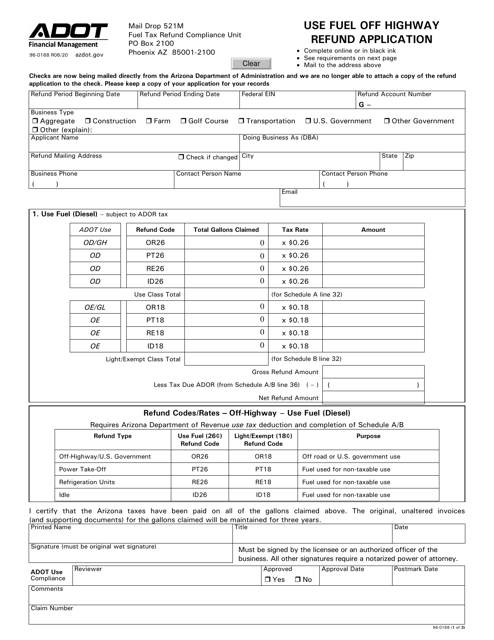

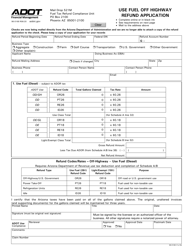

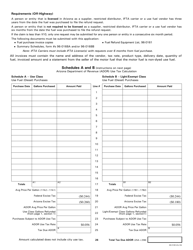

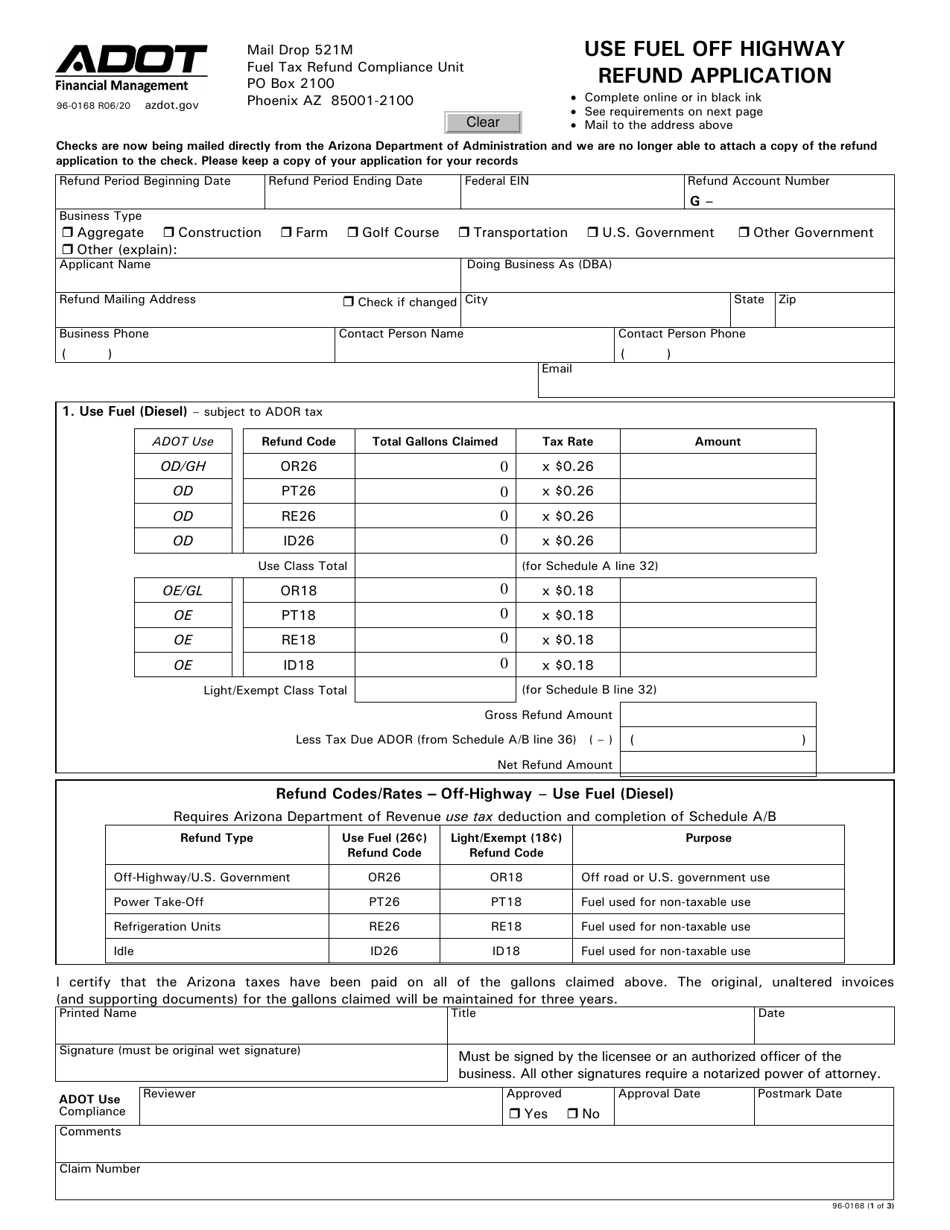

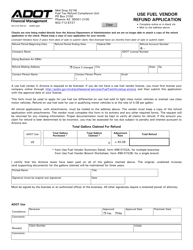

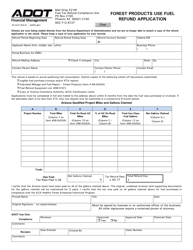

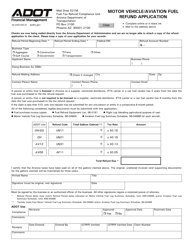

Form 96-0168 Use Fuel off Highway Refund Application - Arizona

What Is Form 96-0168?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 96-0168?

