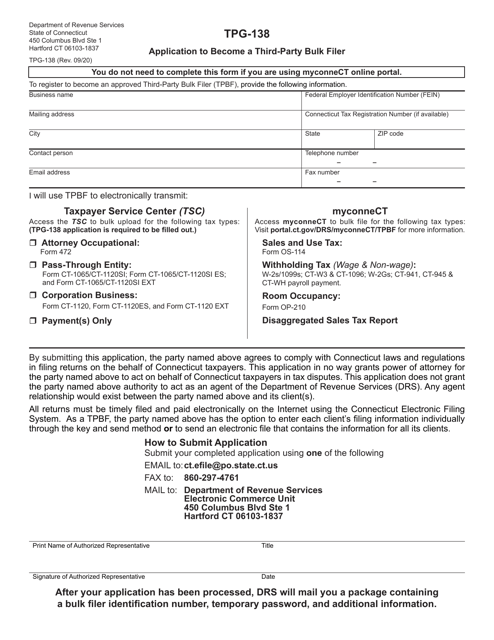

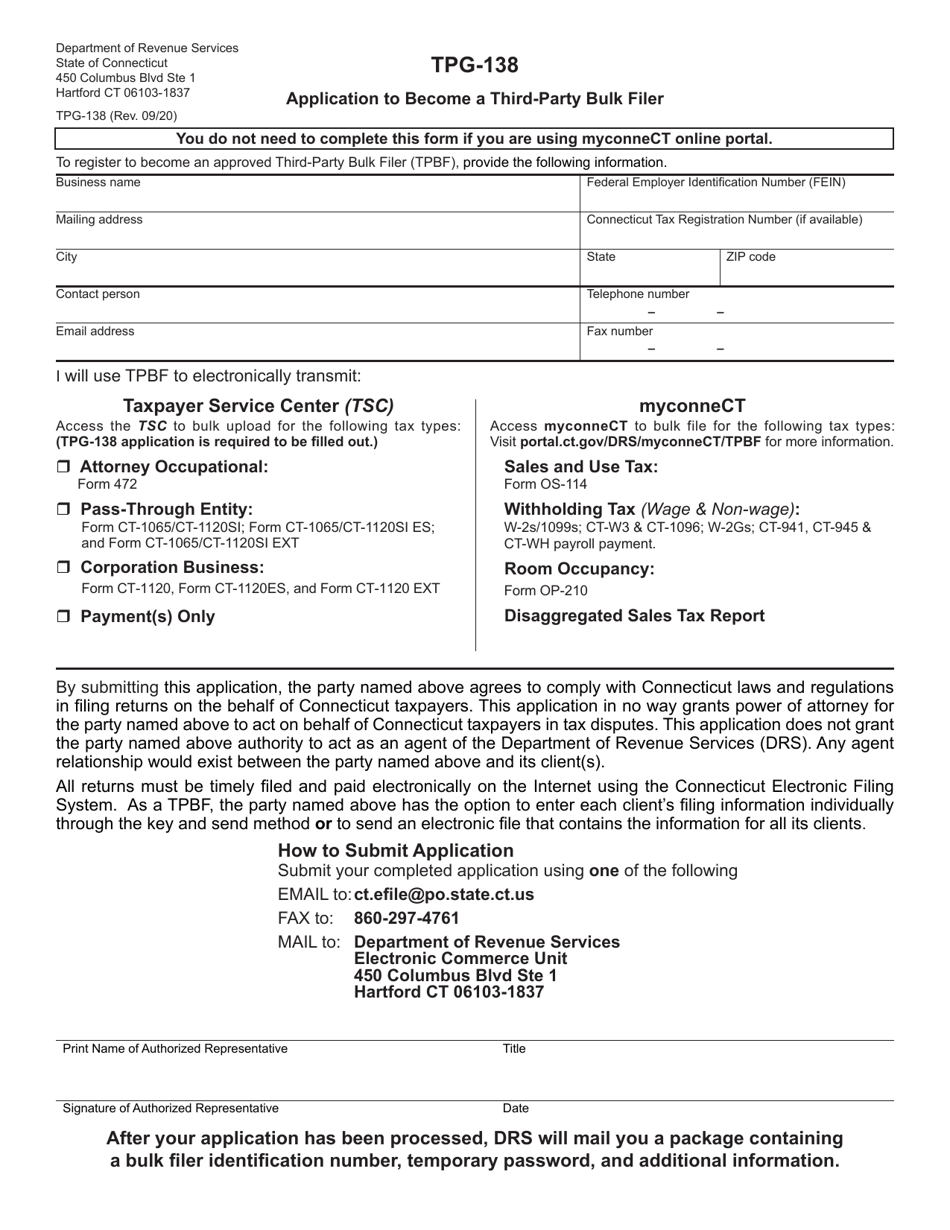

Form TPG-138 Application to Become a Third-Party Bulk Filer - Connecticut

What Is Form TPG-138?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TPG-138?

A: Form TPG-138 is an application to become a Third-Party Bulk Filer in Connecticut.

Q: What is a Third-Party Bulk Filer?

A: A Third-Party Bulk Filer is an entity that files tax returns on behalf of multiple taxpayers.

Q: Why would someone want to become a Third-Party Bulk Filer?

A: Becoming a Third-Party Bulk Filer allows an entity to file tax returns on behalf of multiple taxpayers, simplifying the process for those taxpayers.

Q: How can I apply to become a Third-Party Bulk Filer in Connecticut?

A: You can apply by completing Form TPG-138 and submitting it to the appropriate Connecticut tax authority.

Q: Are there any requirements to become a Third-Party Bulk Filer?

A: Yes, there may be specific requirements that need to be met, such as demonstrating knowledge of tax laws and having appropriate systems in place for filing.

Q: Is there a fee to apply for Third-Party Bulk Filer status?

A: There may be a fee associated with the application process. You should check with the Connecticut tax authority for the current fee amount.

Q: Can individuals apply to become Third-Party Bulk Filers?

A: Typically, Third-Party Bulk Filer status is granted to entities rather than individuals.

Q: Is there a deadline for submitting the application?

A: The Connecticut tax authority may have specific deadlines for submitting the application. You should check with them to ensure timely submission.

Q: What should I do if I have further questions about the application process?

A: If you have additional questions, you should reach out to the appropriate Connecticut tax authority for clarification.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TPG-138 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.