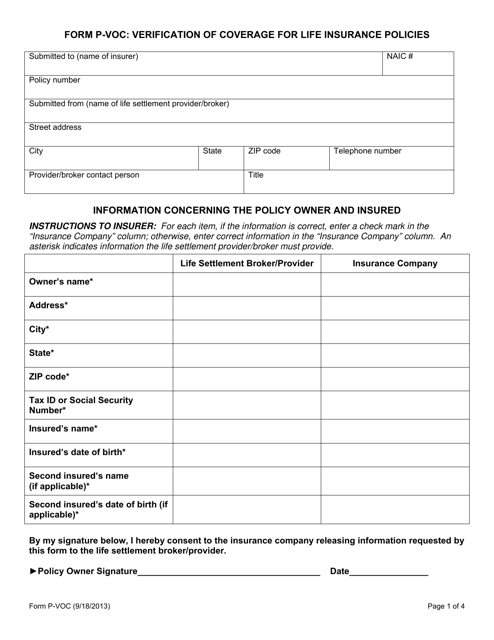

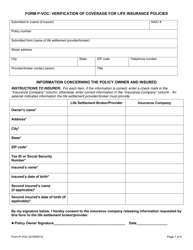

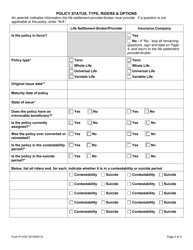

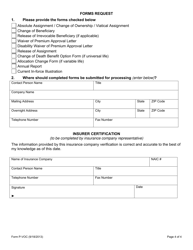

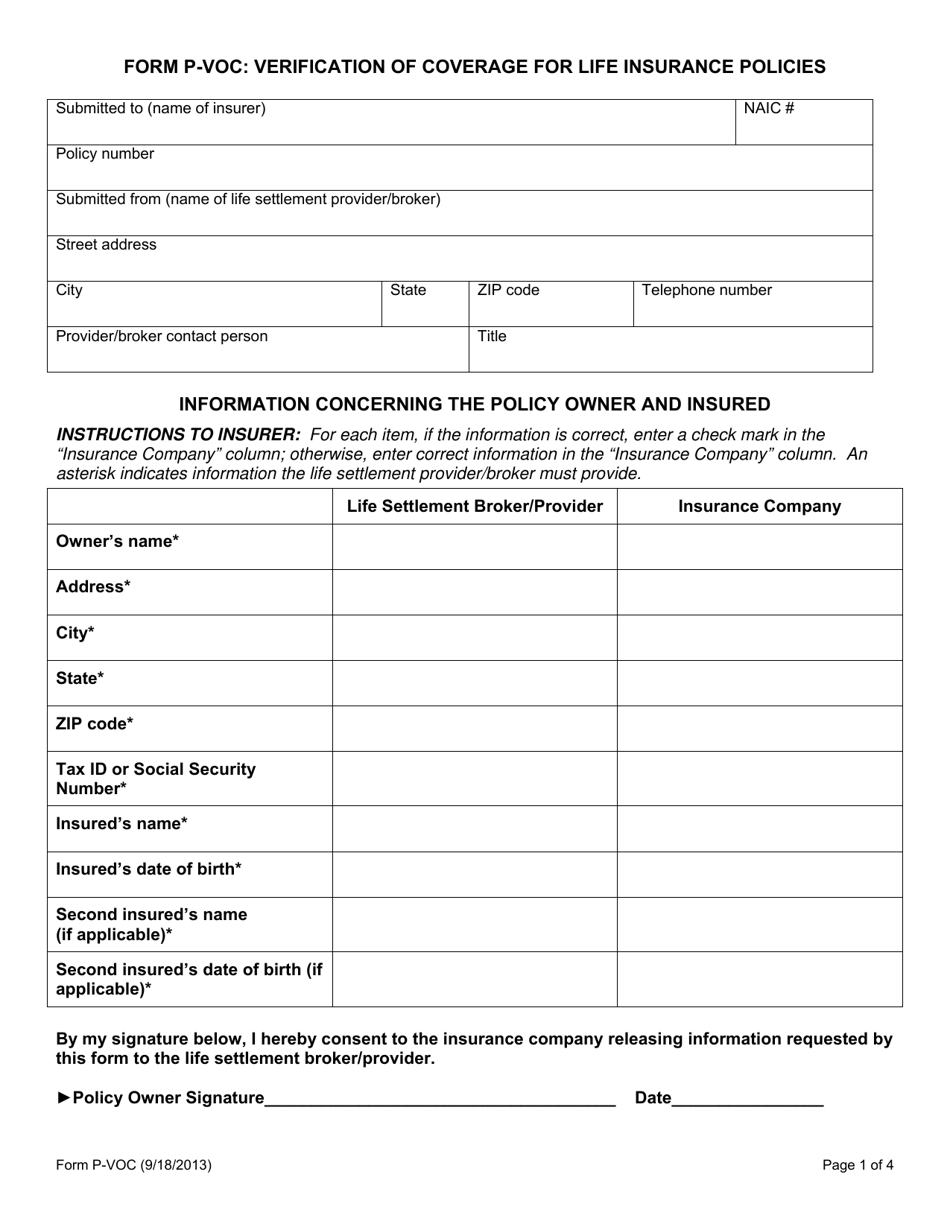

Form P-VOC Verification of Coverage for Life Insurance Policies - Arizona

What Is Form P-VOC?

This is a legal form that was released by the Arizona Department of Insurance and Financial Institutions - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is P-VOC?

A: P-VOC stands for Policyholder Verification of Coverage.

Q: What is a life insurance policy?

A: A life insurance policy is a contract between an individual and an insurance company, where the company provides a designated beneficiary with a sum of money upon the death of the insured person.

