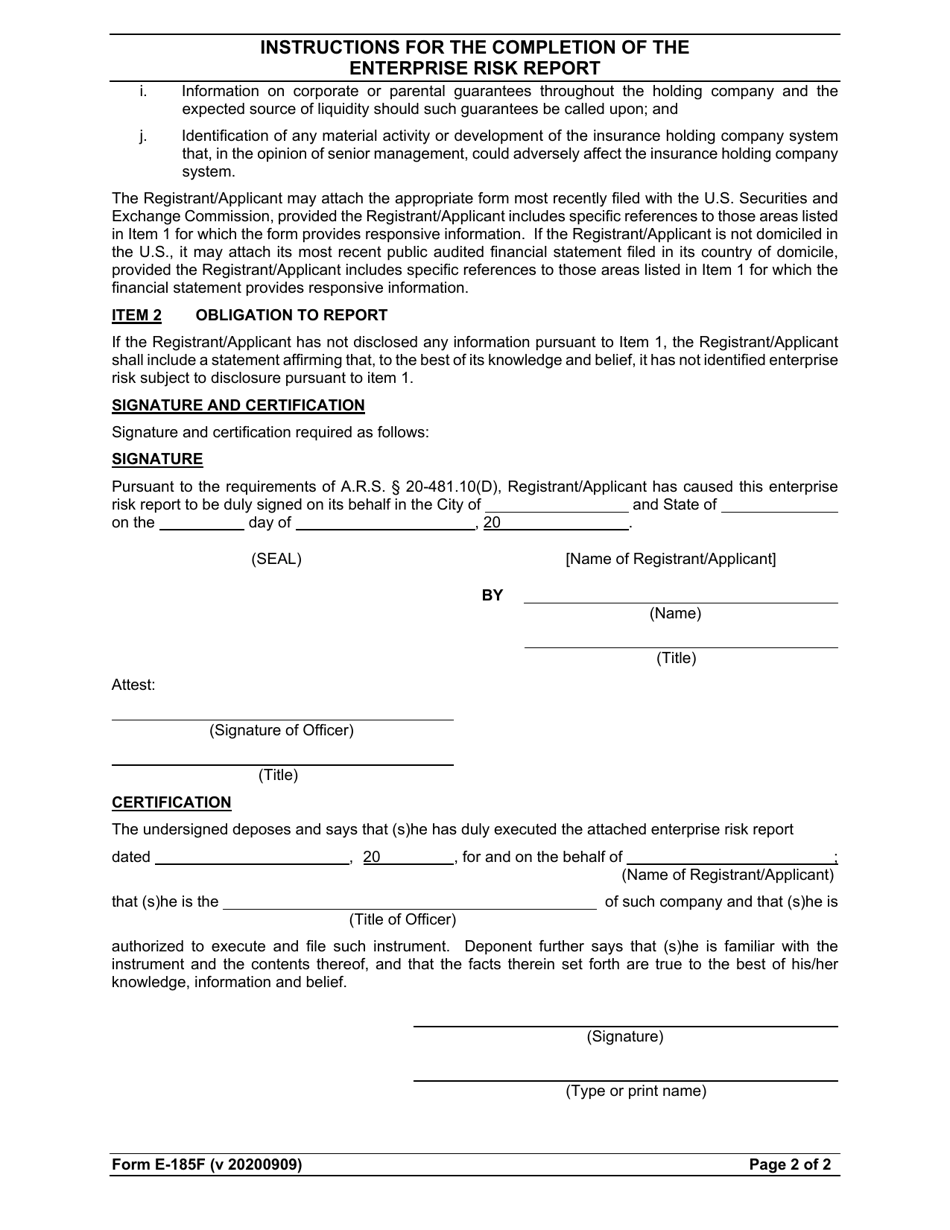

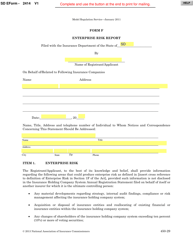

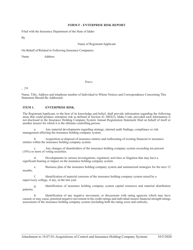

Instructions for Form F Enterprise Risk Report - Arizona

This document contains official instructions for Form F , Enterprise Risk Report - a form released and collected by the Arizona Department of Insurance and Financial Institutions.

FAQ

Q: What is Form F?

A: Form F is an Enterprise Risk Report required in Arizona.

Q: Who is required to file Form F?

A: All entities, including corporations, limited liability companies, and partnerships, that meet certain criteria are required to file Form F.

Q: What is the purpose of filing Form F?

A: The purpose of filing Form F is to assess and disclose any enterprise risks that may affect the stability or solvency of the filing entity.

Q: When is Form F due?

A: Form F is due on or before March 1st of each year.

Q: Are there any fees associated with filing Form F?

A: Yes, there is a filing fee associated with Form F. The fee amount varies depending on the type and size of the filing entity.

Q: What happens if I fail to file Form F?

A: Failure to file Form F or filing an incomplete or inaccurate form may result in penalties and sanctions imposed by the Arizona Department of Insurance.

Q: Is the information provided in Form F confidential?

A: No, the information provided in Form F is not confidential and may be subject to public disclosure.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Insurance and Financial Institutions.