This version of the form is not currently in use and is provided for reference only. Download this version of

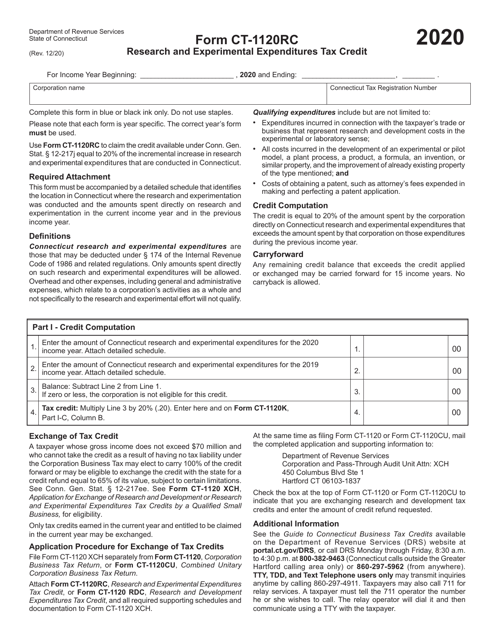

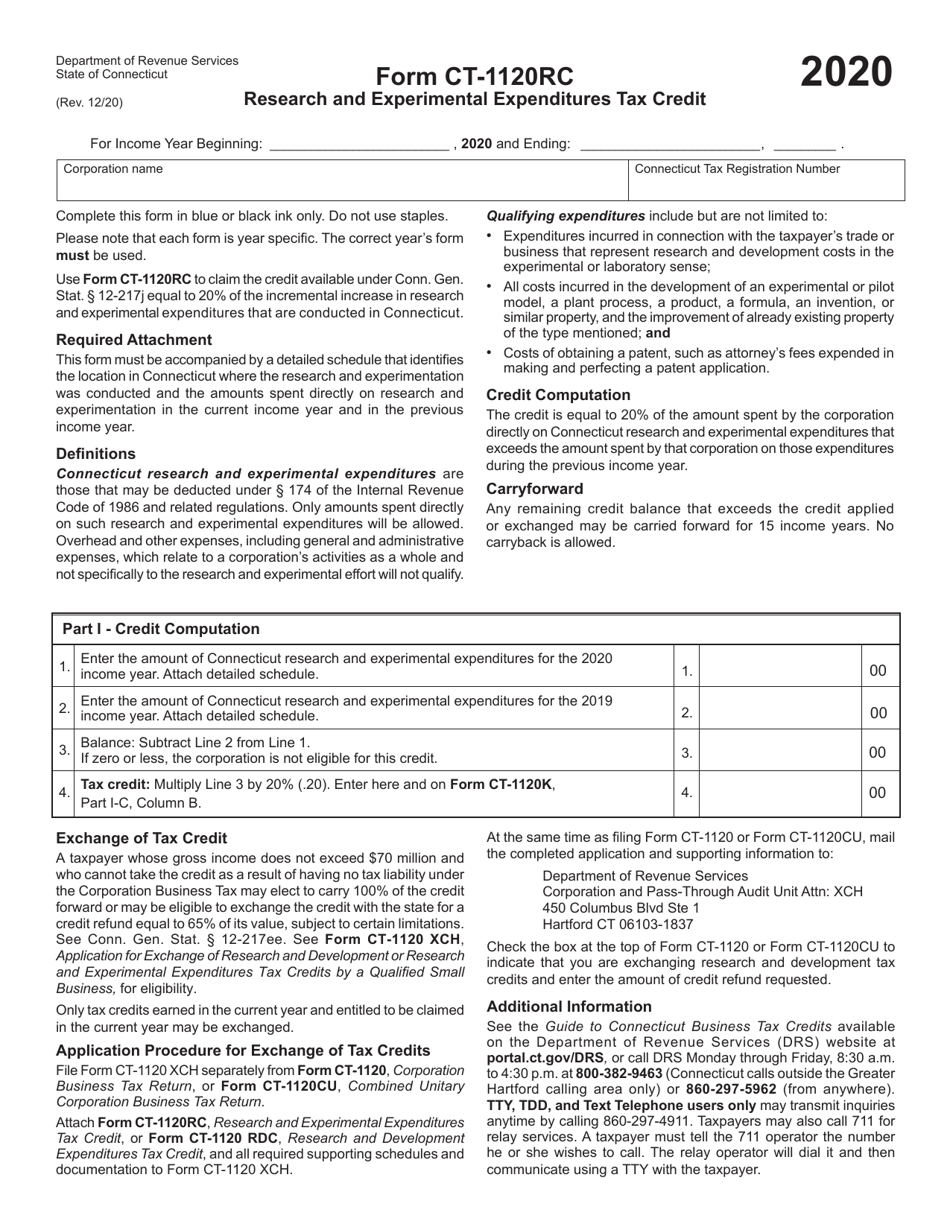

Form CT-1120RC

for the current year.

