This version of the form is not currently in use and is provided for reference only. Download this version of

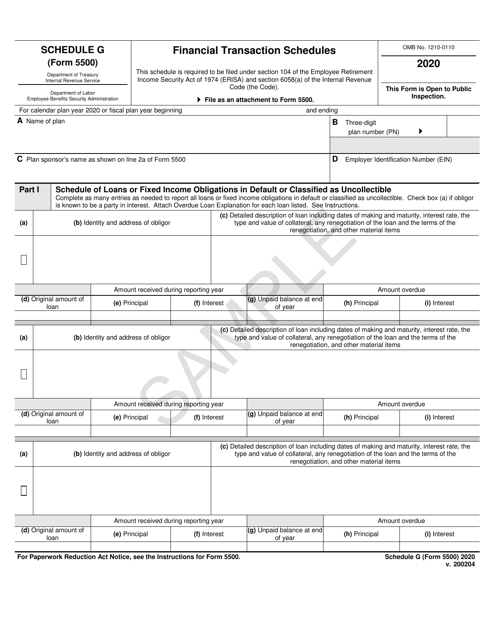

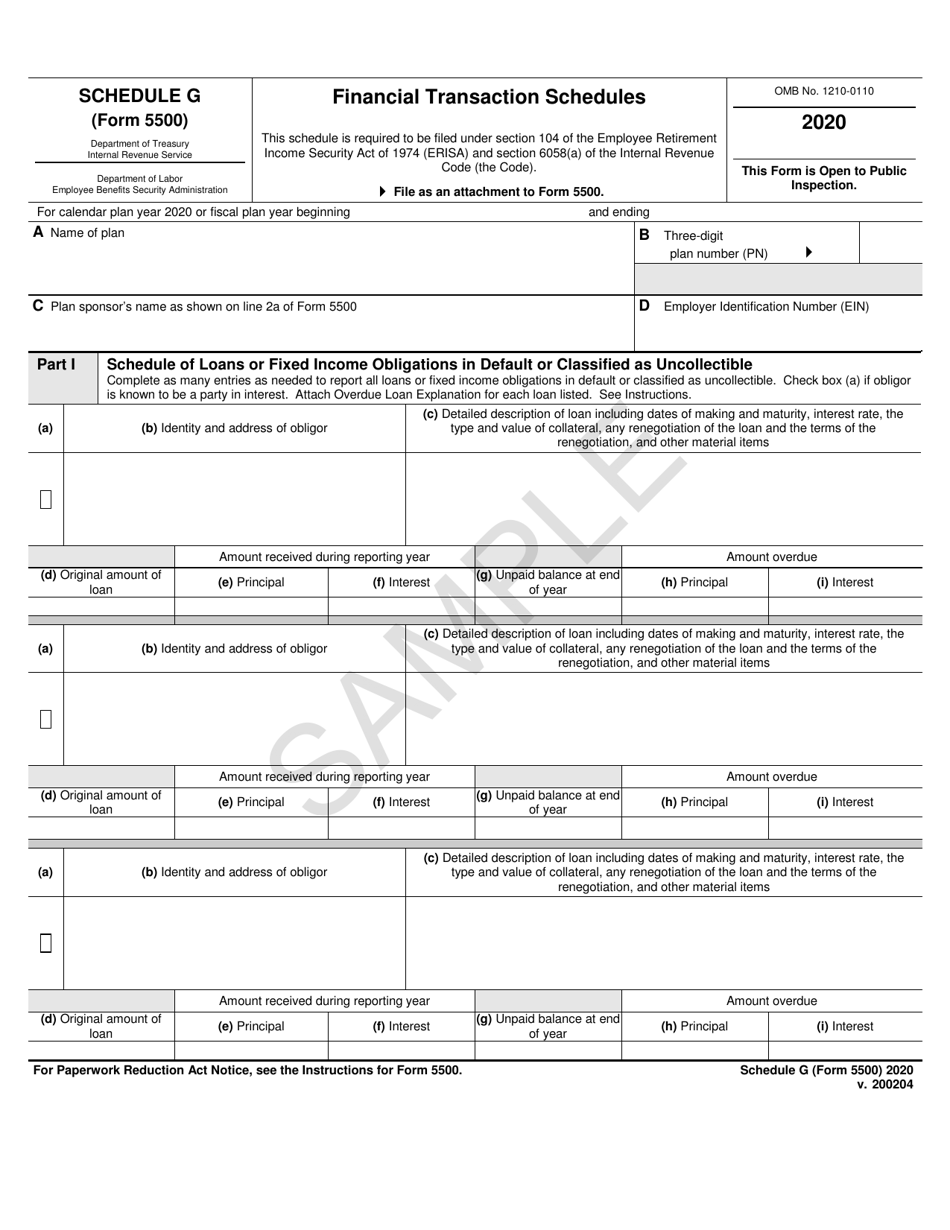

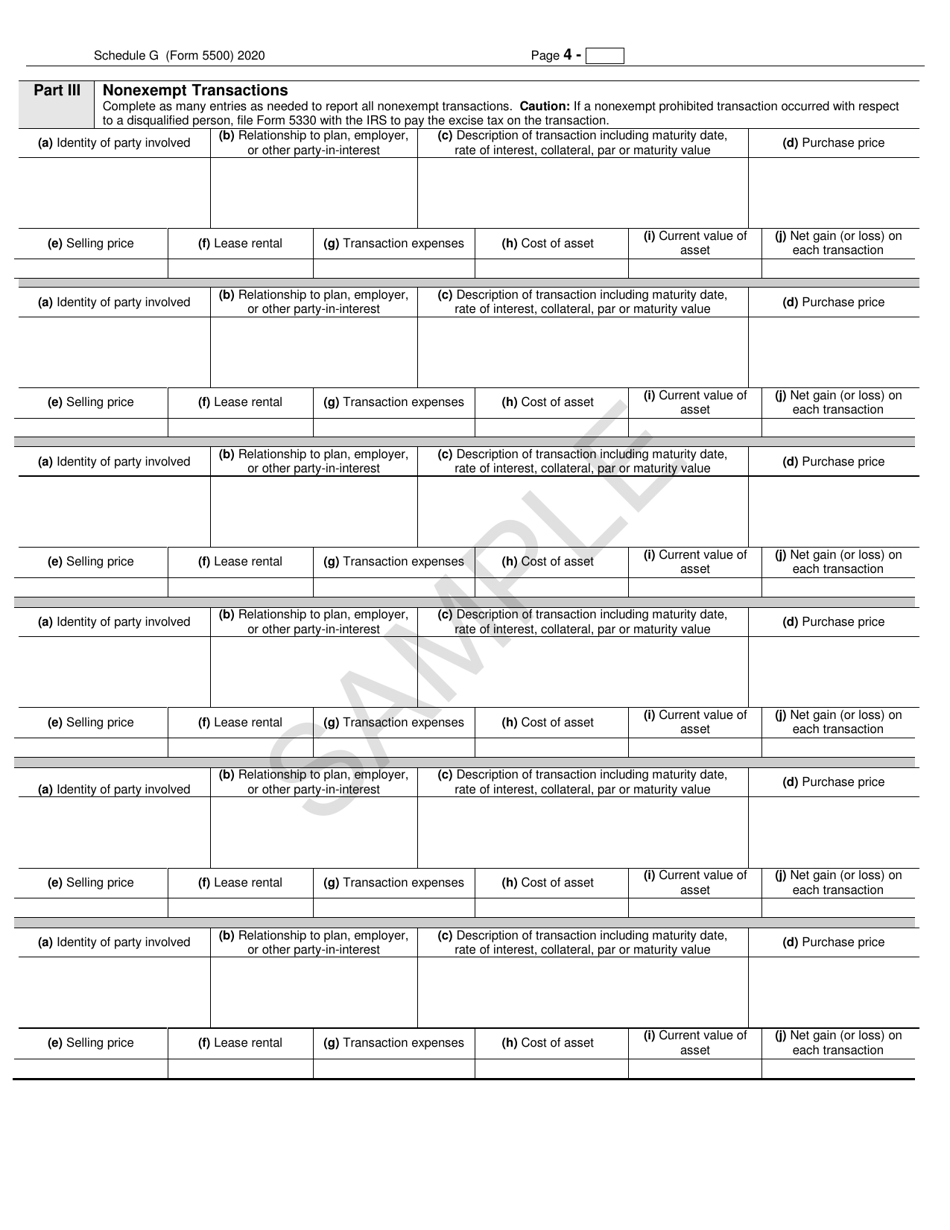

Form 5500 Schedule G

for the current year.

Form 5500 Schedule G Financial Transaction Schedules - Sample

What Is Form 5500 Schedule G?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 5500 Schedule G?

A: Form 5500 Schedule G is a financial transaction schedule that must be filed as part of the annual Form 5500 series.

Q: Who needs to file Form 5500 Schedule G?

A: Employers who sponsor certain employee benefit plans, such as pension plans and welfare plans, need to file Form 5500 Schedule G.

Q: What information does Form 5500 Schedule G require?

A: Form 5500 Schedule G requires information about the financial transactions of the employee benefit plan, including purchases, sales, and exchanges of assets.

Q: Do I need to include supporting documentation with Form 5500 Schedule G?

A: Yes, you generally need to include supporting documentation with Form 5500 Schedule G to verify the accuracy of the financial transactions reported.

Q: When is the deadline to file Form 5500 Schedule G?

A: The deadline to file Form 5500 Schedule G is generally the same as the deadline to file the annual Form 5500 series, which is the last day of the seventh month after the plan year ends.

Q: What happens if I fail to file Form 5500 Schedule G?

A: Failure to file Form 5500 Schedule G may result in penalties and fines imposed by the U.S. Department of Labor.

Q: Can I amend Form 5500 Schedule G?

A: Yes, you can amend Form 5500 Schedule G if you discover any errors or omissions in your original filing.

Q: Is there a fee to file Form 5500 Schedule G?

A: No, there is no fee to file Form 5500 Schedule G.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule G by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.