This version of the form is not currently in use and is provided for reference only. Download this version of

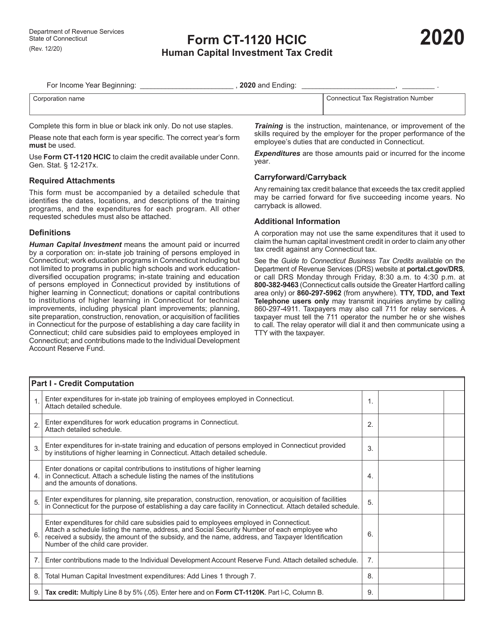

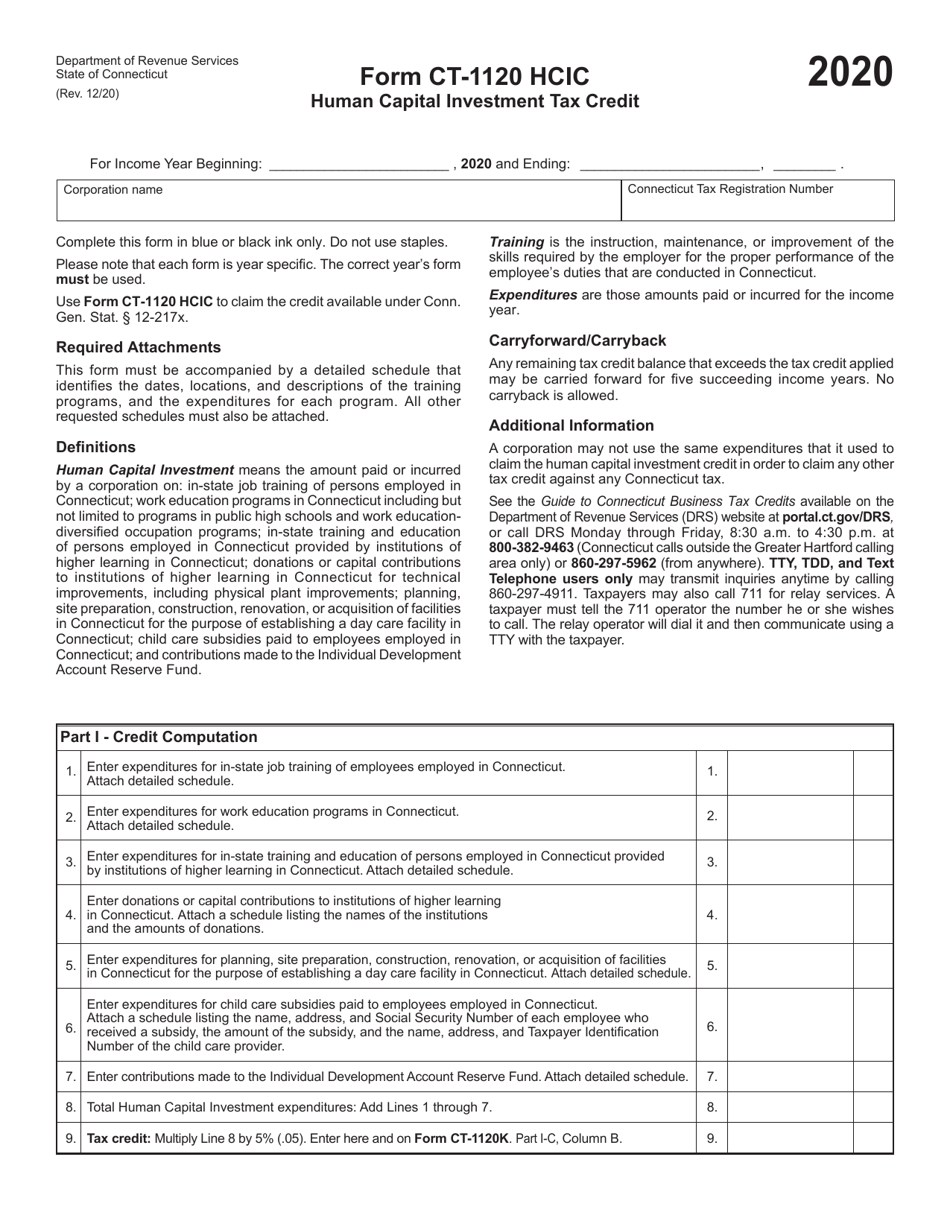

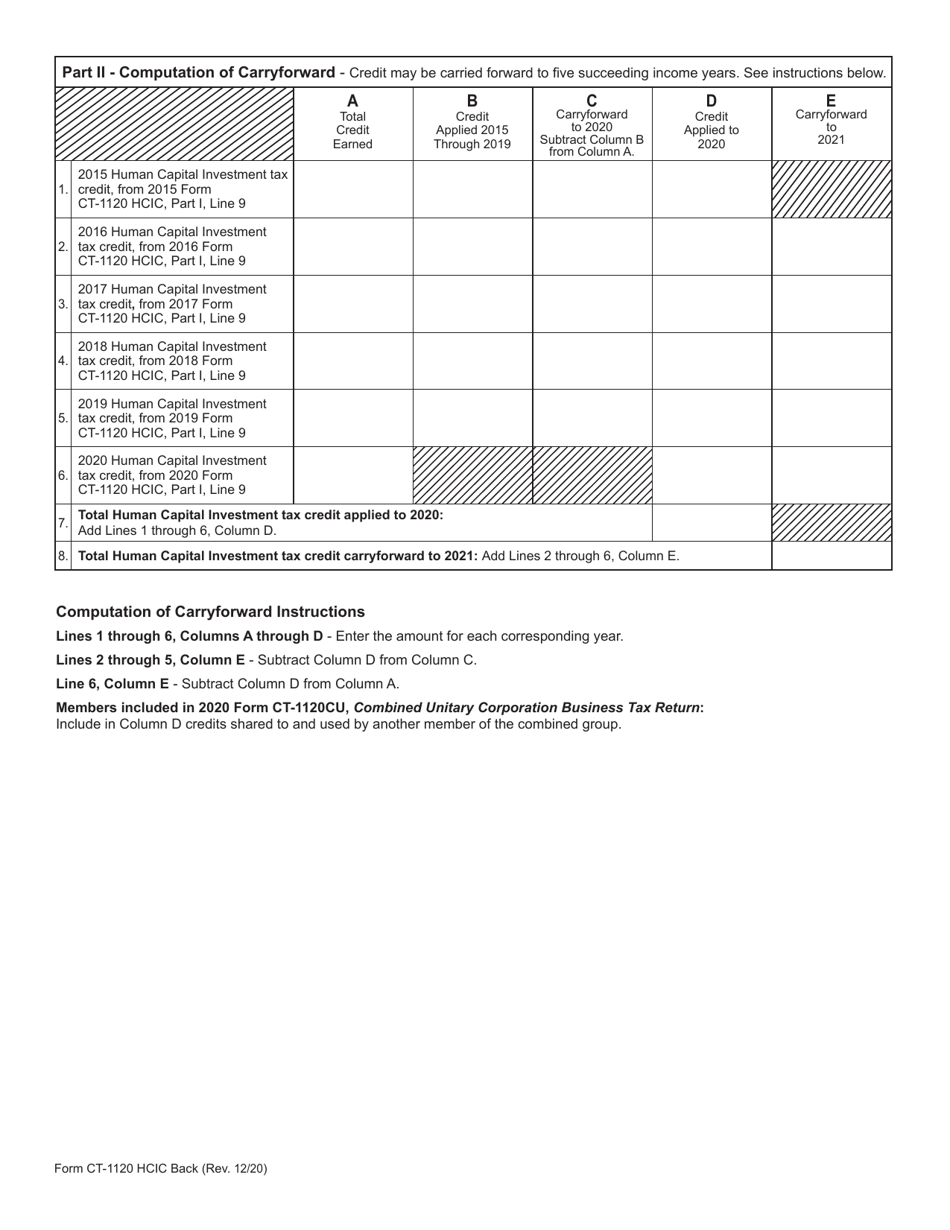

Form CT-1120 HCIC

for the current year.

Form CT-1120 HCIC Human Capital Investment Tax Credit - Connecticut

What Is Form CT-1120 HCIC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 HCIC?

A: Form CT-1120 HCIC is a tax form used in Connecticut to claim the Human Capital Investment Tax Credit.

Q: What is the Human Capital Investment Tax Credit?

A: The Human Capital Investment Tax Credit is a tax credit in Connecticut that encourages businesses to invest in workforce development and education.

Q: Who can claim the Human Capital Investment Tax Credit?

A: Businesses in Connecticut that make qualified investments in employee training and education can claim the Human Capital Investment Tax Credit.

Q: What are qualified investments for the Human Capital Investment Tax Credit?

A: Qualified investments include expenses for employee training, education, or certain apprenticeship programs that improve the skills of the workforce.

Q: How much is the Human Capital Investment Tax Credit?

A: The tax credit is equal to 20% of the qualified investments, up to a maximum of $200,000 per calendar year.

Q: How do I claim the Human Capital Investment Tax Credit?

A: To claim the tax credit, businesses must complete Form CT-1120 HCIC and attach it to their Connecticut state tax return.

Q: Is there a deadline to claim the Human Capital Investment Tax Credit?

A: Yes, the tax credit must be claimed on the business's annual tax return, which is due by the 15th day of the fourth month following the close of the tax year.

Q: Are there any restrictions or limitations for the Human Capital Investment Tax Credit?

A: Yes, there are certain restrictions and limitations for the tax credit, such as a limitation on the amount of credit that can be claimed for any single employee.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 HCIC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.