This version of the form is not currently in use and is provided for reference only. Download this version of

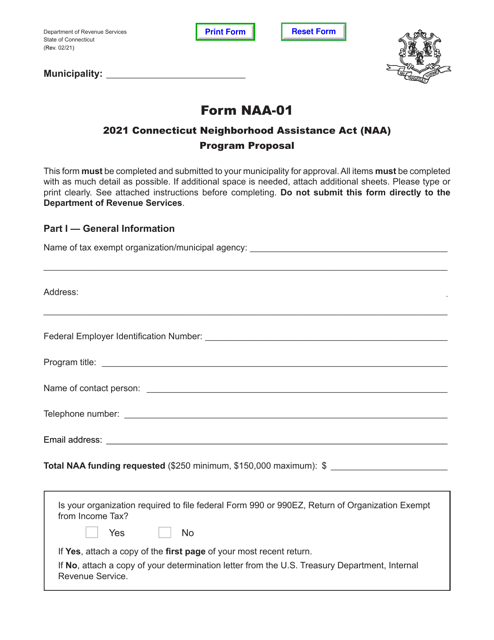

Form NAA-01

for the current year.

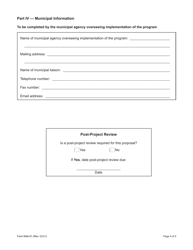

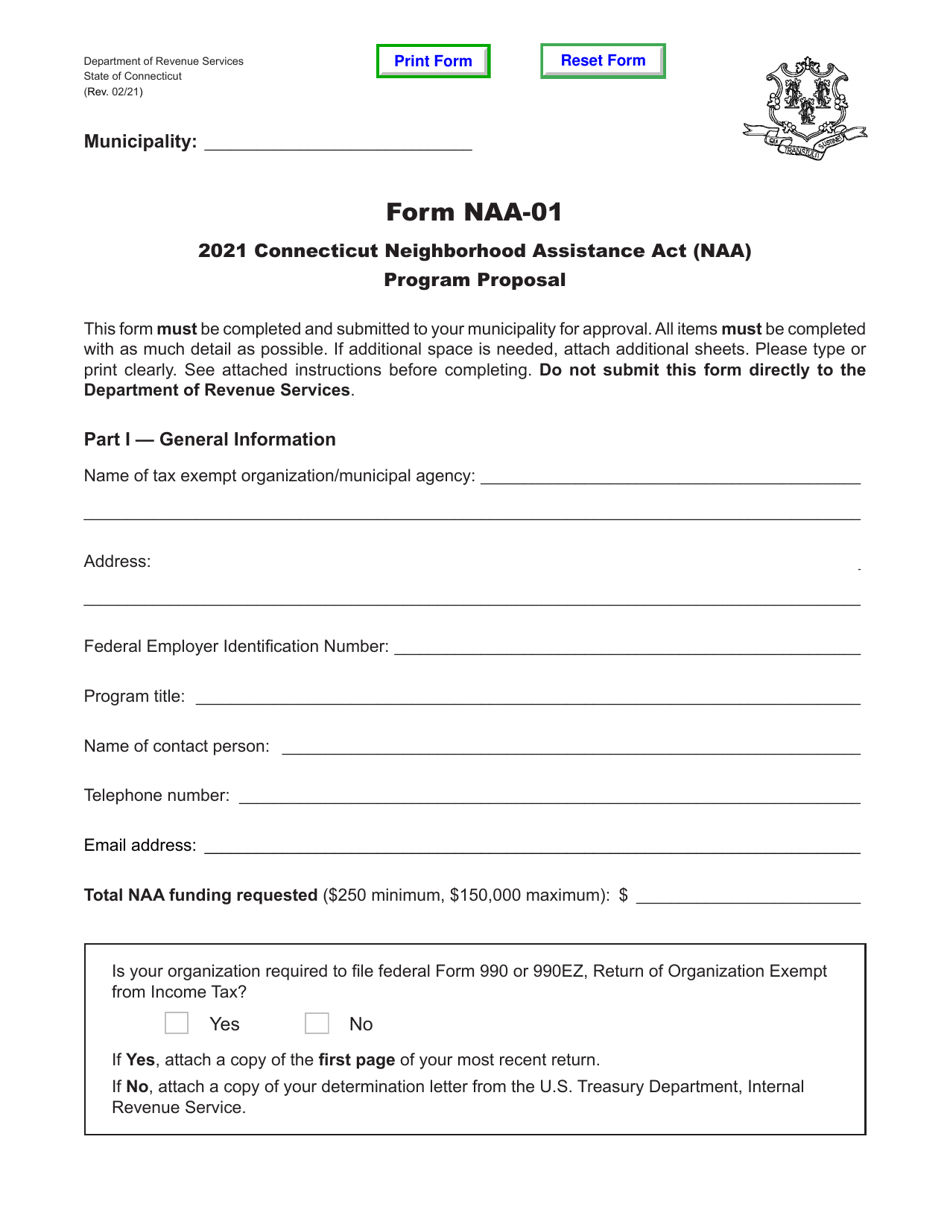

Form NAA-01 Connecticut Neighborhood Assistance Act (Naa) Program Proposal - Connecticut

