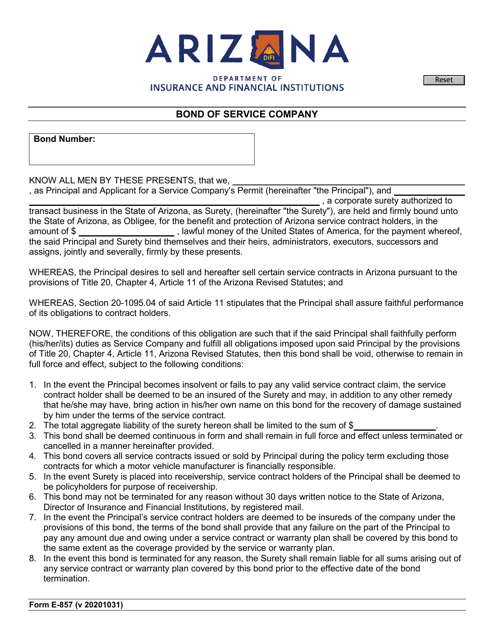

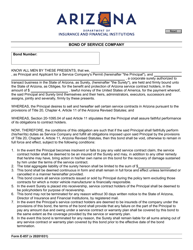

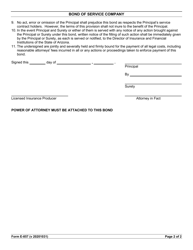

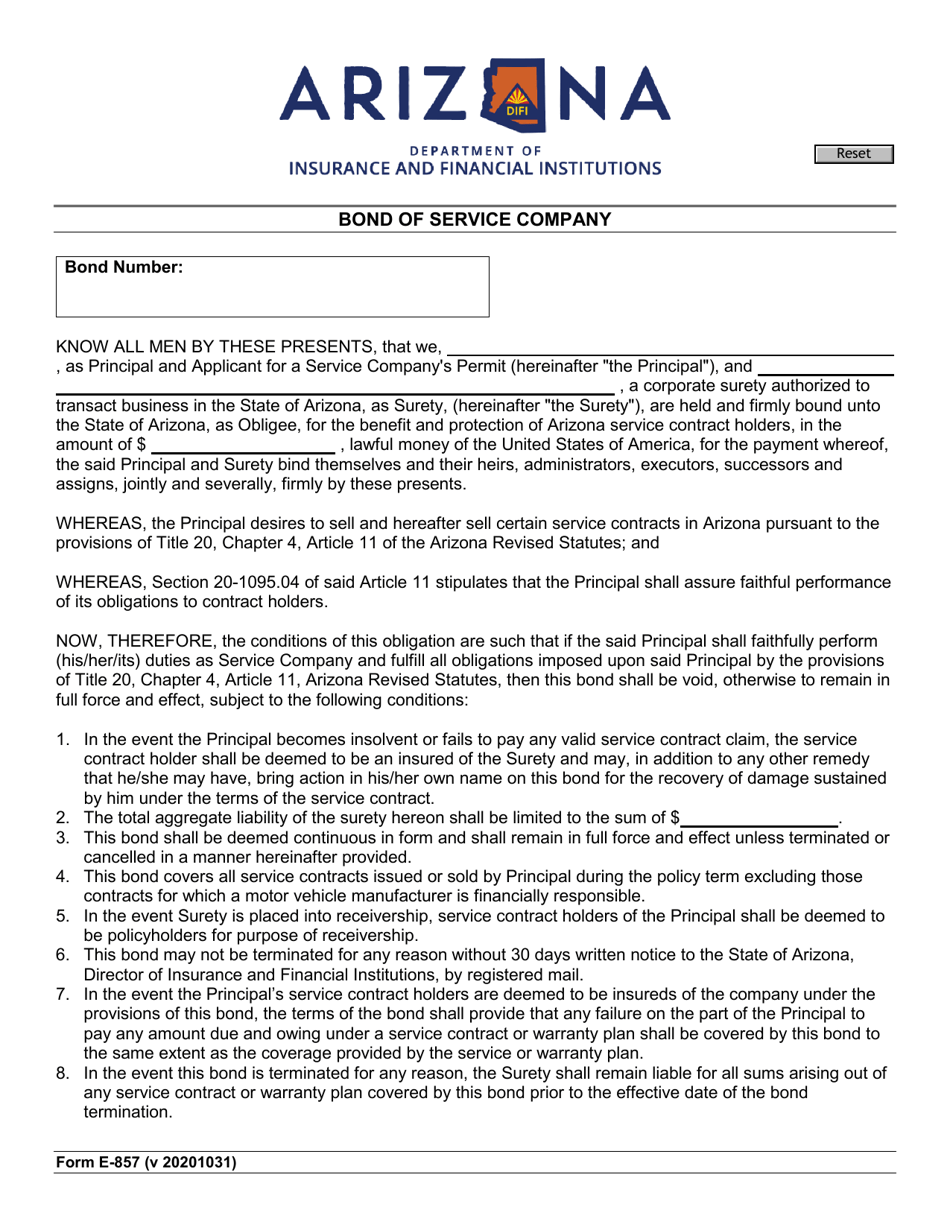

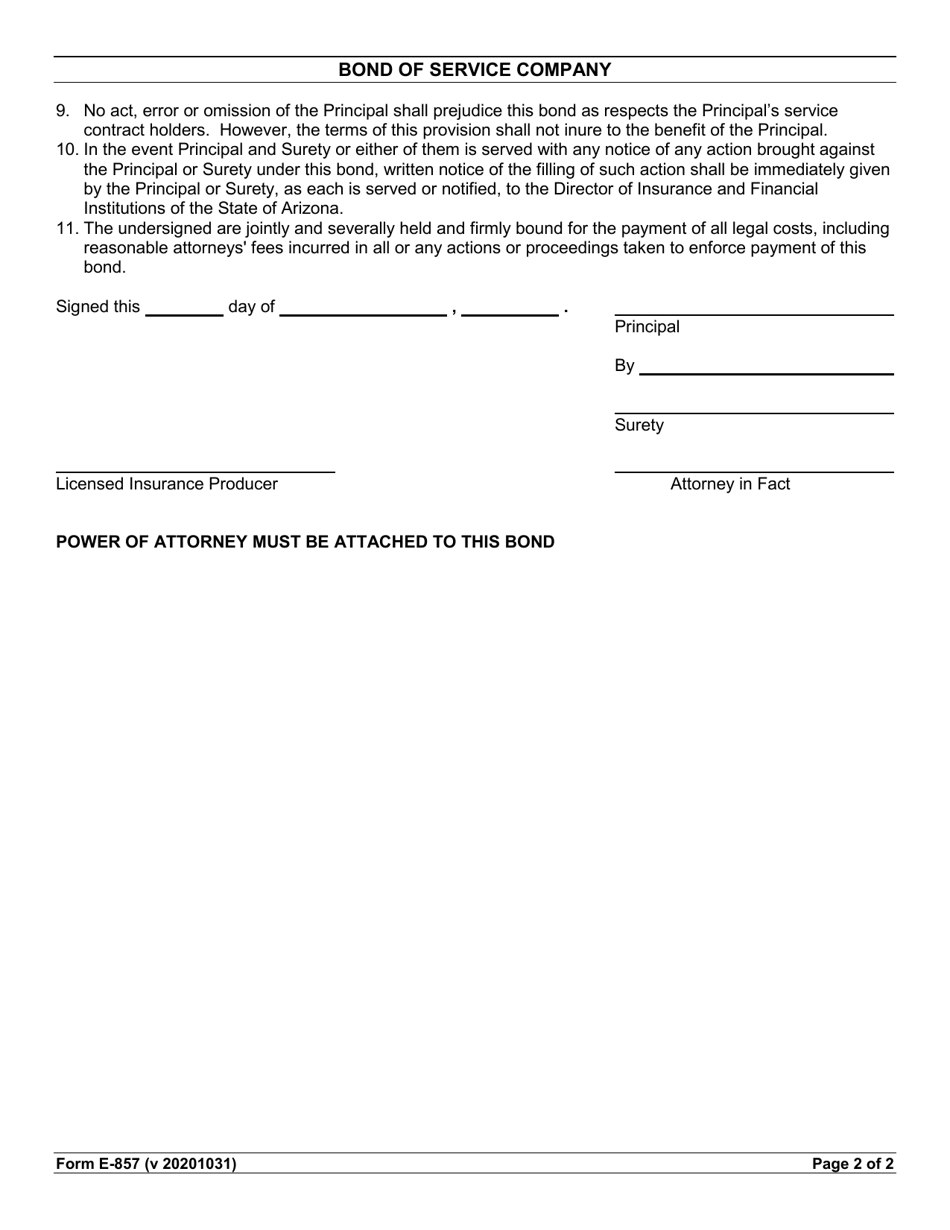

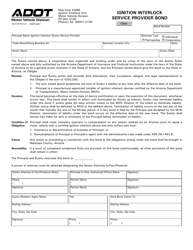

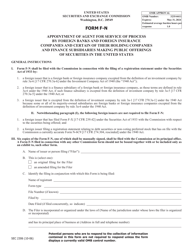

Form E-857 Bond of Service Company - Arizona

What Is Form E-857?

This is a legal form that was released by the Arizona Department of Insurance and Financial Institutions - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-857?

A: Form E-857 is the Bond of Service Company form in Arizona.

Q: What is the purpose of Form E-857?

A: The purpose of Form E-857 is to provide a bond for a service company operating in Arizona.

Q: Who needs to file Form E-857?

A: Service companies operating in Arizona need to file Form E-857.

Q: Is there a fee to file Form E-857?

A: Yes, there is a fee to file Form E-857. The fee amount is specified on the form.

Q: What happens after I file Form E-857?

A: After you file Form E-857, the Arizona Department of Revenue will review the form and issue a bond if approved.

Q: How long is the bond valid?

A: The bond is valid for one year from the effective date.

Q: What is the penalty for not filing Form E-857?

A: Failure to file Form E-857 may result in penalties and fines imposed by the Arizona Department of Revenue.

Q: Can I cancel the bond before it expires?

A: Yes, you can cancel the bond before it expires by submitting a written request to the Arizona Department of Revenue.

Q: Are there any exemptions from filing Form E-857?

A: Some service companies may be exempt from filing Form E-857. It is best to check with the Arizona Department of Revenue for specific exemptions.

Form Details:

- Released on October 31, 2020;

- The latest edition provided by the Arizona Department of Insurance and Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-857 by clicking the link below or browse more documents and templates provided by the Arizona Department of Insurance and Financial Institutions.