This version of the form is not currently in use and is provided for reference only. Download this version of

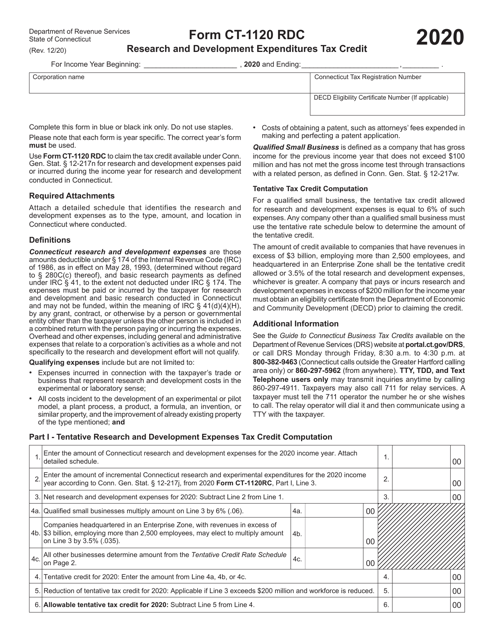

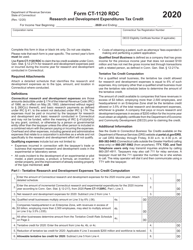

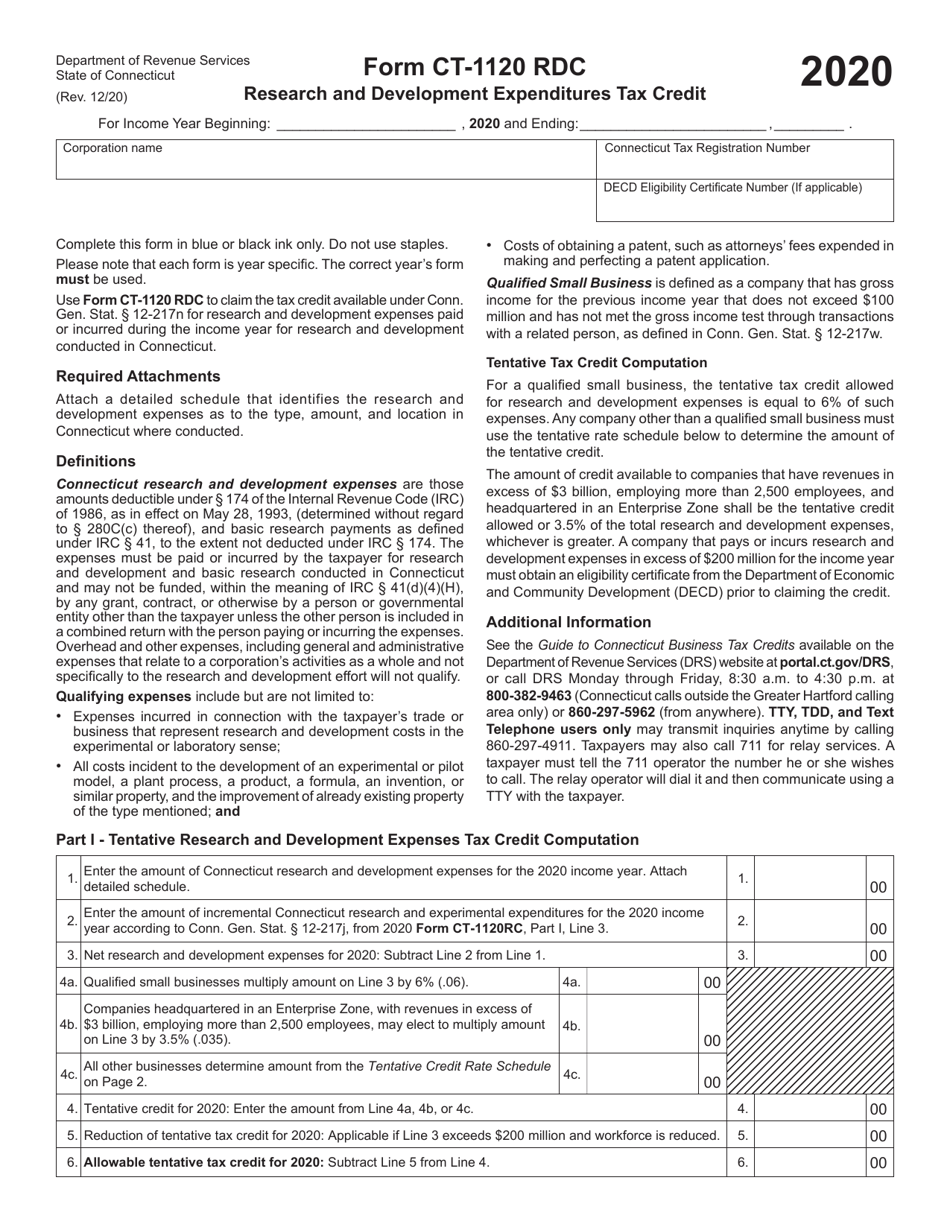

Form CT-1120 RDC

for the current year.

