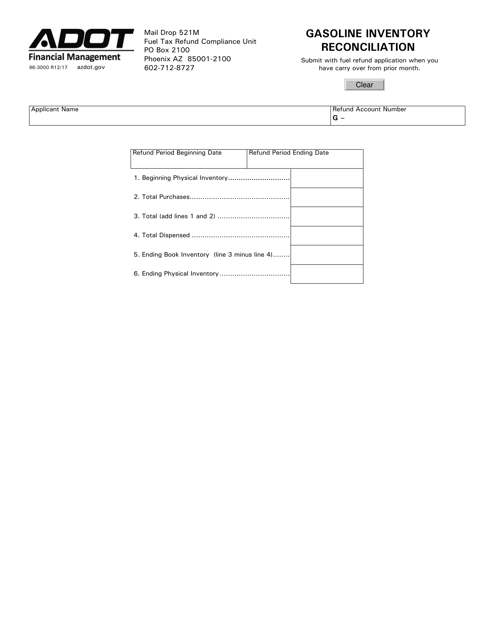

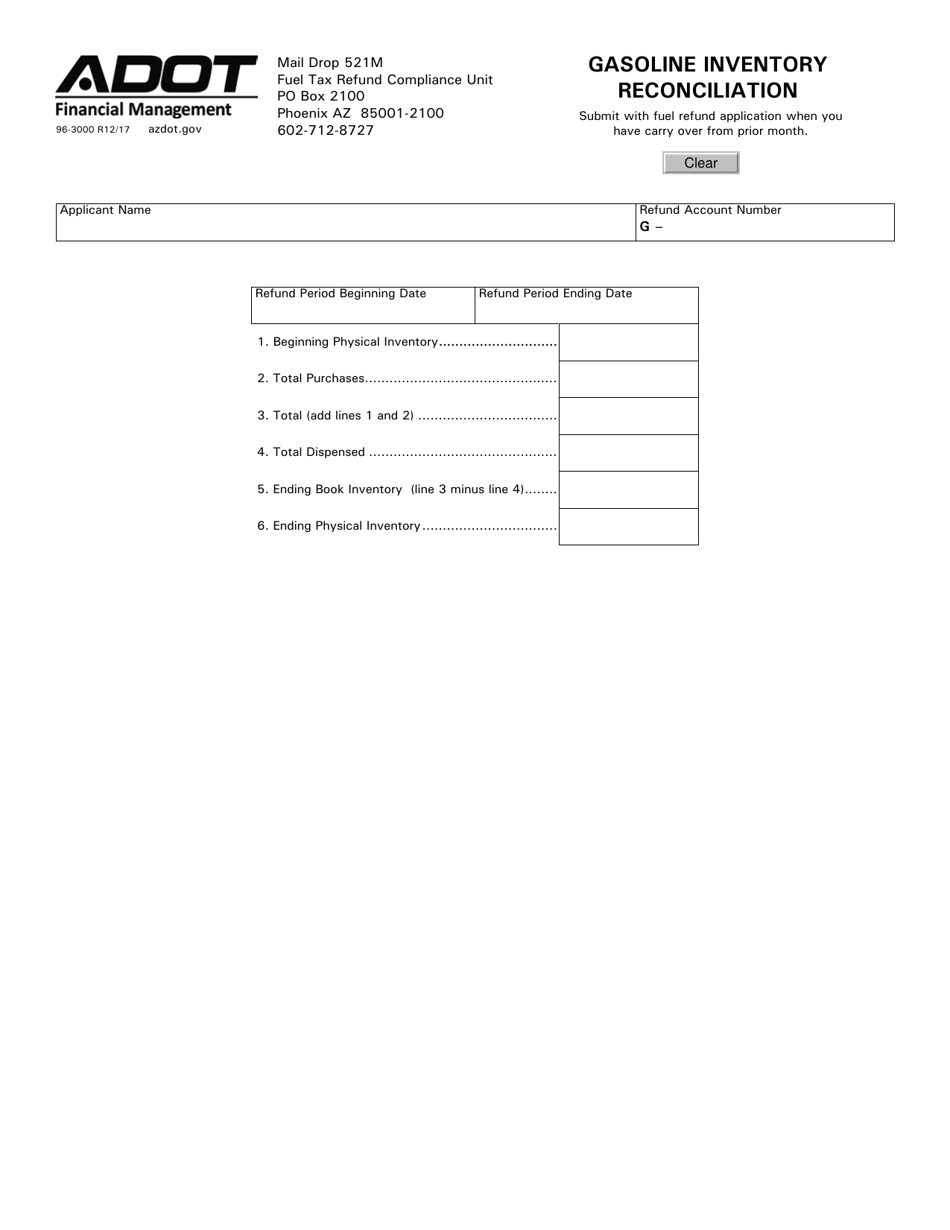

Form 96-3000 Gasoline Inventory Reconciliation - Arizona

What Is Form 96-3000?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-3000?

A: Form 96-3000 is the Gasoline Inventory Reconciliation form used in Arizona.

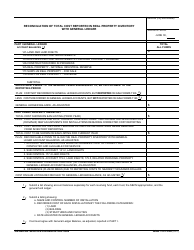

Q: What is Gasoline Inventory Reconciliation?

A: Gasoline Inventory Reconciliation is a process of comparing the physical inventory of gasoline held in storage tanks with the recorded inventory.

Q: Why is Gasoline Inventory Reconciliation necessary?

A: Gasoline Inventory Reconciliation is necessary to ensure that there are no unaccounted losses or gains of gasoline.

Q: Who needs to file Form 96-3000?

A: Gasoline retailers, wholesalers, and suppliers in Arizona need to file Form 96-3000.

Q: When is Form 96-3000 due?

A: Form 96-3000 is due on or before the 20th day of the month following the reporting period.

Q: How can Form 96-3000 be filed?

A: Form 96-3000 can be filed electronically or by mail to the Arizona Department of Environmental Quality.

Q: What should be included in Form 96-3000?

A: Form 96-3000 should include information about the opening and closing inventory, deliveries, withdrawals, and any losses or gains.

Q: Are there any penalties for not filing Form 96-3000?

A: Yes, failure to file Form 96-3000 or filing a false report may result in penalties and fines.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-3000 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.