This version of the form is not currently in use and is provided for reference only. Download this version of

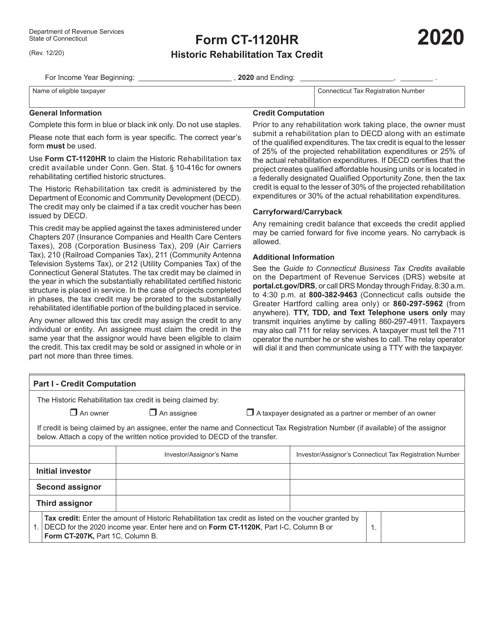

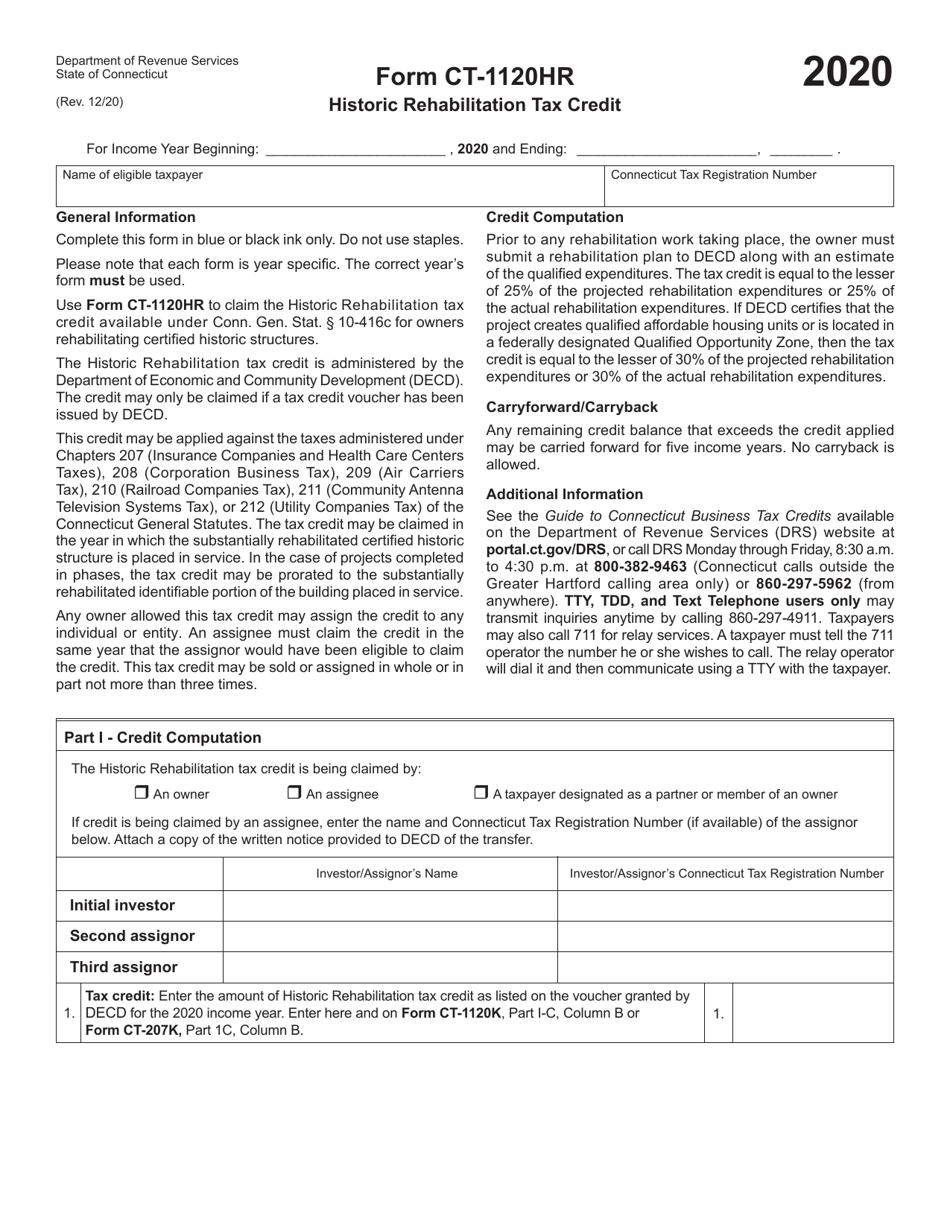

Form CT-1120HR

for the current year.

