This version of the form is not currently in use and is provided for reference only. Download this version of

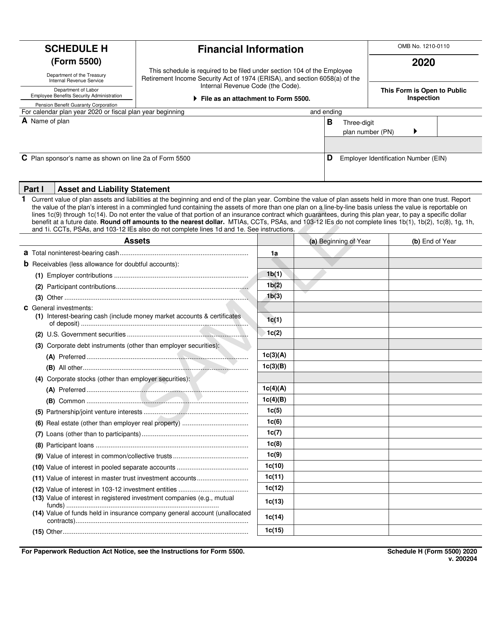

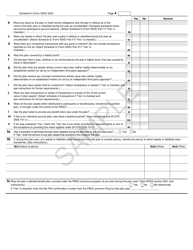

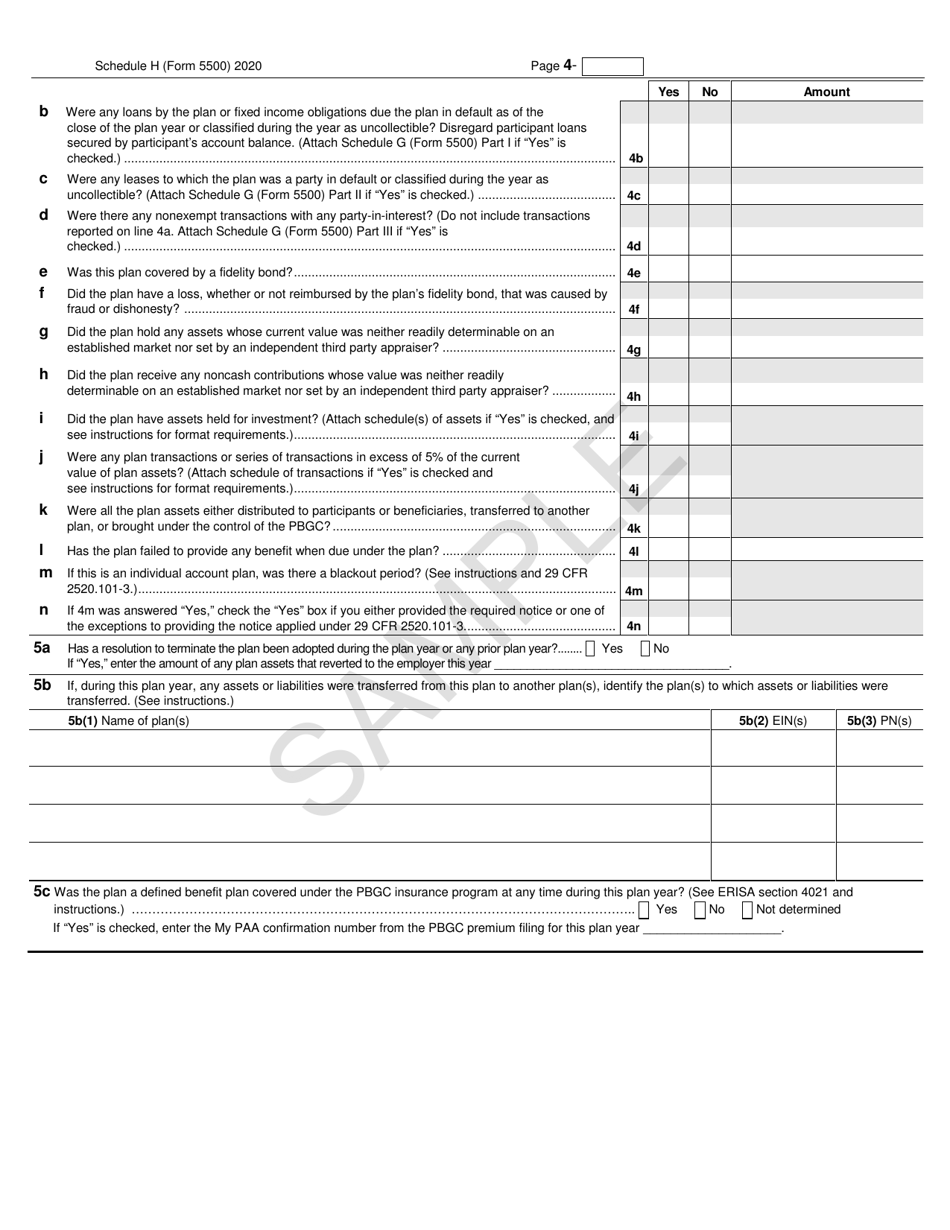

Form 5500 Schedule H

for the current year.

