transfer your future leave accruals to Savings Plus by completing CALHR271 form and submitting it to the appropriate authority in your workplace.

Q: Is transferring future leave accruals to Savings Plus mandatory?

A: No, transferring future leave accruals to Savings Plus is not mandatory. It is an optional choice for employees who wish to save for retirement.

Q: Can I change my decision after transferring my future leave accruals to Savings Plus?

A: Yes, you can change your decision and stop transferring future leave accruals to Savings Plus at any time by submitting a new CALHR271 form.

Q: Are there any fees or costs associated with transferring future leave accruals to Savings Plus?

A: There may be administrative fees or investment fees associated with transferring future leave accruals to Savings Plus. It is recommended to review the plan's terms and conditions for any applicable fees.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CALHR271 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.