This version of the form is not currently in use and is provided for reference only. Download this version of

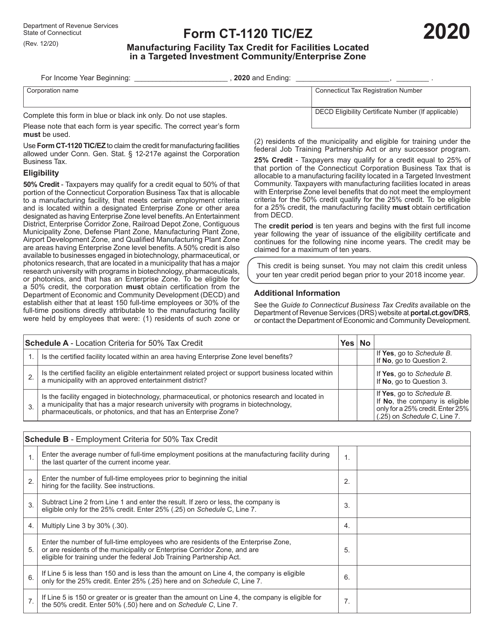

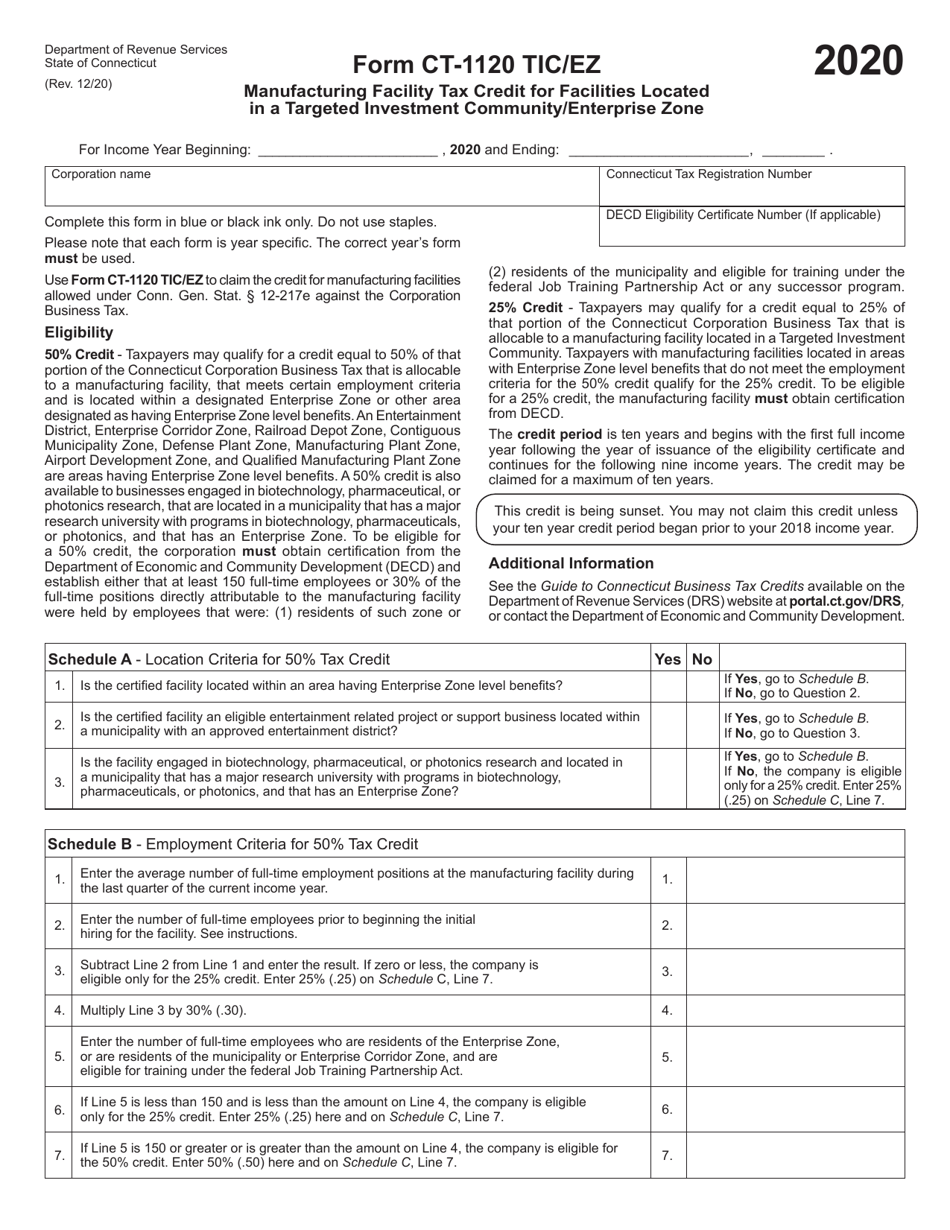

Form CT-1120 TIC/EZ

for the current year.

