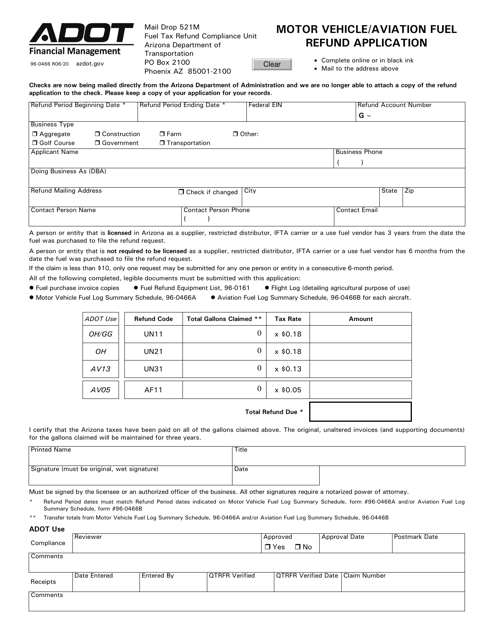

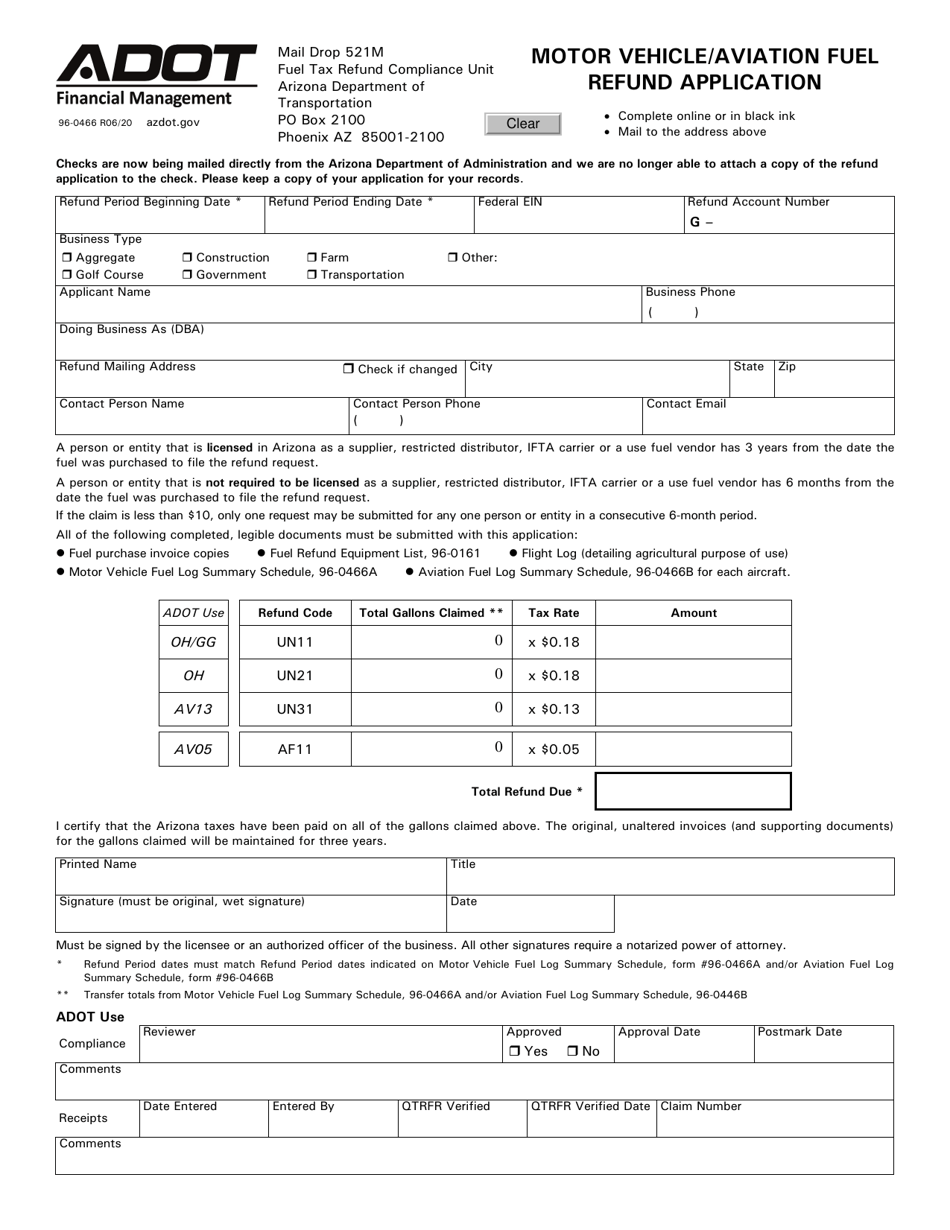

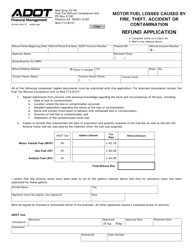

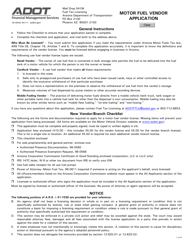

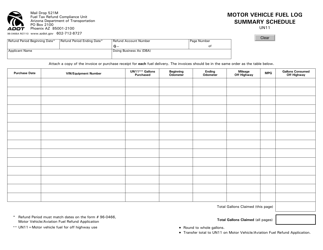

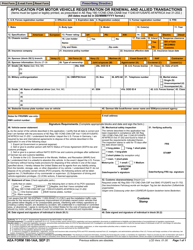

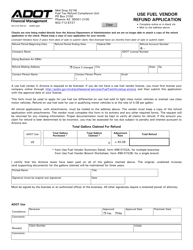

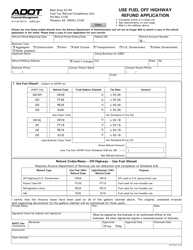

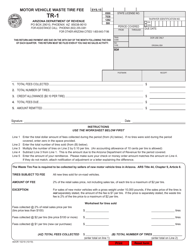

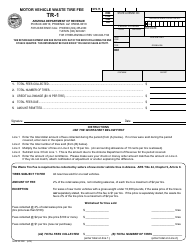

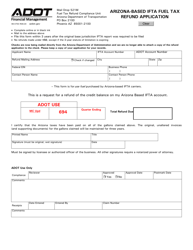

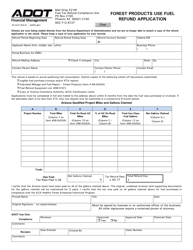

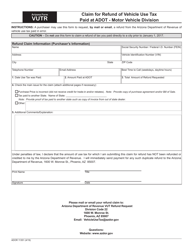

Form 96-0466 Motor Vehicle / Aviation Fuel Refund Application - Arizona

What Is Form 96-0466?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0466?

A: Form 96-0466 is a Motor Vehicle/Aviation Fuel Refund Application used in Arizona.

Q: Who can use Form 96-0466?

A: Anyone who purchased motor vehicle or aviation fuel in Arizona may use this form to apply for a refund.

Q: What is the purpose of Form 96-0466?

A: The purpose of this form is to request a refund of taxes paid on motor vehicle or aviation fuel in Arizona.

Q: What information is required on Form 96-0466?

A: You will need to provide details about your fuel purchases, including the type of fuel, quantity, and date of purchase.

Q: Are there any deadlines for submitting Form 96-0466?

A: Yes, the form must be filed within three years from the date of purchase.

Q: How long does it take to process a refund request using Form 96-0466?

A: The processing time for refund requests can vary, but it typically takes several weeks to receive a refund.

Q: Are there any fees associated with submitting Form 96-0466?

A: No, there are no fees for submitting this form.

Q: What should I do if I have questions or need assistance with Form 96-0466?

A: You can contact the Arizona Department of Revenue for assistance with completing or submitting this form.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0466 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.