This version of the form is not currently in use and is provided for reference only. Download this version of

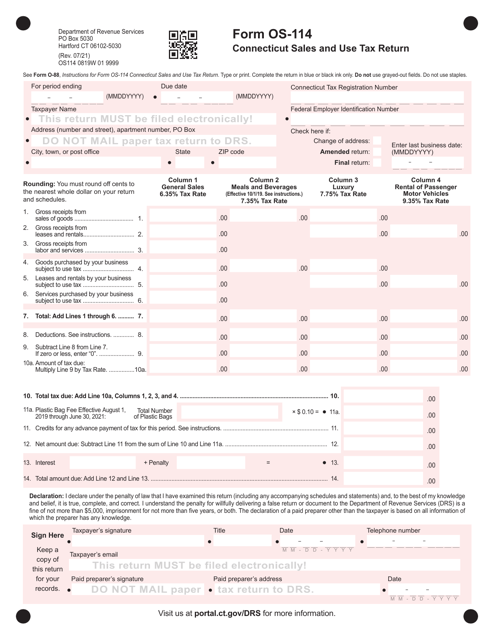

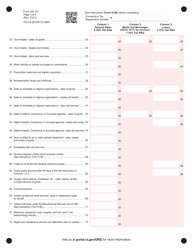

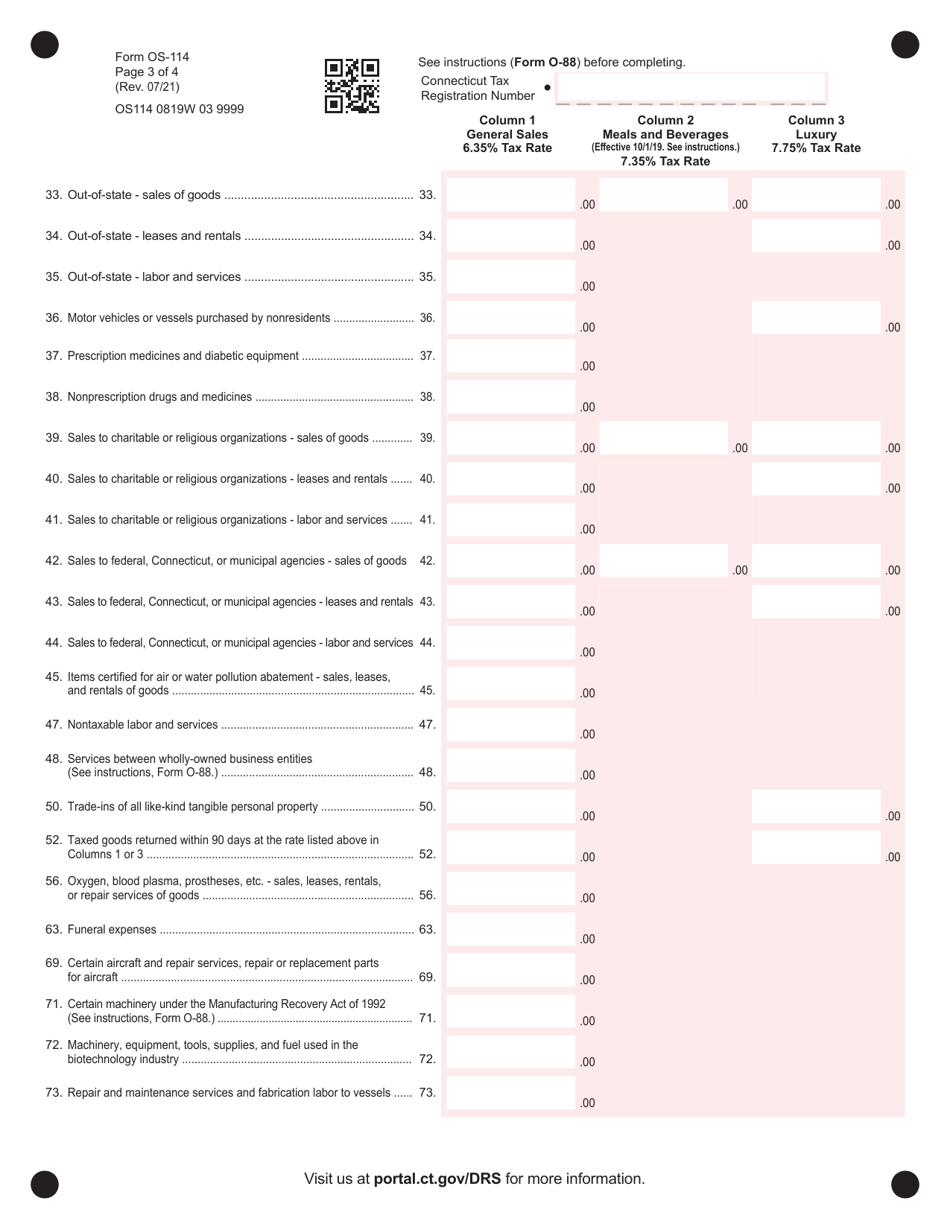