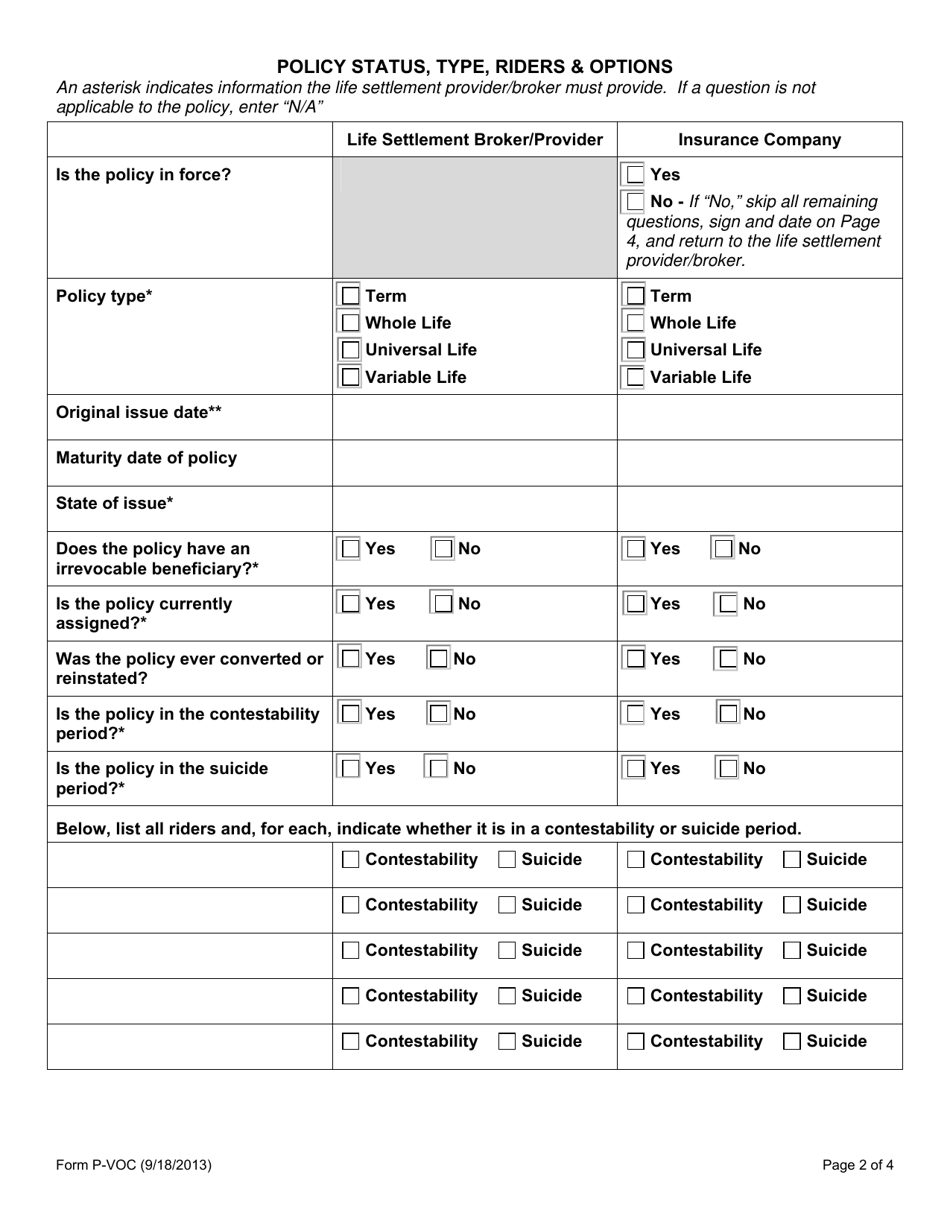

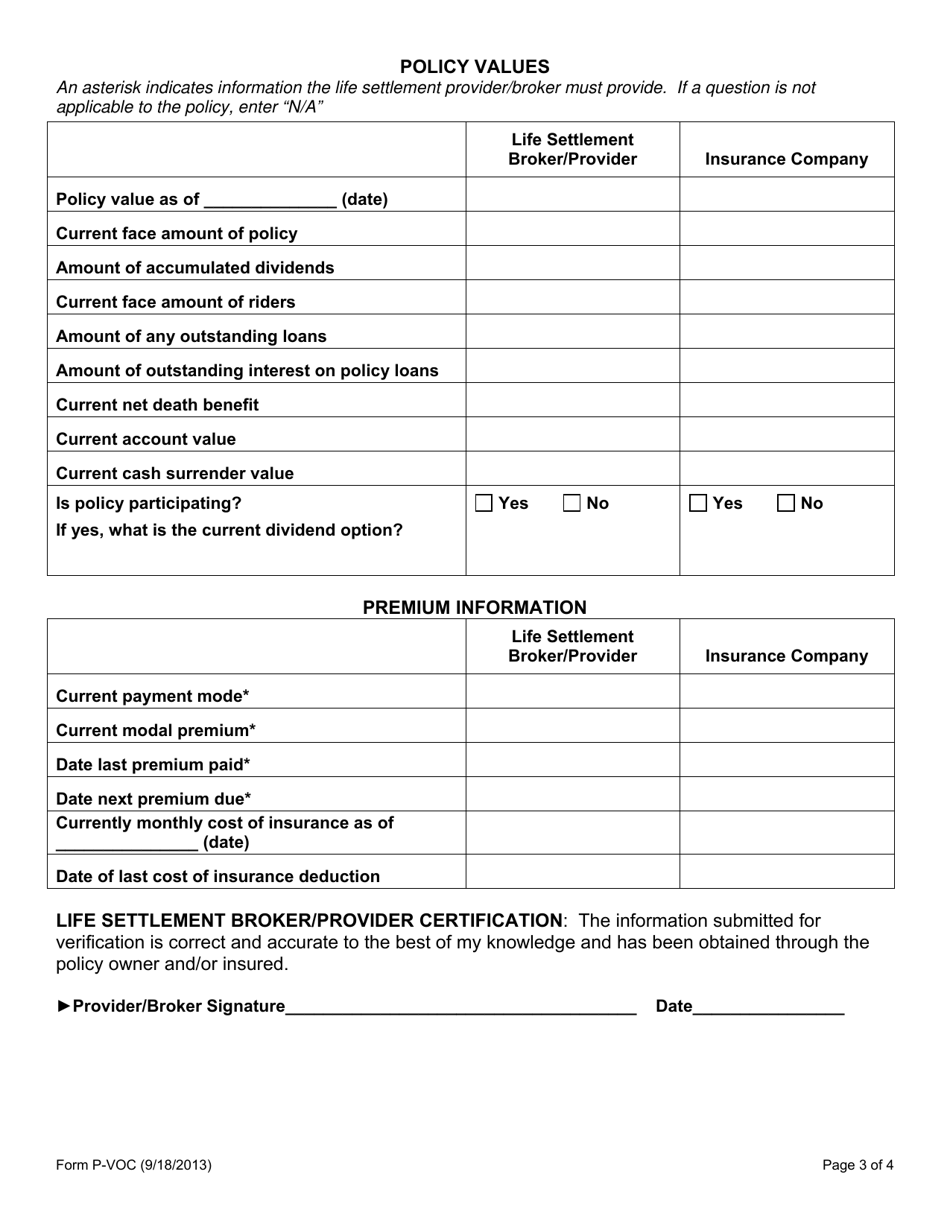

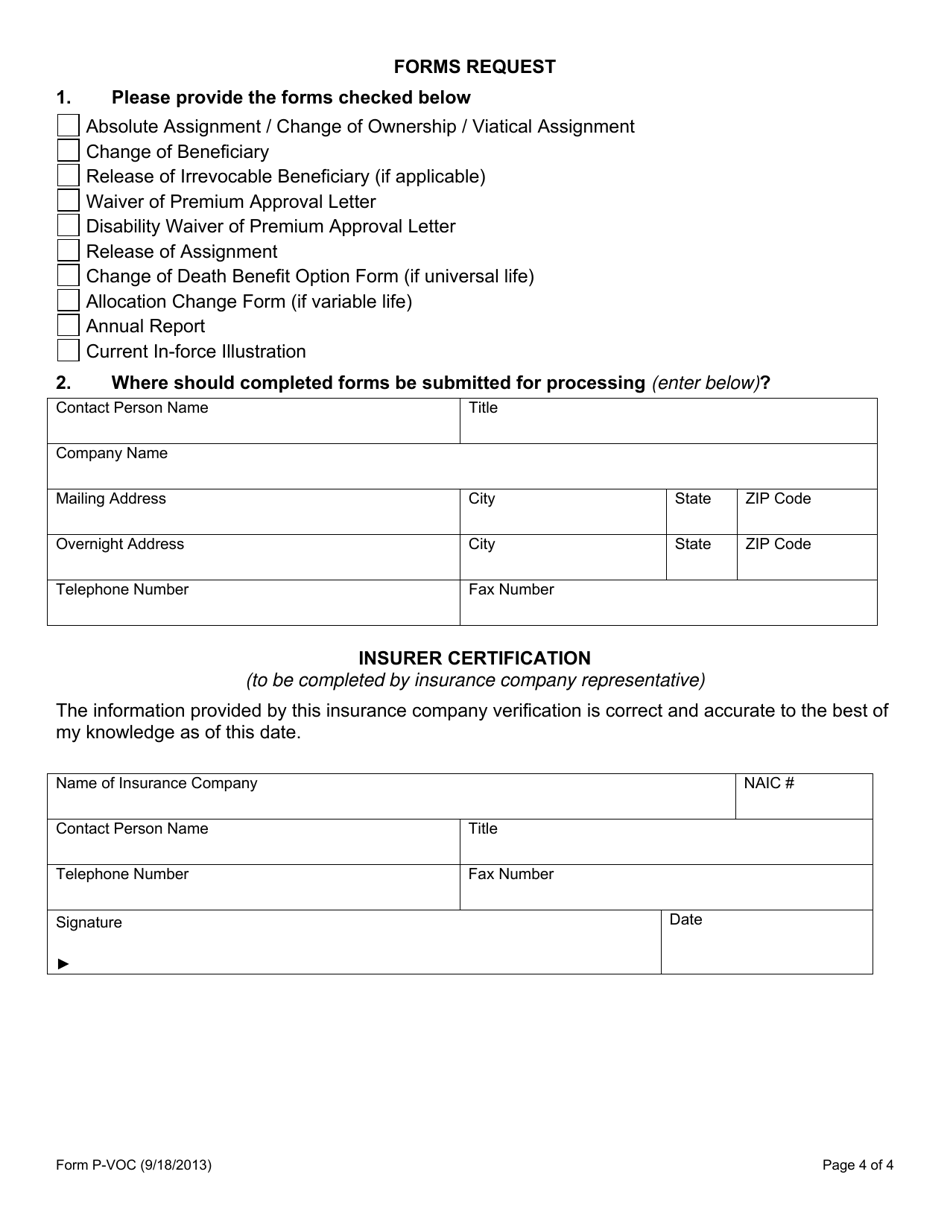

Q: What is the purpose of P-VOC?

A: The purpose of P-VOC is to verify the coverage of life insurance policies.

Q: Who conducts P-VOC?

A: P-VOC is conducted by insurance companies.

Q: Why is P-VOC important?

A: P-VOC is important to ensure that life insurance policies are valid and that policyholders have the coverage they expect.

Q: When should P-VOC be conducted?

A: P-VOC should be conducted periodically, typically every two to three years.

Q: Who needs to participate in P-VOC?

A: Policyholders with life insurance policies need to participate in P-VOC.

Q: How is P-VOC conducted?

A: P-VOC is typically conducted through a questionnaire or by providing updated information to the insurance company.

Q: What happens if P-VOC reveals issues with coverage?

A: If P-VOC reveals issues with coverage, policyholders may need to take corrective actions or make adjustments to their policies.

Q: Is P-VOC required by law?

A: P-VOC requirements may vary by state, but it is generally not mandatory by law. However, many insurance companies conduct P-VOC as a standard practice.

Form Details:

- Released on September 18, 2013;

- The latest edition provided by the Arizona Department of Insurance and Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-VOC by clicking the link below or browse more documents and templates provided by the Arizona Department of Insurance and Financial Institutions.