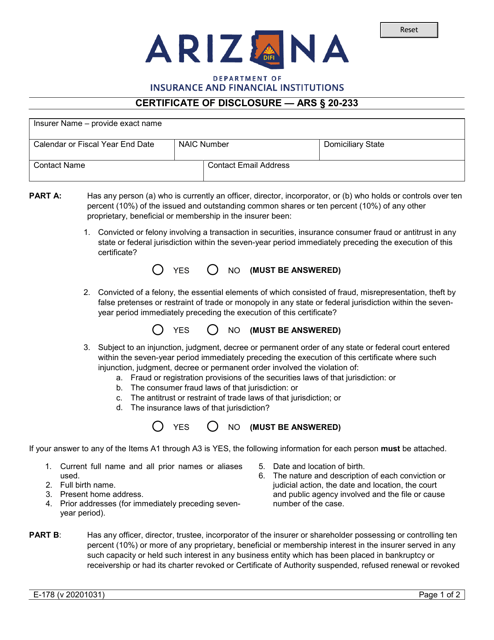

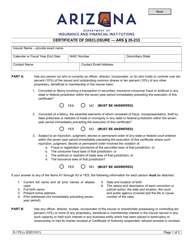

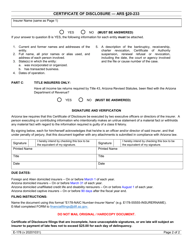

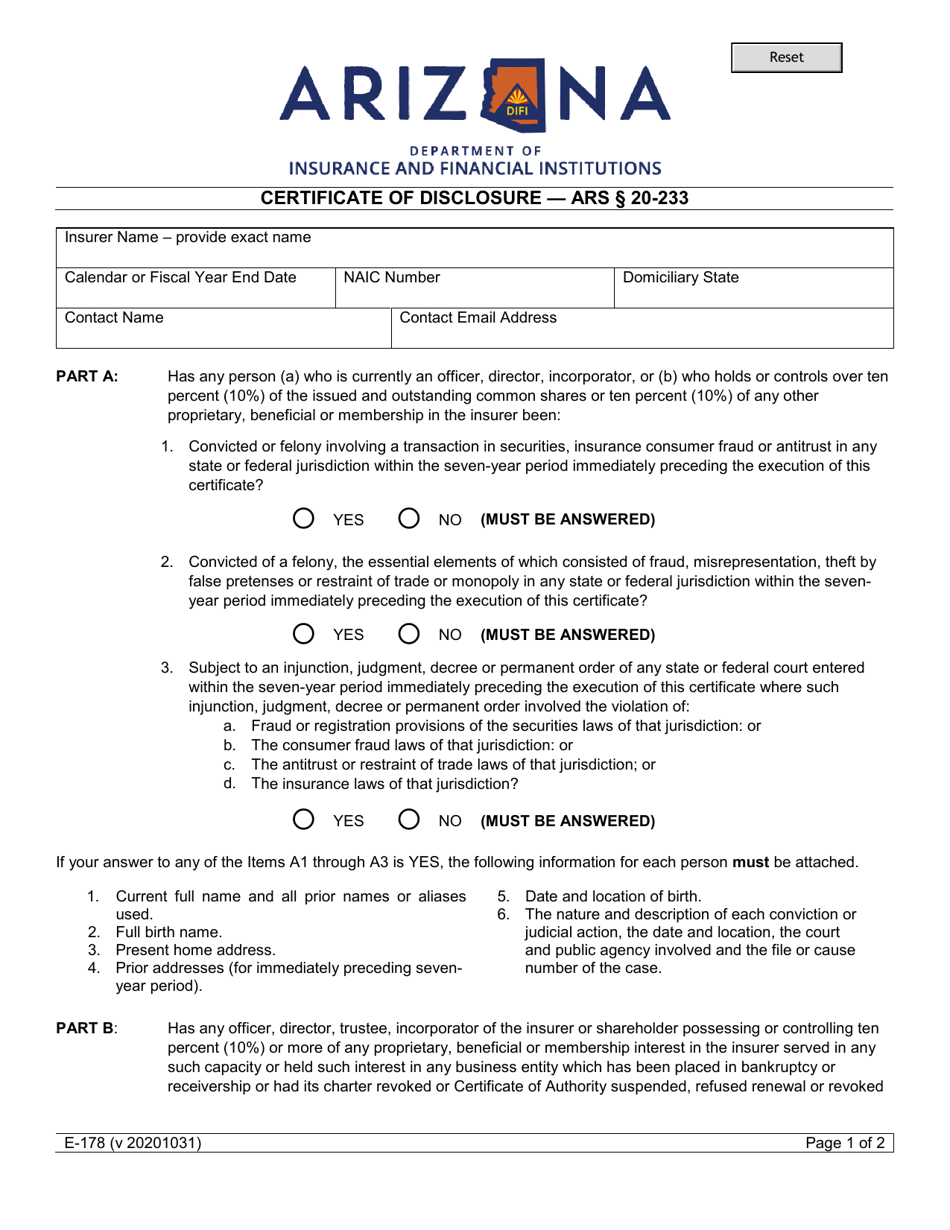

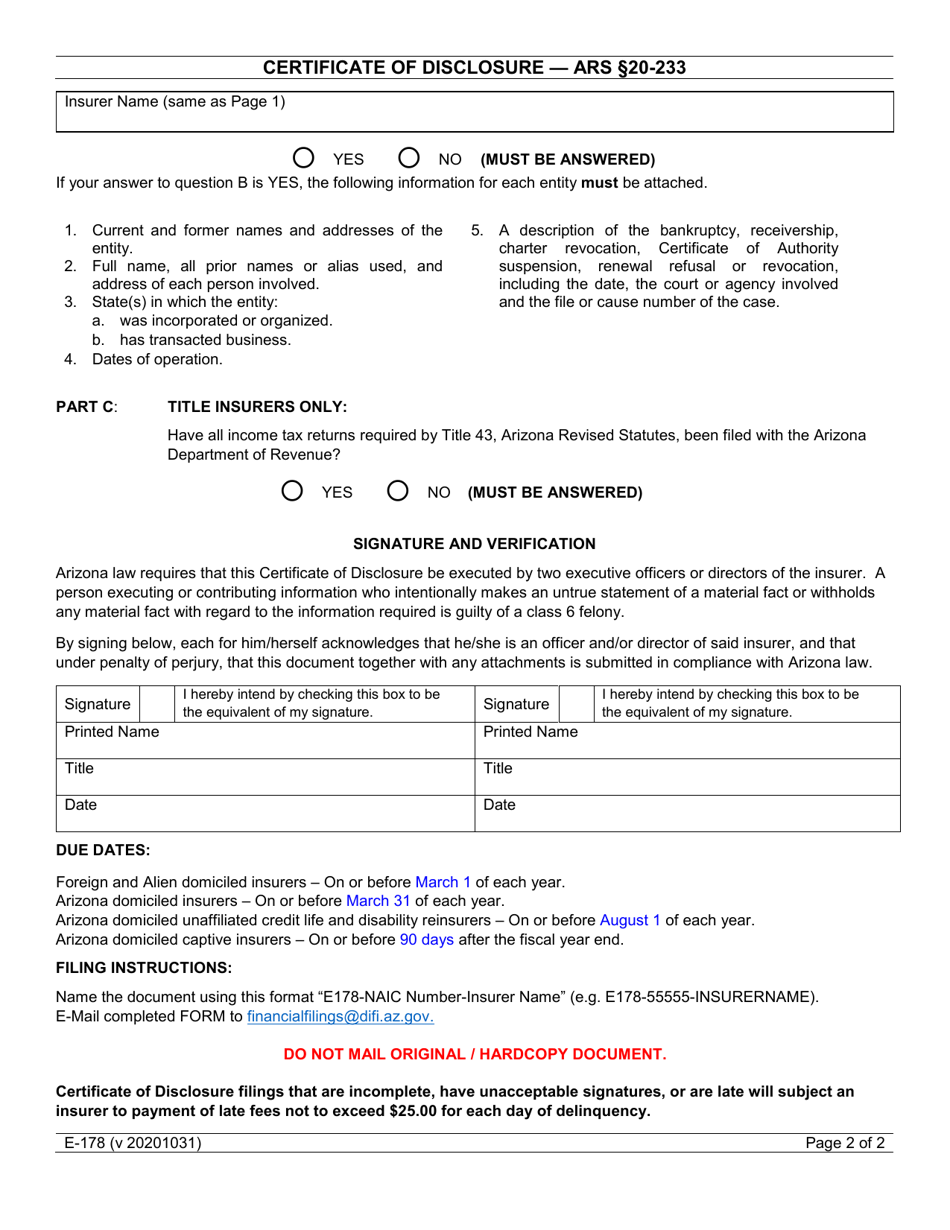

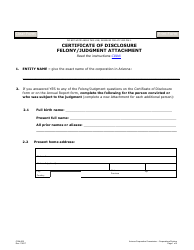

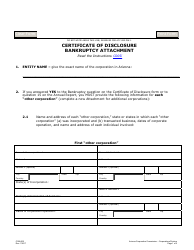

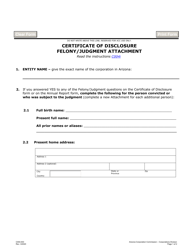

Form E-178 Certificate of Disclosure - Ars 20-233 - Arizona

What Is Form E-178?

This is a legal form that was released by the Arizona Department of Insurance and Financial Institutions - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

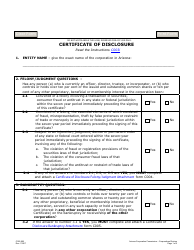

Q: What is a Form E-178 Certificate of Disclosure?

A: Form E-178 Certificate of Disclosure is a document that provides information about any liens, judgments, or encumbrances on a property in Arizona.

Q: Who needs to complete a Form E-178 Certificate of Disclosure?

A: Any person selling or transferring real property in Arizona needs to complete a Form E-178 Certificate of Disclosure.

