This version of the form is not currently in use and is provided for reference only. Download this version of

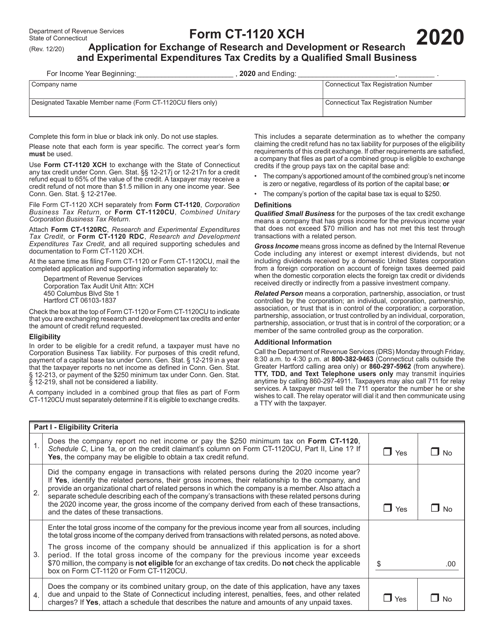

Form CT-1120 XCH

for the current year.

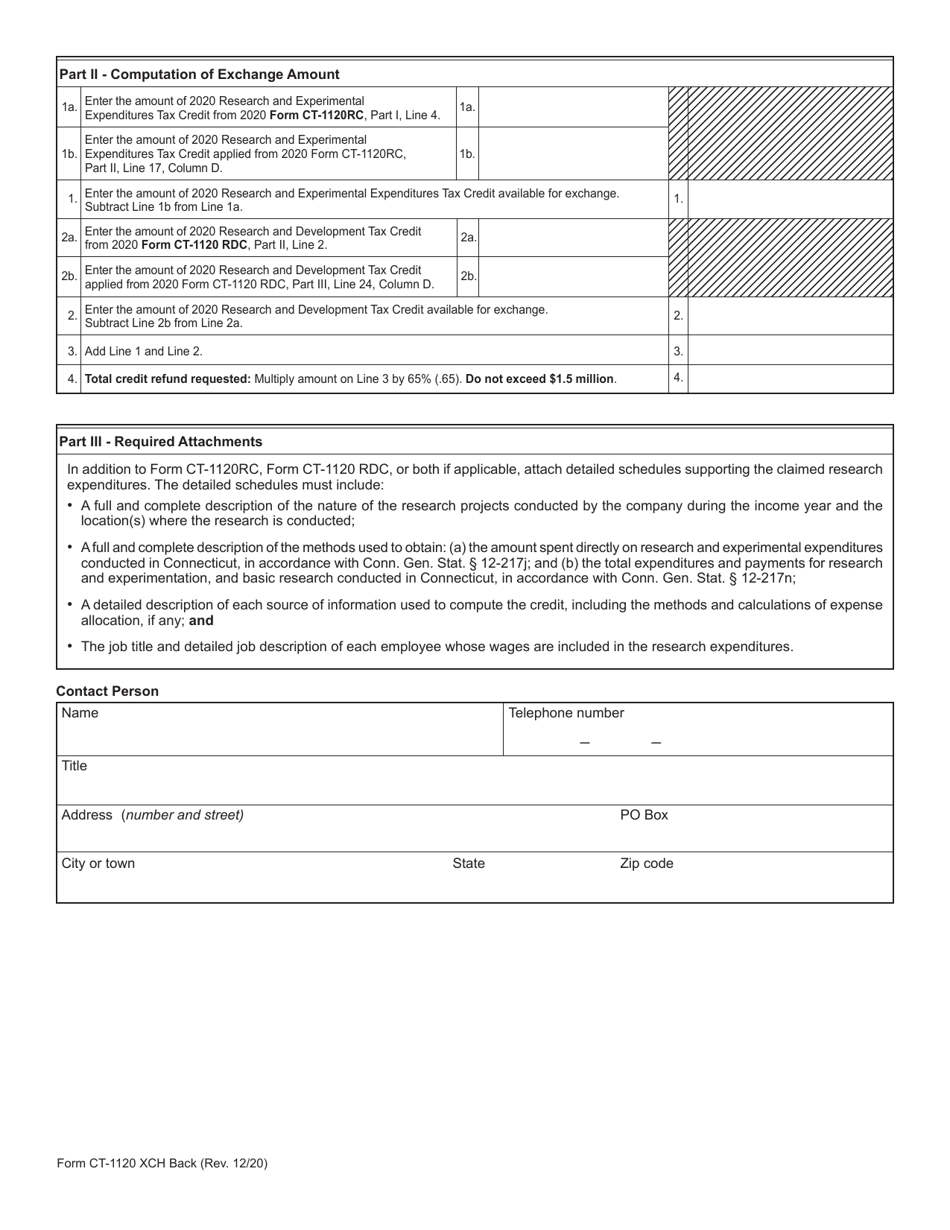

Form CT-1120 XCH Application for Exchange of Research and Development or Research and Experimental Expenditures Tax Credits by a Qualified Small Business - Connecticut

What Is Form CT-1120 XCH?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 XCH?

A: Form CT-1120 XCH is an application form used in Connecticut for the exchange of research and development or research and experimental expenditures tax credits by a qualified small business.