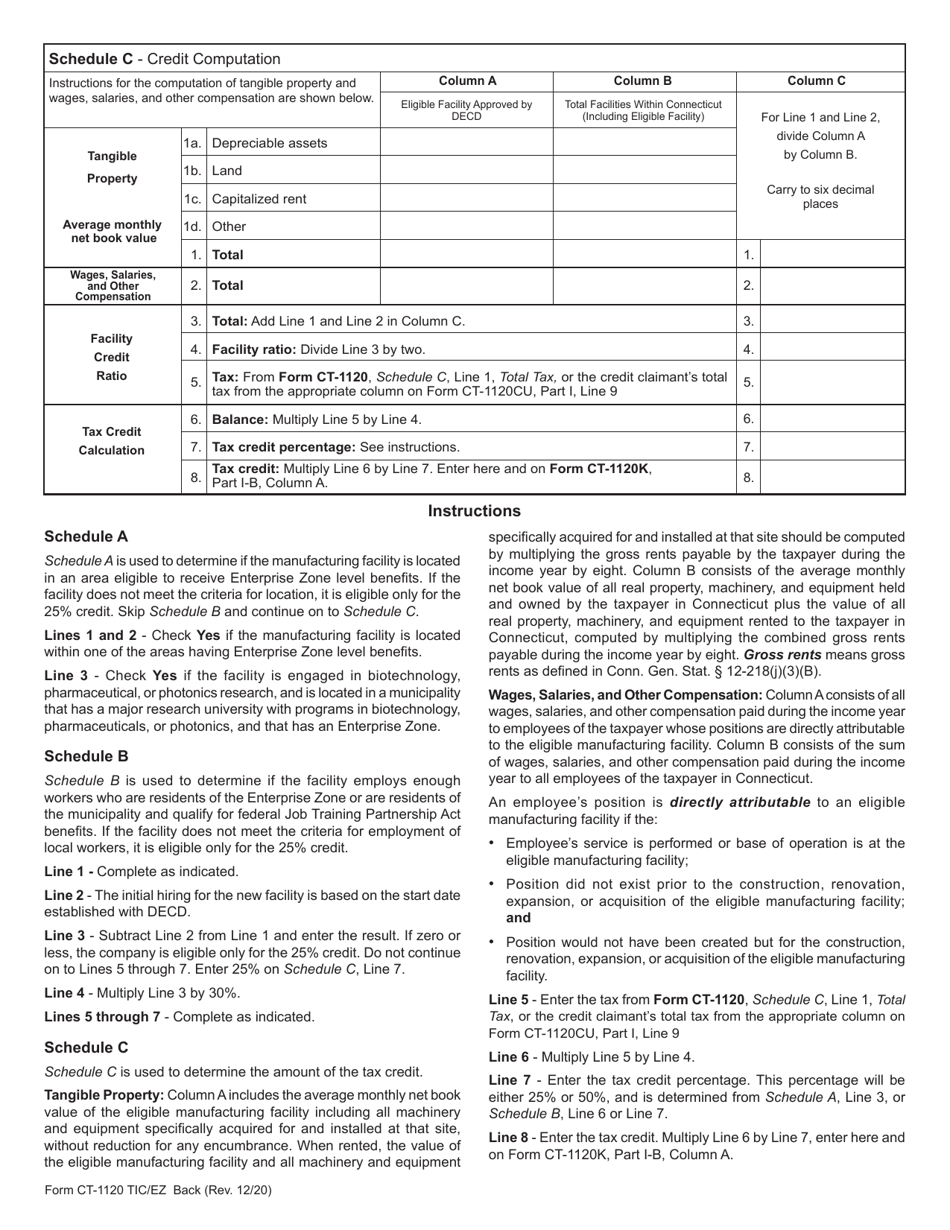

Form CT-1120 TIC / EZ Manufacturing Facility Tax Credit for Facilities Located in a Targeted Investment Community / Enterprise Zone - Connecticut

What Is Form CT-1120 TIC/EZ?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 TIC/EZ?

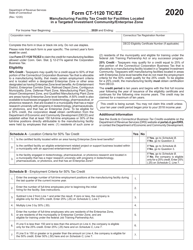

A: Form CT-1120 TIC/EZ is a tax form used in Connecticut to claim the Manufacturing Facility Tax Credit for Facilities located in a Targeted Investment Community/Enterprise Zone.

Q: What is the Manufacturing Facility Tax Credit?

A: The Manufacturing Facility Tax Credit is a tax credit in Connecticut that provides incentives for manufacturing companies located in Targeted Investment Communities/Enterprise Zones.

Q: Who can claim the Manufacturing Facility Tax Credit?

A: Manufacturing companies located in Targeted Investment Communities/Enterprise Zones in Connecticut can claim the Manufacturing Facility Tax Credit.

Q: What is a Targeted Investment Community?

A: A Targeted Investment Community is a designated area in Connecticut that is economically distressed and eligible for certain tax incentives.

Q: What is an Enterprise Zone?

A: An Enterprise Zone is a designated area in Connecticut that is economically distressed and eligible for certain tax incentives.

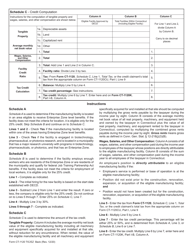

Q: How to claim the Manufacturing Facility Tax Credit?

A: To claim the Manufacturing Facility Tax Credit, manufacturing companies need to fill out Form CT-1120 TIC/EZ and follow the instructions provided.

Q: Are there any eligibility requirements for the Manufacturing Facility Tax Credit?

A: Yes, in order to be eligible for the Manufacturing Facility Tax Credit, the manufacturing facility must meet certain criteria, such as being located in a Targeted Investment Community/Enterprise Zone and meeting certain job creation requirements.

Q: What are the benefits of the Manufacturing Facility Tax Credit?

A: The Manufacturing Facility Tax Credit can provide a reduction in the corporate income tax liability for qualifying manufacturing companies, as well as other tax incentives.

Q: What is the deadline to file Form CT-1120 TIC/EZ?

A: The deadline to file Form CT-1120 TIC/EZ is the same as the regular corporate income tax return deadline, which is generally on or around April 15th of each year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 TIC/EZ by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.