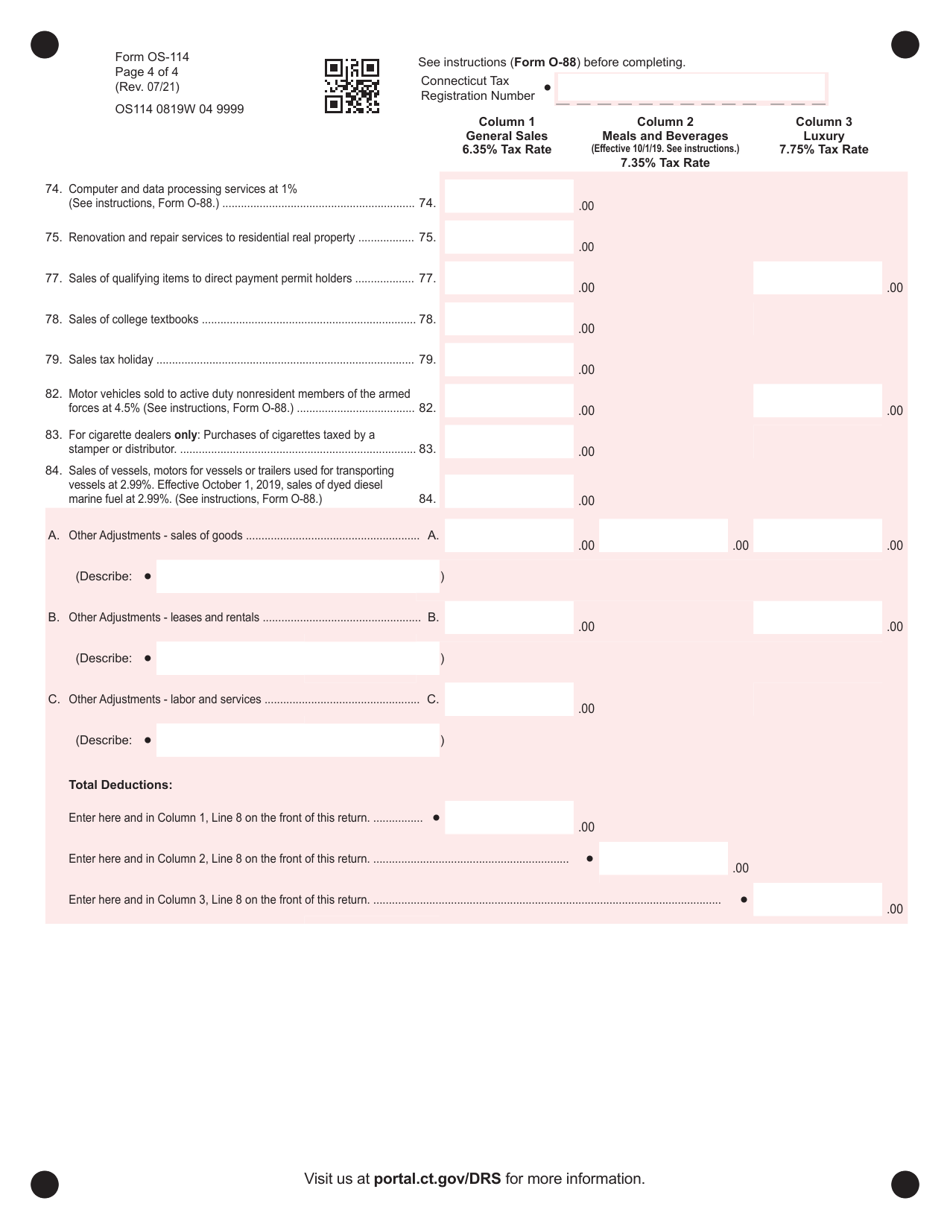

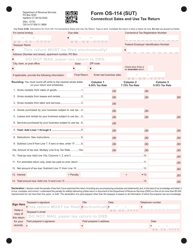

Form OS-114

for the current year.

Form OS-114 Connecticut Sales and Use Tax Return - Connecticut

What Is Form OS-114?