Form CT-1120 RDC Research and Development Expenditures Tax Credit - Connecticut

What Is Form CT-1120 RDC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 RDC?

A: Form CT-1120 RDC is a tax form used in Connecticut to claim the Research and Development Expenditures Tax Credit.

Q: What is the RDC Research and Development Expenditures Tax Credit?

A: The RDC Research and Development Expenditures Tax Credit is a credit offered by Connecticut for businesses that incur qualified research and development expenses.

Q: Who is eligible to claim the RDC tax credit?

A: Businesses that incur qualified research and development expenses in Connecticut are eligible to claim the RDC tax credit.

Q: What expenses qualify for the RDC tax credit?

A: Qualified research and development expenses include wages, supplies, and certain overhead costs directly related to research and development activities.

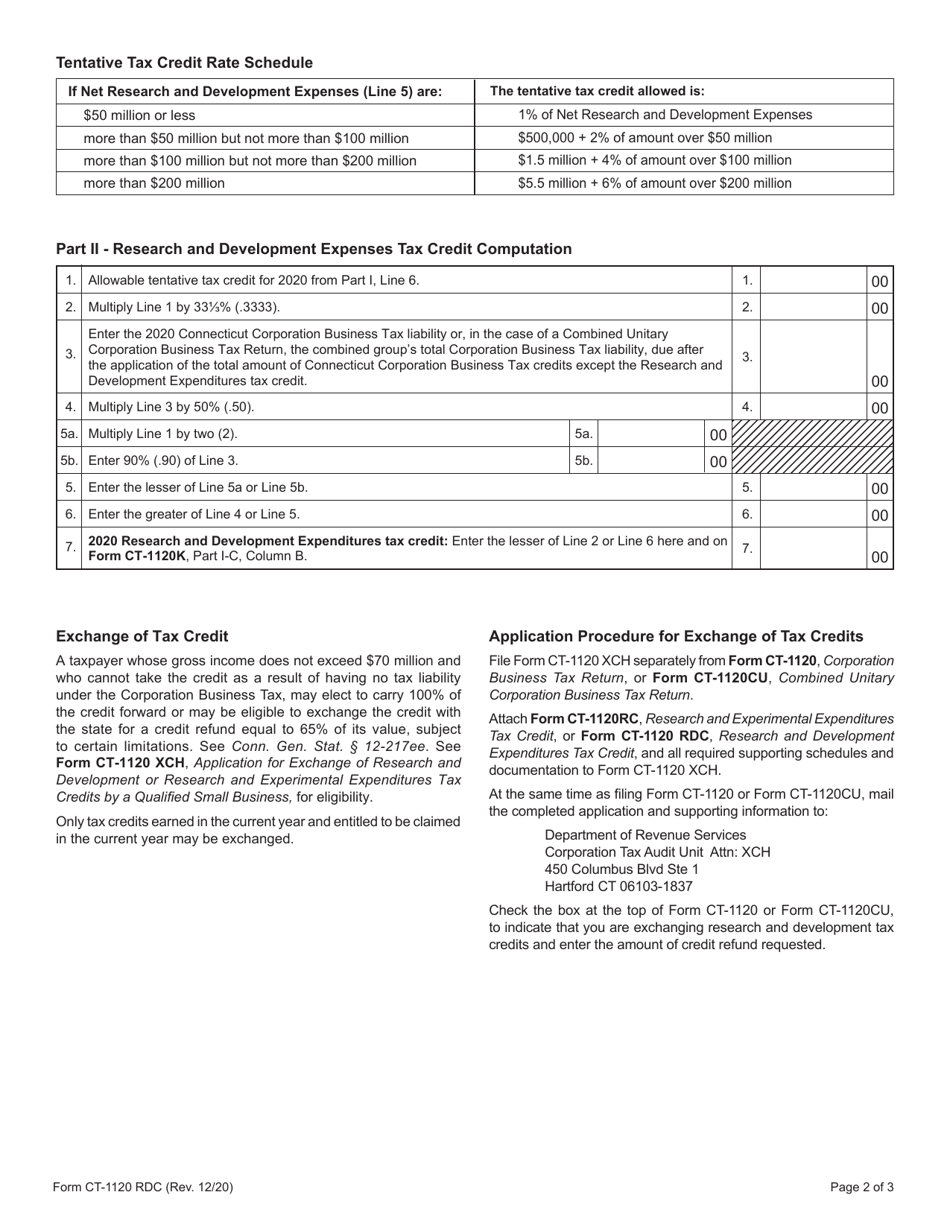

Q: How is the RDC tax credit calculated?

