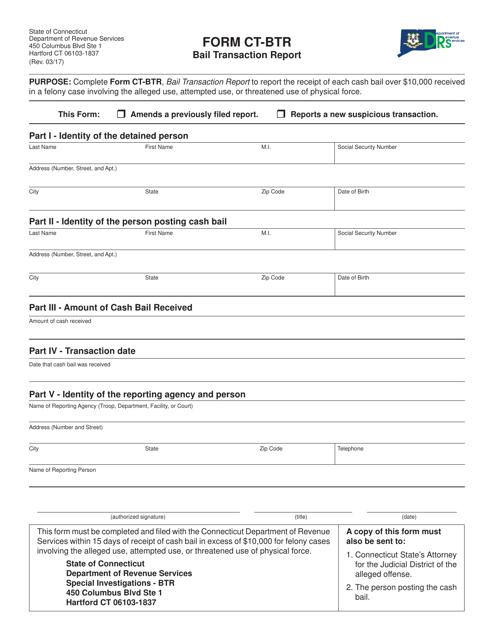

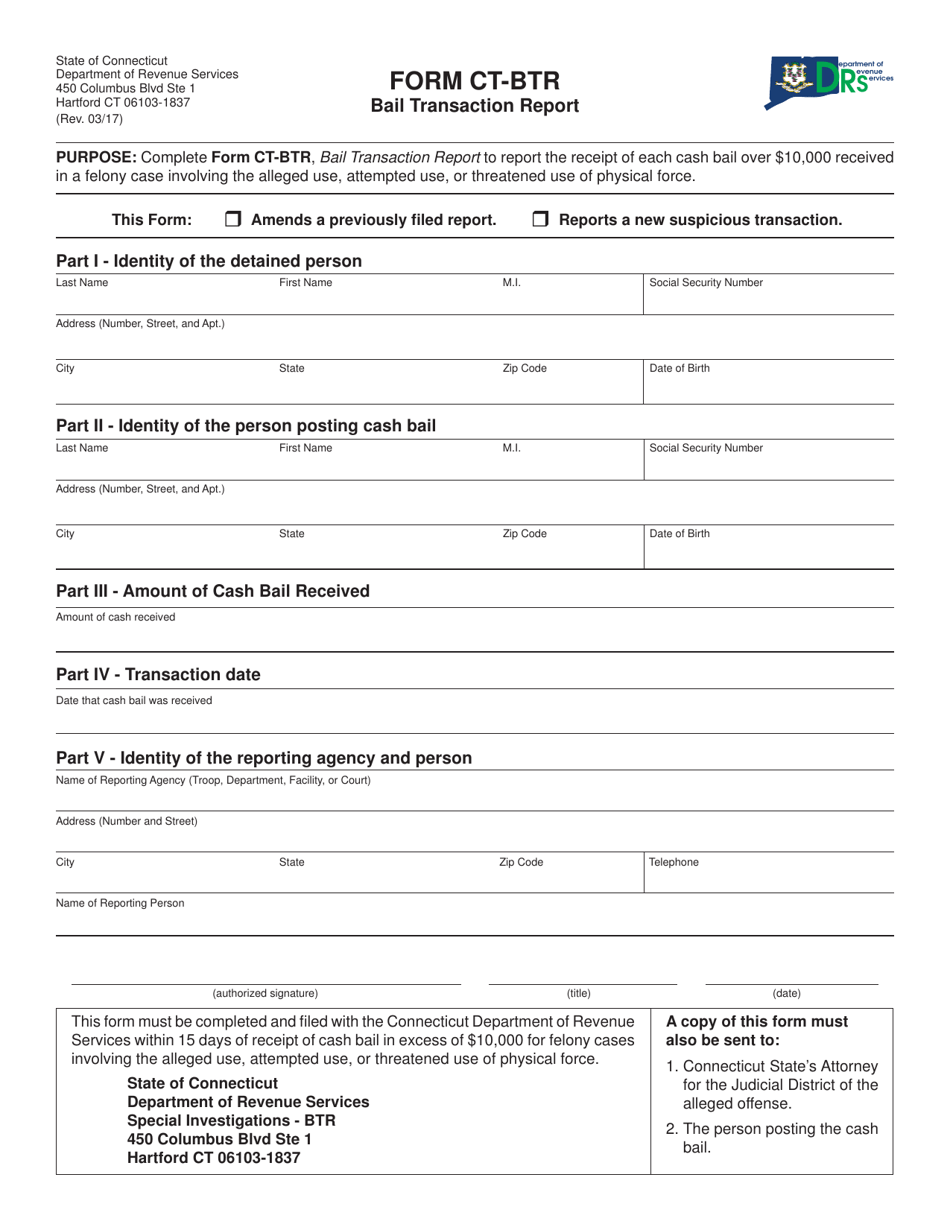

Form CT-BTR Bail Transaction Report - Connecticut

What Is Form CT-BTR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT-BTR?

A: CT-BTR stands for Form CT-BTR Bail Transaction Report.

Q: What is the purpose of CT-BTR?

A: The purpose of CT-BTR is to report bail transactions in Connecticut.

Q: Who uses CT-BTR?

A: Bail bond agents and bondsmen use CT-BTR to report bail transactions.

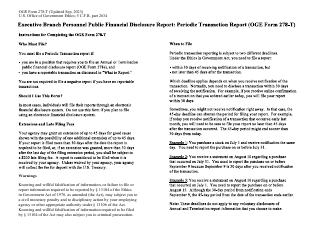

Q: How do I fill out CT-BTR?

A: You need to provide details about the bail transaction, including the defendant's information and the amount of bail.

Q: Are there any filing fees for CT-BTR?

A: No, there are no filing fees for CT-BTR.

Q: What happens after I submit CT-BTR?

A: Once you submit CT-BTR, it will be reviewed by the Connecticut Department of Banking.

Q: Are there any penalties for not filing CT-BTR?

A: Yes, there are penalties for not filing CT-BTR, including fines and potential suspension of your license.

Q: Can I submit a paper copy of CT-BTR?

A: No, CT-BTR must be filed electronically.

Q: What other documents may be required along with CT-BTR?

A: Additional documents, such as Power of Attorney and Surety Company Authorization Form, may be required depending on the bail transaction.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-BTR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.