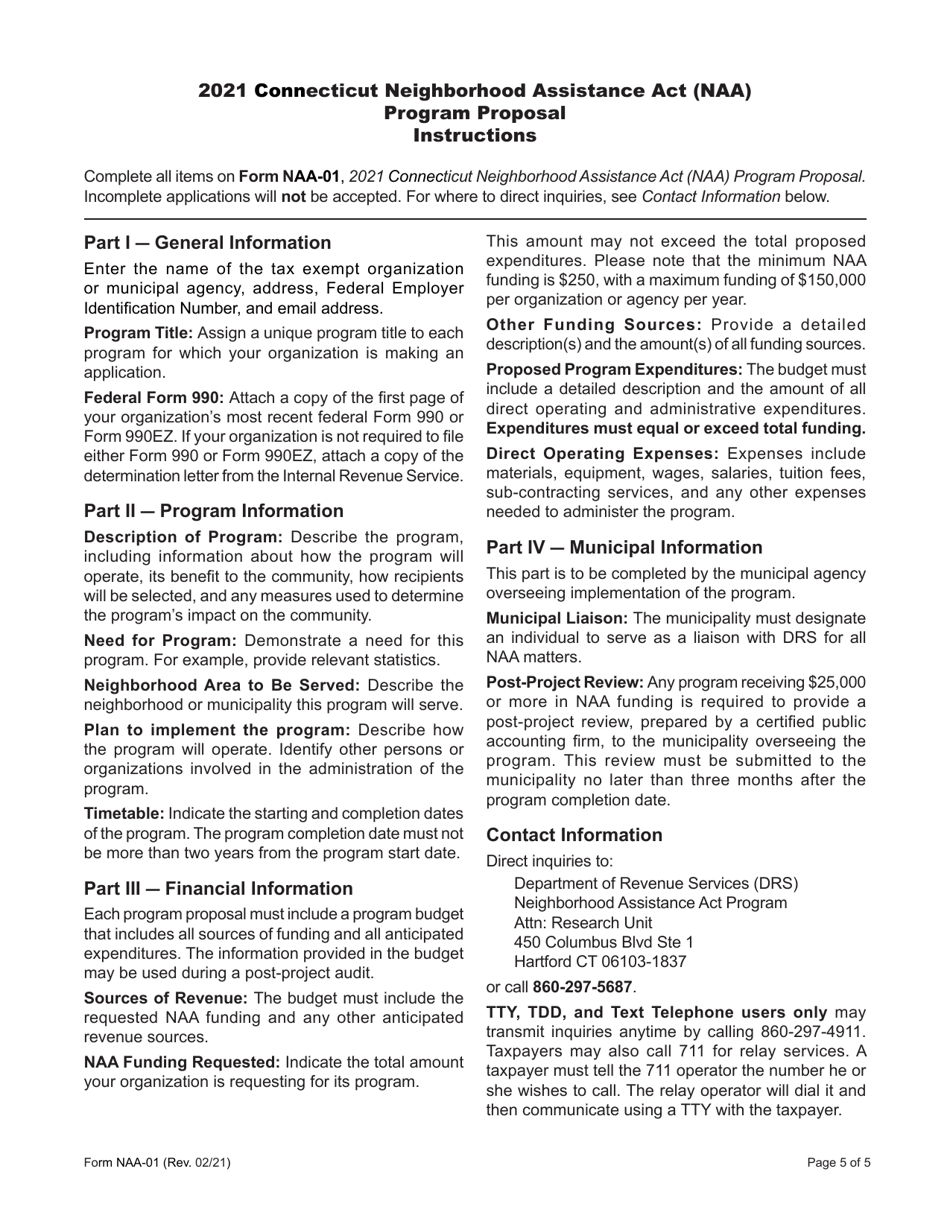

What Is Form NAA-01?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: The NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal is a document that outlines a program proposal under the Connecticut Neighborhood Assistance Act.

Q: What is the Connecticut Neighborhood Assistance Act?

A: The Connecticut Neighborhood Assistance Act is a program that provides tax credits to businesses that make financial contributions to eligible nonprofit organizations.

Q: Who can submit a program proposal under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: Any nonprofit organization that meets the eligibility criteria can submit a program proposal under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal.

Q: What is the purpose of the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: The purpose of the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal is to seek financial contributions from businesses to support community development initiatives.