Form 5500 Schedule H Financial Information - Sample

What Is Form 5500 Schedule H?

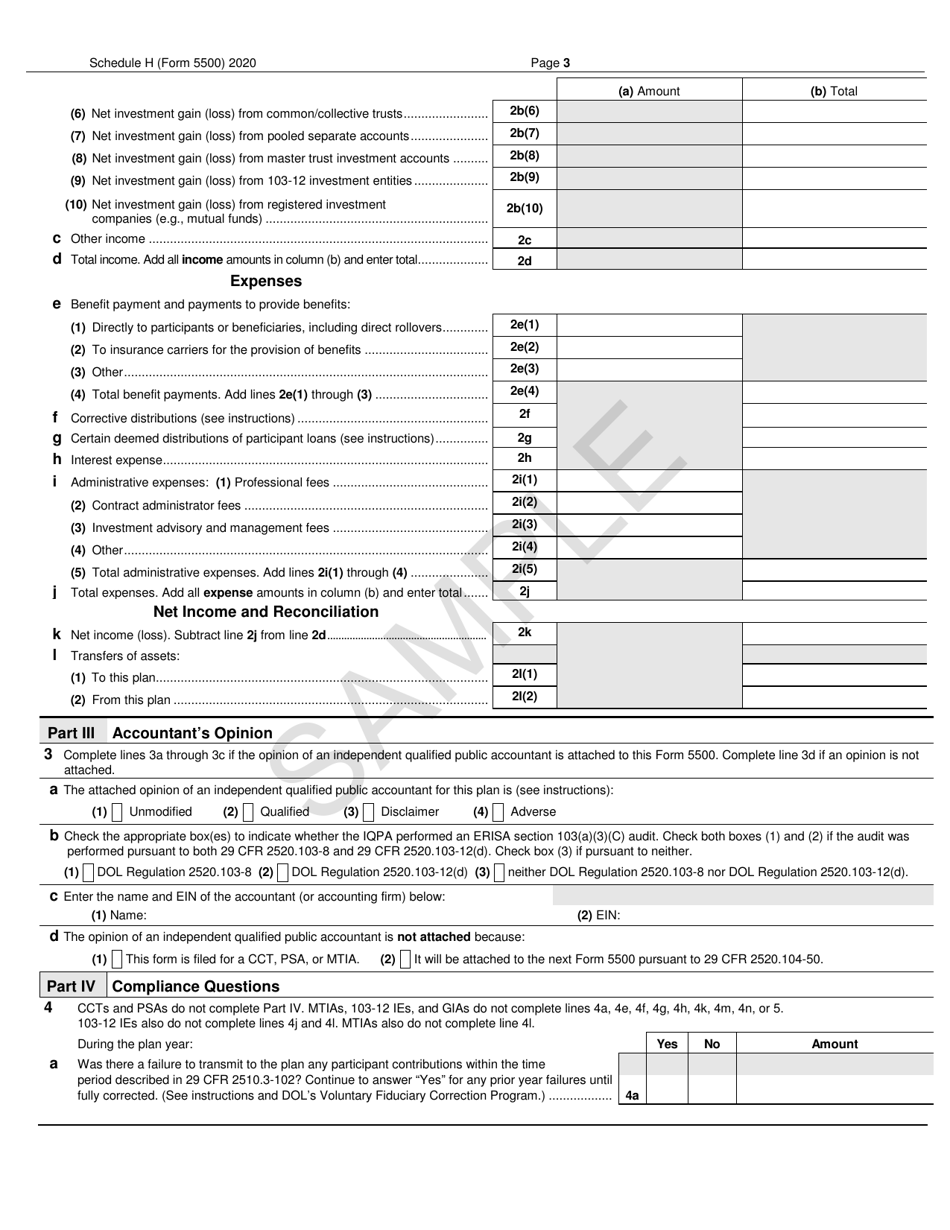

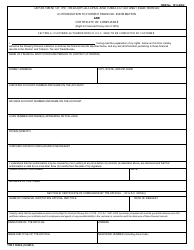

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

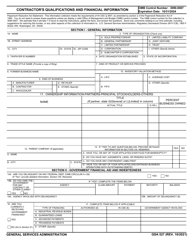

Q: What is Form 5500 Schedule H?

