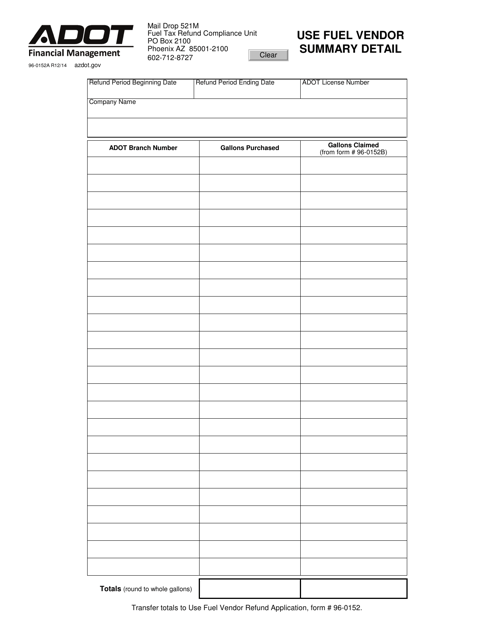

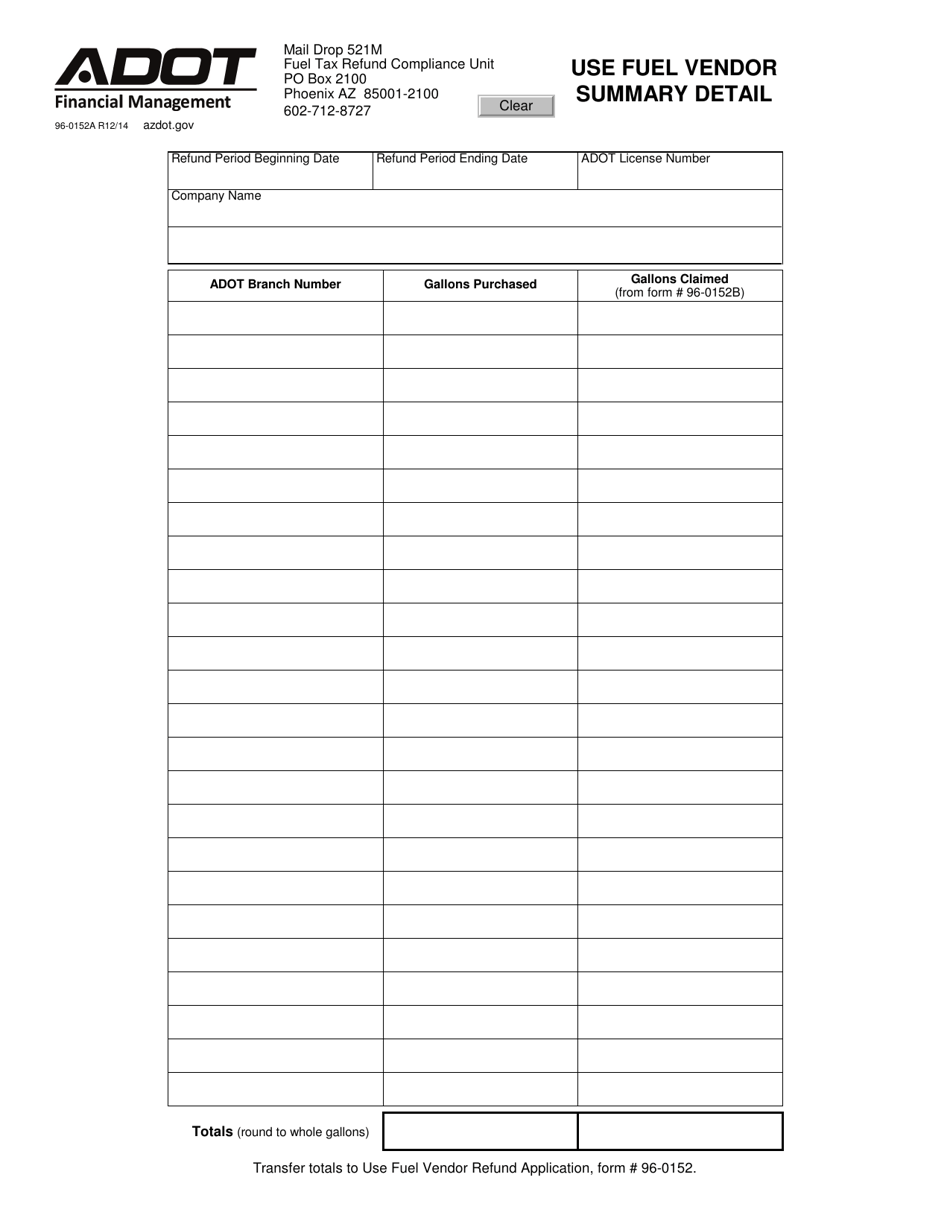

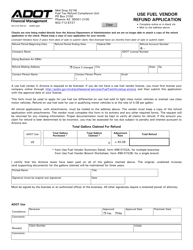

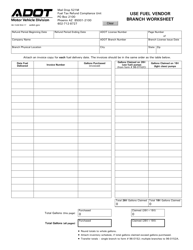

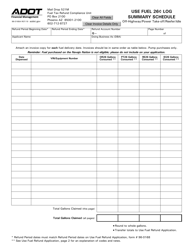

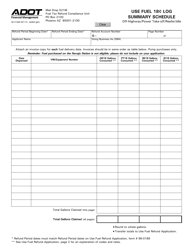

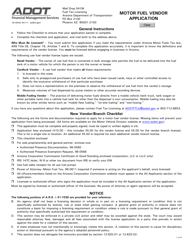

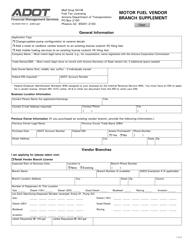

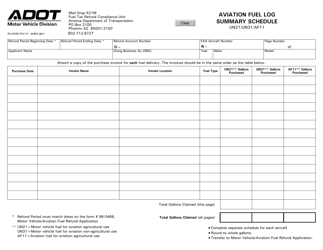

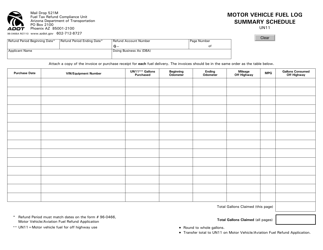

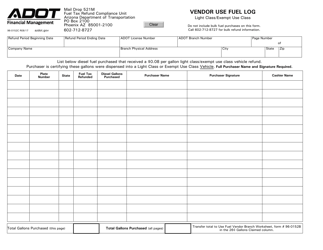

Form 96-0152A Use Fuel Vendor Summary Detail - Arizona

What Is Form 96-0152A?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0152A?

A: Form 96-0152A is a Use Fuel Vendor Summary Detail form for reporting use fuel taxes in Arizona.

Q: Who needs to file Form 96-0152A?

A: Use fuel vendors who sell or transport use fuel in Arizona need to file Form 96-0152A.

Q: What is use fuel?

A: Use fuel refers to any fuel used in a motor vehicle on public highways, other than gasoline or diesel fuel.

Q: What information is required on Form 96-0152A?

A: Form 96-0152A requires information about the vendor, gallons of use fuel sold/transferred, exempt sales, tax rates, and tax collected.

Q: When is Form 96-0152A due?

A: Form 96-0152A is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form 96-0152A?

A: Yes, failure to file Form 96-0152A or pay the use fuel taxes can result in penalties and interest.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0152A by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.