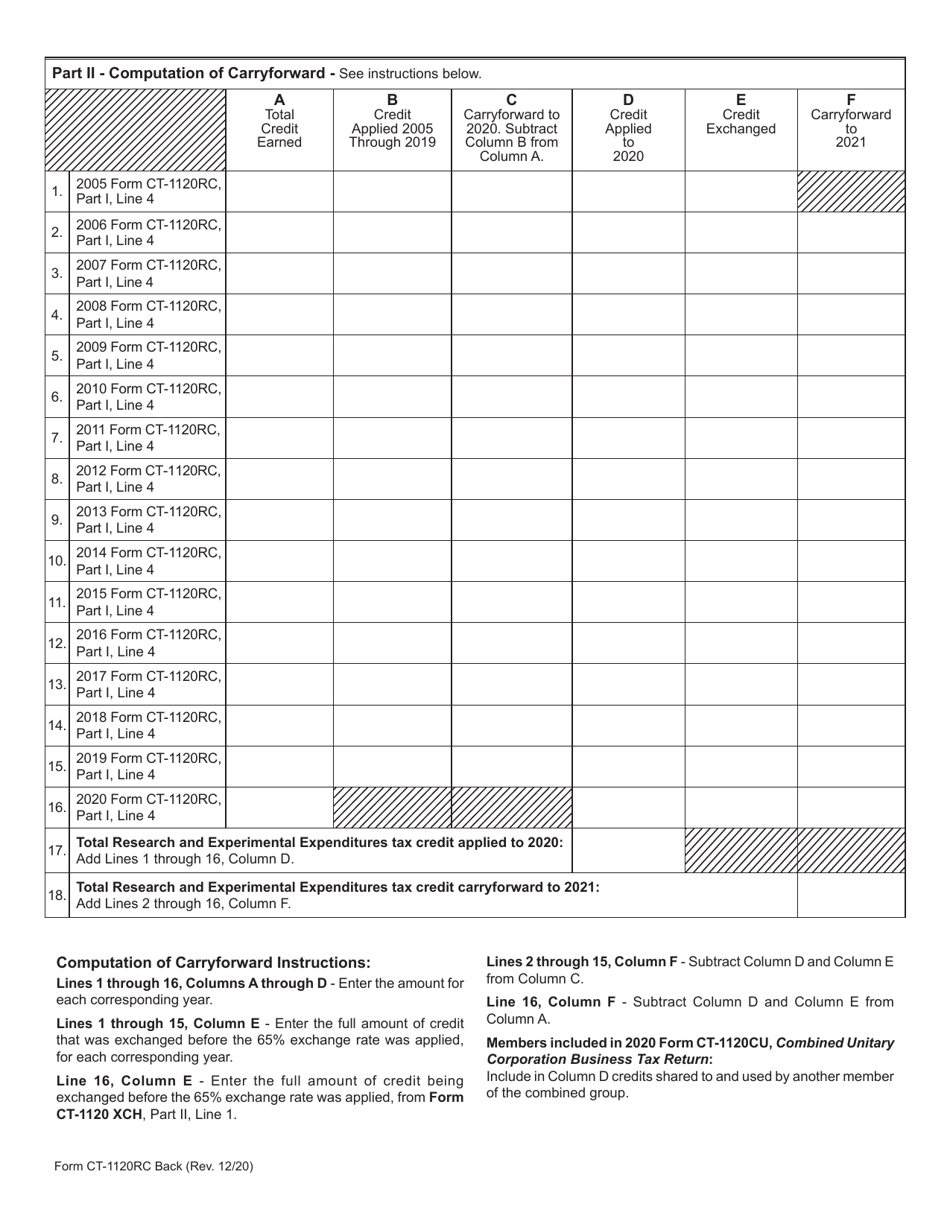

Form CT-1120RC Research and Experimental Expenditures Tax Credit - Connecticut

What Is Form CT-1120RC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120RC?

A: Form CT-1120RC is a tax form used in Connecticut to claim the Research and Experimental Expenditures Tax Credit.

Q: What is the Research and Experimental Expenditures Tax Credit?

A: The Research and Experimental Expenditures Tax Credit is a tax credit in Connecticut that is available to businesses that invest in research and experimental activities.

Q: Who is eligible for the Research and Experimental Expenditures Tax Credit?

A: Businesses that incur qualified research and experimental expenditures in Connecticut may be eligible for the tax credit.

Q: How do I file Form CT-1120RC?

A: Form CT-1120RC should be filed as an attachment to the Connecticut Corporation Business Tax Return (Form CT-1120).

Q: What expenses qualify for the Research and Experimental Expenditures Tax Credit?

A: Qualified research and experimental expenditures include wages, supplies, and contract research expenses related to research conducted in Connecticut.

Q: What is the deadline for filing Form CT-1120RC?

A: Form CT-1120RC must be filed with the Connecticut Department of Revenue Services by the same deadline as the Connecticut Corporation Business Tax Return (Form CT-1120).

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120RC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.