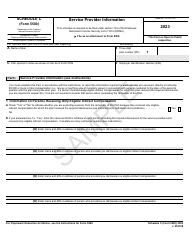

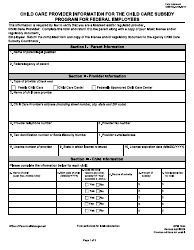

This version of the form is not currently in use and is provided for reference only. Download this version of

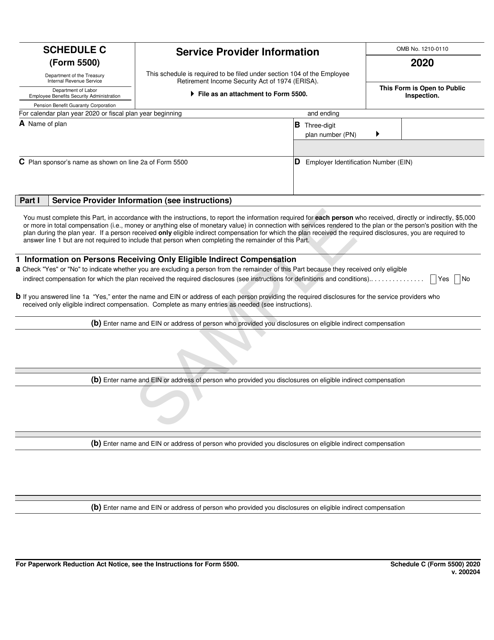

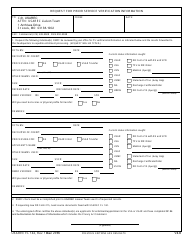

Form 5500 Schedule C

for the current year.

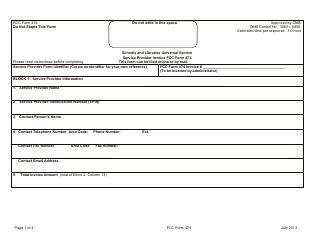

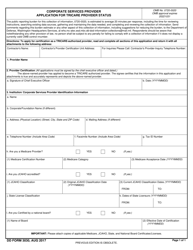

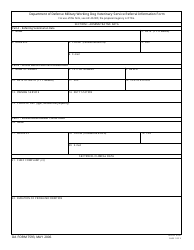

Form 5500 Schedule C Service Provider Information - Sample

What Is Form 5500 Schedule C?