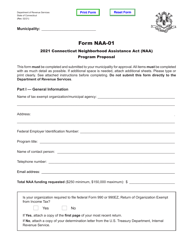

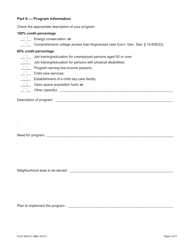

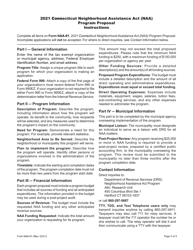

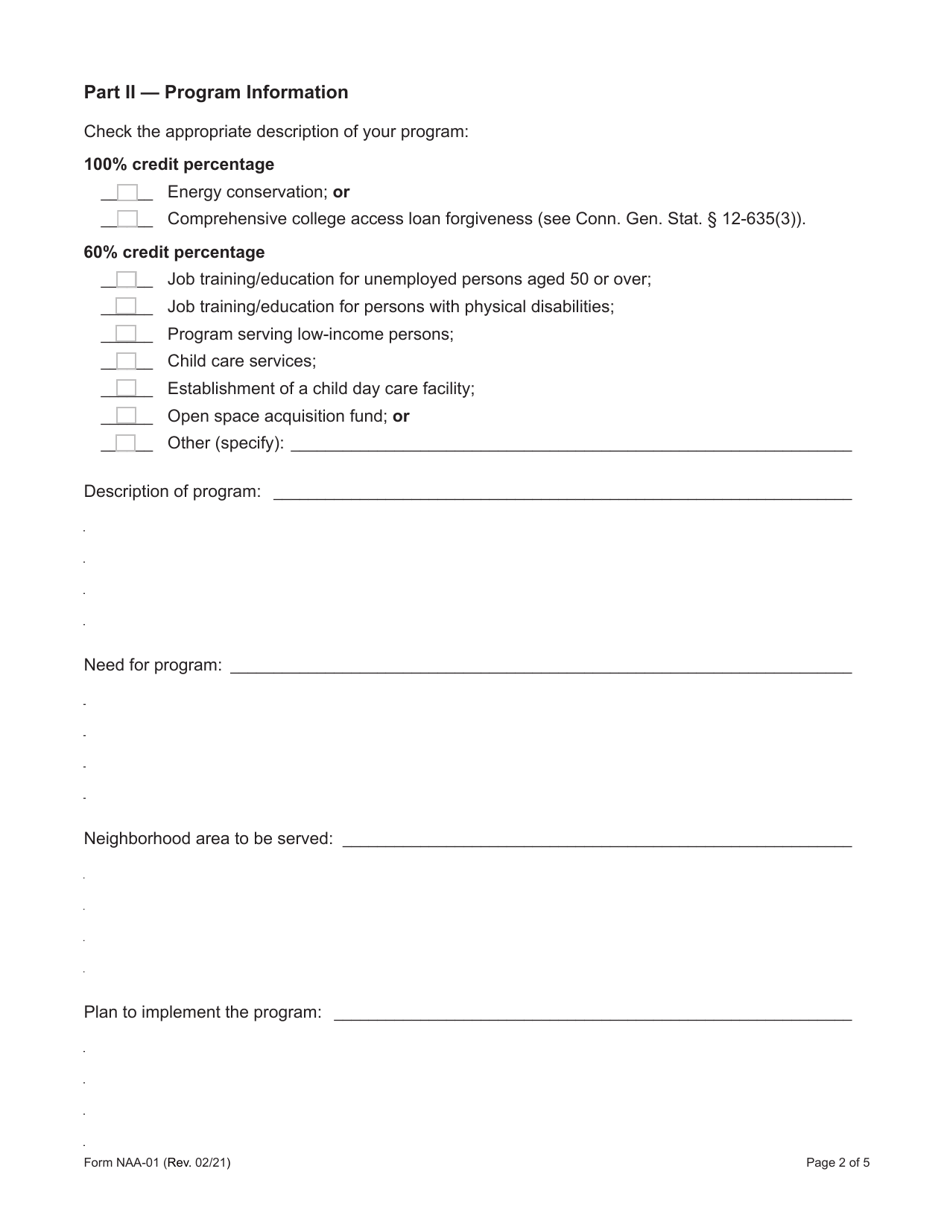

Q: What information is included in the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: The NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal includes information about the nonprofit organization, the proposed program, its objectives, and the expected impact.

Q: How can businesses contribute to the program proposed under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: Businesses can contribute to the program proposed under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal by making financial contributions to the nonprofit organization.

Q: What benefits do businesses receive for their financial contributions under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: Businesses receive tax credits for their financial contributions under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal.

Q: Are there any eligibility criteria for nonprofit organizations to submit a program proposal under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal?

A: Yes, nonprofit organizations must meet certain eligibility criteria to submit a program proposal under the NAA-01 Connecticut Neighborhood Assistance Act (NAA) Program Proposal. These criteria may include being tax-exempt under Section 501(c)(3) of the Internal Revenue Code and having a valid Taxpayer Identification Number.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NAA-01 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.