Q: Who can use Form CT-1120 XCH?

A: Form CT-1120 XCH can be used by qualified small businesses in Connecticut to apply for the exchange of research and development or research and experimental expenditures tax credits.

Q: What is the purpose of Form CT-1120 XCH?

A: The purpose of Form CT-1120 XCH is to allow qualified small businesses in Connecticut to exchange their research and development or research and experimental expenditures tax credits.

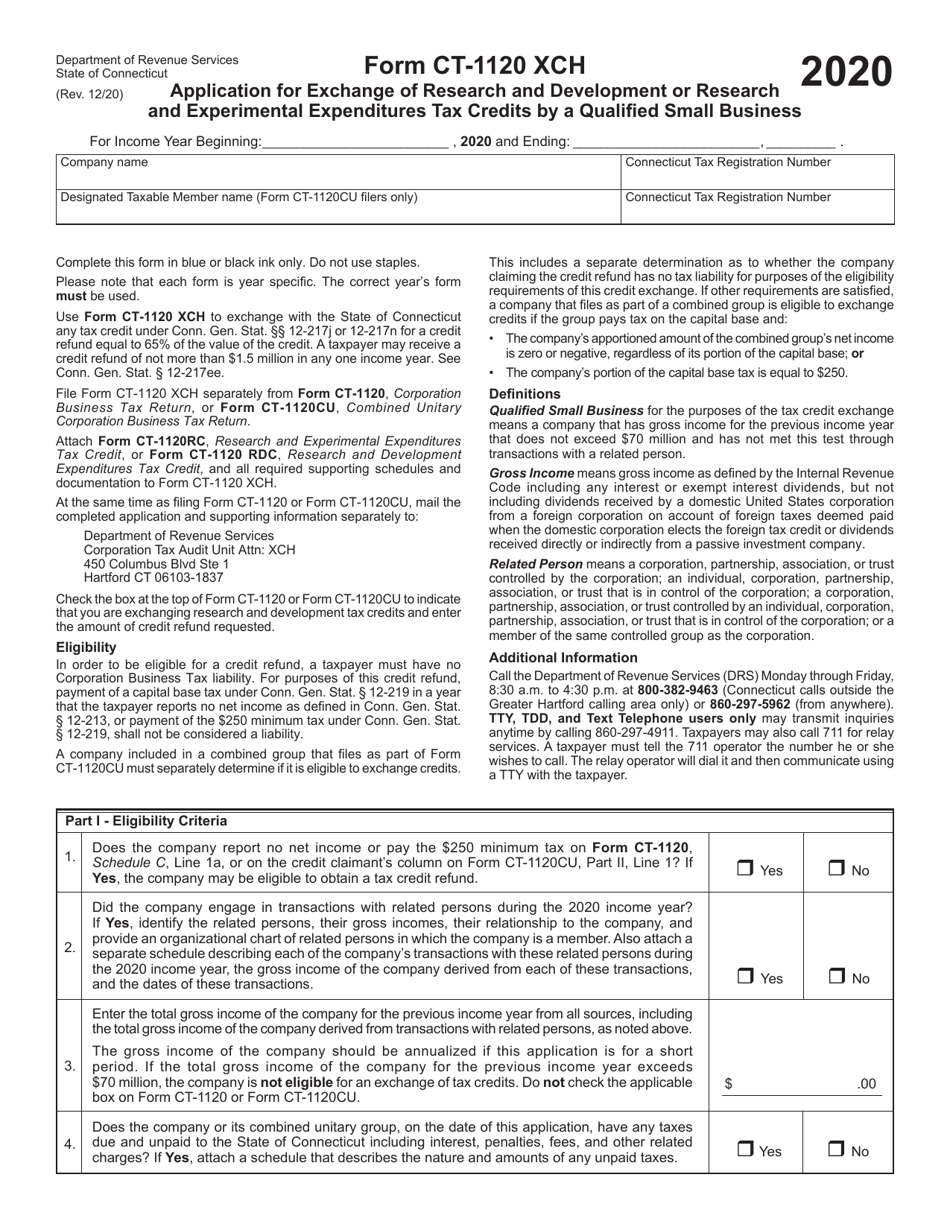

Q: What are research and development or research and experimental expenditures tax credits?

A: Research and development or research and experimental expenditures tax credits are tax credits given to businesses that engage in qualified research and development activities or incur research and experimental expenditures.

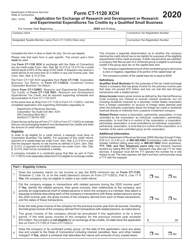

Q: Are there any eligibility requirements for using Form CT-1120 XCH?

A: Yes, there are eligibility requirements to use Form CT-1120 XCH. The business must be a qualified small business and meet certain criteria set by the Connecticut Department of Revenue Services.

Q: What happens after I submit Form CT-1120 XCH?

A: After submitting Form CT-1120 XCH, the Connecticut Department of Revenue Services will review the application and determine if the exchange of tax credits is approved.

Q: Are there any deadlines for filing Form CT-1120 XCH?

A: Yes, Form CT-1120 XCH should be filed on or before the due date of the taxpayer's Connecticut corporation business tax return.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 XCH by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.