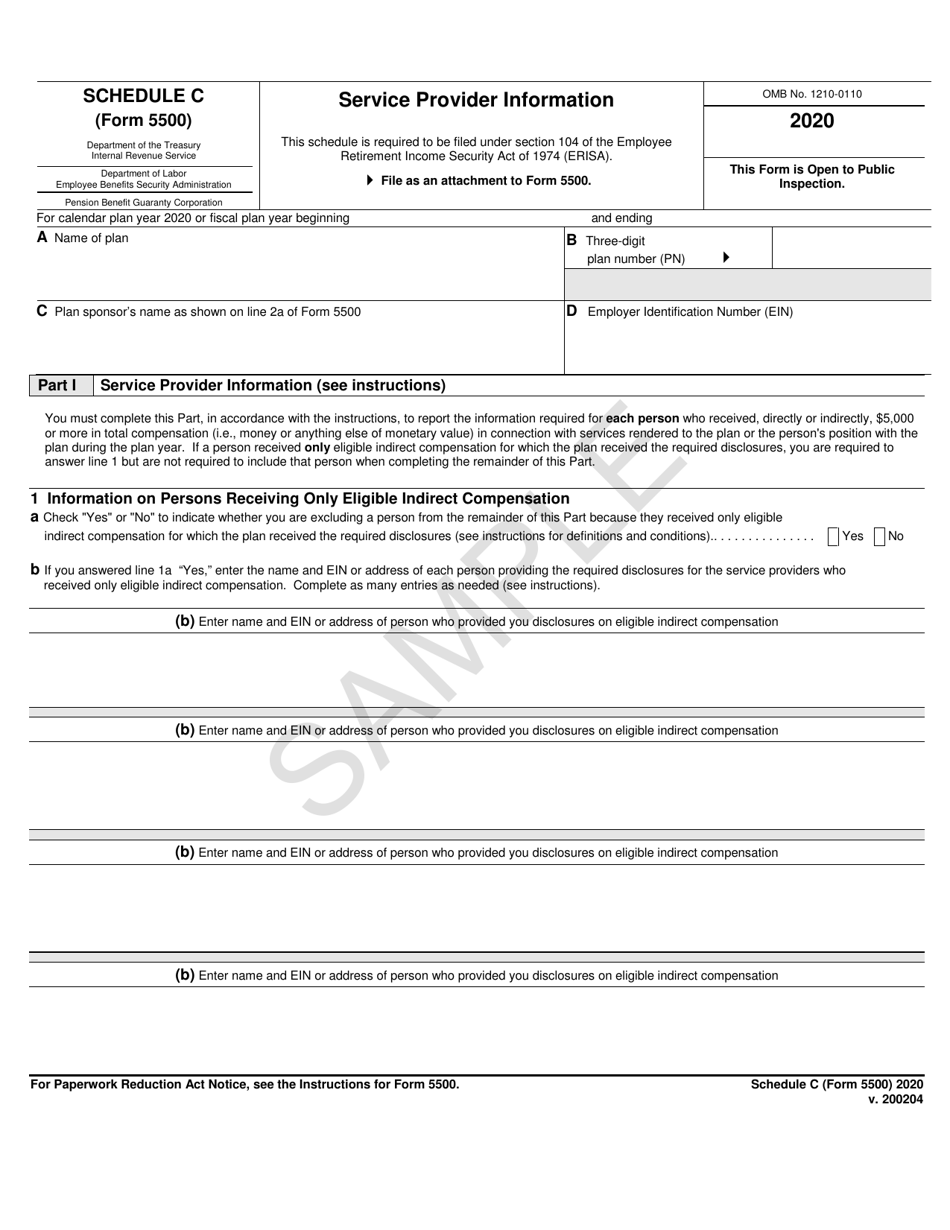

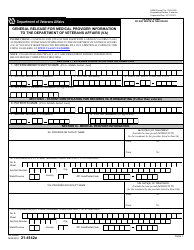

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule C?

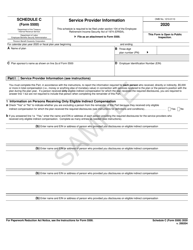

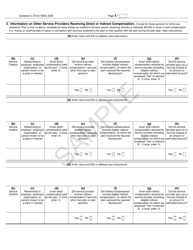

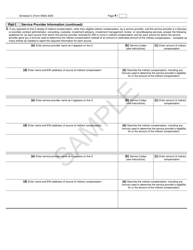

A: Form 5500 Schedule C is a document used to report information about service providers who received compensation from a retirement plan.

Q: What is the purpose of Form 5500 Schedule C?

A: The purpose of Form 5500 Schedule C is to provide transparency regarding the fees and other compensation paid to service providers of retirement plans.

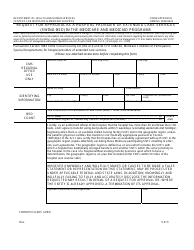

Q: Who is required to file Form 5500 Schedule C?

A: Employers who sponsor retirement plans are generally required to file Form 5500 Schedule C if they have paid compensation of $5,000 or more to a service provider.

