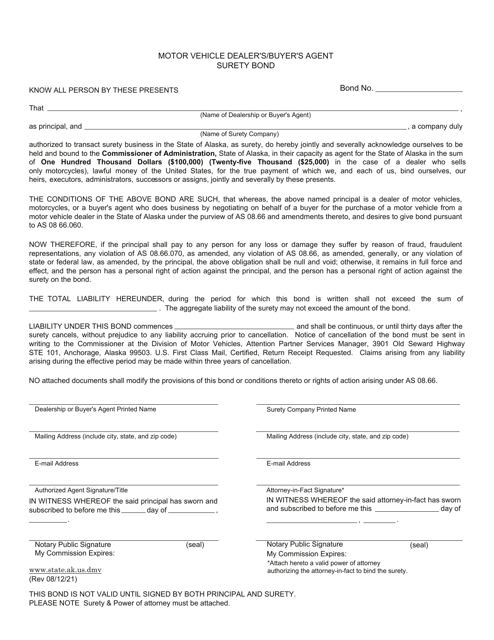

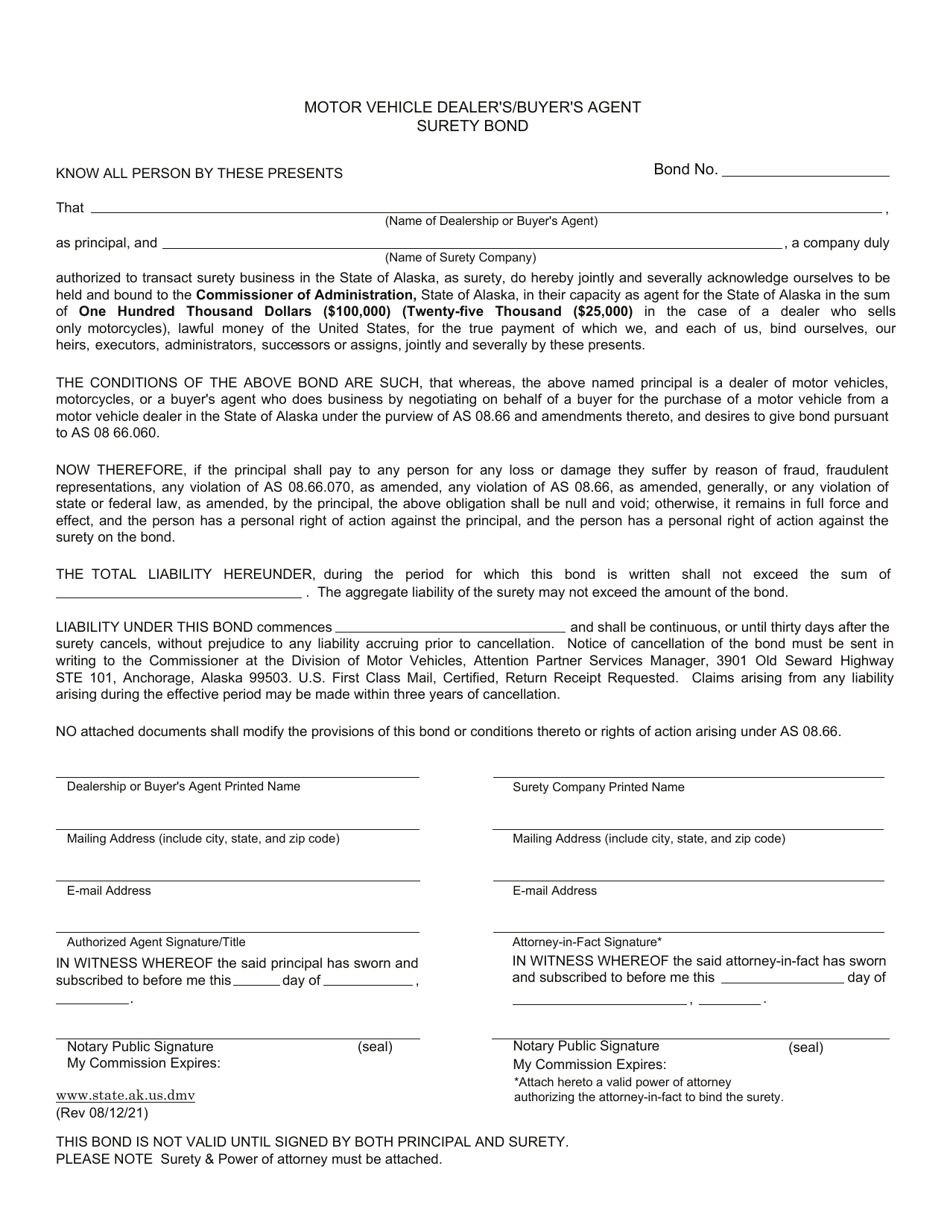

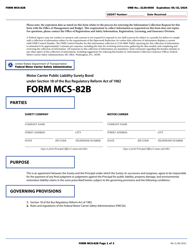

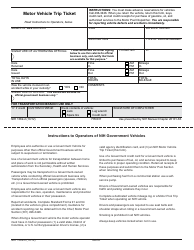

Motor Vehicle Dealer's / Buyer's Agent Surety Bond - Alaska

Motor Vehicle Dealer's/Buyer's Agent Surety Bond is a legal document that was released by the Alaska Department of Administration - a government authority operating within Alaska.

FAQ

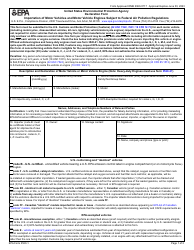

Q: What is a Motor Vehicle Dealer's/Buyer's Agent Surety Bond?

A: It is a type of bond required by Alaska for individuals or businesses acting as motor vehicle dealers or buyer's agents.

Q: Why is a surety bond required for motor vehicle dealers or buyer's agents?

A: The bond provides financial protection to consumers in case the dealer or agent engages in fraudulent or unethical practices.

Q: How much is the surety bond amount in Alaska?

A: The required bond amount varies depending on the type of license and the number of vehicles sold or brokered.

Q: Are there any qualifications or criteria to obtain this bond?

A: Yes, applicants must meet certain eligibility requirements set by the Alaska Division of Motor Vehicles.

Q: Can I get a bond if I have bad credit?

A: While bad credit may make it more difficult to obtain a bond, there are bonding companies that specialize in providing bonds to individuals with less-than-perfect credit.

Q: How long does the surety bond remain valid?

A: The bond must remain in effect for as long as the motor vehicle dealer's or buyer's agent's license is active.

Q: What happens if a claim is made against the bond?

A: If a valid claim is made, the bonding company may compensate the claimant up to the bond amount. The bonded individual or business will then be responsible for repaying the bonding company.

Q: Can I cancel the bond once it is issued?

A: Generally, surety bonds have a term of one year and cannot be canceled before the expiration date.

Form Details:

- Released on August 12, 2021;

- The latest edition currently provided by the Alaska Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.