A: Form 96-0168 is the Use Fuel off Highway Refund Application for Arizona.

Q: What is the purpose of Form 96-0168?

A: The purpose of Form 96-0168 is to claim a refund for taxes paid on off-highway use fuel in Arizona.

Q: Who can use Form 96-0168?

A: Form 96-0168 can be used by individuals, businesses, and government entities that have paid taxes on off-highway use fuel.

Q: What qualifies as off-highway use fuel?

A: Off-highway use fuel includes fuel used in motor vehicles that do not travel on public highways.

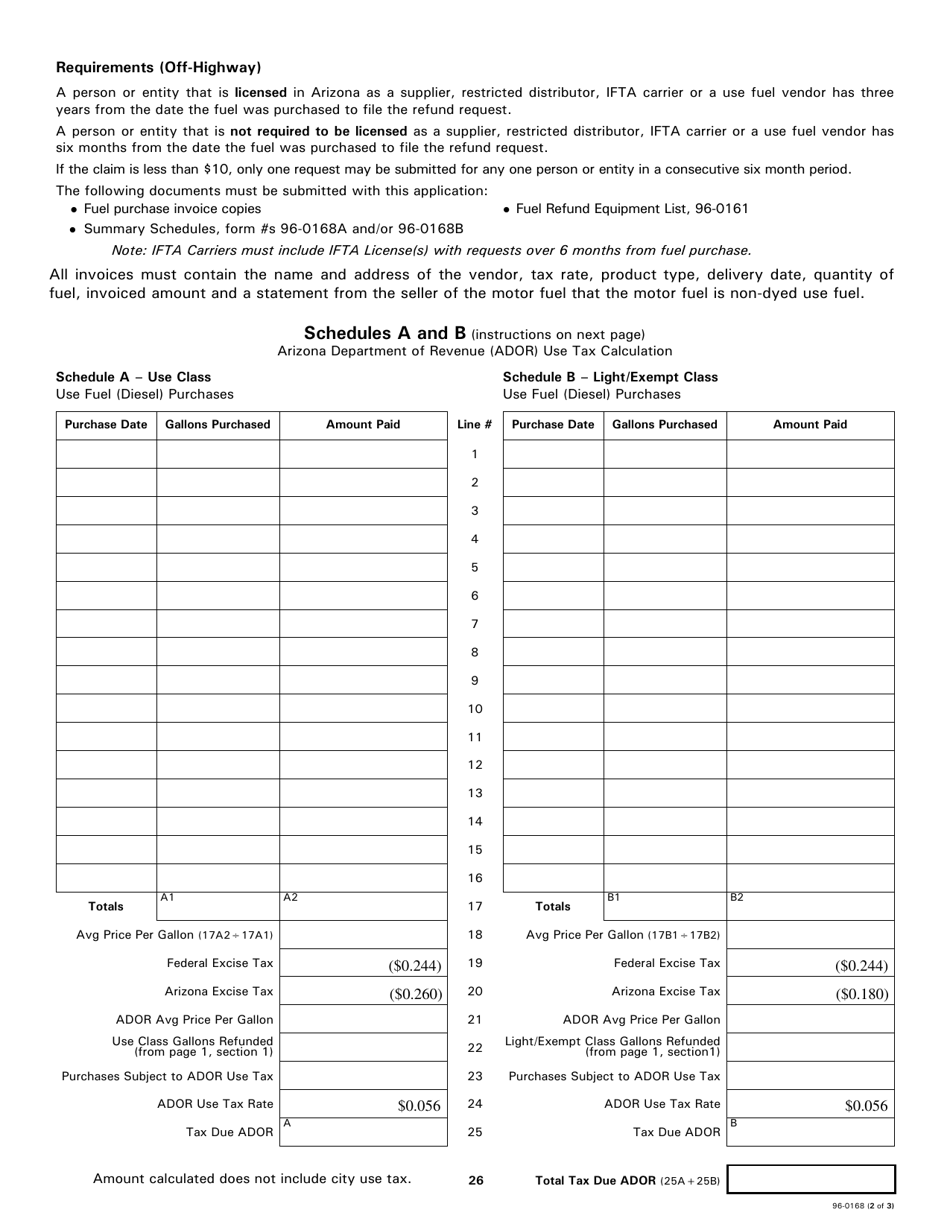

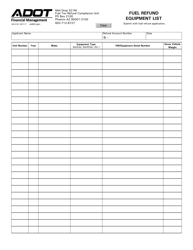

Q: What information is required to complete Form 96-0168?

A: To complete Form 96-0168, you will need to provide details about the off-highway fuel purchases and the amount of tax paid.

Q: When should I file Form 96-0168?

A: Form 96-0168 should be filed within three years from the date the taxes were paid.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0168 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.