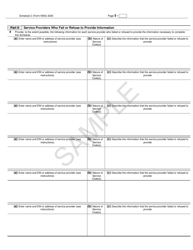

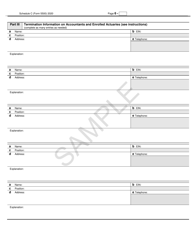

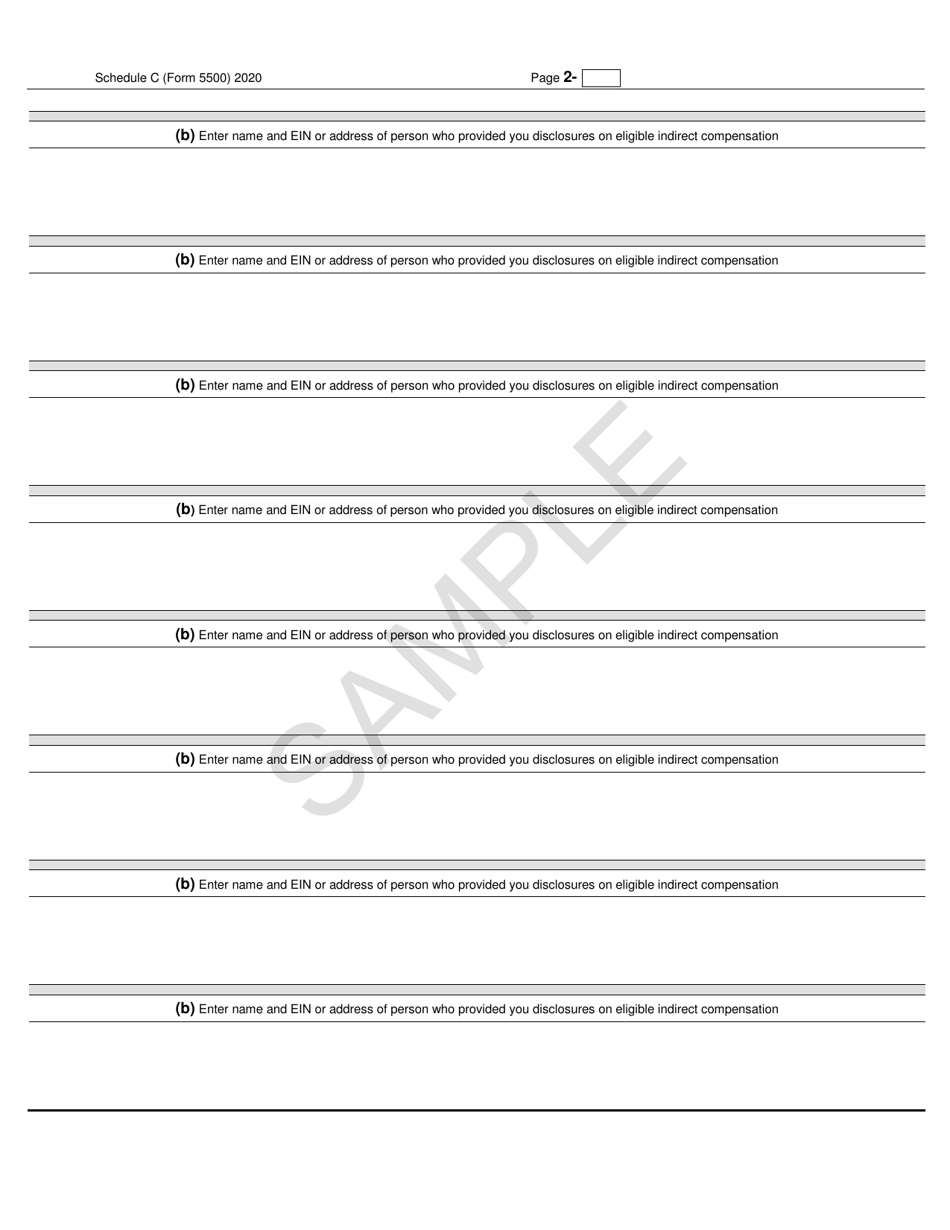

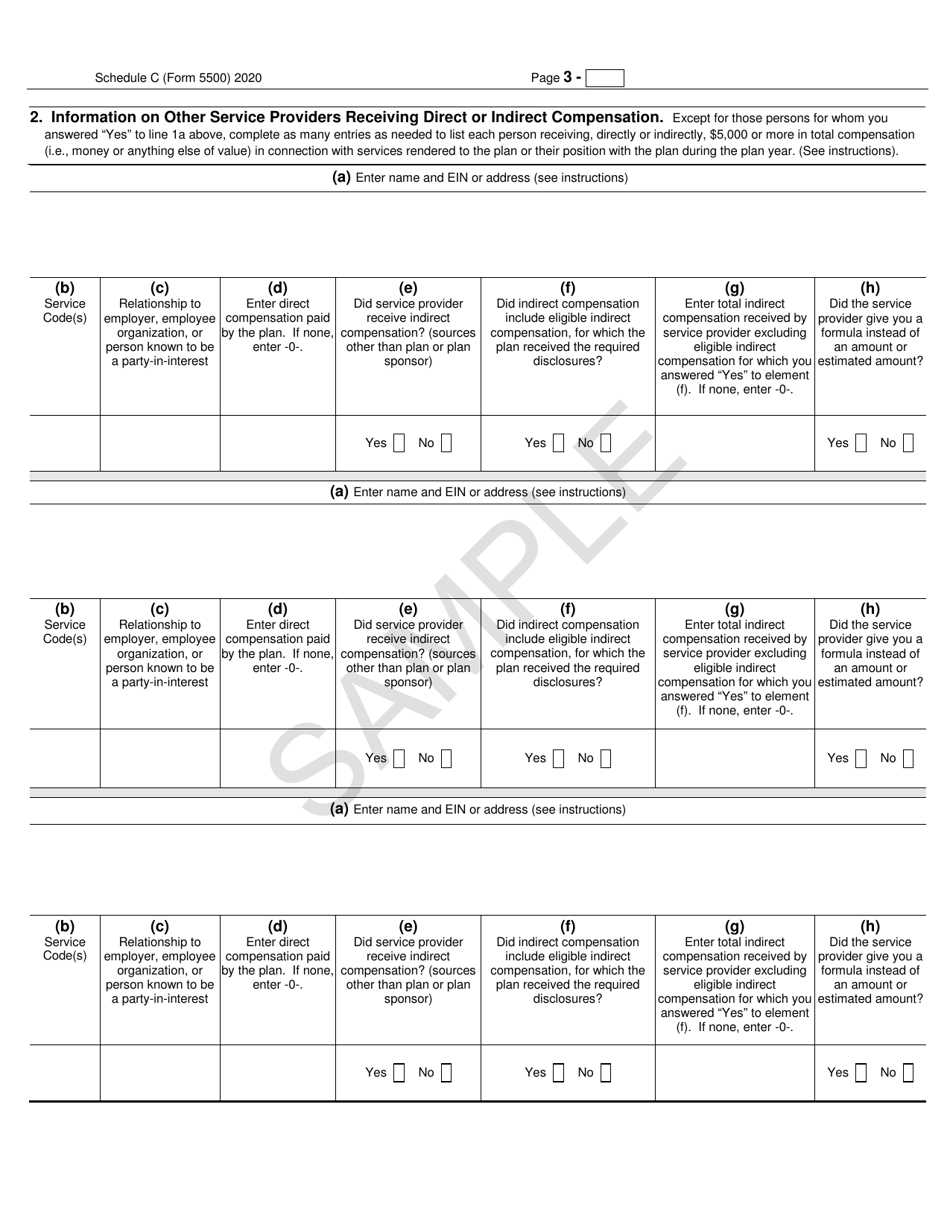

