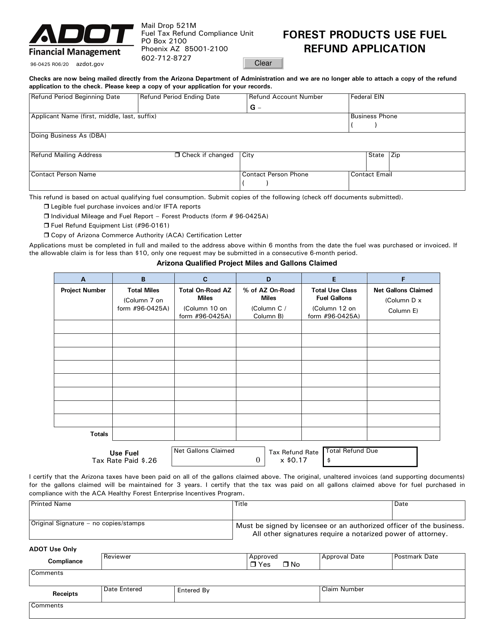

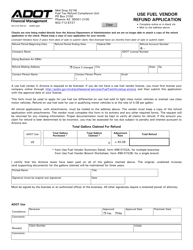

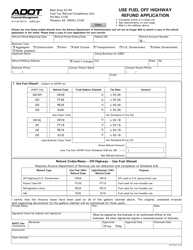

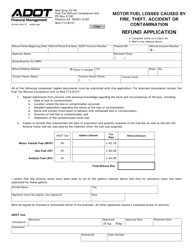

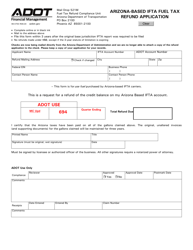

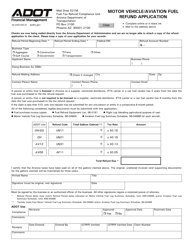

Form 96-0425 Forest Products Use Fuel Refund Application - Arizona

What Is Form 96-0425?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0425?

A: Form 96-0425 is the Forest Products Use Fuel Refund Application for Arizona.

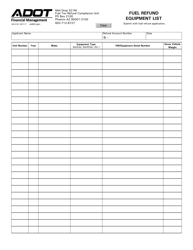

Q: What is the purpose of Form 96-0425?

A: The purpose of Form 96-0425 is to apply for a refund of fuel taxes paid on forest products use fuel in Arizona.

Q: Who can use Form 96-0425?

A: Individuals, partnerships, corporations, and other entities who paid fuel taxes on forest products use fuel in Arizona can use Form 96-0425.

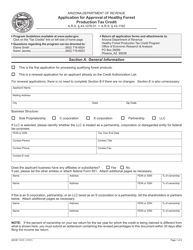

Q: How do I fill out Form 96-0425?

A: The form requires you to provide information such as your name, address, the amount of fuel taxes paid, and the reason for the refund. Follow the instructions provided with the form for detailed guidance.

Q: When should I file Form 96-0425?

A: Form 96-0425 should be filed no later than the last day of the fourth month following the close of the calendar quarter in which the fuel taxes were paid.

Q: Is there a fee to file Form 96-0425?

A: No, there is no fee to file Form 96-0425.

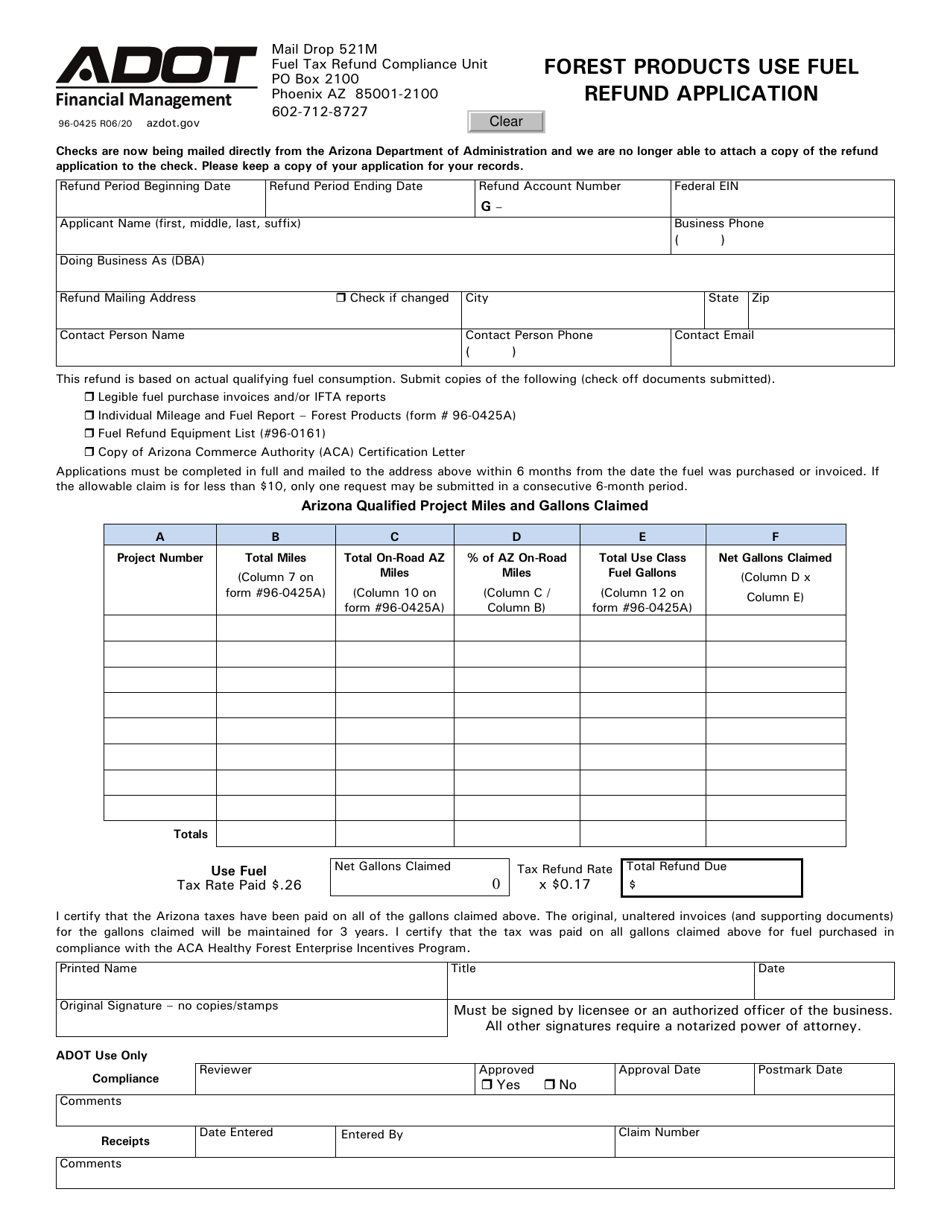

Q: What supporting documents do I need to include with Form 96-0425?

A: You should include copies of fuel receipts, invoices, or other documentation showing the payment of fuel taxes.

Q: What should I do if I have questions about Form 96-0425?

A: If you have questions about Form 96-0425, you can contact the Arizona Department of Revenue for assistance.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0425 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.