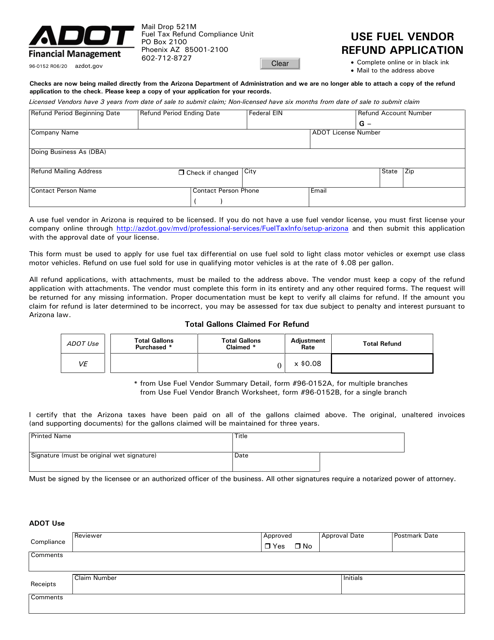

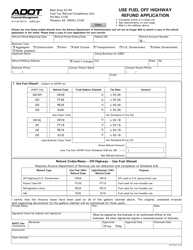

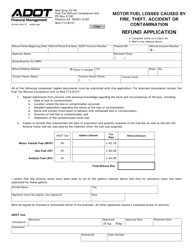

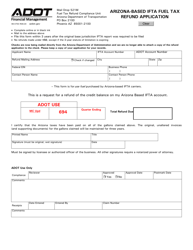

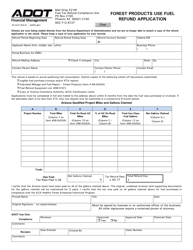

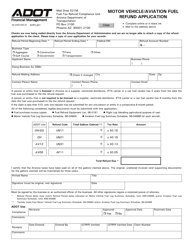

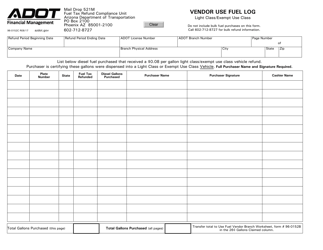

Form 96-0152 Use Fuel Vendor Refund Application - Arizona

What Is Form 96-0152?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0152?

A: Form 96-0152 is the Use Fuel Vendor Refund Application specifically for the state of Arizona.

Q: Who can use Form 96-0152?

A: Use Fuel Vendors in Arizona can use Form 96-0152 to apply for a refund.

Q: What is use fuel?

A: Use fuel is fuel that is not taxed when it is originally purchased, but instead is subject to a separate tax when it is used in certain vehicles or equipment.

Q: What information is required on Form 96-0152?

A: Form 96-0152 requires information such as the vendor's name and address, the amount of refund being requested, and supporting documentation for the refund claim.

Q: What is the deadline for submitting Form 96-0152?

A: The deadline for submitting Form 96-0152 is typically within 12 months from the end of the calendar year in which the refund claim is being made.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0152 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.