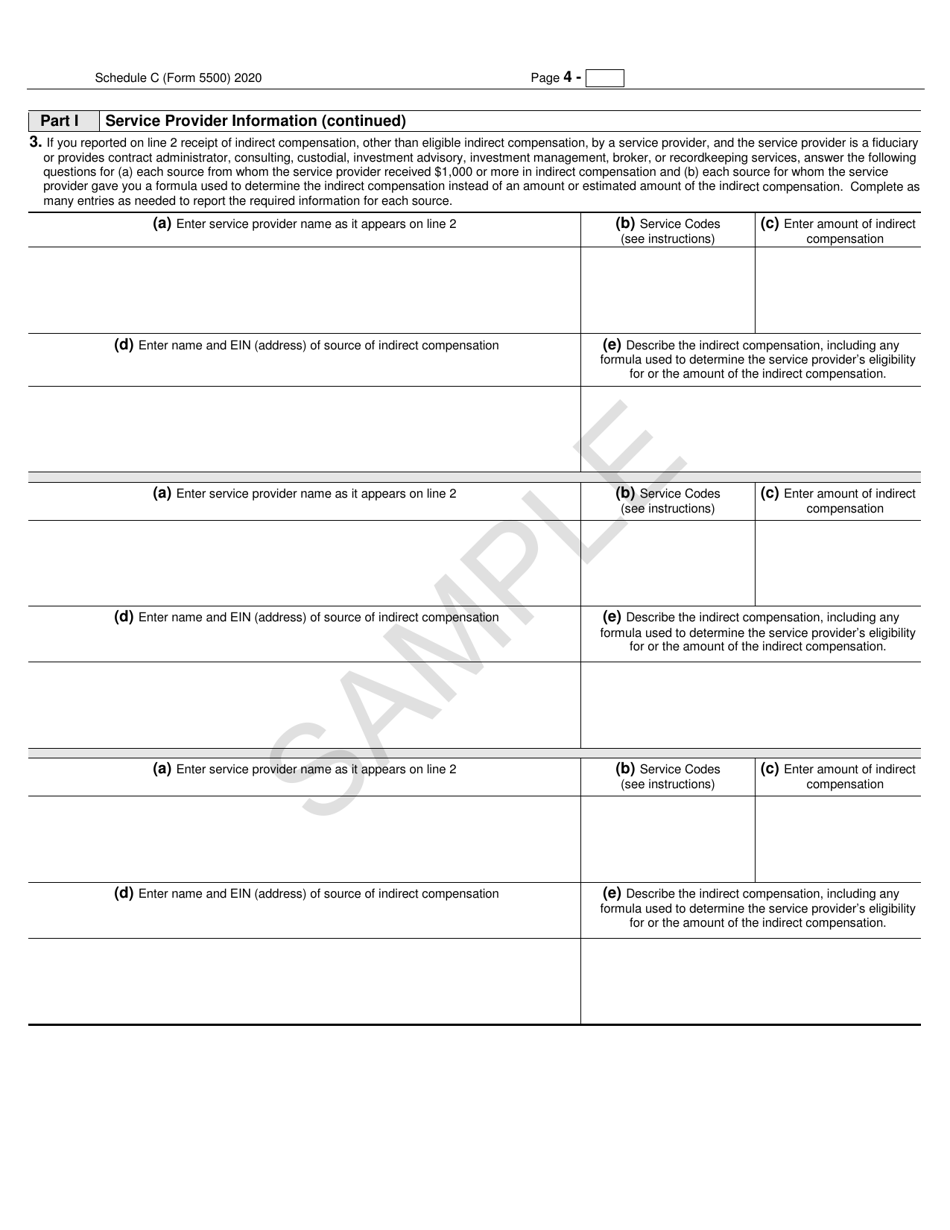

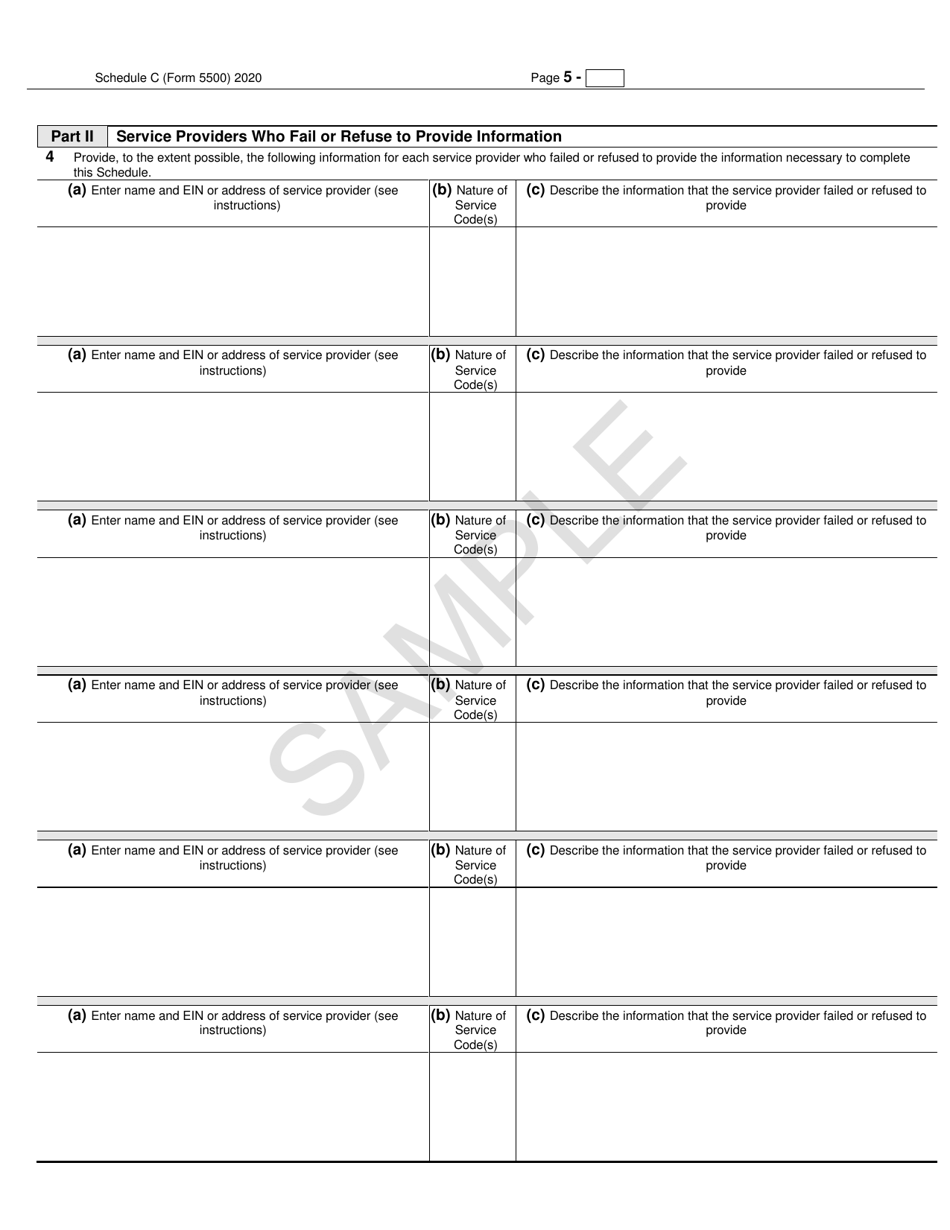

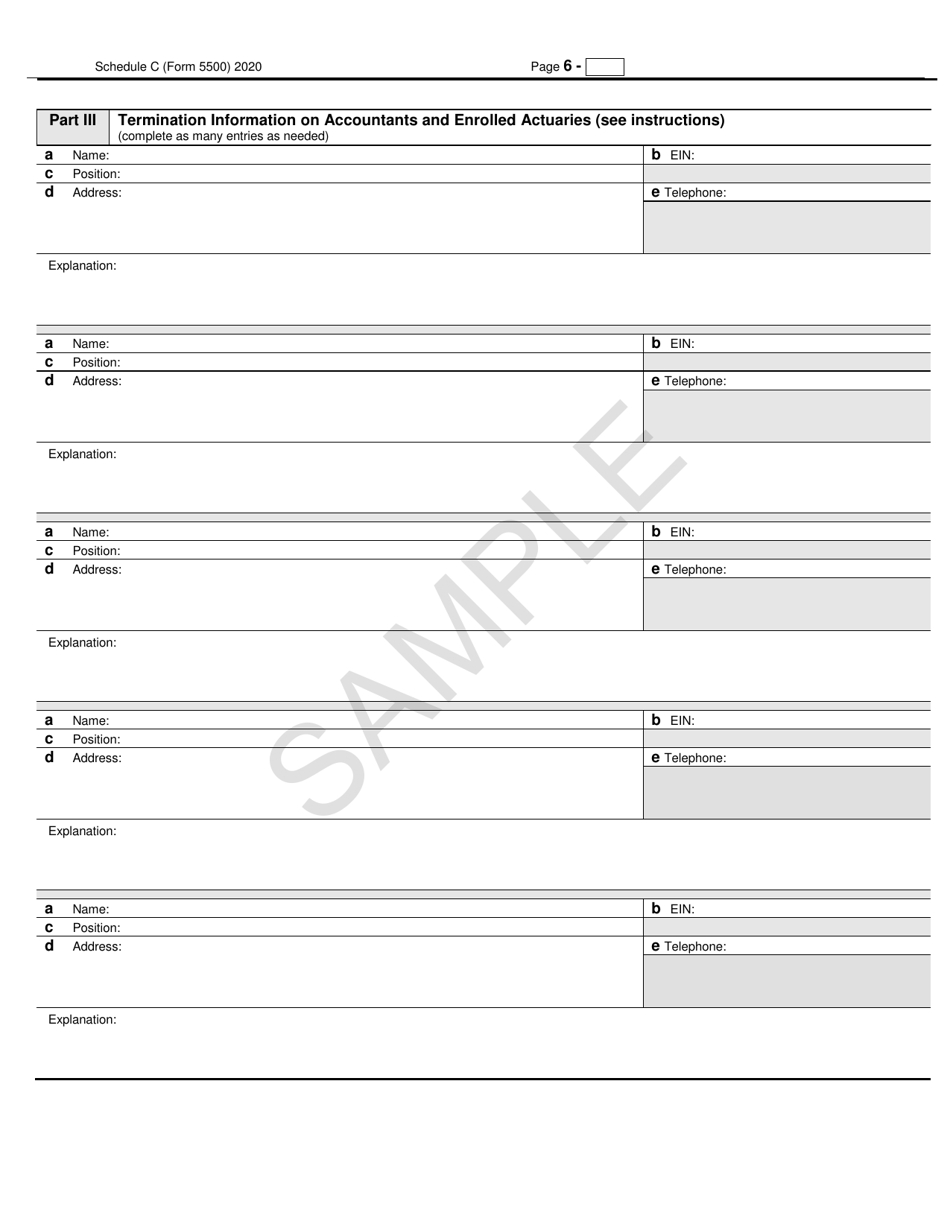

Q: What information is included in Form 5500 Schedule C?

A: Form 5500 Schedule C includes information about the service provider, the type of services provided, and the amount of compensation received.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule C by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.