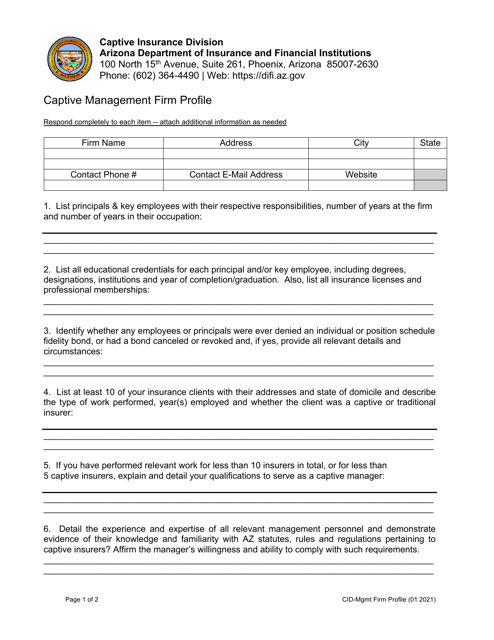

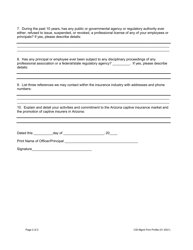

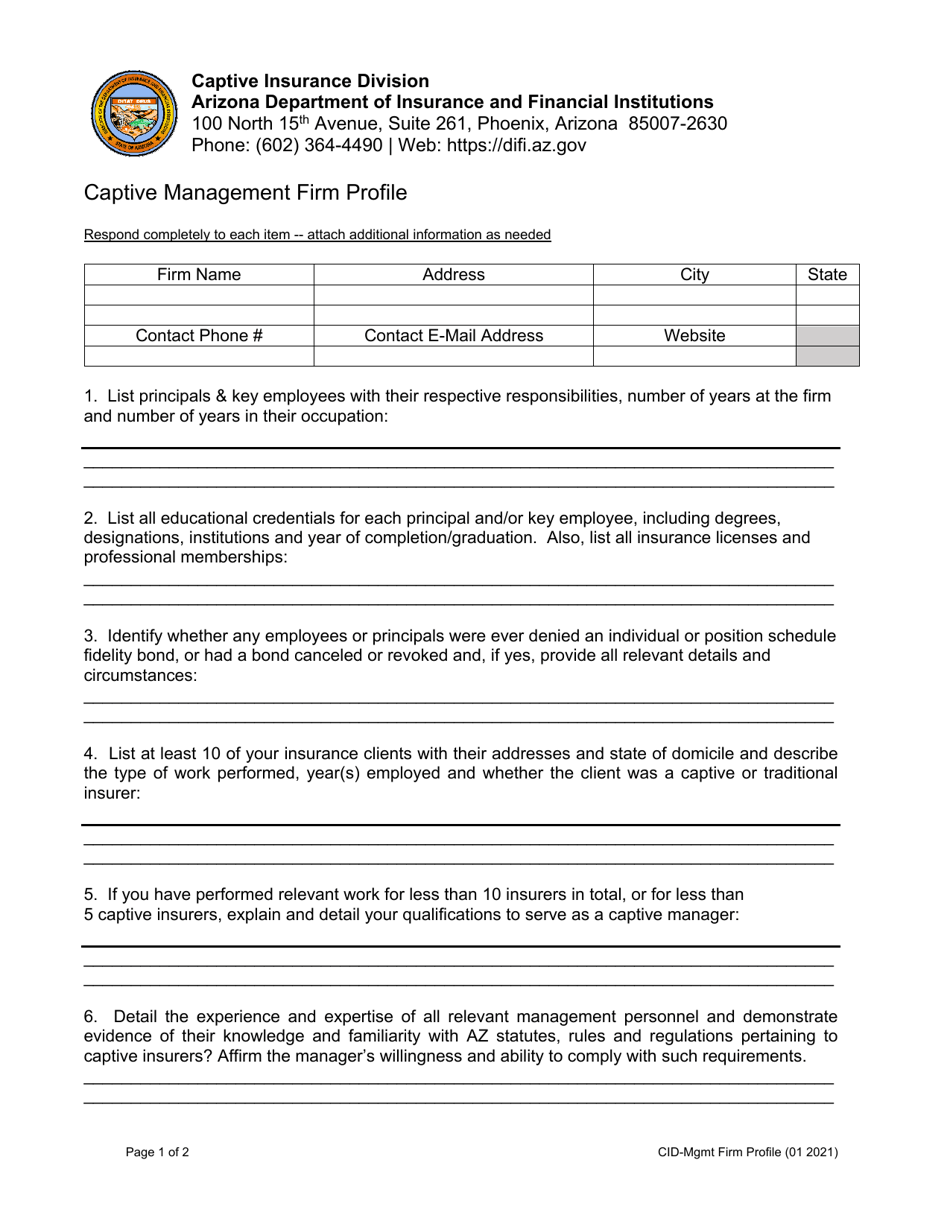

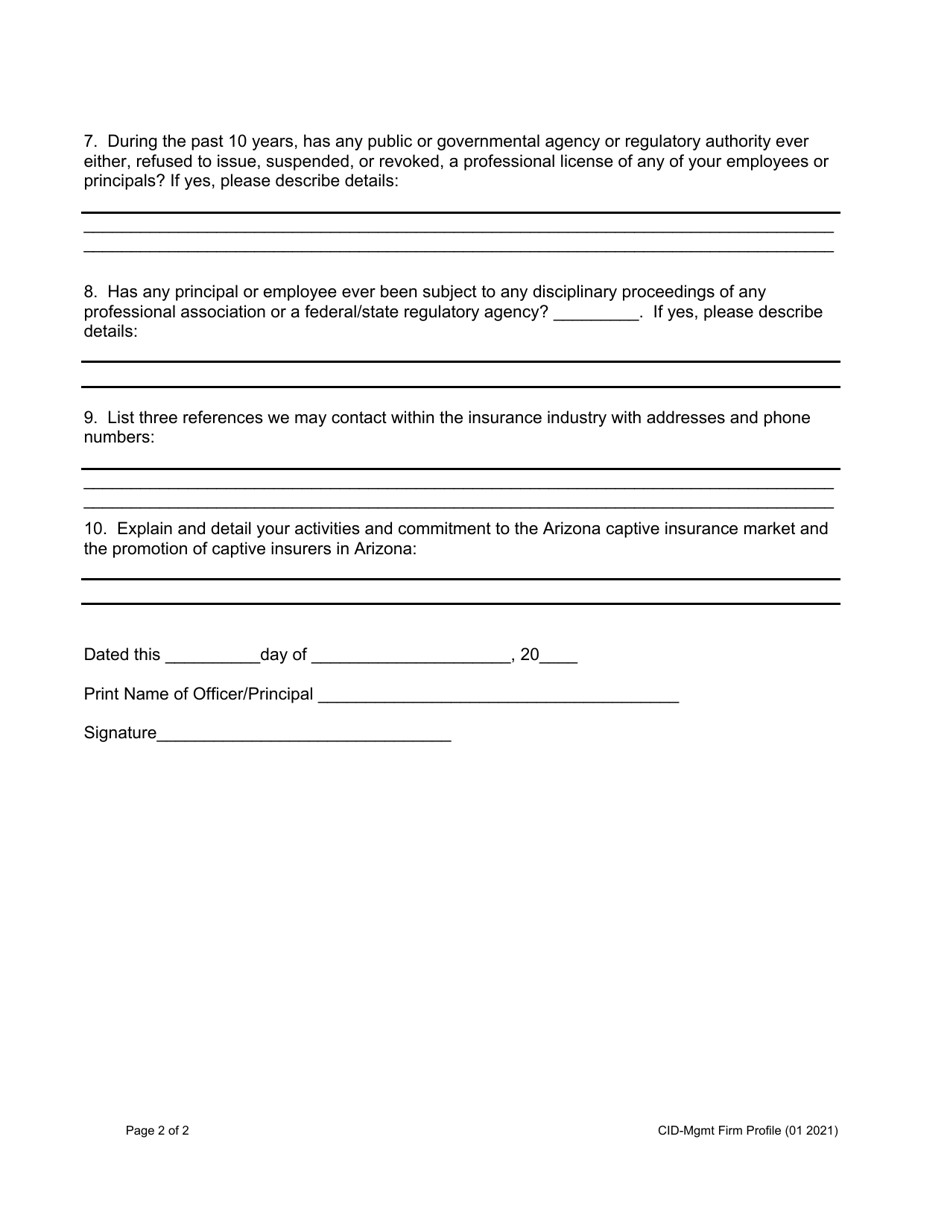

Captive Management Firm Profile - Arizona

Captive Management Firm Profile is a legal document that was released by the Arizona Department of Insurance and Financial Institutions - a government authority operating within Arizona.

FAQ

Q: What is a captive management firm?

A: A captive management firm is a company that specializes in the management of captive insurance companies.

Q: What is a captive insurance company?

A: A captive insurance company is a subsidiary company established by a parent company to insure the risks of the parent company and its affiliates.

Q: What services does a captive management firm provide?

A: A captive management firm provides services such as formation and licensing, underwriting and policy administration, risk management, claims management, and regulatory compliance for captive insurance companies.

Q: Why would a company choose to form a captive insurance company?

A: Companies choose to form captive insurance companies to gain more control over their insurance program, improve risk management, access reinsurance markets, and potentially reduce overall insurance costs.

Q: What industries commonly use captive insurance companies?

A: Industries commonly using captive insurance companies include manufacturing, transportation, construction, healthcare, and professional services.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Arizona Department of Insurance and Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Insurance and Financial Institutions.