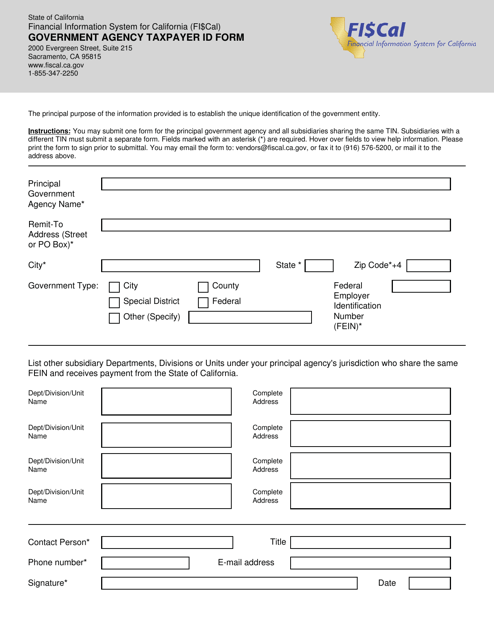

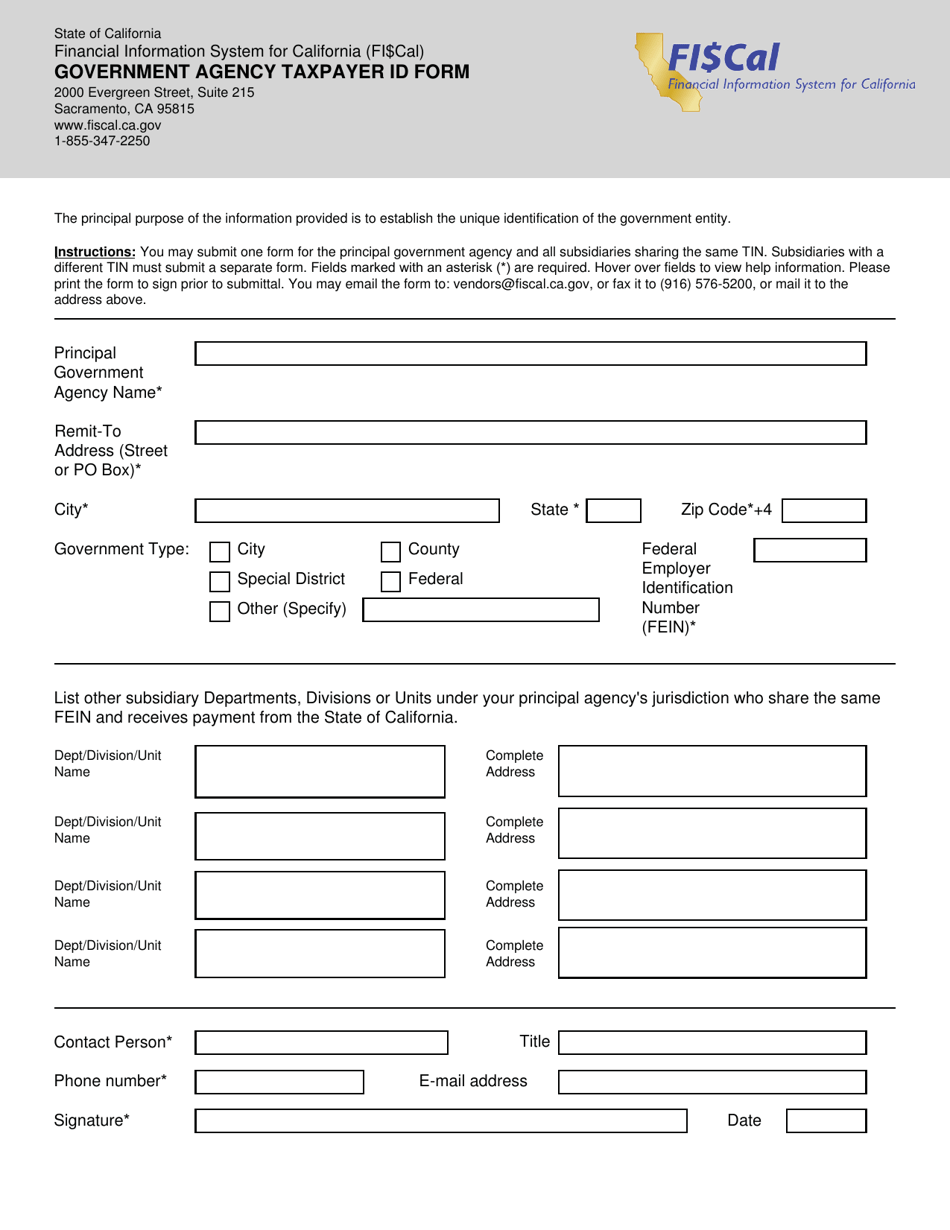

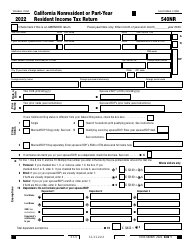

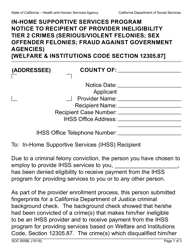

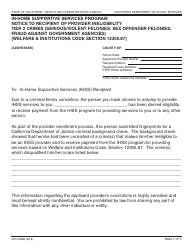

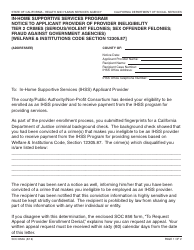

Government Agency Taxpayer Id Form - California

Government Agency Taxpayer Id Form is a legal document that was released by the California Highway Patrol - a government authority operating within California.

FAQ

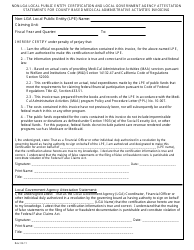

Q: What is the purpose of the Government Agency Taxpayer ID Form?

A: The Government Agency Taxpayer ID Form is used to apply for an identification number for government agencies in California.

Q: Who needs to fill out the Government Agency Taxpayer ID Form?

A: Government agencies in California need to fill out the Government Agency Taxpayer ID Form.

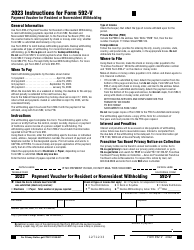

Q: Is there a fee to file the Government Agency Taxpayer ID Form?

A: No, there is no fee to file the Government Agency Taxpayer ID Form.

Q: When should I file the Government Agency Taxpayer ID Form?

A: You should file the Government Agency Taxpayer ID Form as soon as you establish a government agency in California.

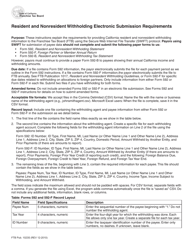

Q: What information do I need to provide on the Government Agency Taxpayer ID Form?

A: You will need to provide information such as the name of the government agency, contact information, and the purpose of the agency.

Q: How long does it take to process the Government Agency Taxpayer ID Form?

A: Processing times for the Government Agency Taxpayer ID Form vary, but it generally takes a few weeks.

Q: Are there any penalties for not filing the Government Agency Taxpayer ID Form?

A: Failure to file the Government Agency Taxpayer ID Form may result in penalties or legal consequences.

Q: Can I make changes to the Government Agency Taxpayer ID Form after submitting it?

A: Yes, you can make changes to the Government Agency Taxpayer ID Form by contacting the California Department of Tax and Fee Administration.

Form Details:

- The latest edition currently provided by the California Highway Patrol;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Highway Patrol.