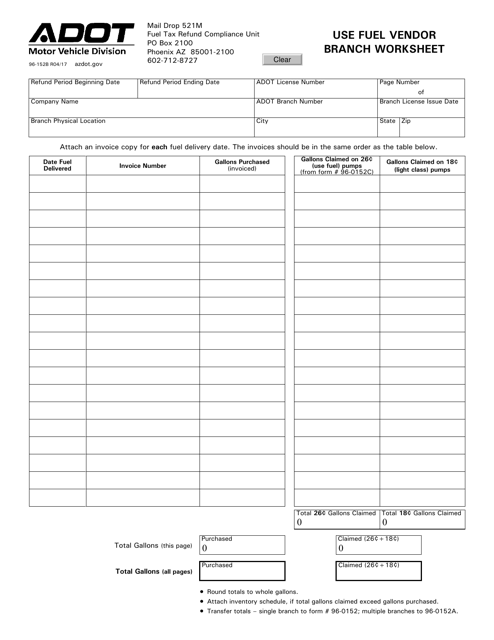

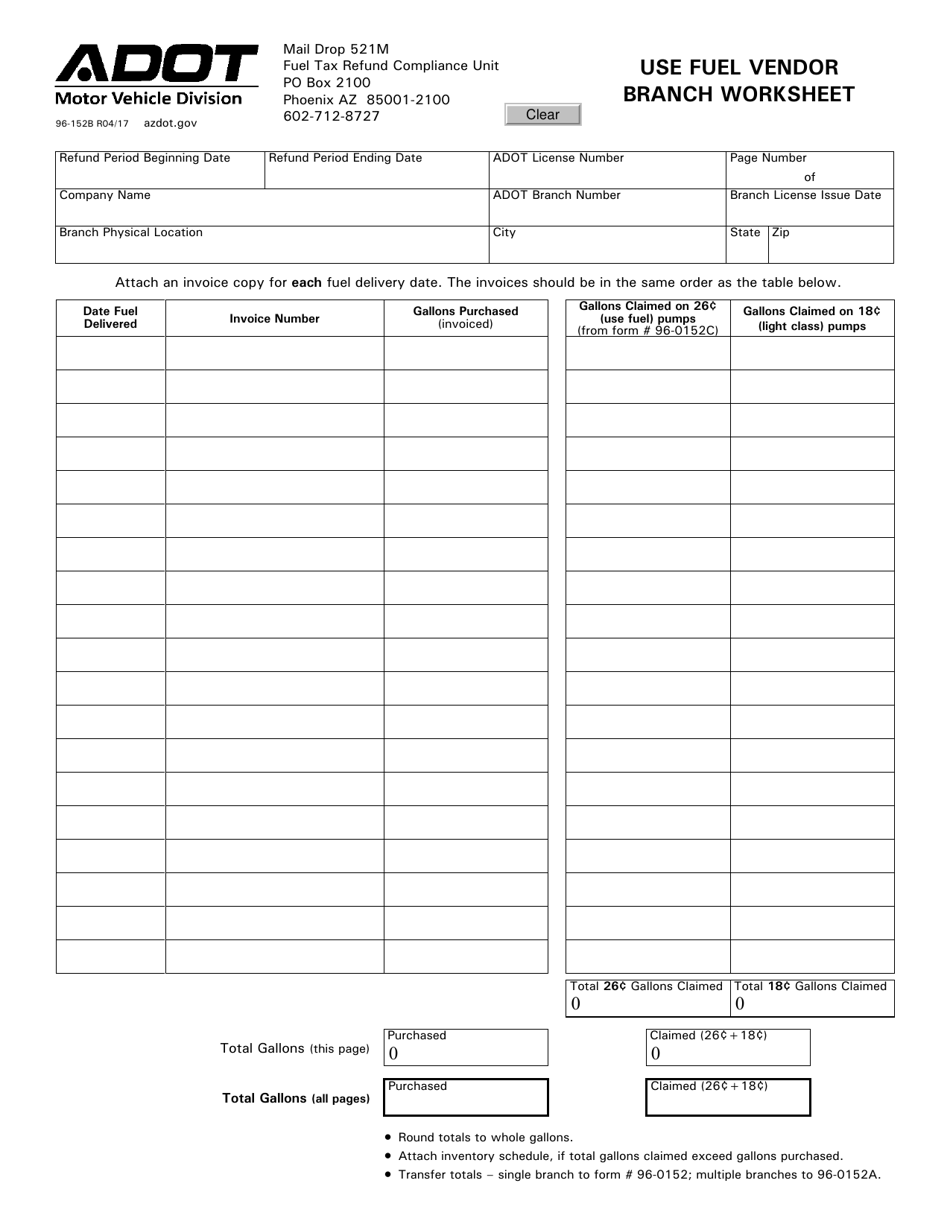

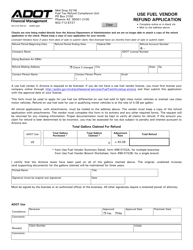

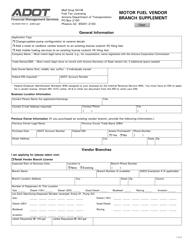

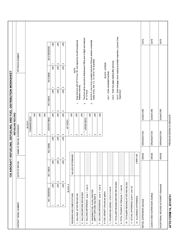

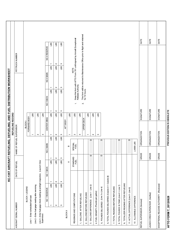

Form 96-152B Use Fuel Vendor Branch Worksheet - Arizona

What Is Form 96-152B?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 96-152B?

A: The Form 96-152B is the Use Fuel Vendor Branch Worksheet used in Arizona.

Q: Who uses the Form 96-152B?

A: Use Fuel Vendors in Arizona use the Form 96-152B.

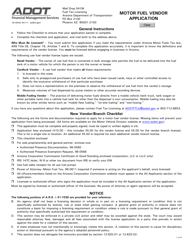

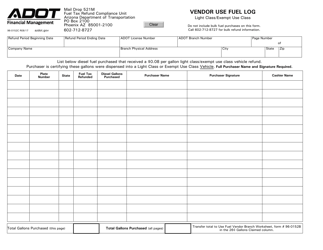

Q: What is the purpose of the Form 96-152B?

A: The Form 96-152B is used to report and calculate the amount of use fuel sold or used by a vendor branch in Arizona.

Q: When should the Form 96-152B be filed?

A: The Form 96-152B should be filed monthly by the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing the Form 96-152B?

A: Yes, there are penalties for not filing the Form 96-152B, including late filing penalties and interest charges on the unpaid use fuel tax.

Q: What information is required on the Form 96-152B?

A: The Form 96-152B requires information such as the vendor's name, address, and contact information, as well as details about the use fuel sold or used.

Q: Is the Form 96-152B specific to Arizona?

A: Yes, the Form 96-152B is specific to use fuel vendors in Arizona.

Q: What should I do if I need help with the Form 96-152B?

A: If you need help with the Form 96-152B, you can contact the Arizona Department of Revenue for assistance.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-152B by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.