A: The RDC tax credit is calculated as a percentage of qualified research and development expenses.

Q: How can I claim the RDC tax credit?

A: To claim the RDC tax credit, businesses must complete and file Form CT-1120 RDC with their Connecticut tax return.

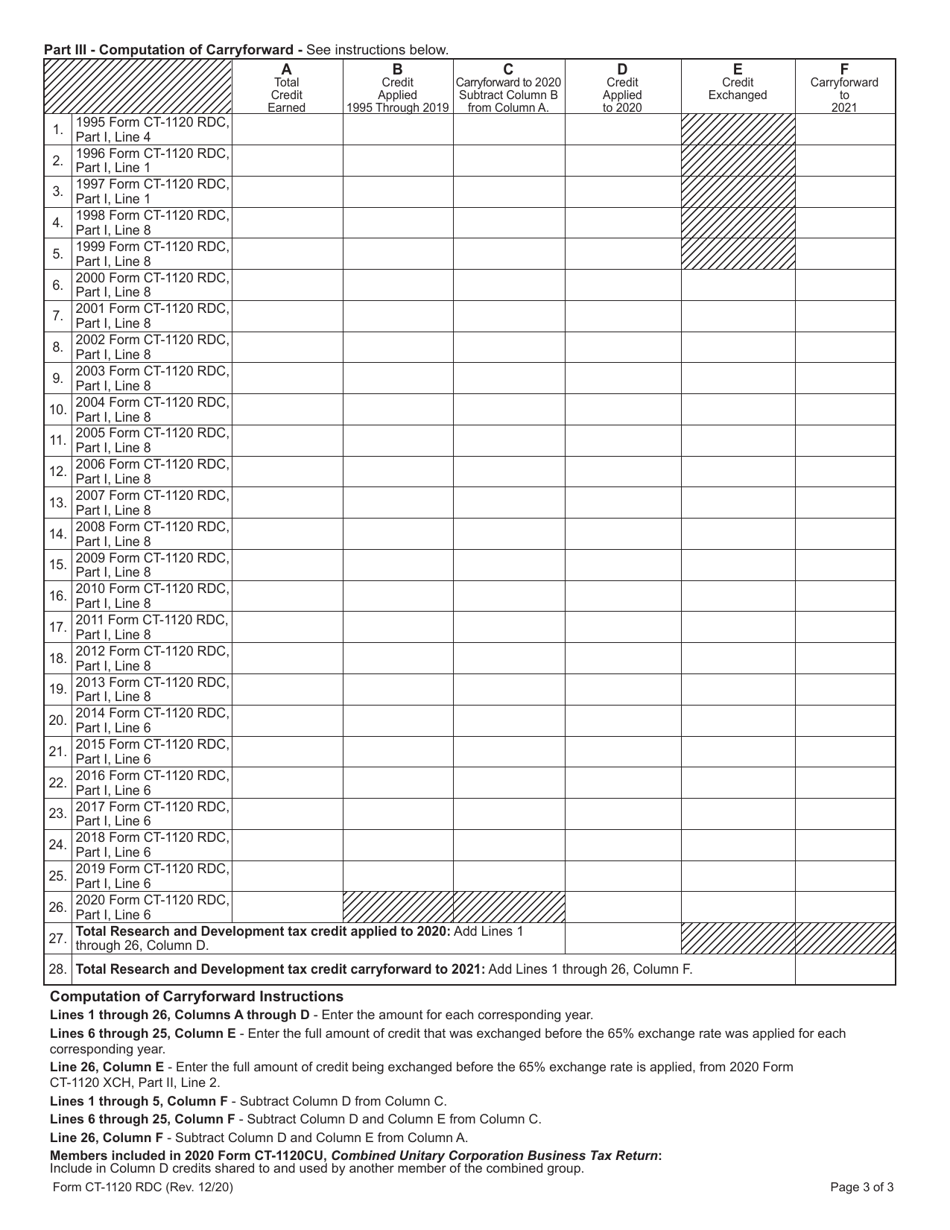

Q: Are there any limitations or restrictions on the RDC tax credit?

A: Yes, there are certain limitations and restrictions on the RDC tax credit, including a maximum credit amount and carryforward provisions.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 RDC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.