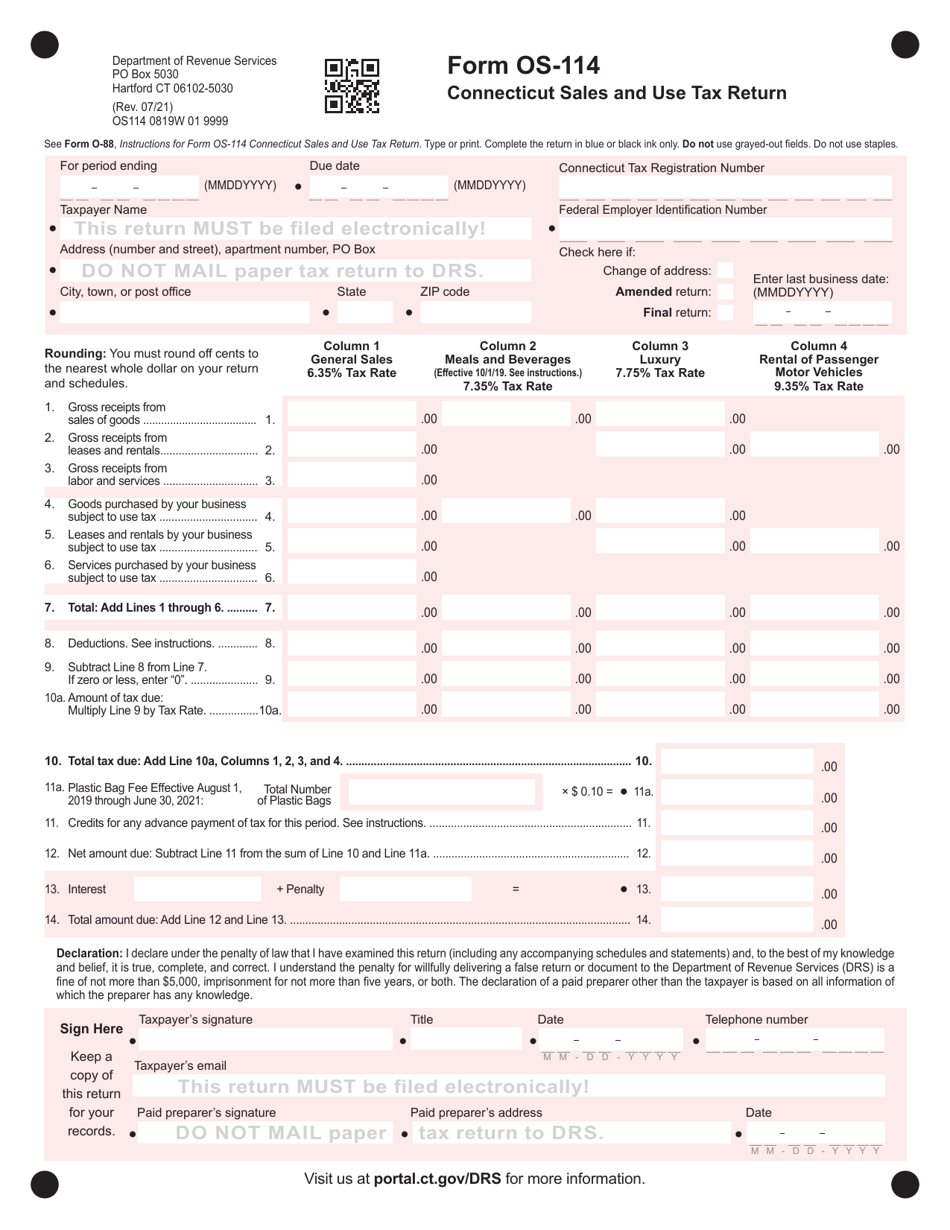

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OS-114?

A: Form OS-114 is the Connecticut Sales and Use Tax Return.

Q: Who needs to file Form OS-114?

A: Businesses in Connecticut that are required to collect and remit sales and use tax must file Form OS-114.

Q: What is the purpose of Form OS-114?

A: The purpose of Form OS-114 is to report sales and use tax collected by businesses in Connecticut.

Q: How often do I need to file Form OS-114?

A: Form OS-114 must be filed on a quarterly basis.