A: Form 5500 Schedule H is a financial information filing required for employee benefit plans.

Q: Who needs to file Form 5500 Schedule H?

A: Employee benefit plans with 100 or more participants must file Form 5500 Schedule H.

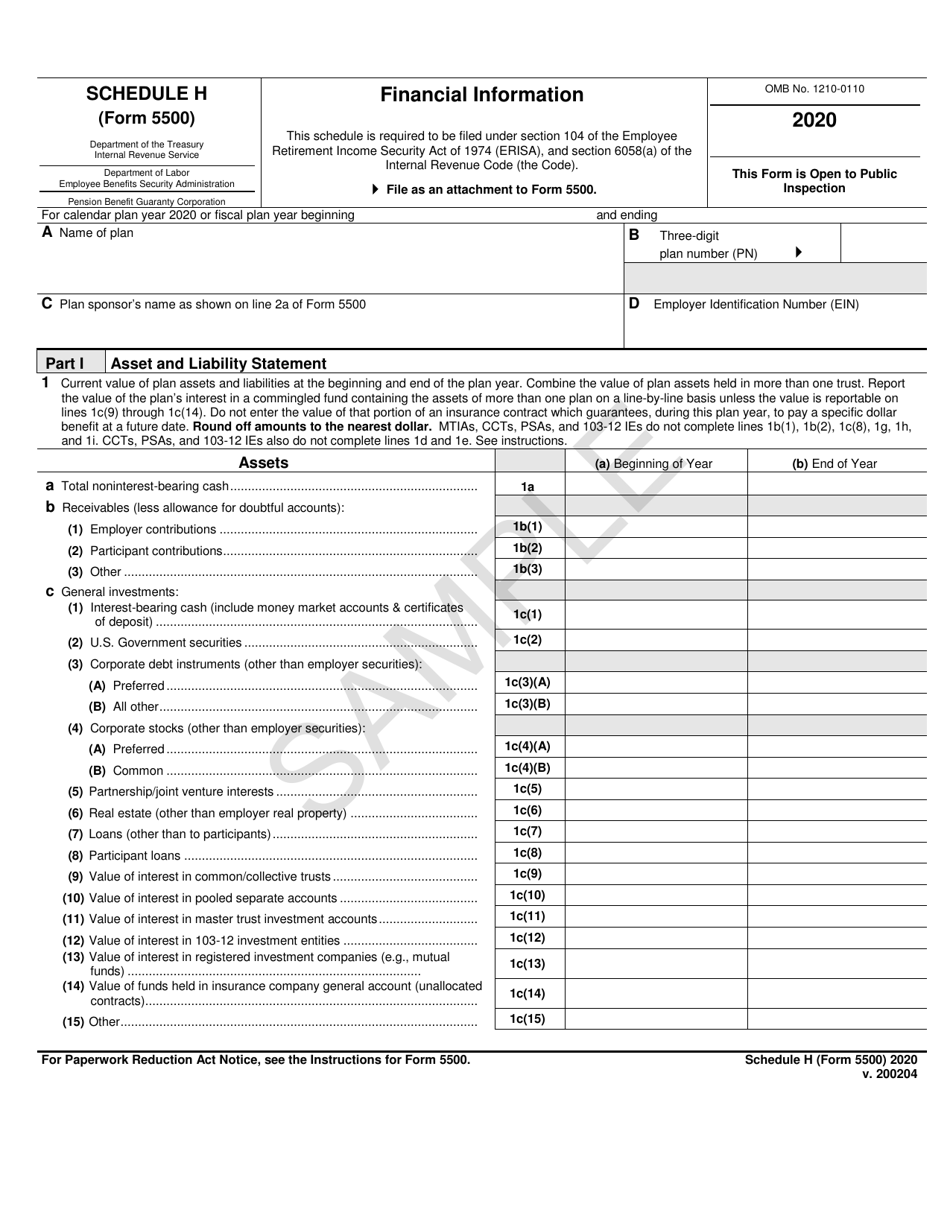

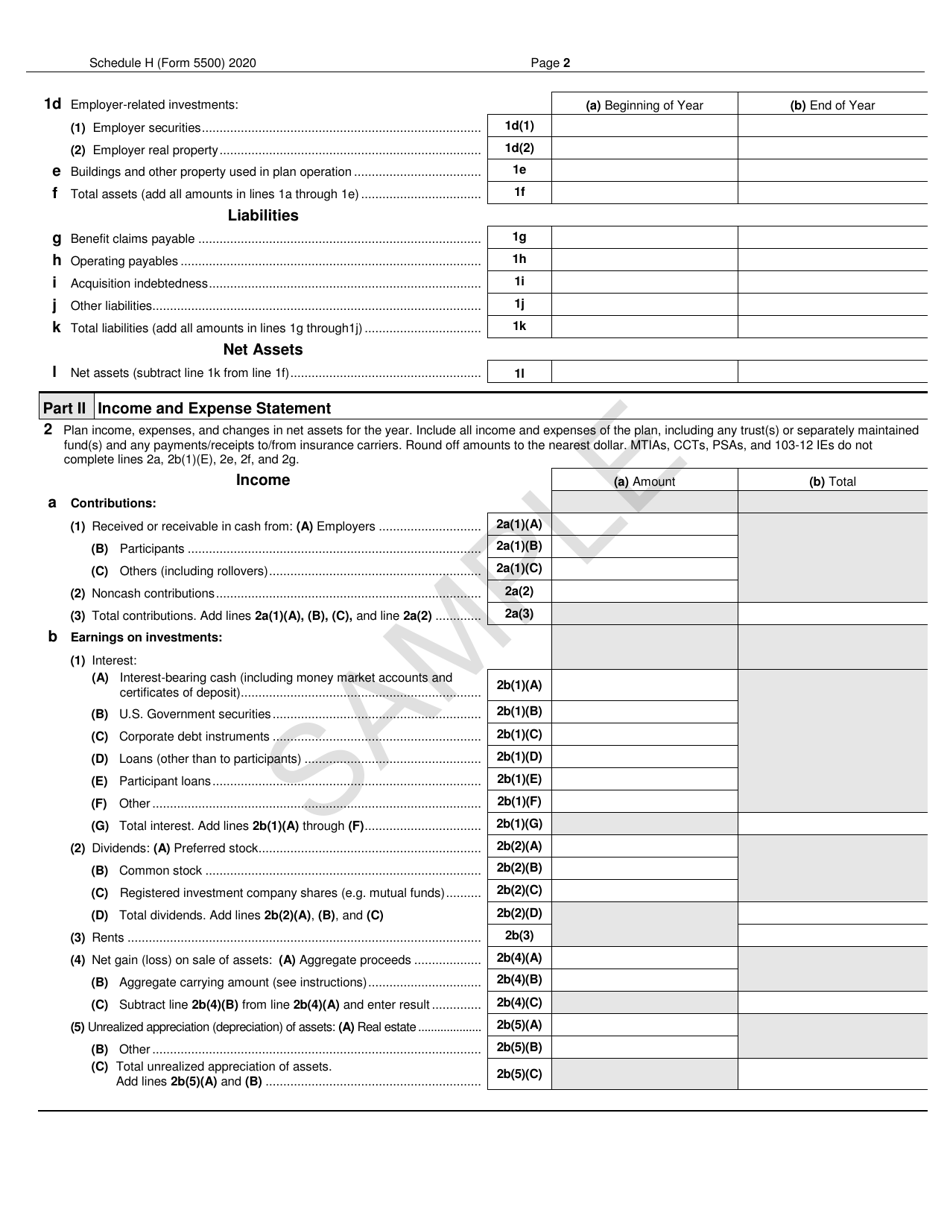

Q: What kind of financial information is reported on Form 5500 Schedule H?

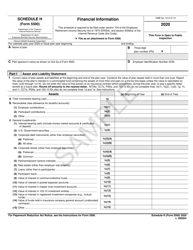

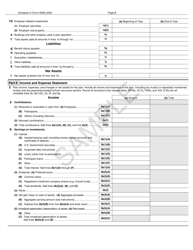

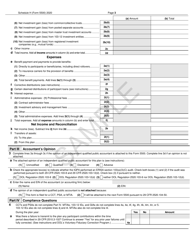

A: Form 5500 Schedule H reports financial information such as assets, liabilities, income, and expenses of the employee benefit plan.

Q: Are there any exemptions for filing Form 5500 Schedule H?

A: Small employee benefit plans with fewer than 100 participants and certain church plans may be exempt from filing Form 5500 Schedule H.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule H by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.