Q: What information is included in a Form E-178 Certificate of Disclosure?

A: A Form E-178 Certificate of Disclosure includes information regarding any liens, judgments, or encumbrances on the property.

Q: Do I need to pay a fee to obtain a Form E-178 Certificate of Disclosure?

A: Yes, there is a fee associated with obtaining a Form E-178 Certificate of Disclosure. The fee amount may vary.

Q: How long is a Form E-178 Certificate of Disclosure valid?

A: A Form E-178 Certificate of Disclosure is valid for 180 days from the date of issuance.

Q: Can I use a Form E-178 Certificate of Disclosure for multiple transactions?

A: No, a Form E-178 Certificate of Disclosure is only valid for a single transaction.

Q: Are there any penalties for providing false information on a Form E-178 Certificate of Disclosure?

A: Yes, providing false information on a Form E-178 Certificate of Disclosure is considered a class 2 misdemeanor and can result in penalties.

Q: Are there any exemptions to the requirement of providing a Form E-178 Certificate of Disclosure?

A: Yes, certain transfers of real property are exempt from the requirement of providing a Form E-178 Certificate of Disclosure. It is advisable to consult with a legal professional to determine if you qualify for an exemption.

Q: What should I do if I discover new information after submitting a Form E-178 Certificate of Disclosure?

A: If you discover new information after submitting a Form E-178 Certificate of Disclosure, you should promptly disclose the new information to the buyer or transferee.

Form Details:

- Released on October 31, 2020;

- The latest edition provided by the Arizona Department of Insurance and Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-178 by clicking the link below or browse more documents and templates provided by the Arizona Department of Insurance and Financial Institutions.