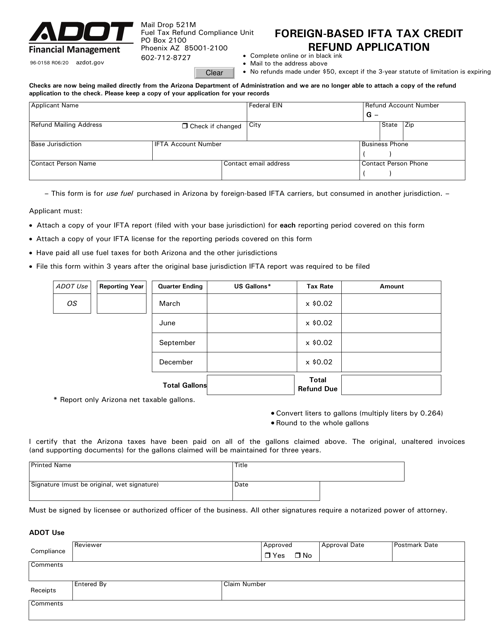

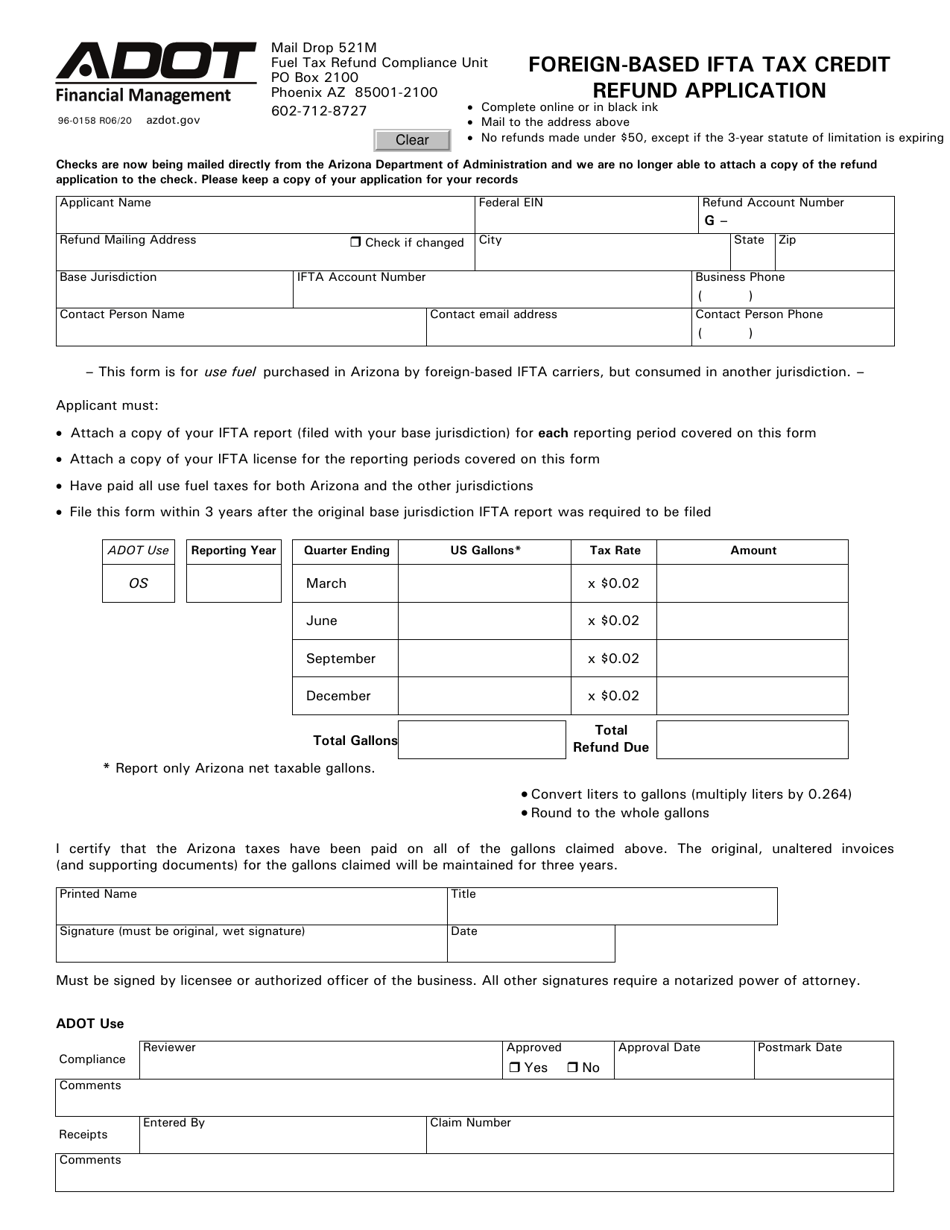

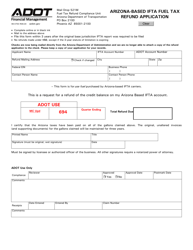

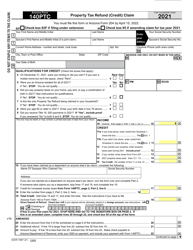

Form 96-0158 Foreign-Based Ifta Tax Credit Refund Application - Arizona

What Is Form 96-0158?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0158?

A: Form 96-0158 is the Foreign-Based Ifta Tax Credit Refund Application - Arizona.

Q: What is the purpose of Form 96-0158?

A: The purpose of Form 96-0158 is to apply for a tax credit refund for International Fuel Tax Agreement (IFTA) qualified motor carriers.

Q: Who should use Form 96-0158?

A: Form 96-0158 should be used by International Fuel Tax Agreement (IFTA) qualified motor carriers.

Q: What is the Foreign-Based Ifta Tax Credit?

A: The Foreign-Based Ifta Tax Credit is a tax credit available to International Fuel Tax Agreement (IFTA) qualified motor carriers who pay fuel taxes in foreign jurisdictions.

Q: What documents are required to submit Form 96-0158?

A: The following documents are required to submit Form 96-0158: proof of payment of fuel taxes in foreign jurisdictions, IFTA schedules and tax returns, and any other supporting documentation requested by the Arizona Department of Revenue.

Q: Is there a deadline for submitting Form 96-0158?

A: Yes, Form 96-0158 should be submitted within three years from the end of the taxable year for which the tax credit is being claimed.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0158 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.