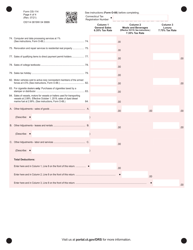

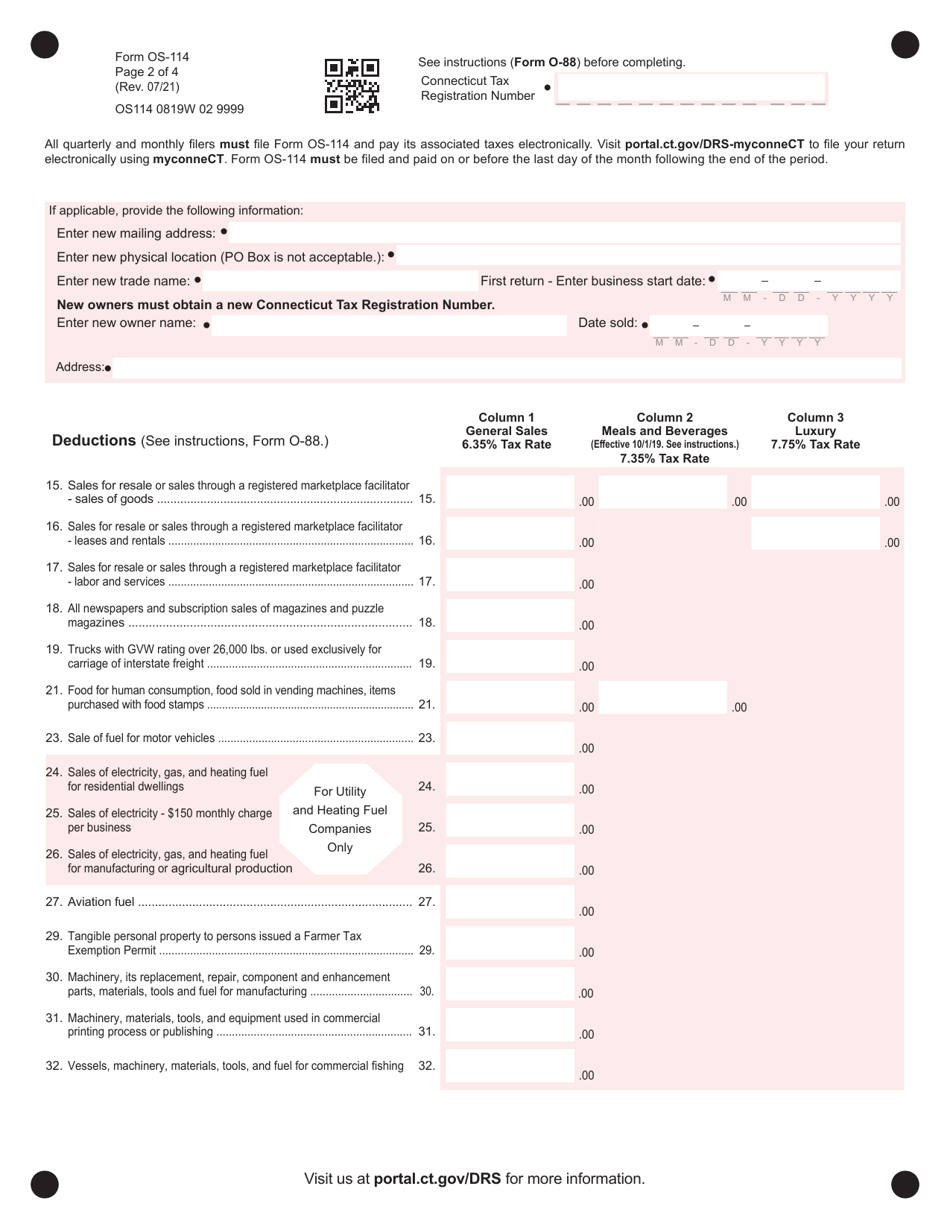

Q: What information do I need to include on Form OS-114?

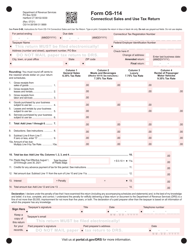

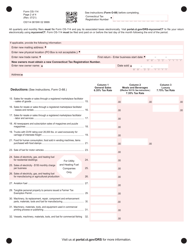

A: You will need to provide information about your business, including sales and use tax collected, and any exemptions or deductions.

Q: Are there any penalties for not filing Form OS-114?

A: Yes, there are penalties for late or non-filing of Form OS-114, including interest and potential legal action.

Q: Can I make payments with Form OS-114?

A: No, you cannot make payments with Form OS-114. Separate payment must be made using the appropriate method.

Q: What should I do if I need help with Form OS-114?

A: If you need assistance with Form OS-114, you can contact the Connecticut Department of Revenue Services for guidance.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OS-114 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.