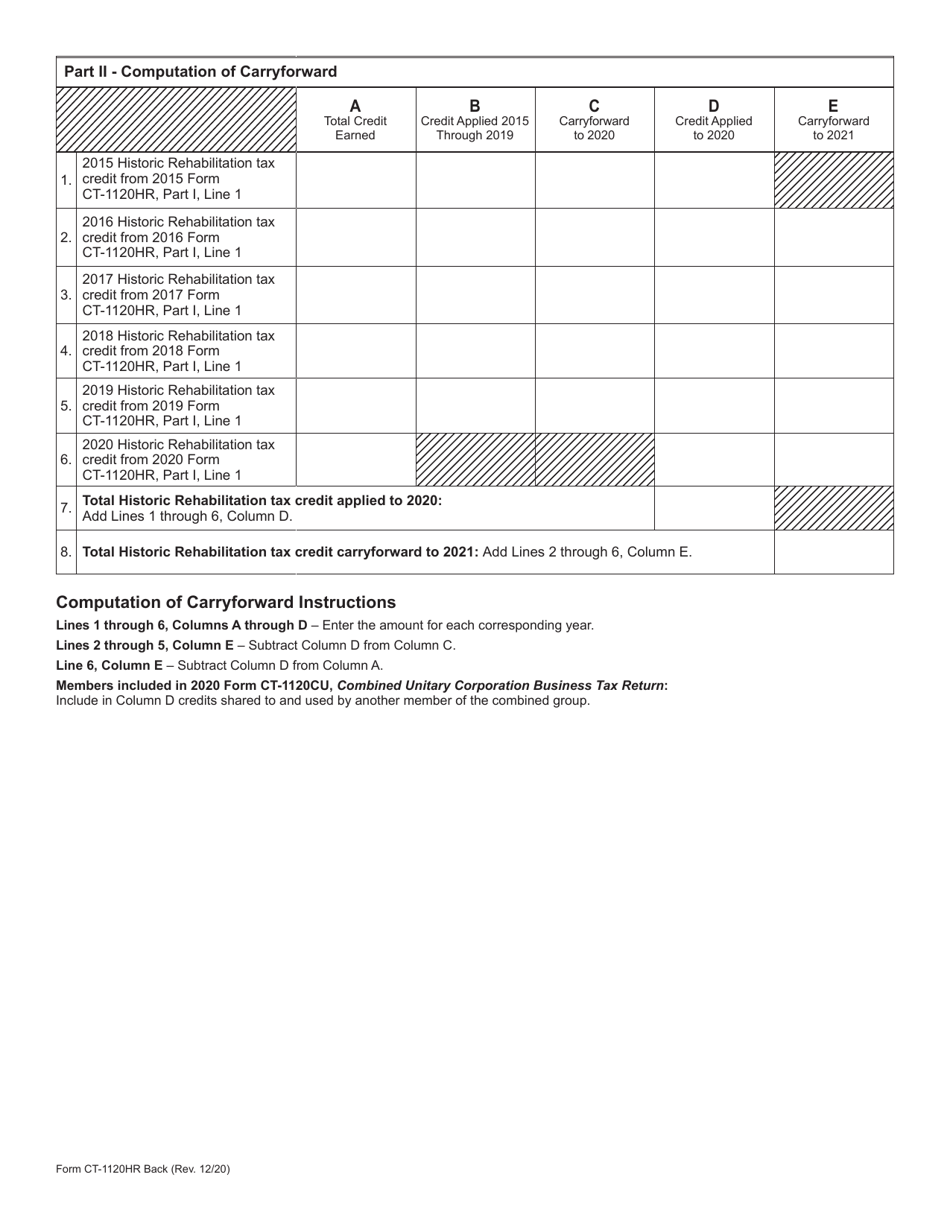

Form CT-1120HR Historic Rehabilitation Tax Credit - Connecticut

What Is Form CT-1120HR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HR?

A: Form CT-1120HR is a tax form used in Connecticut to claim the Historic Rehabilitation Tax Credit.

Q: What is the Historic Rehabilitation Tax Credit?

A: The Historic Rehabilitation Tax Credit is a tax incentive program that encourages the rehabilitation of historic properties by providing a tax credit.

Q: Who is eligible to claim the Historic Rehabilitation Tax Credit in Connecticut?

A: Property owners or developers who have rehabilitated a certified historic structure in Connecticut may be eligible to claim the tax credit.

Q: How do I fill out Form CT-1120HR?

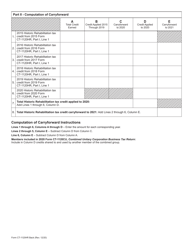

A: You need to provide information about the historic rehabilitation project, including the property information, project costs, and the amount of the tax credit being claimed.

Q: What is the deadline for filing Form CT-1120HR?

A: Form CT-1120HR must be filed by April 15th of the year following the year in which the rehabilitation project was completed.

Q: What documents do I need to attach to Form CT-1120HR?

A: You will need to attach supporting documents such as architectural plans, photographs, and receipts for project expenses.

Q: Is the Historic Rehabilitation Tax Credit refundable?

A: Yes, the Historic Rehabilitation Tax Credit is refundable, meaning that if the credit exceeds your tax liability, you may receive a refund for the remaining amount.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.