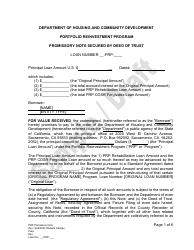

First-Time Homebuyer Promissory Note - Calhome Program - California

First-Time Homebuyer Promissory Note - Calhome Program is a legal document that was released by the California Department of Housing & Community Development - a government authority operating within California.

FAQ

Q: What is the Calhome Program in California?

A: The Calhome Program is a first-time homebuyer program in California.

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan.

Q: Who is eligible for the Calhome Program?

A: First-time homebuyers in California are eligible for the Calhome Program.

Q: What is the purpose of the Calhome Program?

A: The Calhome Program aims to assist first-time homebuyers with down payment and closing costs.

Q: How does the Calhome Program work?

A: The Calhome Program provides a deferred payment loan, which means the loan does not have to be repaid until certain conditions are met.

Q: What are the requirements for the Calhome Program?

A: The eligibility requirements for the Calhome Program may vary, but generally, applicants must meet income and credit score criteria.

Q: How can I apply for the Calhome Program?

A: To apply for the Calhome Program, you should contact the California Housing Finance Agency or a participating lender.

Q: What happens if I sell my home before repaying the Calhome loan?

A: If you sell your home before repaying the Calhome loan, you may have to repay a portion or all of the remaining loan balance.

Q: Can the Calhome loan be used for refinancing?

A: No, the Calhome loan is specifically designed for first-time homebuyers and cannot be used for refinancing purposes.

Form Details:

- Released on March 18, 2011;

- The latest edition currently provided by the California Department of Housing & Community Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Housing & Community Development.