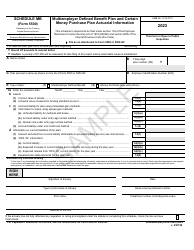

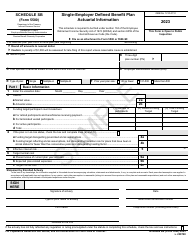

This version of the form is not currently in use and is provided for reference only. Download this version of

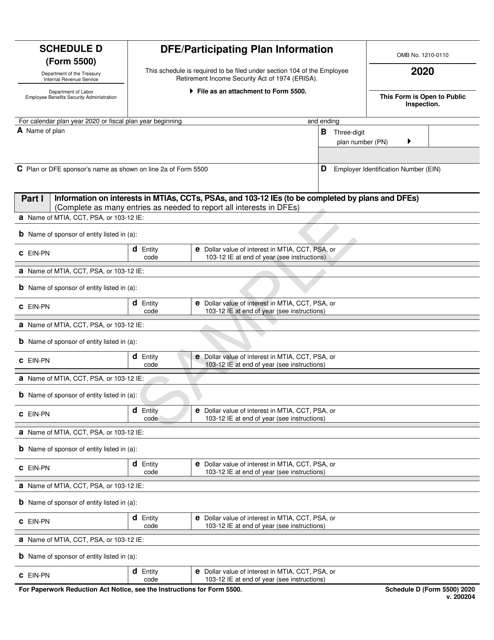

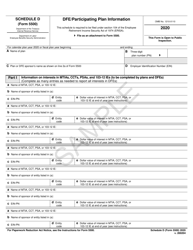

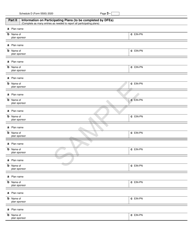

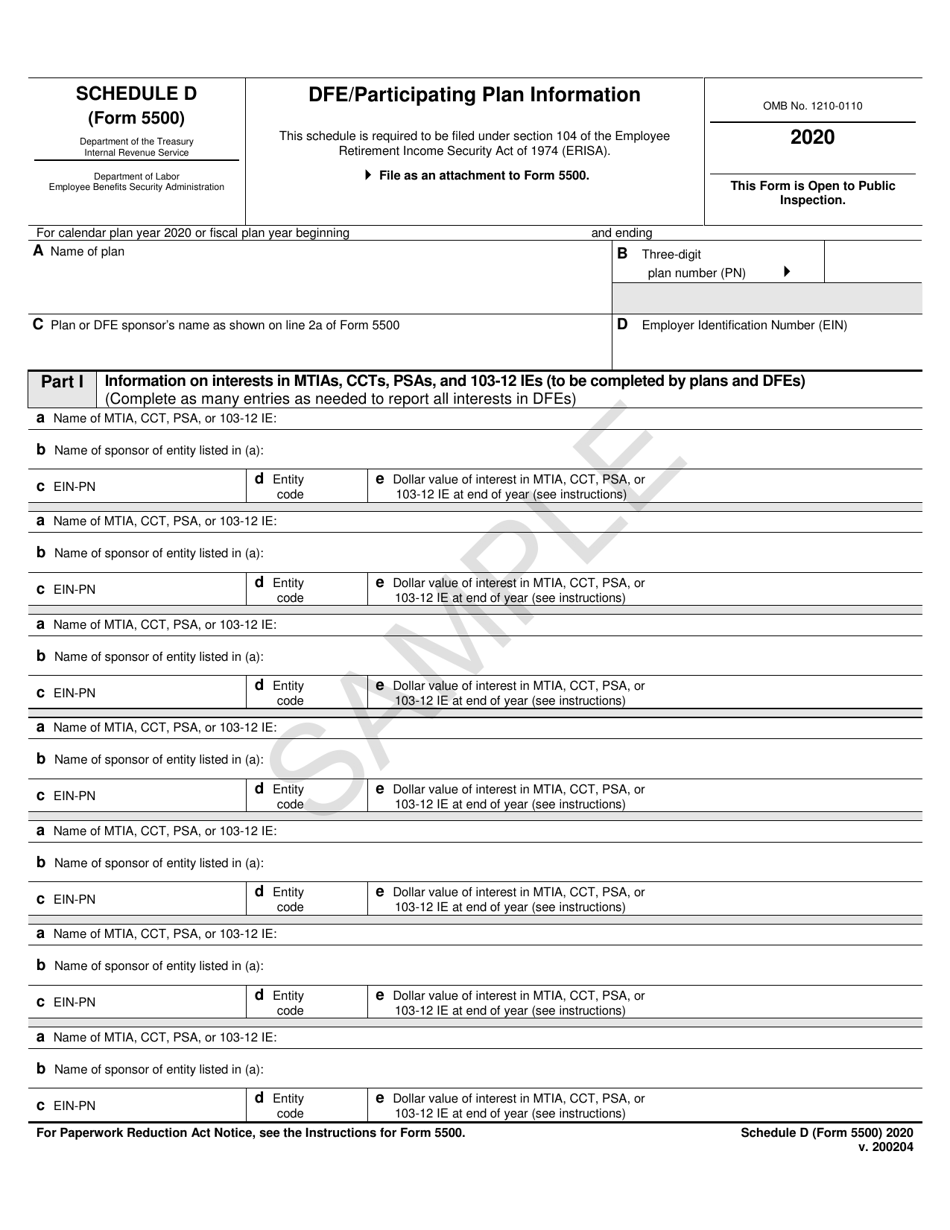

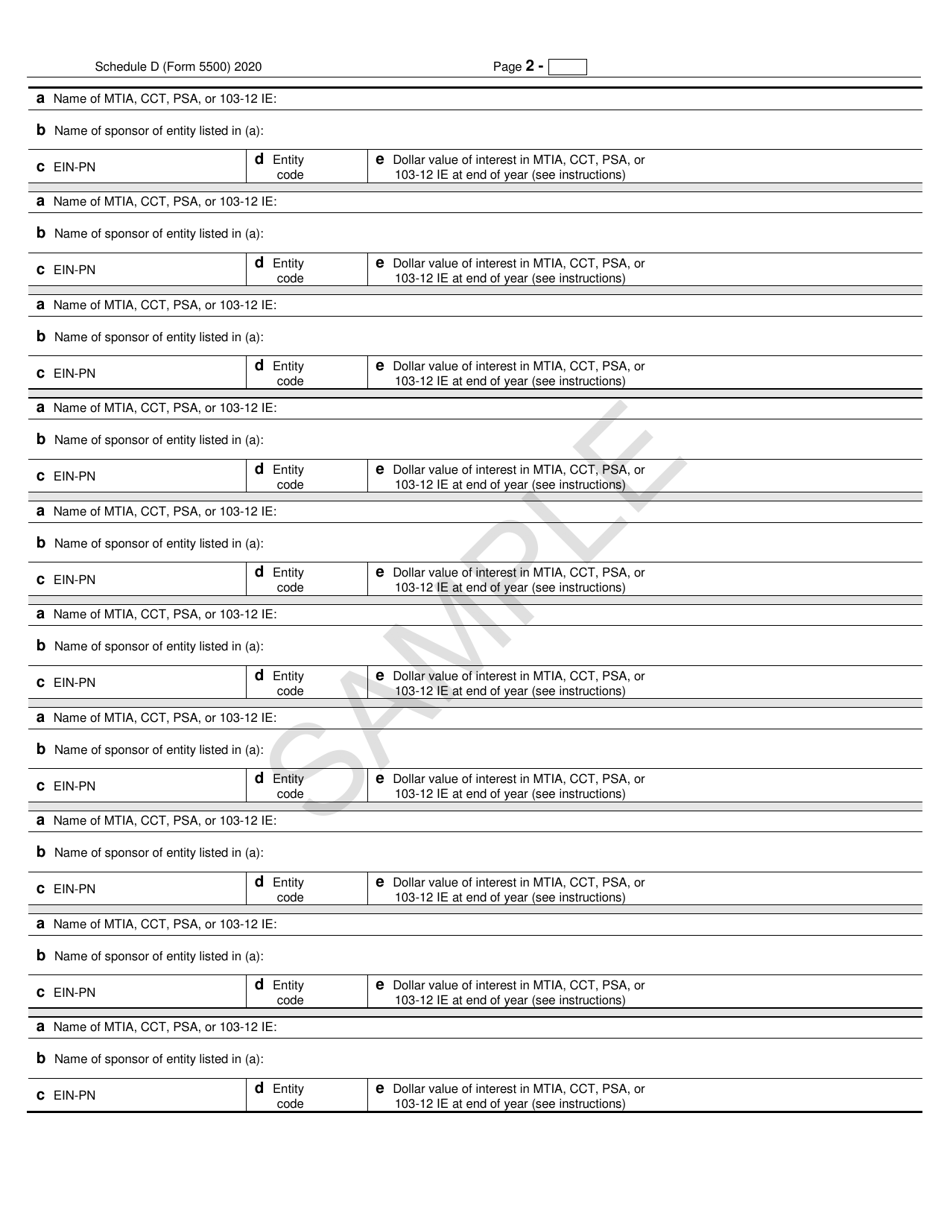

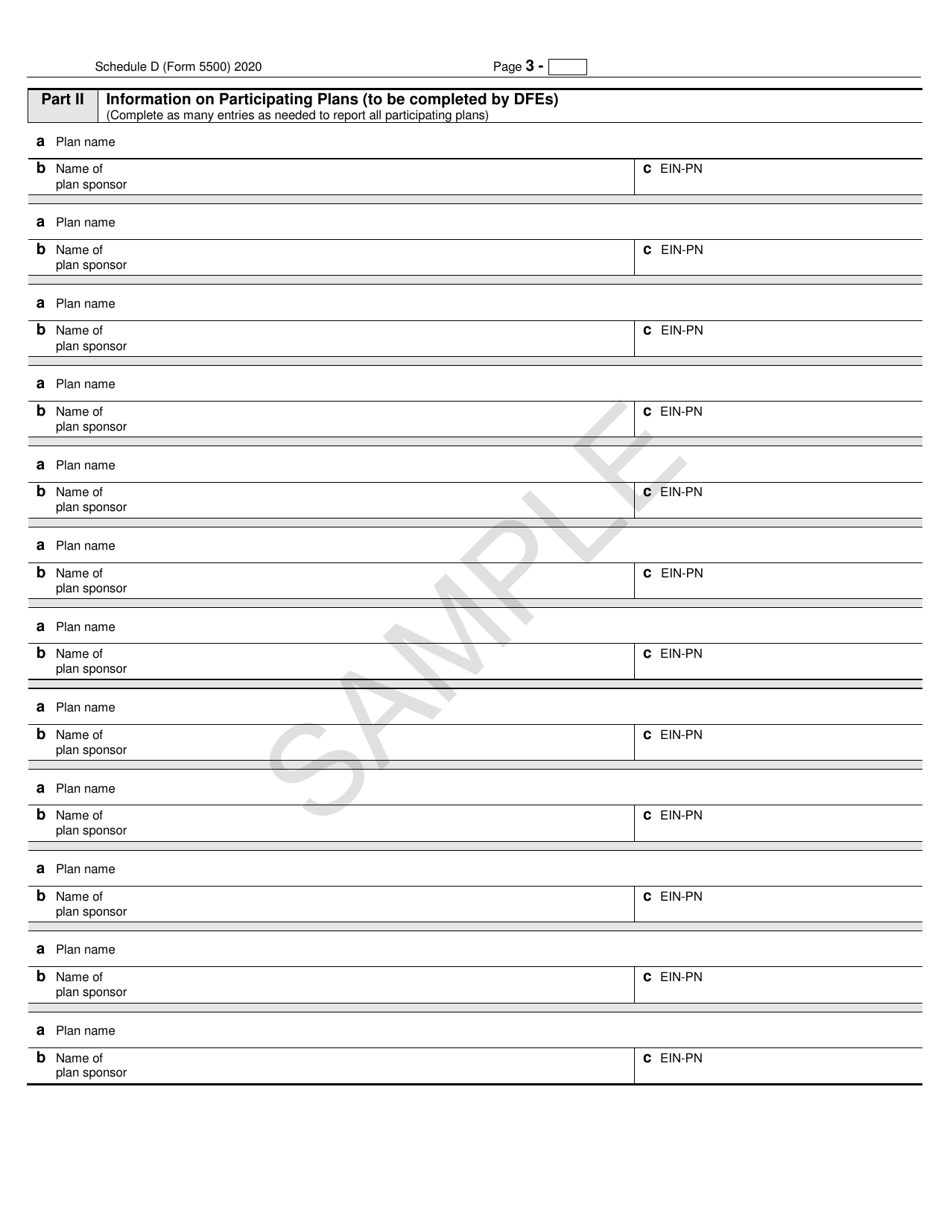

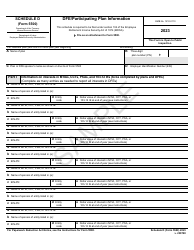

Form 5500 Schedule D

for the current year.

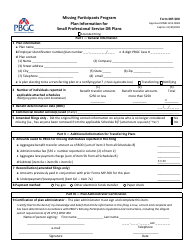

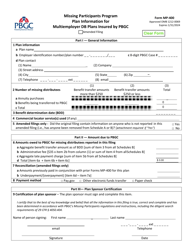

Form 5500 Schedule D Dfe / Participating Plan Information - Sample

What Is Form 5500 Schedule D?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule D?

A: Form 5500 Schedule D is a document that provides information about the DFE (Direct Filing Entity) and participating plans.

Q: What is DFE?

A: DFE stands for Direct Filing Entity, which is an organization that files the Form 5500 on behalf of multiple employee benefit plans.

Q: What is a participating plan?

A: A participating plan refers to an employee benefit plan that is covered by the Form 5500 filing of the DFE.

Q: What information does Form 5500 Schedule D include?

A: Form 5500 Schedule D includes information about the DFE and participating plans, such as their names, addresses, and employer identification numbers (EINs).

Q: Why is Form 5500 Schedule D important?

A: Form 5500 Schedule D is important because it provides transparency and accountability regarding the DFE and participating plans, ensuring compliance with federal reporting requirements.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule D by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.